By: BJ Lackland, CEO of Lighter Capital

At Lighter Capital, we spend lots of time talking to SaaS companies about their capital needs. SaaS companies have some unique characteristics that we think make them great candidates for our type of loan. But these same characteristics can make it harder to get funding from more traditional sources. So before approaching investors – either equity or debt providers – give yourself the best chance of success by making sure you have checked your business against these 7 critical factors.

At Lighter Capital, we spend lots of time talking to SaaS companies about their capital needs. SaaS companies have some unique characteristics that we think make them great candidates for our type of loan. But these same characteristics can make it harder to get funding from more traditional sources. So before approaching investors – either equity or debt providers – give yourself the best chance of success by making sure you have checked your business against these 7 critical factors.

- Benchmark your company against the key metrics capital providers look at.

- The 40% rule: There’s been a lot of talk recently among high profile VC’s such as Mark Suster and Brad Feld, about the 40% rule for SaaS businesses. The 40% rule is this: your growth rate plus your net income percentage should add up to 40% (i.e. if you are growing at 100% per year and you are losing 60% on the net income line you are at 40% or if you are growing at 30% and you have positive net income of 10% you are at 40%). A 40% growth rate at breakeven is a good place to be.As an aside, we recently took a look at our SaaS portfolio here at Lighter Capital and found that the MRR growth rate (year over year) plus the Net Income percentage was 47%, so it looks like our SaaS companies are doing great. Kudos to them! We always love it when a key metric works out!

- MRR: MRR – Monthly Recurring Revenue – is a key statistic for any SaaS business to know. It looks at your historic revenue on a monthly basis and is important because it tells you how much revenue you can expect to generate in future months.MRR is often looked at in conjunction with churn. In a static state, your MRR less your monthly churn would tell you how your revenue would decline over time. In other words, how many new customers do you have to add each month to stay at the same MRR level.

- CAC ratio: A number of years ago, Bessemer Venture Partners came out with some key metrics for SaaS businesses, and one metric that has really stuck in people’s mind is the CAC ratio (Customer Acquisition Cost). This ratio helps you to determine your sales and marketing investment for your business. Sales and marketing is key to growing your business so understanding this ratio is a good idea.The ratio takes the difference in your Gross Profit in the two most recent quarters and annualizes it divided by your Sales and Marketing spend for the prior quarter. If your CAC ratio is below 1 it means it will take more than a year for your Sales and Marketing spend to be recovered and if your CAC ratio is greater than 1 your Sales and Marketing spend is paid back in less than a year. The quicker your Sales and Marketing is paid back the better!

- Have your financials in orderThe first thing any investor is going to ask for is your historic financials, so you should have them ready and in a useable format. At Lighter Capital, we like to see 24 months of historic financials for both the P&L and the Balance Sheet. Some investors may require less, but at the minimum, I would suggest having the quarterly financials for the last 12 months ready. One issue we see a lot with SaaS businesses and their financials is their accounting for revenue, in particular, deferred revenue. I won’t go into the gory details here but we have a blog post all about the correct accounting for them here.You should know that any institutional lending source is going to require that you produce monthly financials so this is something to think about as you head to market. Equity backers may be more flexible on the timing for financials and may be open to quarterly or annual financials.

- Projections – know where you’re headedWe are trying to achieve Initial Scale so it would make sense that you have projections on why you need outside financing to get there. The most helpful projections are not the ones that just take a growth percentage and apply it on a monthly or quarterly basis, but the ones that are based on your pipeline and historic performance. When generating projections a couple of things to keep in mind:

- Are you a seasonal business, and if so, do your projections reflect it? Do you have some big customer wins projected over the next 12 months and when do you expect them? In a SaaS business if you are doing cash accounting and receive annual payments, you definitely have some lumpy payments and will want to show them in your projections.

- You might want to think about having two sets of projections — a tortoise and a hare. Your ‘hare’ scenario is a high growth shoot-to-the-moon scenario for equity investors and the ‘tortoise’ is a more stable, plodding scenario for debt investors.

- Explain your customer base

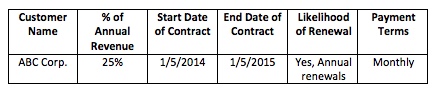

Everyone will want to know something about your customers. If you put together a basic chart (like the one below) for your top 10 customers, you’ll help fend off 90% of potential questions.

- If you have customers that represent more than 10% of your annual revenue, expect some type of follow-up questions from interested investors who might ask to see copies of the contract, request reference checks, and review historic churn in your customer base.

- White Space – highlight your competitive difference

You have to show where you sit within the marketplace. How is your product or service different from the others out there and why? Telling someone that you are the next Facebook or Instragram isn’t really the best explanation of your positioning, and honestly, most people are just going to roll their eyes and say, “Sure you are.” Instead, present the lay of the land, demo your product, tell your customer stories, and focus on the problem your product is addressing or solving. Be truthful with your plan! At the end of the day, investors who want to invest in your business also want to invest in you. So demonstrating your inspiration and ability to execute the plan will help differentiate you from your competitors.

- Service / Product Elevator Pitch

Try to make your product pitch concise and easy for people to understand. In Lighter Capital’s online application, we call it the elevator pitch and we limit it to 500 words. After you have investors hooked, you can get into more details of the market and your service or product and why it is unique.

- Have a funding strategy

If you think you need outside capital to get to initial scale the kind and type of funding you take will significantly impact the shape and future trajectory of your business. Ask yourself is – What is the goal of my initial scale:- Is my product a paradigm shift in the industry that could be the next “unicorn”?

- Am I attempting to build out my product offerings so that I can attract a higher valuation before the big push?

- Or am I trying to build a business that I intend to run for sometime?These three questions will help you to frame the type of financing path that might make the most sense for your business over its life. Lighter Capital’s guide for growing SaaS companies: How to Choose the Best Funding Path for your Startup, digs in on these questions and lays out a different funding path for each – the VC-backed, the non-VC backed and the blended path. It also gives you 6 key questions you need to ask when deciding whether a particular funding option suits your specific personal and financial goals.

Every investor is a little different

Every investor will have their own set of requirements. But by running through the above 7 point checklist you will at least have a clear funding strategy in mind, know that your key metrics are in good shape and you have all the basic information in place.

At Lighter Capital, we really focus on making the funding process fast and simple. As entrepreneurs ourselves, we know first hand you’d rather spend your precious time running your business instead of looking for and pitching investors. You can learn more about our RevenueLoans here and try our funding calculator and find out how much you might qualify for.. You can also get the ball rolling with our super quick online application.

About Lighter Capital Lighter Capital is 100% focused on providing early stage SaaS, software and technology services companies with the long-term capital you need to grow your business to the next level. Our RevenueLoans provide flexible monthly payments, require no personal guarantees and do not dilute your equity. We aim to get you funded in one month. To learn more visit www.lightercapital.com.

About Lighter Capital Lighter Capital is 100% focused on providing early stage SaaS, software and technology services companies with the long-term capital you need to grow your business to the next level. Our RevenueLoans provide flexible monthly payments, require no personal guarantees and do not dilute your equity. We aim to get you funded in one month. To learn more visit www.lightercapital.com.