Reading the tech press you might get the sense that The Enterprise is something they are sort of forced to write about because it’s having a good run. We had a great Consumer run, a nice set of Multi-Billion Dollar deals around Social Networking, a WhatsApp/Snapchat fad around mobile messaging, an Alibaba, Instacart, Fab-ulous e-commerce run … and now it’s the Enterprise’s turn. With Enterprise IPOs left and right, with more coming up soon. Marketo, Zendesk, Hubspot, Tableau Software, etc. with their Billion+ Enterprise IPOs. Splunk at a $7 billion market cap after its IPO. WorkDay at $14 billion. Yammer and Eloqua sold for $1b+, Etc. etc. Box debuting at a unicorn market cap.

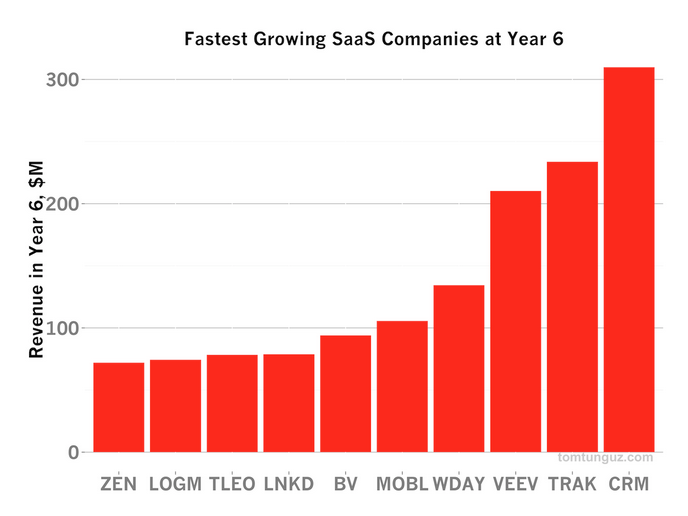

Here’s the thing. It’s nothing new, as anyone in SaaS and the Enterprise can tell you. Because it takes, in the Enterprise, 6-10 years to build something real, something ready to IPO. So what seems faddy today is in fact just the start of a 2.0 SaaS/Enterprise wave that started back in ’04-’06. In fact, what we’re seeing today is really just The Last Generation. The guys that are now getting to $100m+ ARR today. That’s old stuff, really.

In fact it’s just getting to the good part. Why? What’s going on?

First, nothwithstanding a fall in absolute enterprise/SaaS multiples since 12 months ago … Wall Street is buying into Enterprise recurring revenue models. The reasons include the rare combination of predictable revenue + high growth. Usually high growth carries high beta, but that’s much less the case with annual SaaS contracts with their extremely high renewal rates. And Wall Street has good comps to look to now, multiple successful billion dollar valuation leaders at high multiples.

But Wall Street is just a financing and liquidity vehicle. It’s not the explanation for Why It’s Just Getting Good in Enterprise IPOs.

There are three key factors that are driving the dramatic acceleration in the Business Web and SaaS — and thus this and the next wave of Enterprise IPOs:

1. Number One, The Markets are Exploding and Growing Faster Than Ever. Let’s look at the #1 leader in SaaS, Salesforce.com. It wasn’t too long ago that Salesforce hit $1 billion in recurring revenue. Now, it’s well past a $5 billion run-rate. Next up: $10 billion in ARR. It’s not that far off.

Now yes, Salesforce is executing to perfection. But fundamentally, they are solving the same problems, with basically the same core software and features, that they did at a $500m run rate, a $1b run rate, and now a $4 billion run rate.

What’s happening? There are just so many more businesses, and so many more customers, moving more and more of their businesses processes to the web. Every day. Customers that weren’t ready to use Salesforce, or Marketo, or Box, or Any Leading SaaS Service just a year or three ago … are ready. And even more will be ready next year and the year after.

Beyond that, SaaS is just starting to hit the mainstream phase outside of the U.S. and the U.K. International growth is just starting. And mobile enterprise is likewise just kicking into gear. On mobile, the enterprise is about 2-3 years behind the consumer web. The growth there is almost entirely ahead of us.

2. Second, You Can Scale Much Faster Now (Though It’s Still Very Expensive). Because the markets are larger, you can scale faster. Eloqua, as noted, above was founded in 1999 and was acquired by Oracle for $1 billion in December 2012. It’s arch-rival, Marketo, founded in 2006, hit a $1 billion market cap in May 2013 — in half the time. And adjacent competitor HubSpot hit $60 million+ in ARR in 5 years and its own billion+ IPO in late ’14. The idea that Yammer could be acquired by Microsoft for $1.2 billion just a few years ago would have sounded like a delusional fantasy. Now, it’s only half crazy that Slack got that same approximate valuation just 12 months after it starting collecting revenue. Because it got from $0-$10m in ARR in single digit months.

Bigger markets mean that if you hit the market just right, with the right team and the right product … you can get to scale so much faster and stronger than just a few years ago.

3. Competition is Much, Much Fiercer. And This is a Good Thing. Even just 5-6 years ago in the Enterprise, the truth is, you could launch a half-decent product that did something truly innovative and still get traction. If you take a look at the Box of 2006, or even my own EchoSign in 2006 … the 2006 versions of these products are, to be charitable … primitive by 2015 standards. And there are at least 30x-60x more entrepreneurs founding companies in the broad Enterprise/SaaS space today. Maybe more.

Competition accelerates change, strengthens the products — which further accelerates market adoption and growth. The frenetic pace of Consumer Internet hasn’t fully reached the Enterprise. But it’s getting there. In another 12-24 months, the Enterprise will be just as rapidly innovative and competitive at a product level as Consumer Internet is. It’s close already. We won’t have to talk about the Consumerization of the Enterprise anymore. Because it’ll be a fait accompli.

4. The Next Wave is Coming. A long pipeline of potentially Billion Dollar+ high profile IPOs, both those with a consumer-esque aspect like Box, Evernote and DropBox, and more true business-process Enterprise, like MobileIron, Veeva Systems, Zendesk, Hubspot, and others have paved the way for the ’15+ batch.

But that’s still the last generation, the guys from ’05-’11, who’ve done an incredible job building their businesses, in many cases relatively quietly by Consumer Web standards, over the past 4-10 years.

There’s far more innovation happening now with second and third-generation SaaS and Enterprise veterans and next generation plays — and new markets. That’s when it get’s really good — once you actually know what you are doing, and Go Big from Day 1. First, we’ve been doing this long enough for the second-timers to be at their second at-bat. WorkDay was an early example of a hyper-successful repeat Enterprise play. But there are many others. The second and third generation list goes on but really, is just getting started. More on the second-timers here.

Perhaps more importantly, there are so many new markets that are SaaS-ifyng. From browser-based call centers to search-as-a-service or QA-as-an-API, to grab-and-go eDiscovery to web-based HR training and employee onboarding, just a few years ago these would have seemed too small. Not today.

So it may seem a touch frothy. It may seem au courant. But trust me. The Return of the Enterprise (really, it’s the rise of SaaS and the democratization of B2B) … it’s just getting started. It’s just getting good.

Hold on for what’s going to be a wonderful and rather dramatic ride.