Let’s take a look at a few recent $1B+ “exits”, i.e. sales in SaaS:

- Pipedrive acquired by Vista for $1.5B

- Thoma Bravo acquires Sophos for $3.8B

- Insight Partners buys Veam for $5B

- Gainsight sells a majority interest to Vista at $1.1B valuation

What do these deals, and so many more have in common? The acquirer wasn’t a Big TechCo. It was a Private Equity firm.

What exactly is Private Equity? Well, it is a category of investors in private (or private-to-be) companies and startups that is larger than venture capital (at least, larger than the traditional, pre-Softbank categories of venture capital).

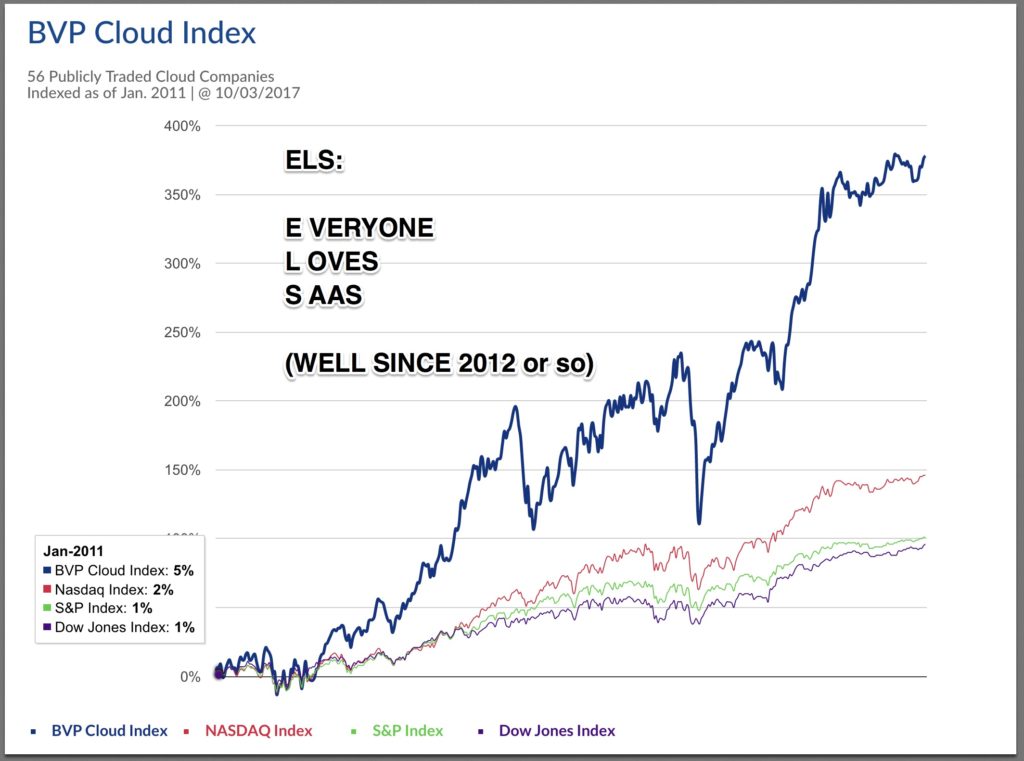

In about 2012 or so, Private Equity entered SaaS in force. It was there before, but as valuations and revenues grew, private equity’s footprint began to grow dramatically in SaaS.

Before that, there were 2-and-a-half routes to liquidity in SaaS: an acquisition or an IPO, with some opportunities for “secondary liquidity” (i.e., selling your founders’ stock) in later rounds. But starting around 2012 Private Equity came into SaaS much more aggressively and created a third party to liquidity: selling your SaaS company, either entirely or mostly, to a Private Equity firm. If there had been a third option back then, I would not have sold. I would have played the next card. No doubt about it.

I remember the first time a friend of mine sold a SaaS company to a PE firm, it was way back in 2012. Not too long after I’d sold. He told me he had an offer to “sell” his company — but I was puzzled. His company was bootstrapped and an industry leader, but it wasn’t growing that quickly. I couldn’t imagine Google or Salesforce or Oracle would buy a startup at about $15m growing 30%-40% a year for a good price. It just wasn’t growing fast enough to be “super hot”. It was stuck in the middle, in my mind.

And indeed, the acquirer wasn’t Salesforce. It was a Private Equity firm. They paid the 3 co-founders $50m in total, split 3 ways. The multiple at 3.5x revenues or so wasn’t huge by M&A or venture standards. But it was $50,000,000 cash on the table to the founders, who had never sold a single share. They took it, retired, and picked up golf.

Fast forward to today, and Private Equity is everywhere in SaaS, although they intentionally keep a low profile compared to the VCs all over Twitter and TechCrunch. Vista Equity and others bought out SaaS leaders Marketo, Cvent, Applause, Lithium, Xactly, and more for many many billions just in the past few years. Vista even just raised a new $10 billion fund to keep buying them. Phew! And that’s just one PE firm. There are many. You can check out a great session including Vista from the 2017 SaaStr Annual here:

Now Private Equity isn’t all sunshine and daisies. Usually, they are looking for at least relative bargains. And they are usually looking for fairly capital efficient companies, with relatively little venture “overhang”. Their goal is to invest just a little more, build out a management team, and ideally, IPO or sell it again for 3x-10x their investment in a few years. This also means PE isn’t interested in startups that are too early-stage or burning too much.

But Private Equity has fallen in love with SaaS. As SaaS multiples overall have grown, white space has opened up where they can pay 3x-10x revenue multiples and still make money.

And there are just so many SaaS businesses past $10m in ARR or so now with highly recurring revenues. PE firms know how to model their returns here fairly well now. They are buyers. They are looking and hunting. They have billions to deploy to buy SaaS companies. So they likely will find you, if, in fact, you end up fitting their model.

Rough-and-tough, what are Private Equity buyers looking for?

- SaaS companies with $10m+ in ARR (sometimes less, if they think they can do a roll-up, but usually at least $6m-$8m ARR)

Capital efficiency. Buying out most VCs can be tough for PE since they pay relatively lower prices. But if you’ve raised less than, say, $10m in VC capital, you become very attractive.

Capital efficiency. Buying out most VCs can be tough for PE since they pay relatively lower prices. But if you’ve raised less than, say, $10m in VC capital, you become very attractive.- Very predictable revenue, ideally very low churn and relatively low CAC. PE gets spooked if you need 2+ years to make money off new customers. They want models with better-than-average sales and marketing efficiency. They don’t want to dump $50m into sales and marketing. Versus some VC firms may be just fine with that.

- Low-ish prices for exit/sale. PE can’t pay crazy prices. Or at least, they won’t. Roughly, they want to pay about half of what the public market multiples are. Versus, VCs can often pay 2x public market comps if you are hot and growing quickly. If they pay, say, half the public market comps, then they believe, with faster growth, they can make 3x-10x their money.

If you fit that mold, as you pass $10m ARR … you’ll become very attractive to PE firms.

Also, PE firms are OK with certain risks VCs and often Corporate Acquirers aren’t:

- PE firms are often OK investing in the #2 or #3 player as long as they are growing nicely. Cash is cash. If they believe they can grow the #2 or #3 player to $100m+ in ARR, many PE firms will still want to do the deal. Most VCs by contrast try to only invest in #1 in a space, at least when it becomes clear who that is. Or at least the fastest growing newer player.

- PE firms often don’t care if you stay. If a BigCo acquires you, they often make you stay for 3+ years now, by tying up your payout. PE firms often don’t care, especially if they are going to bring in their own CEO to run it. They may want you to stay as an advisor for a year or so, but often don’t even care if it’s full-time. Tech acquirers will care.

- PE firms often don’t sweat the small stuff. It can take a long time to sell your stock after an IPO. And if you sell to a BigCo, there are multi-year escrows, lock-ups, holdbacks, and other barriers to getting your cash. PE firms often don’t care. They are in the business of deploying capital. If they get a good deal, they write you a check the day it closes and move on.

- PE firms don’t care as much if you are in a hot space. VCs care a lot that you are in a hot space. PE firms care too, but most don’t care quite as much. Mostly they care you are in a large space with predictable revenues, reasonably high public multiples, and low burn.

- PE firms are often OK if your platform and tech are old. Google or Salesforce may only want to buy a SaaS company that also has the best engineers and tech. They want to buy a startup not just with traction, but also that is state-of-the-art. Private Equity is more zen about this. PE is generally fine if it’s all a hack in PHP — so long as the customers are reasonably happy and the revenues are material and recur.

And many large VC firms have also become semi-PE firms, or hybrid firms. They’ll buy majority positions in later-stage companies along with smaller positions in startups.

Net net, PE is a Wonderful Third Option for liquidity if you stay relatively capital efficient and get to $10m+ in ARR.

It’s cool. And what it also means is, if you hit $10m+ in ARR and are growing reasonably quickly, there are more options other than just getting to $150m+ to IPO or hoping an acquirer writes you a big check. More options mean you can chill just a little bit more along the journey. That’s good for everyone.

And if you are cruising and doing well and a Private Equity firm wants to drop by the office and meet … maybe, take the meeting. At least to learn.

Also that company I noted above, that sold to Private Equity for $50m in 2012? Today they are worth $1B. A reminder that many times, not selling is the best choice of all.

(note: an updated SaaStr Classic post)