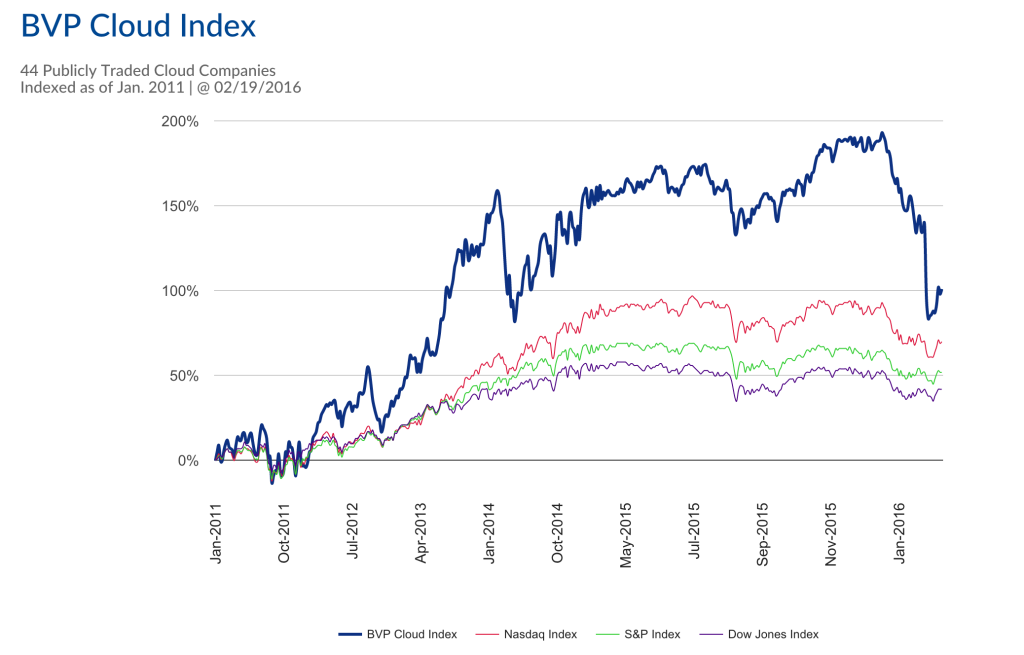

Right now, a few doubts have creeped into the SaaS investor community. Multiples have plummeted since February. And for confusing reasons. Because … the best SaaS companies are growing faster than ever. And even the ones that haven’t missed a beat, like Salesforce, Atlassian, Marketo, Hubspot, etc. still have gotten hit:

None of that worries me, though. Multiples swing up and down. I didn’t totally get the crazy ARR multiples on ’14 and into 1H’15, but it’s all good.

One thing I do worry a smidge about though, is … where is our Facebook? Where is our $100b, $200b, $500b+ SaaS public company?

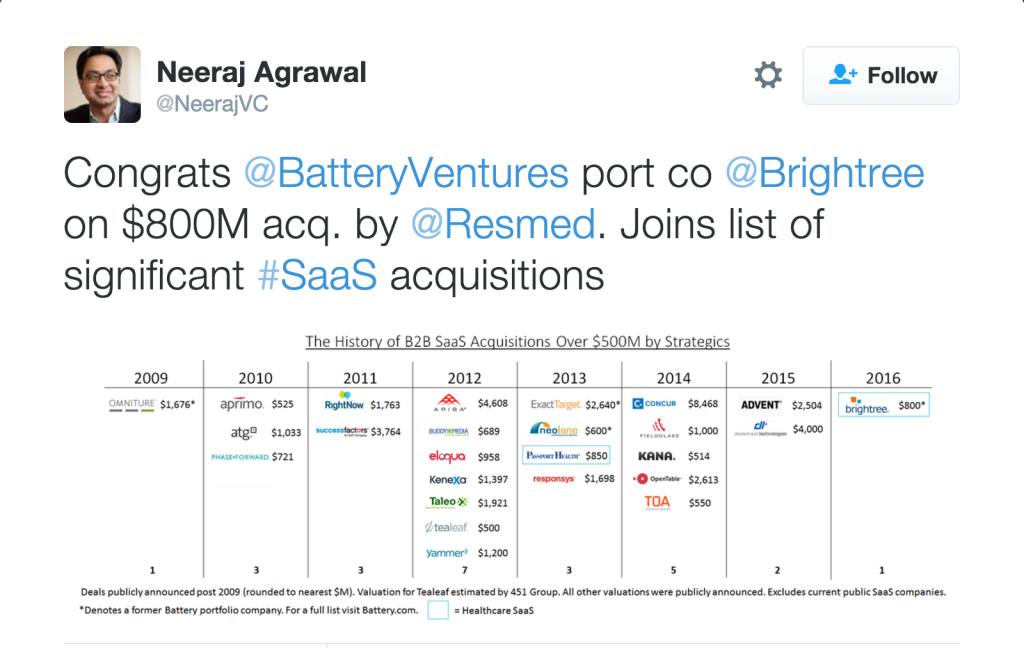

And where’s our WhatsApp? Our $20b+ acquisition?

Take a look at the chart below from Neeraj Agrawal, General Partner at Battery Ventures:

Huge, big, epic congrats to Resmed on an $800,000,000 acquisition. That’s a lot of Benjamins. And huge congrats to Neeraj and the Battery team as the majority investor 🙂 And look at all the other amazing exits on Neeraj’s chart above. More than enough to create several 8-10x venture funds.

And yet … the biggest M&A deal of all here was Concur for $8.4 billion.

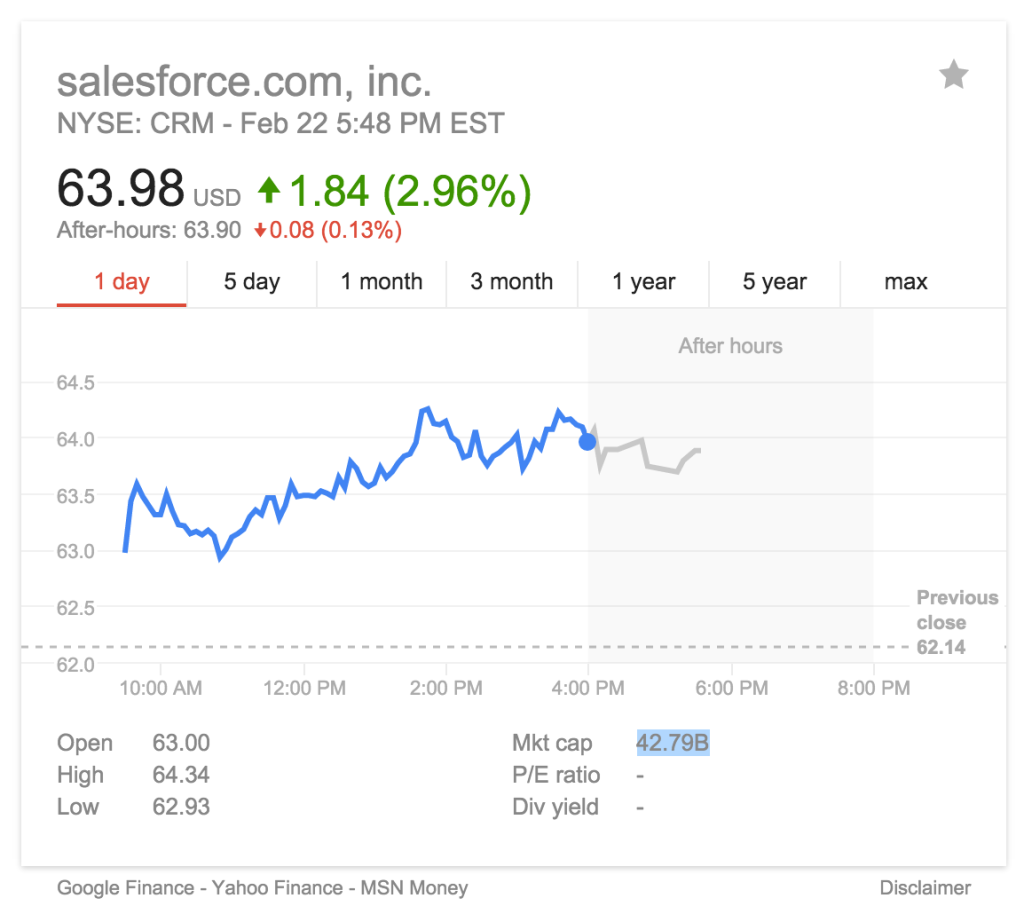

And our #1 largest SaaS company, our Hero, Salesforce.com … is “only” worth $42.5 billion.

Yes, I know Oracle is worth $150b+. But man it’s oooooold.

The thing is, all these Unicorns. It’s not silly. It’s just … they can only make sense if Salesforce is just the tip of the iceberg. If we can have dozens of SaaS companies worth $10b+ or more, and a handful worth $100b+.

We’re not there today. It’s all good. In fact, it’s all great. But I’m not sure all the investments we’re doing make sense until we have our our Facebook and WhatsApp in SaaS.

Or at least, until we know they are coming.