Top advantages to being a first mover:

– No roadmap

– Tiny market

– Customers aren’t sure

– Limited legitimacy

– Never budgeted

– VCs don’t get it

– Many VPs don’t get it

– Tiny TAM at first

– Seems minor to many

– Why wasn’t it already done if it’s so importantIt’s great

— Jason ✨Be Kind✨ Lemkin (@jasonlk) April 26, 2022

Guest Post by Daniel Barber, VP of Sales at Datanyze

The explosion of sales and marketing technology from ~150 vendors in 2011 to 3500+ in 2016 has led to fierce competition. Every deal counts. Every dollar is fuel for the next battle.

The winners are playing chess not checkers. And more importantly building businesses around the success of their customers. Here are my 7 learnings along the way:

- Strategic Advantage

The reality is that first mover in SaaS is often not an advantage. In fact, the disadvantages have been well-documented here, here, and here.

Differentiated strategic advantage requires the creation of a shared vision beyond a set of features. The future customer must believe that your product (and only yours) will deliver 10X more value above and beyond the associated switching costs.

Significant behavioral change of the end user is difficult in the beginning, however gradual change combined with benefits for management will create barriers for wannabe competitors. This involves interweaving your product into the daily (and hopefully hourly) workflow across the organization.

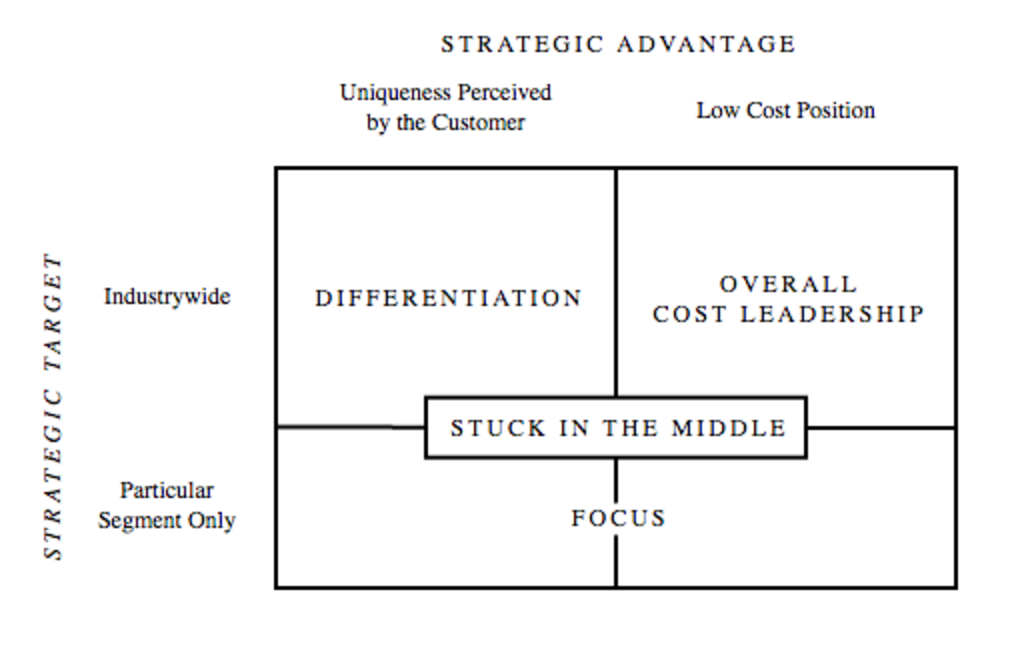

Michael Porter’s Three Generic Strategies

- Creative pricing

Within established SaaS application markets (CRM, Support, Communication), application of record businesses (Salesforce, Zendesk, Slack, respectively) will often set the tone and price ceiling. Navigating these waters is often a game of price elasticity (think back to your Econ 201 class), however applying a different model can often out-seat the ceiling. The key to this strategy is reducing barriers to adoption while simultaneously creating organizational value.

The freemium model (used by Yammer, Slack, Evernote) allows users to create an account using their work email and give access to others within the organization. Once the critical mass (and subsequent value) is large enough, the sales team can negotiate an organization-wide contract – reducing the friction of up-front seat pricing.

- Anchoring tiers

At this point, SaaS products generally have three tiers: individual, team, and enterprise (contact us for details!). What’s often misunderstood is that the visible price on the website acts as a psychological anchor for all further negotiating. If you position your product at below the value of your competition (even for your individual plan), you risk setting a pricing floor that relegates you to the Low Cost Position (see matrix above).

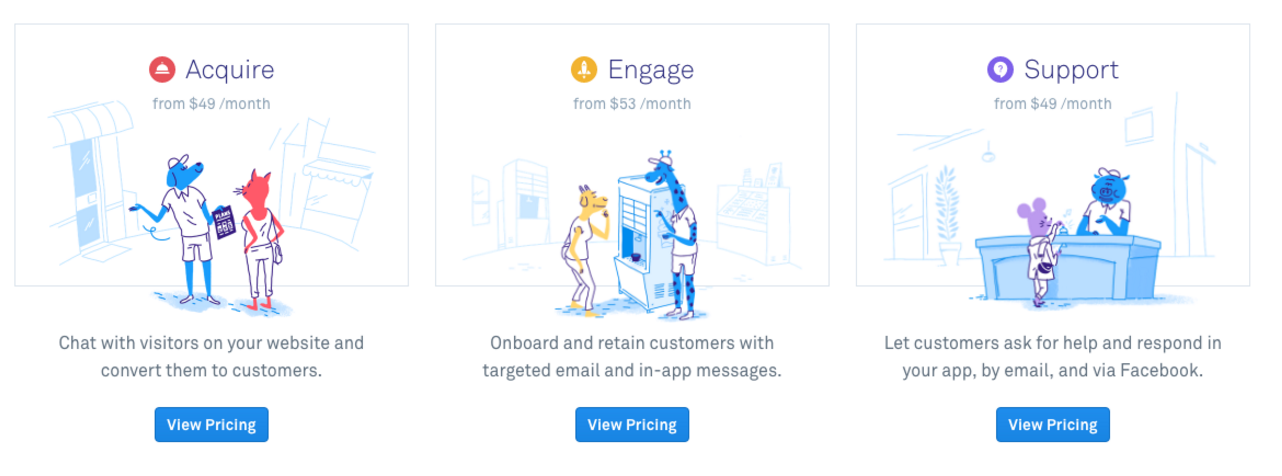

An example of price anchoring is “Zendesk: Plans start from just $5 a month” vs. “Intercom: Start with the recommended set (of three products) – $61/month. In this example Zendesk has set the price floor at $5, so F500 enterprises might question paying more than $10. In contrast, Intercom starts at $49 – for only one product, which makes the $61 offering even more appealing.

Intercom: Price Anchoring by Product

- Make it an executive problem

Every sales organization thinks they’re solving world peace through their cloud-based, industry leading, [insert additional buzzword here]. The reality is that unless you’re able to bring an executive into the conversation, you’ll be relegated to middle management or even worse, beaten to death by ROI requests by the Analyst army. Getting access to the executive team isn’t easy, however can be done through triangulating the conversation and proactively engaging with multiple internal stakeholders. In many cases, I’ve seen deal sizes increase by 3X simply by involving an executive buyer.

If your end-user is a sales rep, selling exclusively to the front-line manager will increase your hurdles to organization-wide adoption. Conversely, engaging a VP/CRO while simultaneously building a loyal user following will expedite the sales process and lift the conversation to a strategic purchase.

- Capture the budget

As clearly articulated by Tomasz, there are three types of budgets: competitive, enlargement, and new. Under all three models, you want to wall-out your competitors by capturing the maximum budget available in the given category. For example, if there’s an existing provider, competing on price will reduce budget allocation in the category. By contrast, positioning the value proposition as an upgrade will induce a psychological behavior that leads to enlargement. This starts with product marketing on the website and continues all the way to the email subject line: upgrade to X, step after Y, advance to Z.

- Competitive evangelism

Competitive takeaways are common practice in SaaS markets. Sales and marketing organizations can fuel the fire by focusing on competitors’ marquee customers and developing content that articulates why xyz companies made the switch. Companies in the same category add significant social proof and will often see 3X+ conversion into pipeline. Moreover, investment in the creation of competitive battle cards will pay dividends – and surfacing takeaway logos across the sales floor will increase adoption.

- Buy-out contracts

Once you’re above $10M in revenue (and in select cases even before), buying out competitor contracts can be an effective strategy to capture budget (assuming you’re enlarging not contracting). Securing a multi-year deal will cut the ankles out from from your competition and shift the discussion to a long-term partnership. The tactics for mastering this maneuver are straightforward: 1) Determine your internal thresholds for contract takeover (i.e. price and contract length) 2) Co-create long term customer milestones to illustrate partnership vis-à-vis. tool 3) Delineate pricing in the MSA/Order Form to concentrate focus on the exclusivity of the deal. The CAC will be cost prohibitive in the long-run, however for multi-year and/or marquee takeaways the investment is well spent.

Daniel Barber is the VP of Sales at Datanyze, a sales acceleration software provider that helps technology companies combine data and predictive analytics to find and reach their best accounts. Prior to Datanyze, Daniel led revenue for Node.io, built and scaled sales teams at ToutApp (backed by Andreessen Horowitz) and Responsys (acquired by Oracle for $1.5B in December 2013).

Daniel Barber is the VP of Sales at Datanyze, a sales acceleration software provider that helps technology companies combine data and predictive analytics to find and reach their best accounts. Prior to Datanyze, Daniel led revenue for Node.io, built and scaled sales teams at ToutApp (backed by Andreessen Horowitz) and Responsys (acquired by Oracle for $1.5B in December 2013).