Before I ever made a single investment, I was 100% heads down running my own SaaS company. I remember asking Jason Green of Emergence Capital (my 2x investor), back in the day, how pre-IPO Successfactors was doing, where he was also on the board.

Successfactors later went on to a very successful IPO and then a huge sale to SAP for $3.4 billion.

His answer: “I’m buying every share I can”

I didn’t really get what he meant.

Fast forward to today, I haven’t really been investing all that long, but man have I learned a lot. I’ve raised $90m for two SaaStr Funds, been part of another $195m fundraise, and made about 30 total investments of various sizes. The first batch is doing pretty well, and now we can go back and see what we’ve learned.

One of the first investments I made when I actually figured out my “formula” was Algolia, an amazing search-as-a-service product & API. If you are looking at adding search to your web or mobile service, you need to look at Algolia. 3,000 companies do, including 100 SaaS leaders and companies from Stripe to Twitch to Twitter/Persicope to Really Big Tech Leaders They Can’t Talk About. For product, document, SaaS, small object and similar searches, it’s up to 100x faster than the competition (Elastic Search, etc.) and just as importantly, can be deployed in minutes. That’s cool. (Everything should be an API today). Go to Hackernews or David Skok’s For Entrepreneurs or right here on SaaStr.com to see it in action!

Before my first check into Algolia in 2014, I didn’t have a true investment thesis yet. I was sort of betting on either great founders I knew, or traction. And those were good bets too. But when I got to Algolia and Talkdesk in particular, I began to narrow my focus. I first invested in Algolia a little over 3 years ago, when they were at just $15k in MRR. I led their first U.S. round, a whopping $1.25m. At the time, this was seen as a very expensive investment.

Fast forward to the other day, and Algolia has grown several orders of magnitude in revenue and closed a $53,000,000 round. With a 72 NPS. And growing >100% Year-over-Year even now, well into eight figures in ARR.

You can read my original investment thesis back then: Going Upmarket, Lead Velocity, Commitment to Sales (especially for developer-centric products like Algolia), Large but Nonobvious Market (at the time, search-as-service was a $2m market!), and Extreme Founder Commitment.

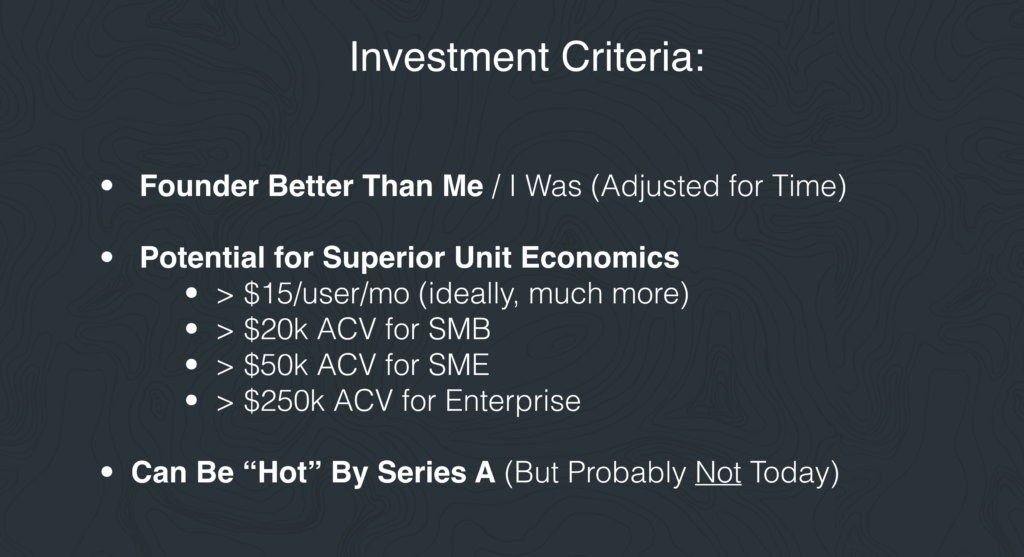

Since then I’ve further refined it:

- First, extreme commitment is necessary, but not sufficient. I’ve refined this to: The founders have to be much better than me. A much better CEO than I was, adjusted for time. After all, I had about $150m in exits as a founder. If you aren’t better than me, you probably won’t build a unicorn. Folks reading this who aren’t founders may not know what I mean. But the founder CEOs will. You know who is better than you.

- Second, I refined “going upmarket” to — Potential for Superior Unit Economics. My learning is that I sold a $15/mo SaaS product. If yours is $30/mo, or even $45/mo … it really is 2-3x easier. It really is. All things being equal, of course. Since I invested, Algolia has gone on to close over 3,000 customers. But that also includes many six figure deals. There are several free versions of Algolia. But the natural deal economics are … superior.

- Third, I learned the power of NPS. Algolia’s NPS has been from 50-72 since I invested 3 years ago. Since basically Day 1. As a result, among other things, they have 140% net negative churn and amazing brand awareness.

If you are better than me, if you have better unit economics than I did, and you have truly, insanely happy customers and a hint of traction … magic is just going to happen. Almost every time. I haven’t lost on any of these investments yet.

Now, I do deals that meet all 4 of these criteria in about 20 minutes. I did Automile, Talkdesk, RainforestQA, Logikcull, and many other emerging leaders in about 20 minutes.

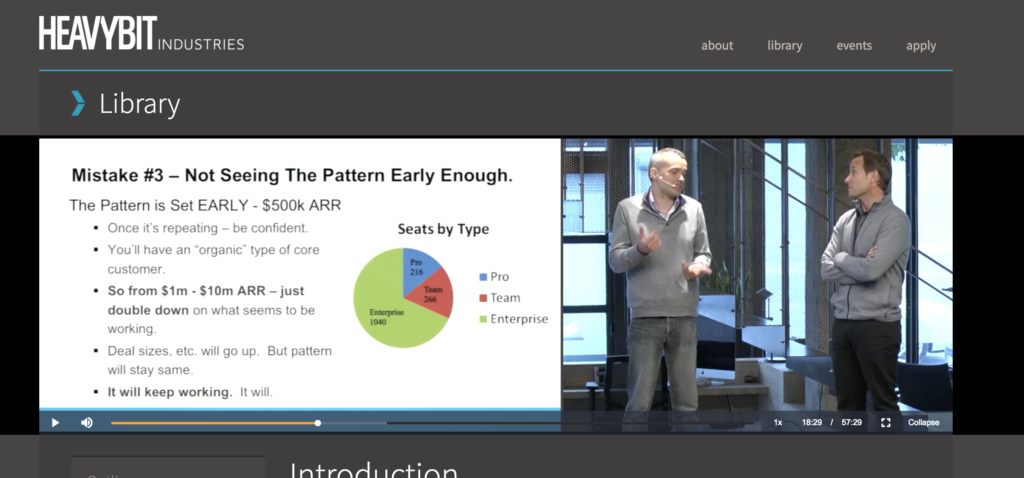

When the time then came about a year later to invest in the A round in Algolia in 2015, I’d learned from Jason Green and Successfactors. Even many folks thought that round was crazy expensive again. In fact, we had no pro rata. But I wrote a $2,500,000 check. I would have done $5m if I could have. You can see a great presentation of CEO Nicolas Dessaigne and me a few years back on our Top Mistakes here:

Then, a while later, Algolia crossed $10m in ARR. The Inevitable phase, as we talk about at SaaStr. And the growth, the NPS, and the product quality didn’t tail off. All three accelerated, in fact, after $10m ARR. That’s what happens with the very best founders, with the most extreme commitment to excellence combined with net negative churn and 72 NPS. The brand, the referrals, and the net negative churn really (and finally) kick in. The Cavalry comes. And especially, Second Order Revenue becomes a key driver of predictable growth. And you can squint, and on the horizon, begin to see $100m in ARR.

Fast forward again to a few months ago, before the company ever started raising this round, and CEO Nicolas Dessaigne asked me what I thought if they chose to raise again (they had barely spent any of the prior round and didn’t need to).

I said, well, I’d just wait. That’s what I’d do. You don’t need the money. But. You are better founders than me. With great unit economics. And 3,000 insanely happy customers. You are probably already halfway to an iconic company. Do whatever you think helps you get there even faster. Do it.

I said let me know how I can help.

And.

I’ll buy every share I can 😉