The thing about B2B vs. B2C is … at least today … B2B and SaaS haven’t yet bred nearly as many Decacorns.

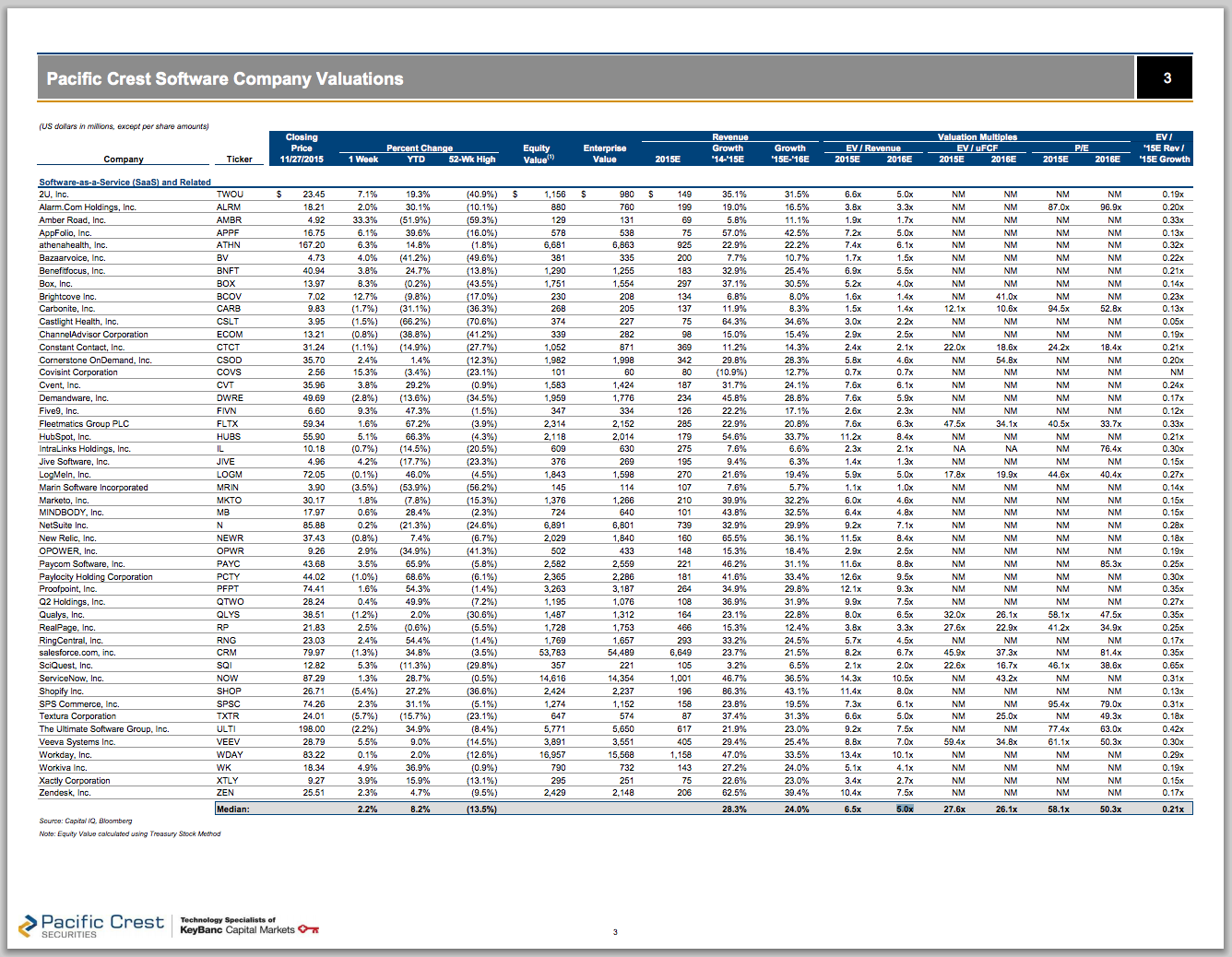

Facebook is worth $300 billion today — in just 10 years. Google is worth $500 billion. But Salesforce is “only” worth ~$50 billion after 16 years. Runner up Workday is “only” worth ~$16 billion. And that’s as good as it gets in SaaS, folks. Add in ServiceNow at $14 billion … and all the rest of the public SaaS companies are only single-digit unicorns:

Also note their multiples. On average, the Public SaaS companies trade at 5x next year’s GAAP revenues, and 6.5x this year’s revenues.

Now, of course, in theory at least, your SaaS start-up is growing faster than Salesforce, Workday, and ServiceNow. But … they are all well past billions in revenues. So the real question is — are you better? Because if, adjusted for time, you are better than Salesforce-Workday-ServiceNow (“SWS”), or at least, reasonably could be — you deserve to be a unicorn today, or at least, a pre-nicorn.

And if there are 20-30 start-ups better than SWS — then all this unicorn math makes sense. Because really, the only justification for investing at a $1 billion or $2 billion pre is if you can see a shot at getting to $10 billion in valuation years down the road.

And if there are 20-30 start-ups better than SWS — then all this unicorn math makes sense. Because really, the only justification for investing at a $1 billion or $2 billion pre is if you can see a shot at getting to $10 billion in valuation years down the road.

At 20-40x ARR multiples … the price where Hot SaaS Start-Ups get funded … you can see it. Invest in a Hot SaaS Start-up at $30m ARR, then at 30x ARR … that’s just about a $1 billion valuation. That’s a Unicorn. And the valuation makes sense IF that start-up then can grown 30-70x from there (to hit $1b-$3b in revenues), and once it gets there, can grow 30%+ Year-over-Year like Workday, Salesforce, and ServiceNow.

So … are there 20-30 of these? That are better than SWS? Well …

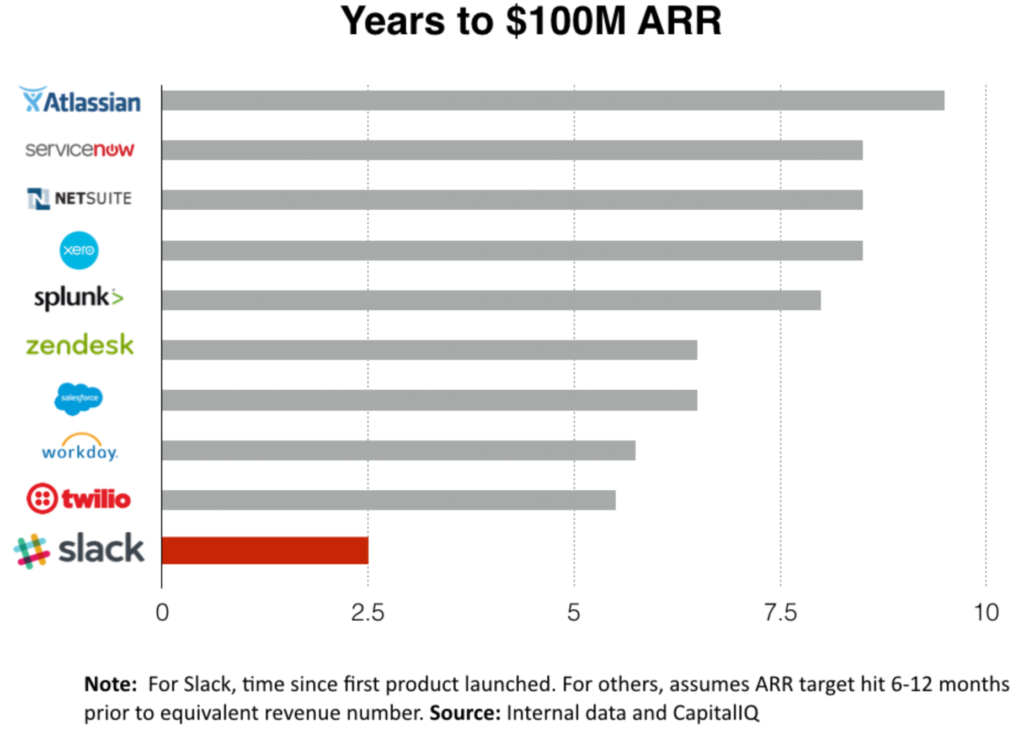

- If you look at the growth rate of say Slack or Talkdesk or Intercom, you can believe. You can trace the line through that epic growth. It makes sense.

- But if you think ultimately we aren’t going to be buying at least 20-30x more SaaS software than we do today by $$$$ spent … then it doesn’t. That math doesn’t hold up.

Now at a macro level …

- It’s easy to see 20-30x growth in $$$ put into SaaS if you just see it as a small migration of the CIO’s budget from on-prem and other services to SaaS. Easy.

- And … it’s easy to see 20-30x the SMBs running their businesses on SaaS. We’re already seeing this. Easy.

- But

- Still … it’s a huge amount of new $$$ going into SaaS software. 20-30x more.

I’m bullish. Software may or may not be eating the world, but SaaS is bigger and growing faster than ever. I firmly believe we are just at the bottom of the second inning.

But to justify all these SaaS unicorns — all the end customers have to buy at least 20-30x more SaaS software than they do today. Maybe even 50x.

I believe it. The trendline supports it. It’s happening. But. That’s a lot of aggregate spending growth.

If nothing else, realize to make it all work, all the SaaS Unicorns … we have to all buy into a new, and at least 20-30x larger, SaaS world in 2021 or so. I see it. I believe it. I can almost touch it.

Also, B2B lags B2C by 3-5 years. It just takes longer to sell a product, and change business processes … than it does to change the way people share pictures. It just does. So if FB and GOOG are almost at $1 trillion in value today, and WhatsApp can get purchased for $20 billion essentially pre-revenue, and Snap is IPO’ing at $20b+ … it makes sense this will happen in SaaS and B2B in 4-5 years. We’ll get there.

But it will be nothing like the world we are in today.