Dear SaaStr: What Kind of Background Checks Do VCs Do on Entrepreneurs They Fund?

Dear SaaStr: What Kind of Background Checks Do VCs Do on Entrepreneurs They Fund? It varies. Everyone does some background checks, or least they did outside of the Boom Times of late 2020 through late 2021. And some do very in-depth ones with lots of “off sheet”...

Dear SaaStr: How Do Investors Feel About “Acquihires”?

Dear SaaStr: How Do Investors Feel About “Acquihires”? Back when I started investing, in 2013, VCs worked on getting acquihires for their struggling startups. A lot of energy was put in to find a “soft landing” for struggling investments...

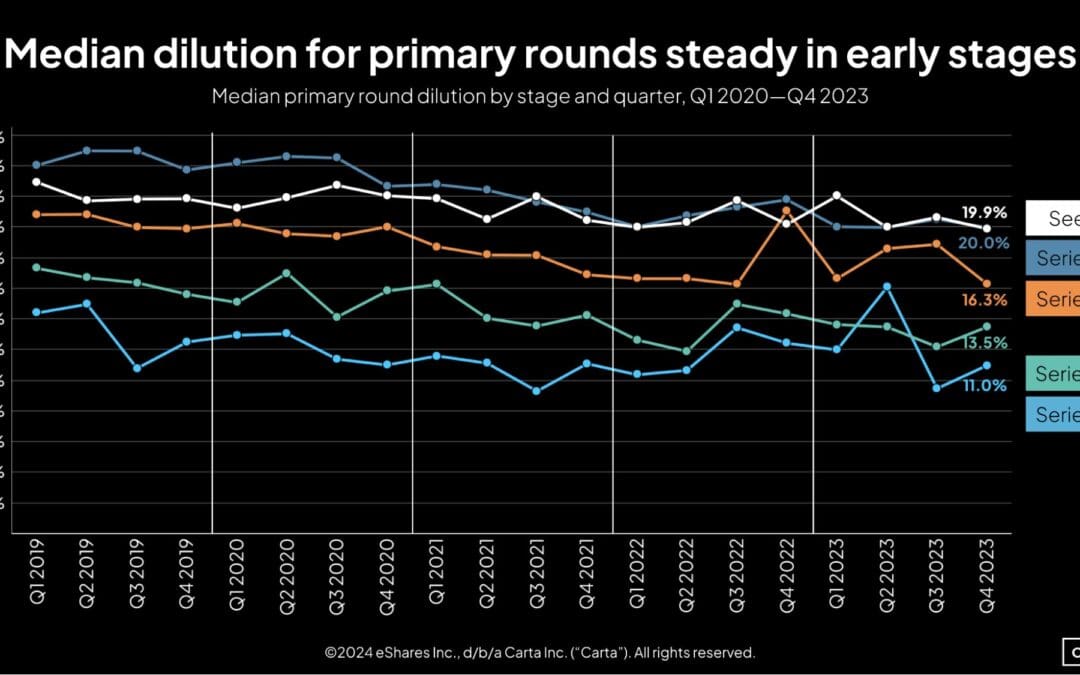

Dear SaaStr: Is It Normal for a Founder CEO to End Up With Just 10% Equity?

Dear SaaStr: Is It Normal for a Founder CEO to End Up With Just 10% Equity? Yes — if you are venture-backed. Roughly speaking, this is what generally will happen after 3 rounds of traditional venture capital. Expect it and plan for it. If the company sells...

Dear SaaStr: How Big of a Return Are VCs Looking For in a Startup?

Dear SaaStr: How Big of a Return Are VCs Looking For in a Startup? For Angel, Pre-Seed: At least 50x, with a possible chance of more. The loss rate in general is so high here, the winners have to do 50x. And this is after dilution, so 100x from the valuation at...

Dear SaaStr: Can A Startup Without Any Prior Experience Raise Money From VCs?

Dear SaaStr: Can a startup without any prior experience raise money from venture capitalists (VCs)? Of course, but the answer is a bit more complicated than that. The less proven you are, generally speaking, the further along you need to be to raise from VCs. A...

A Look Back: Zoom At $100m ARR, Burning Almost Nothing (Video + Pod)

As we gear up for SaaStr Europa 2024 in London on 4-5 June and SaaStr Annual 2024 in the SF Bay Area on September 10-12, we wanted to take a look back at some of our most iconic speakers and sessions from over the year, that we can still learn from today. Today, Zoom...

Dear SaaStr: My Investor Wants Weekly Meetings. Is This Too Much Time?

Dear SaaStr: I am a startup founder that writes extensive monthly report to investors. We are also doing weekly meetings, are they asking for too much of my time? Yes. Some rough rules: For every 1% of a company an investor owns, an investor should get one meeting a...

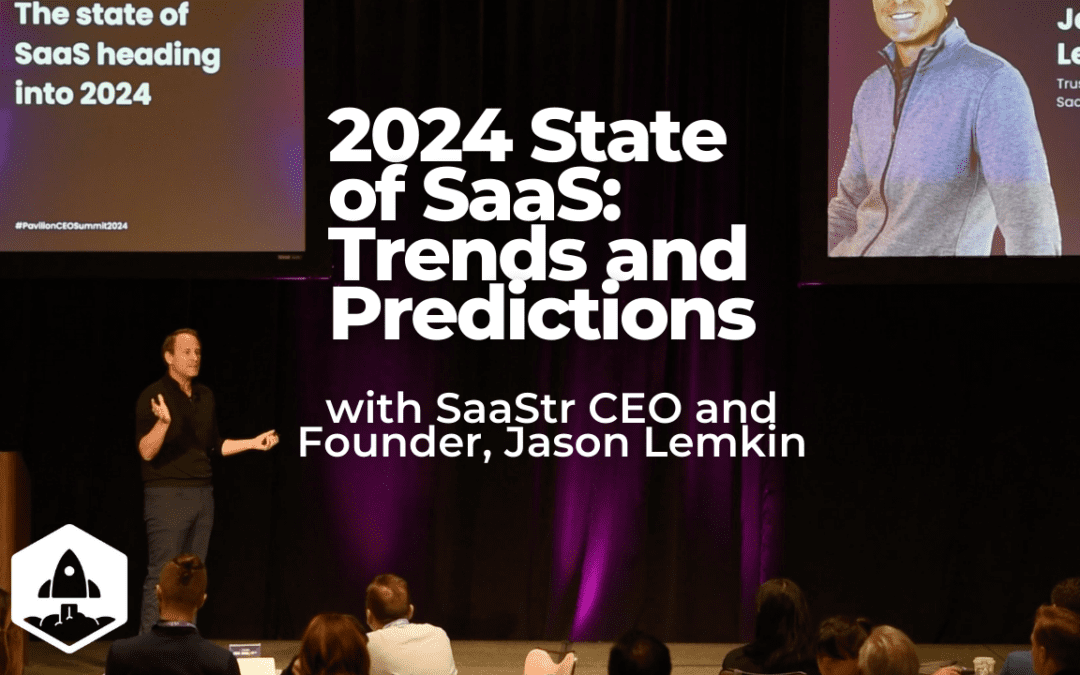

2024 State of SaaS: Trends and Predictions with SaaStr CEO and Founder, Jason Lemkin

At Pavilion’s CEO Summit, SaaStr CEO and Founder Jason Lemkin, took the stage to share what’s most top of mind for him at the start of 2024.

Why 2024 May Be Tougher on Venture Capital Than 2023

I thought this year would be better for venture: – Folks internalized markdowns, write-offs– Ready to get back to business– Most top VCs have fresh funds to invest But: – The "AI Chase" burning up tons of energy– Unicorns not...

Dear SaaStr: What Happens After You Raise Venture Capital for the First Time?

Dear SaaStr: What Happens and Changes After You Raise Venture Capital for the First Time? A few thoughts if you haven’t raised venture capital before: 1. Remember you have to prove yourself, still. Yes, you got the $$$, and they really can’t get it back, and...

Dear SaaStr: What Are The Most “Evil” Things That VCs Do?

Dear SaaStr: What Are The Most “Evil” Things That VCs Do? I’ve been on every side of the table, and had challenging experiences with my investors. I think what founders get wrong is not understanding incentives. VCs really do want you to be a big success....

Venture Backed or Bootstrapped? There’s a Third Way. Just Raise One Round.

There’s so much debate on social media and elsewhere on bootstrapped vs VC. Bootstrapped you maintain control, and the unit economics. But many see it as so much harder. And it’s almost always longer. VC can let you go faster, but it can become an addiction. And...

It’s Just Better If Your VCs All Trust Each Other (Updated)

You’re life as a founder will be from 5%-50% easier if your VCs all trust each other It’s at least worth trying to end up with a syndicate like that — Jason ✨Be Kind✨ Lemkin 🇮🇱 (@jasonlk) December 20, 2023 I’ve been investing long enough — since...