So it took me a little while to grok and figure out Demo Days. They are overwhelming. Too many start-ups presenting, too quickly. Too many charts and graphs with unlabelled X and Y axes. Not enough detail, not enough time, too canned, too polished, not polished enough.

But with 20 institutional and angel investments under my belt, I’ve learned. Accelerators are super valuable to investors. About 50% of my investments have gone through YC or 500 Startups, and others have been through Angelpad, Techstars, etc. If nothing else, they teach founders how to package up an investment opportunity well, or at least, far better than most would know how to otherwise. And if I’m buying a product (in this case, stock) … having it packaged up well for consumption does help.

And a well-done Demo Day makes the inbound side (investors reaching out to founders) more efficient and effective. Which is great.

What I haven’t seen done quite as well is hacking the outbound side of Demo Days and selling early-stage stock. Here’s what I see:

- Crazy emails clearly sent to everyone. A top-tier SDR would NEVER do this.

- Emails sent with bizarro formatting. They need to look like they came from your Gmail, at least. Salesloft, ToutApp, etc. all figured this out for SDRs and AEs.

- Lack of sophisticated personalization. Think of this like Account-Based Marketing. I guess if you are reaching out to 100s of true angels, light personalization maybe is OK. Like an SDR reaching out to 1000 names. But for Key Accounts, you need a super-targeted message. “Satya and Hunter — I love Homebrew, and I read the Skim every day, and I already used ManagedbyQ …” I mean, that’s just a start. But you have to at least do this much. A good SDR would never send a Key Account anything but a carefully researched email, tailored to the prospect. Maybe even with a personalized video attached. GET THIS RIGHT, FOLKS.

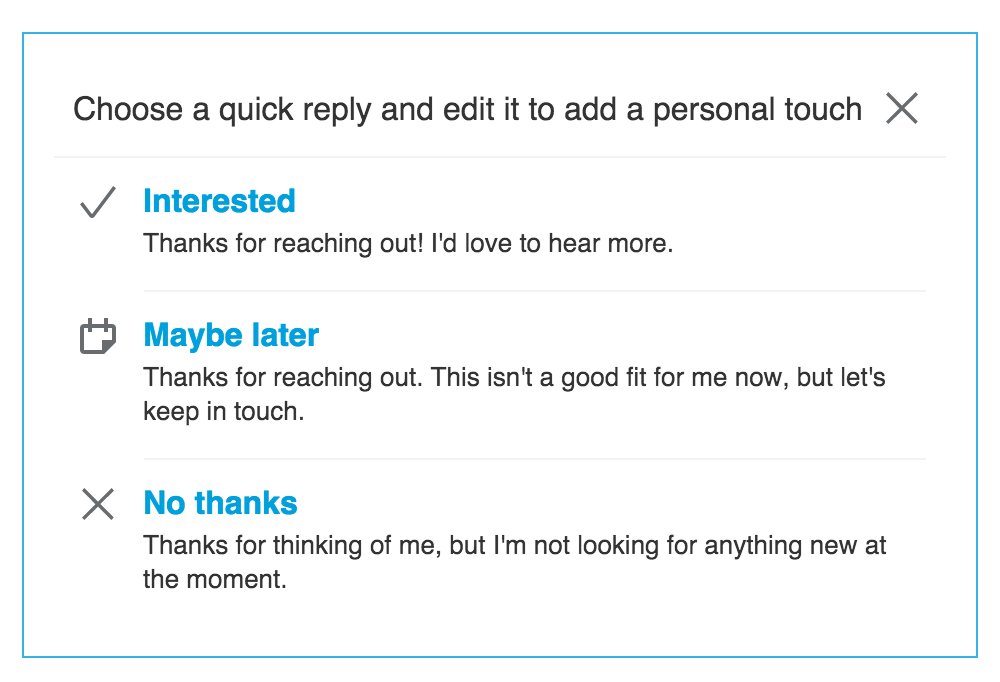

- Wrong / insufficient next steps. No, I don’t have time for coffee. But I might want to see more. I might even want to talk after Demo Day. Give me some options. Not just a crazy “can we meet for 2 hours tomorrow?”

- Don’t ever, ever, ever use LinkedIn Inmail or similar. SDRs don’t do this anymore, either. They figure out your real email, one way or another.

- Allow me to buy the way I like to buy. SDRs know there are different types of buyers. Some will go to a webinar, some want a 1-on-1 demo. Some want to try the product on their own. Ask me. Meet before Demo Day? After? During? What do I need? I know you are supposed to figure out who you want to invest in before Demo Day. But that’s not me. I’d rather meet after.

Treat VCs at Demo Days like Named Accounts. Focus on the 2, 3, 5 ones you have a high interest in. And invest the time to tailor a very thoughtful pitch to them, that reflects their interests.

…

OK. So you’ve done your initial outreach / outbound the right way. But then founders don’t know how to follow-up:

- Send a second email IF the first one was really good. If you really think the outbound was strong and personalized, send a second one. But don’t send a second spam. But if the first one was good, we all get distracted. The best SDRs know how to send a strong, personalized, good second email. But not 72 spammy drip emails.

- Don’t create stupid timelines. Look, if you are closing a $3m seed next week for real, great. But bluff this the wrong way, I’m busy, so I’ll just pass. AEs manage prospects to the end of the month, the end of the quarter. Whatever you do here, be true, not false.

- The best investors may need extra time if it’s early stage. Many of the best VCs in SaaS / enterprise don’t shoot from the hip. We may need to meet more people. Think through the data. So bear in mind, you may need to budget in a few extra weeks to get the investors of your dreams.

Ok, now some specific advice for SaaS companies. Because I think most demo days, except the 100% enterprise ones like Accelprise, get this wrong:

- More real data, please. I don’t need any stupid hockey-stick chart with no data.

- A data-driven projection, please. How much revenue will you be doing in 12 months and WHY? Yes, you can do this in one slide.

- Send me the whole, detailed deck in advance of Demo Day. I’ll read it. This is SaaS. I want more data and info.

- All I will get out of your Demo Day preso is a sense of you and what you want to do. There isn’t enough time otherwise. This may be OK in B2C, but I need to learn more. So make sure I at least know where you want to be in 12, 24, and 60+ months. Let me see that vision for the future and how you’ll get there. That’s the most important thing for me to see on stage in 5-10 minutes.

Good luck!

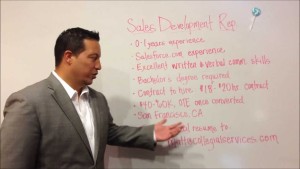

Attack the outbound part like an SDR. You are selling stock, after all. If you do, you’ll do better, and importantly, have a better chance of getting to pick the right investors for you. Not just the ones that do a Quick Handshake.