Lately I’ve been meeting with a lot of early-stage entrepreneurs and I’ve realized that one byproduct of acqui-hires, incubators, seed fund explosions, etc. is that people don’t always really think about whether venture capital is a good idea for them or not. Especially with seed and Series A rounds, often no one really asks them or challenges them. Perhaps they should.

Lately I’ve been meeting with a lot of early-stage entrepreneurs and I’ve realized that one byproduct of acqui-hires, incubators, seed fund explosions, etc. is that people don’t always really think about whether venture capital is a good idea for them or not. Especially with seed and Series A rounds, often no one really asks them or challenges them. Perhaps they should.

Venture capital is a niche product and a niche industry. The vast majority of companies not only won’t get venture capital — but they shouldn’t seek it. Because even if they get it, they won’t ever have enough success to make anyone enough money and/or justify the effort.

But how do you know?

I believe it can all be answered in one (and a half) question:

>> Do you deeply, honest believe there’s a way to build your company into a $100,000,000 business?

[Also, it must be in a good, high-multiple space, but we’ll take that as a given here.]

When you’re starting a SaaS company, you don’t need all the answers. But you do need to, if you squint and look in the distance, and have a bit of luck, and beat some serious odds — see the path to a hundred million dollar business. Even if you are acquired (well) before then, it’s SaaS start-ups on their way to $100,000,000 businesses that get acquired for good multiples and good all-around results.

If you don’t believe it — my advice is, at least in SaaS, don’t do it, even if you can get it. The venture capital piece. Fund it, make it happen, some other way. Use friends & family money. Borrow, scrimp and save. But don’t take “traditional” venture capital.

—————————————————————————-

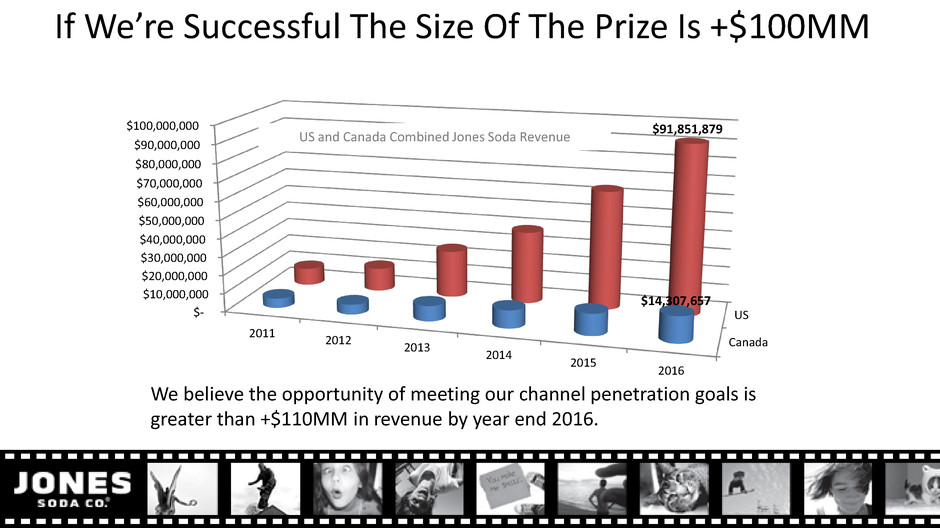

Image from Jones Soda 8-K SEC filing here.