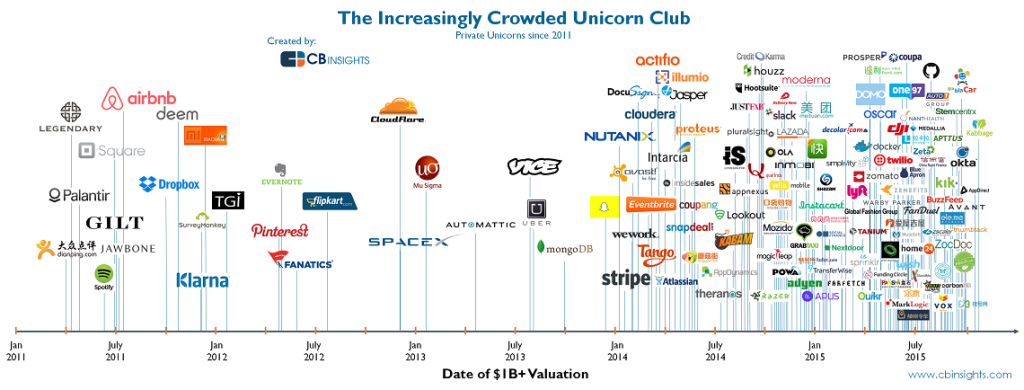

I know you can’t escape talk of the 7,000 Unicorns these days no matter how hard you try. The world’s gone crazy, right?

Well, maybe. Maybe. I don’t understand the negative gross margin ones, that’s for sure. But we’re SaaS folks here on SaaStr. Our revenues have their challenges, but 98% of the time, they are real, and with 75%+ gross margins. Sometimes the CACs and realized quotas are a little scary in the Unicorns, but other than that, our revenues are pretty real. And highly recurring.

What’s really going on, beyond the epic run of Nasdaq (which is half of what this is all about) … is that the bar has gone up. No one invests at $1b pre in a SaaS start-up they think will top out around $100m or $150m in ARR. Or certainly, in a start-up whose seeming ambitions end there.

In fact, I want to simplify what I think has changed in the Age of SaaS Unicorns — $300m ARR is the new $100m ARR.

By that I mean, having a plan to get to “just” $100m ARRm, and then IPO, isn’t good enough anymore.

I think it has to be $300m. As crazy as this may sound at say $50k MRR.

Sorry. I didn’t get to $300m ARR myself. And yes we know, even getting to $100m ARR is rare thing, indeed. Let alone $300m.

But let me give you two recent examples to frame it.

First, I’m an investor in a company I love that took 2.5 years to get to just a token amount of revenue at the start of this year. But they’ll end the year at $3m ARR. That’s crazy growth given where they started. But it’s not the impressive or interesting part. The interesting part is that after that long slog, even at $3m, they are just at the very earliest stage of early adopters.

So I did this thought exercise with them. One, can we double prices next year? Everyone agreed that was easy as the customers go more and more upmarket. It was already happening.

So I did this thought exercise with them. One, can we double prices next year? Everyone agreed that was easy as the customers go more and more upmarket. It was already happening.

Ok then. Since we are still in the early adopter stage at $3m ARR, then question #2: can we get 50x the customers? Everyone agreed 50x more customers was easy to see. Because they’d just gotten going, really. Of course there were that many customers still to get. Even with the product just as it is today.

So … then … take $3m ARR at 12/31/15, double the effective ACV (2x) in ’16, and add 50x the customers over the coming X years … that’s “just” $3m x 2 x 50 = $300,000,000 ARR.

Woah.

Now I’m not saying that will actually happen. So few SaaS companies have ever hit $300m ARR. Like less than three hands worth, so far.

But the maths say this company, and indeed many others, can do it.

So goodbye, $100m ARR as the way-the-frack-out-on-the-distance milestone. Hello, $300m ARR.

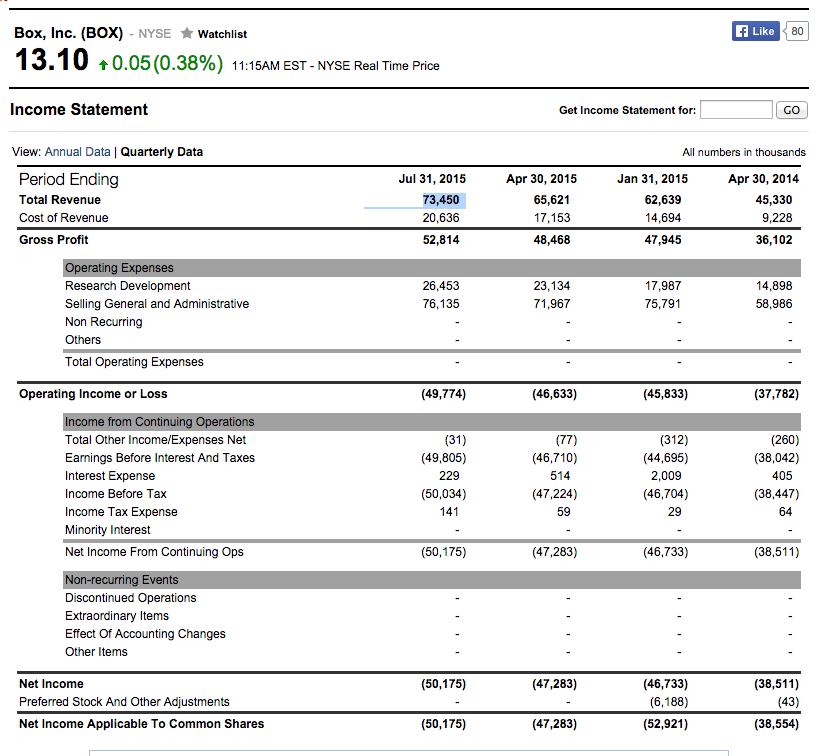

Ok the second example is two we are all familiar with. Box and Zendesk.

First, Box. Before the IPO, in the year-long quiet period, Box had a lot of armchair critics. I wasn’t one of them. I wrote a piece in TechCrunch on how Box will get to $1 billion in ARR before you know it. A lot of people didn’t get it at the time. Read it here.

But it’s just SaaS physics and math. If you get to nine figures in ARR, growing quickly, you can get to ten. So …

Where is Box today? Indeed, it’s at $300m ARR. Actually, well past it.

And yet, as epic as Box is, in today’s slightly depressed SaaS multiple market — it’s a $2 billion market cap company. Totally epic. Two. Billion. But — a relatively modest revenue multiple compared to all these private unicorns.

And yet, as epic as Box is, in today’s slightly depressed SaaS multiple market — it’s a $2 billion market cap company. Totally epic. Two. Billion. But — a relatively modest revenue multiple compared to all these private unicorns.

Now Box’s market cap will continue to grow along with its ARR. At $1b in ARR, there’s not a snowball’s chance Box will be valued at just 2x ARR. But today the market (and multiples) is what it is.

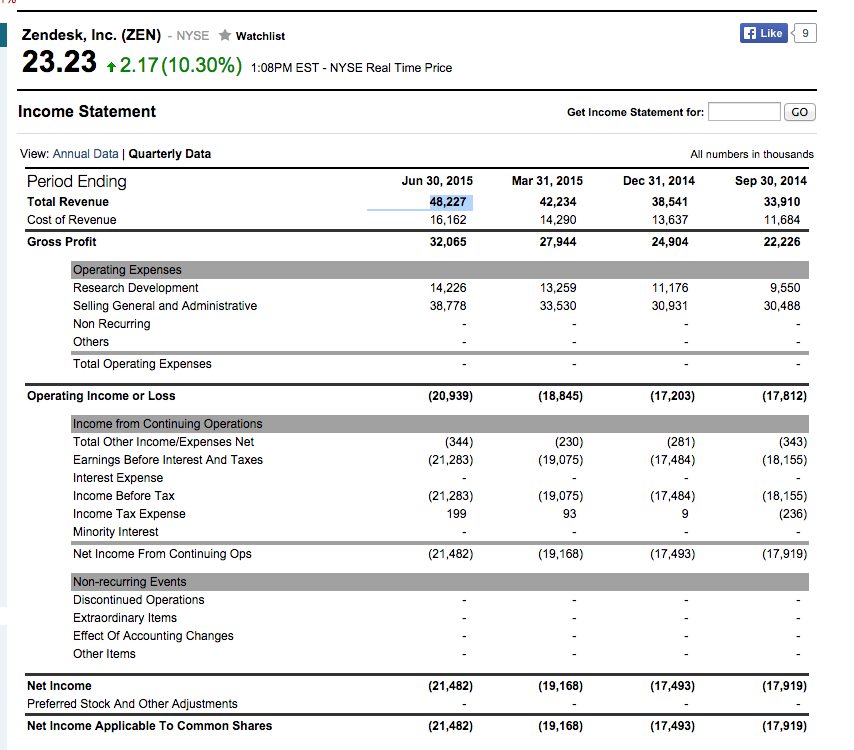

Let’s take another — Zendesk. Zendesk has cruised past $200m ARR, growing 60% (!) Year-over-Year. Woah. Yes, woah. And like Box, it’s also “just” a $2 billion public unicorn, too.

So …

Two related thoughts:

- The best SaaS companies are scaling faster than ever (Zenefits, Slack, Talkdesk, etc.). That justifies higher multiples and Unicorn valuations. But it also means $100m ARR isn’t an impressive, or maybe even impactful, milestone anymore. It’s just a pit stop. (I know. That’s crazy. Sorry).

- You have to do as well as Box or Zendesk to be a True, Real Unicorn. And Box is at $300m+ ARR. And Zendesk is at $200m+ ARR growing 60% YoY. And everyone uses Box, it has an A+ brand and CEO, and it’s still growing like a weed. At $300m+ ARR. If you are doing “better” than Box or Zendesk (whatever that means) — you deserve to be a Unicorn. No doubt. But if you aren’t, it’s an illusion. And you better come up with a $300m ARR strategy. Not just a piddly $100m ARR one.

The Unicorn party isn’t all fun and games.

The Unicorn party isn’t all fun and games.

The bar has gone up, folks. As it should — SaaS, and the overall SaaS markets, are far bigger than they were just 24 months ago.

But if you aren’t willing to play the game as it’s played in ’15, don’t play it. Which is OK. Go another way. Get to cash-flow positive around $5-$6m ARR if not earlier. Don’t take that extra round. Or whatever, my real suggestion is don’t play the game of ’11 or ’12. Don’t look to the past for expectations of what “success” in SaaS is.

‘Cuz the game and its rules have changed.

[ Don’t shoot the messenger. I still believe in you no matter what. ]