So I’ve sold thrice. Twice as a founder, once as part of the management team of a start-up. And been through one failed Web 1.0 IPO.

I’ve learned a lot. One time, the sale was clearly a friggin’ mistake. We sold to eToys for $900 million on paper, instead of a more complex deal with Amazon. Ouch. Felt great, until it didn’t. Lost several commas. Ah, youth.

The next time, it was clearly the right decision. In my first start-up as a founder, we sold for $50m cash-on-the-barrel after 12.5 months in a tough time (Dec ’03) when we had a truly innovative product and $6 million in bookings our first year … but huge, huge go-to-market challenges. It was the right decision. No escrow, no hold-backs, no re-vesting, no options, no stay package. Just $50,000,000 laid out in ’04 cash on the table. We walked away and never looked back. I stayed 13 days after closing.

The next time, it was clearly the right decision. In my first start-up as a founder, we sold for $50m cash-on-the-barrel after 12.5 months in a tough time (Dec ’03) when we had a truly innovative product and $6 million in bookings our first year … but huge, huge go-to-market challenges. It was the right decision. No escrow, no hold-backs, no re-vesting, no options, no stay package. Just $50,000,000 laid out in ’04 cash on the table. We walked away and never looked back. I stayed 13 days after closing.

The third time, well, today’s the 4 year anniversary.

The third time it’s different. I’m older. Wiser. A few more nickels in the bank. Got kids. More on the 3 times here.

And … I’m done. As a founder at least. I won’t do another one, not from scratch. Now my day job and hobby is to help other founders do even better than me. I’m not particularly old, but I’m too “old” mentally to start at $0 MRR again. [More on “how old is too old?” here.]

So how did we do in selling EchoSign?

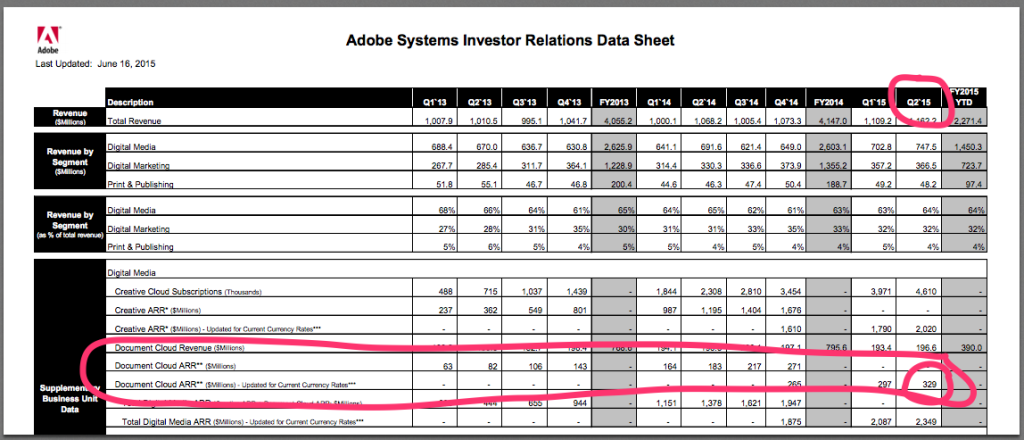

- It was a good deal for the acquirer, IMHO. Adobe’s cloud document business, of which EchoSign is the largest non-Acrobat portion, hit $329m ARR, up from less $20m at the time of the acquisition.

- The leadership and management team has gone on to do great things. Our revenue team has gone on to VP and other leadership roles at Zenefits, Talkdesk, Parklet, Pipedrive, Insightly, Avanoo, and other leaders. Our engineering team has gone on to VP roles in leading SaaS start-ups as well.

- The learnings created SaaStr. The experiences of scaling to tens of millions in ARR created a SaaS community, 1.5 million views a month (including 10 million+ on Quora), the SaaStr Annual, Predictable Revenue 2.0 book with Aaron Ross, and many other good things.

- It got me a job. As a VC.

- It met the 10x rule. My general rule is if you can sell for 10x the amount of VC capital invested, at least consider it. More on that here.

- It was at a local maximum. For a while at least, we weren’t going to get a better price even if our ARR grew like clockwork. More on that here.

And yet …

- It was just when things were getting good — although I didn’t really know this at the time. Not so long after the deal closed, EchoSign was at $20m ARR. Against the odds of navigating BigCo life, growth accelerated for the next 18 mos. as the existing team just executed with more resources. The uber-learning in SaaS is, money aside … never sell once you hit Initial Scale. Because you just can’t be killed, unless you kill yourself. More on that here. Also, get the team the resources they needed. With hindsight, the fact that the exact same team could accelerate within the taxes and challenges of a BigCo shows we should have put more resources to work earlier.

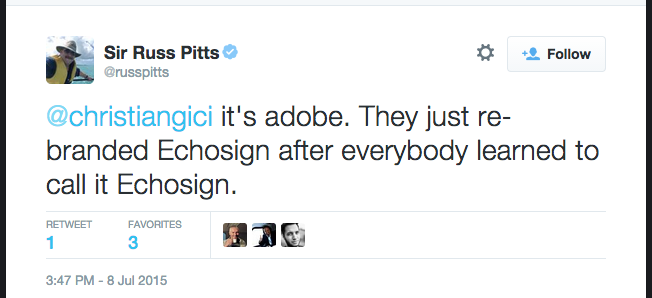

The brand is gone. This hurts. The brand was abandoned a few months ago in favor of “Adobe Document Cloud DC eSign Services”, or something similar, as part of Adobe brand evolution with the launch of the Document Cloud. While I don’t agree with the decision, I do agree it makes some sense at a corporate marketing level, to tie it better to the larger Adobe push on Document Cloud as a core strategic initiative. But … so much for the 100,000,000+ times the product had been used as “EchoSign.” And the brand equity there. And soon, no one will ever even remember the brand. We didn’t start something for it to be extinguished as a brand. Microsoft kept “Powerpoint”. Adobe kept “Photoshop.” This one hurts. I didn’t think 4 years ago I’d care that what happened here on branding. Turns out, I do. A lot.

The brand is gone. This hurts. The brand was abandoned a few months ago in favor of “Adobe Document Cloud DC eSign Services”, or something similar, as part of Adobe brand evolution with the launch of the Document Cloud. While I don’t agree with the decision, I do agree it makes some sense at a corporate marketing level, to tie it better to the larger Adobe push on Document Cloud as a core strategic initiative. But … so much for the 100,000,000+ times the product had been used as “EchoSign.” And the brand equity there. And soon, no one will ever even remember the brand. We didn’t start something for it to be extinguished as a brand. Microsoft kept “Powerpoint”. Adobe kept “Photoshop.” This one hurts. I didn’t think 4 years ago I’d care that what happened here on branding. Turns out, I do. A lot.- The markets & multiples exploded after that. Based on the multiples of ’14 and ’15, we clearly sold way too cheaply. Multiples have grown 2-5x since then. This no one really predicted in SaaS. But still, kind of a bummer. But no one knew.

- The longer it is, the more it’s like your child. When I sold my first start-up for $50m after 12.5 months, it felt like our creation. But not our child. Selling after 5 years, at least for me, is a little like selling a child.

So what are the actionable learnings? Here are mine:

- Do consider selling even if things are good if it’s for >=10x capital invested. Consider just passing if it’s going well and this hurdle isn’t met. At this point, everyone makes money.

- Do consider selling if it’s 2x your High Price. If your gut says you’d take, say $150m … and you get offered $300m+ … probably take it. Even if it’s a mistake later. 2x the highest end of your Gut Price is worth it, because right or wrong with hindsight, there won’t be any regrets at this price.

- Don’t worry about threats. I got worried when, twice, Big Tech Cos. said to me “Sell or We’ll Buy / Invest in Your Competitor.” Hey, they may. But so what. If it’s not core to them, they can’t do much to stop you — once you are at Initial Scale at least. More on that here.

- Be patient. SaaS takes a loooong time. It’s a 7-10 year journey to get anywhere good. Yes, Zenefits got to a $4.5 billion valuation in 24 months 🙂 But they’re not done. They haven’t even gotten started. Even there, they won’t truly be anywhere for 5-7 years.

- Take a few nickels off the table when you’re bigger, if it feels right. Secondary liquidity is a good thing in SaaS. Don’t sell any of your common stock until the valuation is at least in the nine figures. ‘Cause you worked too hard for that stock to sell it on the cheap. But if you build something real, the rise of secondary liquidity is a good thing. It can destress your life.

- If you’re tired, get help. I sold at Year 5. Turns out a lot of people sell at Year 5. A lot. Soooooo many. More on that here. Not saying being tired was a major factor, but it contributed. Get help. Bring in a COO. Another great VP. Someone else to help. CEO is a tough job, but once you get some fat on the system, get to Initial Scale, focus a ton of your time on recruiting the management team.

- Don’t get trapped by too high of a burn rate. Growth is at a premium today, and yes, go for it. But don’t burn so much cash that you’re boxed in. At least, try to maintain 50% of your ARR on your balance sheet if you can. More on that here.

- If you say No, don’t expect a Second Proposal. M&A is episodic. A new VP comes in, a new CEO. Priorities change. Our deal sponsor’s boss was gone by the time our deal closed. Turns out, this happens all the time. So if you say No — mean it. Sometimes they come back with a higher price. But just as often, priorities change. Next year, it’s a new space, a new initiative. And you’re no longer on the M&A short list.

- Wh

at’s next? If you’re ready to move on, and have another one in you — sell at >=10x capital invested. That’s easy. But we’re not all Elon Musk. We don’t all have 10 new companies to create from the ground up. Aaron Levie said somewhere that one of the reasons he didn’t sell, to Citrix or otherwise, is this was, in essence, as good as it got. Being CEO of a multi-billion dollar company he co-created. For most of us, at whatever scale, this may be true as well. If you can do even better on the next one, maybe sell. If you can’t, and you are doing reasonably well … maybe don’t. Yes, money matters. So does the journey. And in SaaS, with recurring revenue … the journey can take you quite far once you have something. Quite far, indeed.

at’s next? If you’re ready to move on, and have another one in you — sell at >=10x capital invested. That’s easy. But we’re not all Elon Musk. We don’t all have 10 new companies to create from the ground up. Aaron Levie said somewhere that one of the reasons he didn’t sell, to Citrix or otherwise, is this was, in essence, as good as it got. Being CEO of a multi-billion dollar company he co-created. For most of us, at whatever scale, this may be true as well. If you can do even better on the next one, maybe sell. If you can’t, and you are doing reasonably well … maybe don’t. Yes, money matters. So does the journey. And in SaaS, with recurring revenue … the journey can take you quite far once you have something. Quite far, indeed.