The other day, Bill Gurley, who has to be on the Top 5 most successful and smartest VCs, had a few semi-cryptic tweets. Cryptic to non-VCs, at least:

Wet bubbles (1999) are more fun than dry ones (2015).

— Bill Gurley (@bgurley) June 10, 2015

At our recent LP meeting, an LP told me industry wide distribution $ relative to paper value is at an all time low. — Bill Gurley (@bgurley) June 10, 2015

Many of you may not even know what an LP meeting is. It’s where VCs meet with their own investors, the “Limited Partners”. And it might be a bit cryptic what this LP said to him.

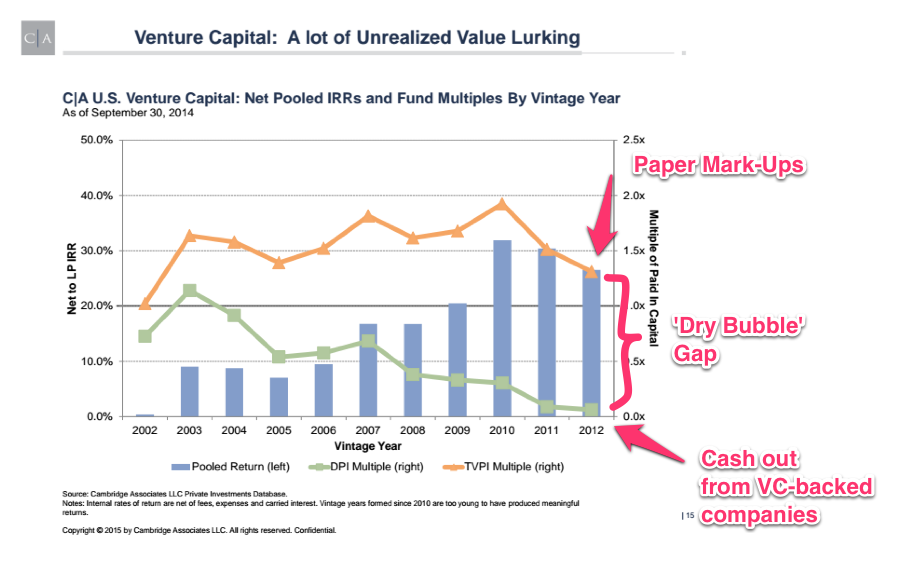

But it’s very interesting, and here’s the actual data from Cambridge Associates (Thank You!), the leading industry analysts of VC data — albeit only through the end of ’12 (though as we’ll see below, nothing’s really changed since then):

There is even more VC industry lingo in here, but once you understand it, it’s interesting.

The top line, or “TVPI”, are paper mark-ups + cash back out (distributed capital). “DPI” on the bottom is just the actual cash back out. You can see the delta is quite, quite large. A lot of this is because of ‘vintage’ years … 2012 funds can’t be expected to have returned much capital yet. But as we’ll see below, a lot of it is just plain unrealized returns.

What’s a paper mark-up? Well, some late-stage private market investor invests in my company at a $1 billion valuation. If I invested at a $10 million valuation, I get a 100x paper mark-up. I’m a hero at the firm. I brag. I run a pre-victory lap and tell myself how brilliant I am. That I see the future.

But …

In this scenario, as brilliant as I look with my 100x mark-up … I’ve actually returned nothing in cash. No cash. Not a nickel. It’s a gain, yes — but on paper only. Until an IPO, or an acquistion, no cash goes back out. Sometimes a little goes back out in a so-called secondary sale, but even when it does, this is usually pretty small.

In this scenario, as brilliant as I look with my 100x mark-up … I’ve actually returned nothing in cash. No cash. Not a nickel. It’s a gain, yes — but on paper only. Until an IPO, or an acquistion, no cash goes back out. Sometimes a little goes back out in a so-called secondary sale, but even when it does, this is usually pretty small.

So the bottom line on the chart above, DPI, is hard cash back out to the LPs.

And as you can see, there ain’t as much cash going back out.

Hence — Bill Gurley’s Dry Bubble. It’s a bubble in valuations. But there ain’t no cash. The bubble isn’t an IPO bubble, like Broadcast.com or GeoCities or TheGlobe. No cash is going back out to create the next Mark Cubans, at least not that much. At least not yet.

Now, some great IPOs in ’16 can “cure” this and generate cash back to those folks putting all this money into Unicorns. And many of the best companies are intentionally holding off on IPO’ing, taking time to grow faster without the scrutiny of Wall Street. This delta, this gap, may be temporary. An Uber IPO, an AirBnb IPO, etc. will boost that bottom line substantially. If every unicorn IPOs, all will be right in the world, and the Dry Bubble will become very, very Wet (i.e., cash rich) indeed.

You can see though that even with 2014 data, from this great A2Z prez below, the “gap” between private Unicorn $$$ (75% of investment) vs. “real” Unicorns (from an IPO or acquisition) is still quite high:

With 75% of invested capital trapped in private Unicorns (another way to look at it), that’s pretty dry.

So for now at least — it’s a roach motel. All this money is going in at higher, all time higher, valuations — but very little is coming back out.

The optimists believe it’s just a matter of time. But if you’re say the guy that sold Broadcast.com to Yahoo! for $5.7 billion … you might think this really is the driest of all bubbles, of all time.

[ Dry Party image from here. ]