One of the most important operating metrics in your SaaS start-up, if you aren’t predictably cash-flow positive, is your Zero Cash Date (“ZCD”).

You hear a lot about SaaS metrics, but this one doesn’t often come up. It should, and it should be very near the top of the list of core metrics.

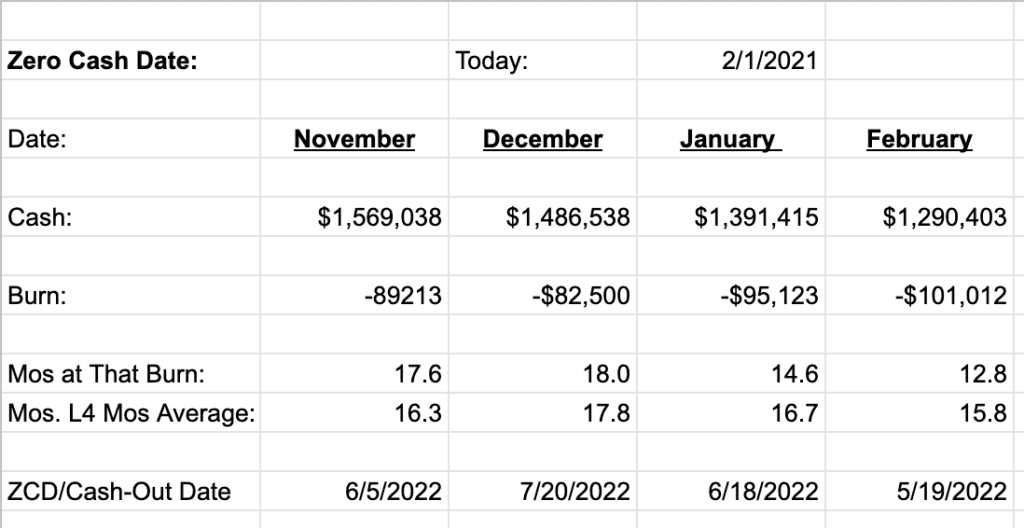

Your Zero Cash Date is the most likely date, at your current spend/burn, that you will run out of cash.

Many start-ups don’t track this religiously, or with 100% certainty, and just as importantly, don’t always share it with every single one of your investors — and your employees. As you can see in the survey above, it looks like most start-ups don’t really share their ZCD, or at least don’t fully share it.

I didn’t track it as carefully in my first start-up, but it was the #1 metric for my first investor in Adobe Sign / EchoSign. For good reason. Once I tracked it super-carefully, I found it super-helpful. It aligned everyone in the company, and all the investors (including F&F), on exactly what our runway was, and by when we had to demonstrate objective success.

Your ZCD is nothing to hide, and it should change every 30-60 days or so, depending on how revenue comes in, and how expenses flow. I think it’s also OK to have a primary ZCD, the one you use as your core company metric, and a more conservative one for your own planning.

At least, it took a lot of stress off my plate having everyone understand what the ZCD was. That way, we all intuitively understood what we were building to, what the rough limitations were on spending — and why they existed. Until we reached cash-flow positive. The team understands your current cash may not last forever. It’s OK. They are start-up people. Let them know.

If you have any trouble calculating it, just take your average actual cash burn rate for the last 3-4 months — the amount of cash out the door on your bank statements — and divide it by the amount of cash left in the bank. That’s usually plenty good enough, and just takes a few minutes. You don’t need a CFO, or a controller, or anyone to do this.

More on that quick-and-simple approach here:

Reasons I've lost money investing, or had mediocre outcome:

– founder wars

– CEO misled on metrics

– CEO ignored zero cash dateWhat didn't stop unicorn outcomes:

– one terrible year

– bigger competitors

– taking a long time— Jason ✨Be Kind✨ Lemkin (@jasonlk) October 28, 2021

(Note: an updated SaaSr Classic post)