So we’ve probably covered HubSpot more than any other SaaS and Cloud leader on this 5 Interesting Learnings series, but there’s a good reason for it: First, HubSpot is a lot like most of us. It sells sales, marketing, support and more tools. And second, so many of us use HubSpot. The majority of the SaaStr community uses HubSpot! So it’s very … tangible.

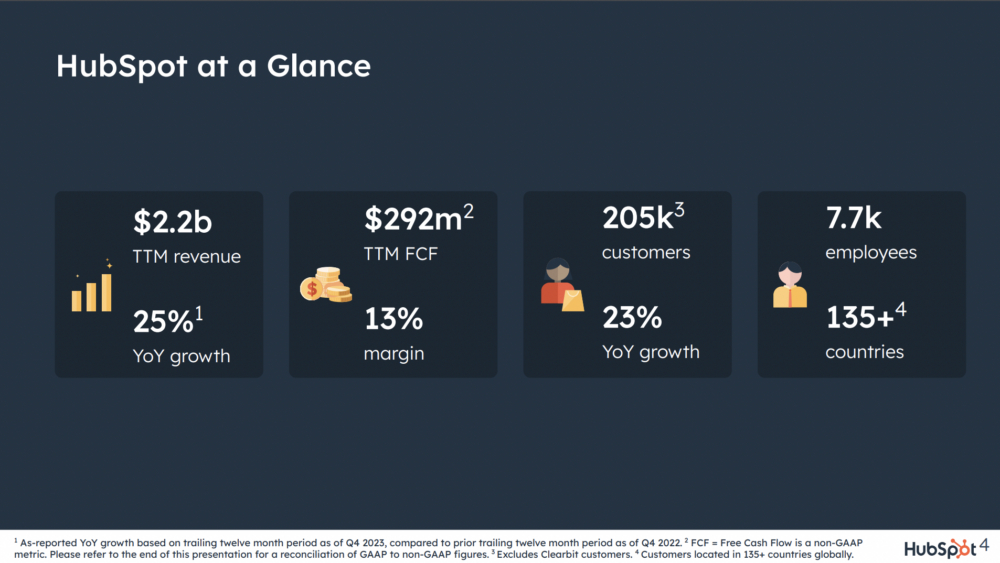

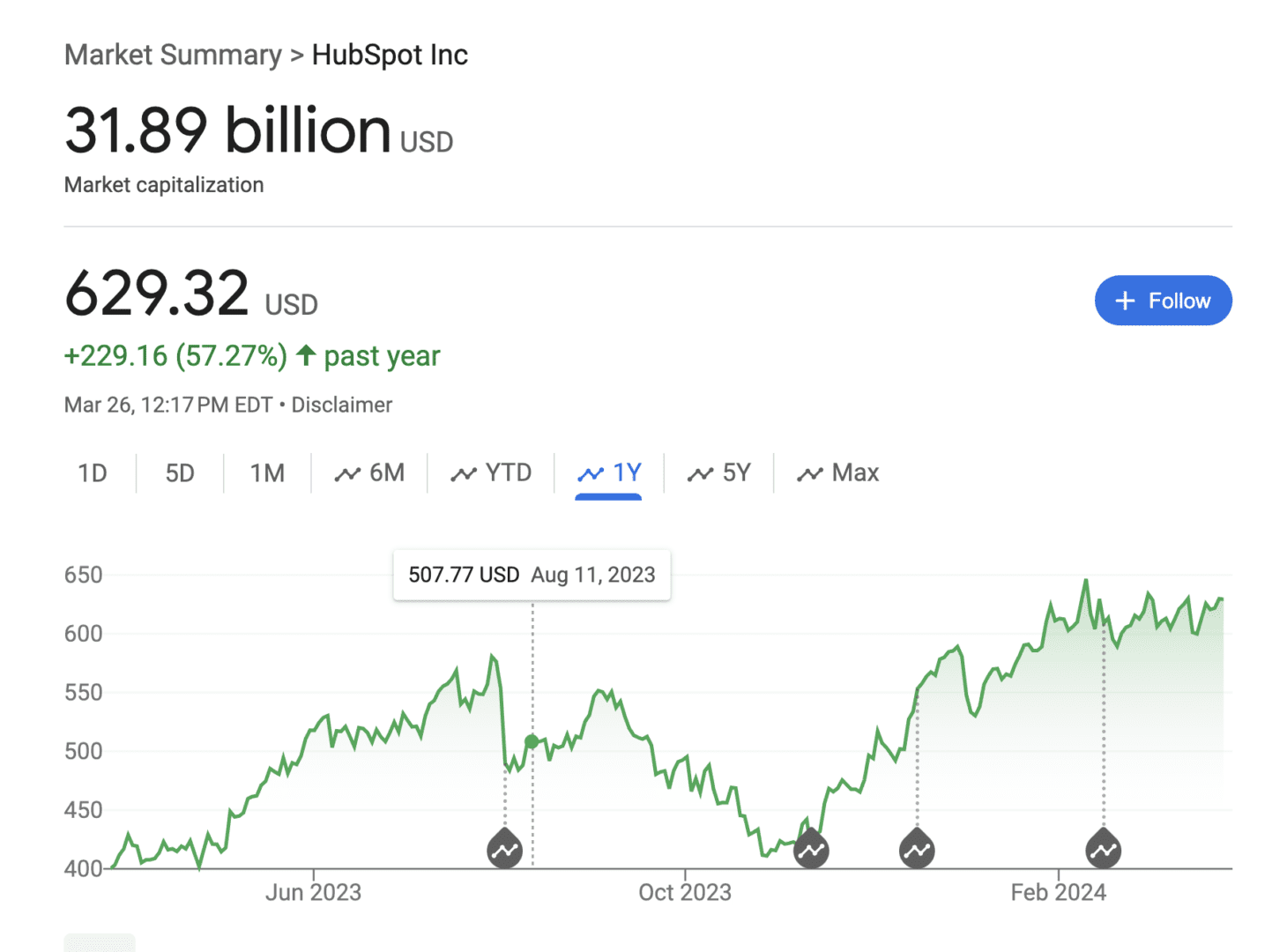

And despite the overall macro headwinds, which HubSpot has not been immune from, it’s still gone on a tear. It has a $32 Billion (!) market cap, growth is still strong at 24%, and it’s now becoming very, very profitable.

So HubSpot is doing as well as it ever has. But it’s now doing it differently.

5 Interesting Learnings:

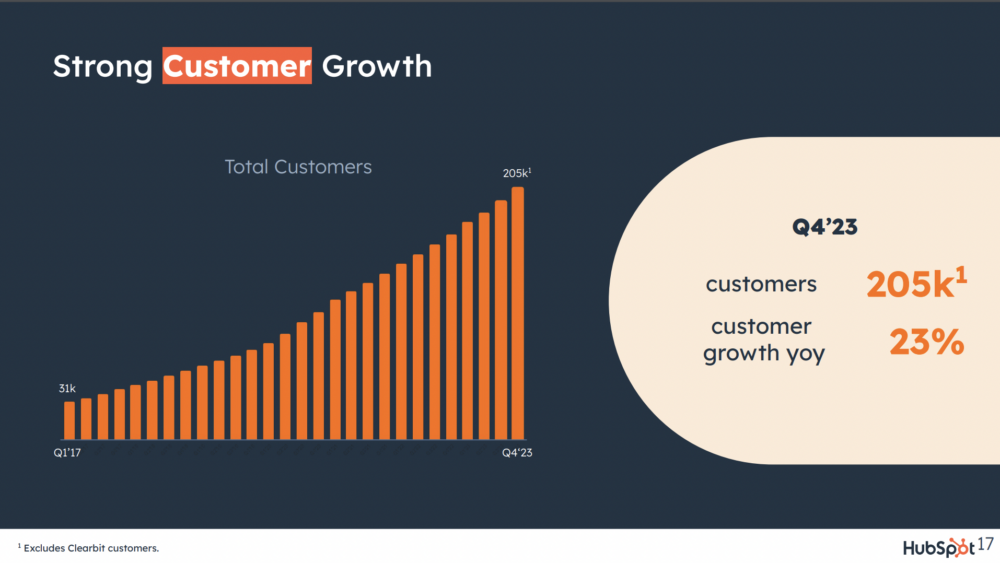

#1. New customers are still growing 23% a year, even at 200,000+ Customers and $2.4 Billion in ARR.

To me, this is just the impressive metric of all. So many SaaS companies just run out of new customers by $100m ARR or so. New customer count slows to the teens, or even lower. But HubSpot has found a way. Going multi-product has helped. A lot has helped. But most importantly, they’ve found a way to continue to close more and more SMBs, especially bigger SMBs. They now have 205,000 customers and are still growing new customer count by 23% a year!

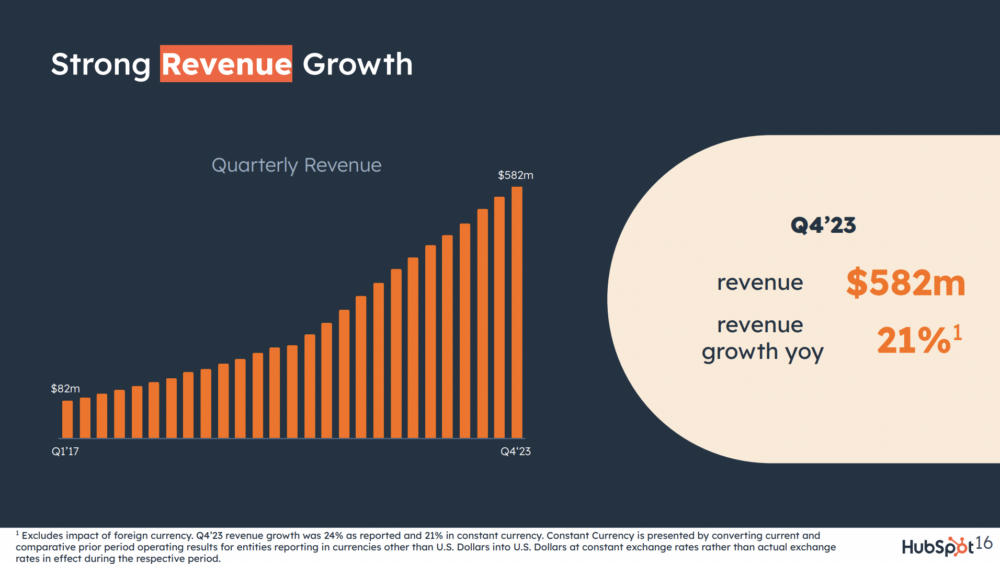

#2. Revenue Growth is Up Just 24%. NRR Likely Down to Around 100%.

HubSpot’s revenue growth of 24% (21% in constant currency) is basically equal to its net new customer count. So it’s NRR likely has fallen to around 100%, down from 110%+ a few years back and 104% at $2B in ARR. So while HubSpot is on a tear, it’s not immune to macro impacts. Customers are cutting back on incremental spend, and HubSpot selling to SMBs does have to work to keep NRR even at 100% in today’s environment.

#3. ACV Basically Flat at $11,365

This is likely a “macro” impact as well in part — as well as the fact that HubSpot continues to invest in its smaller starter customers. Despite raising prices and selling more products, HubSpot ACV is basically flat at $11,365. Clearly, even SMBs are working to moderate spend, even as vendors increase pricing. So price increases don’t always automatically lead to an ACV / ARPU bump.

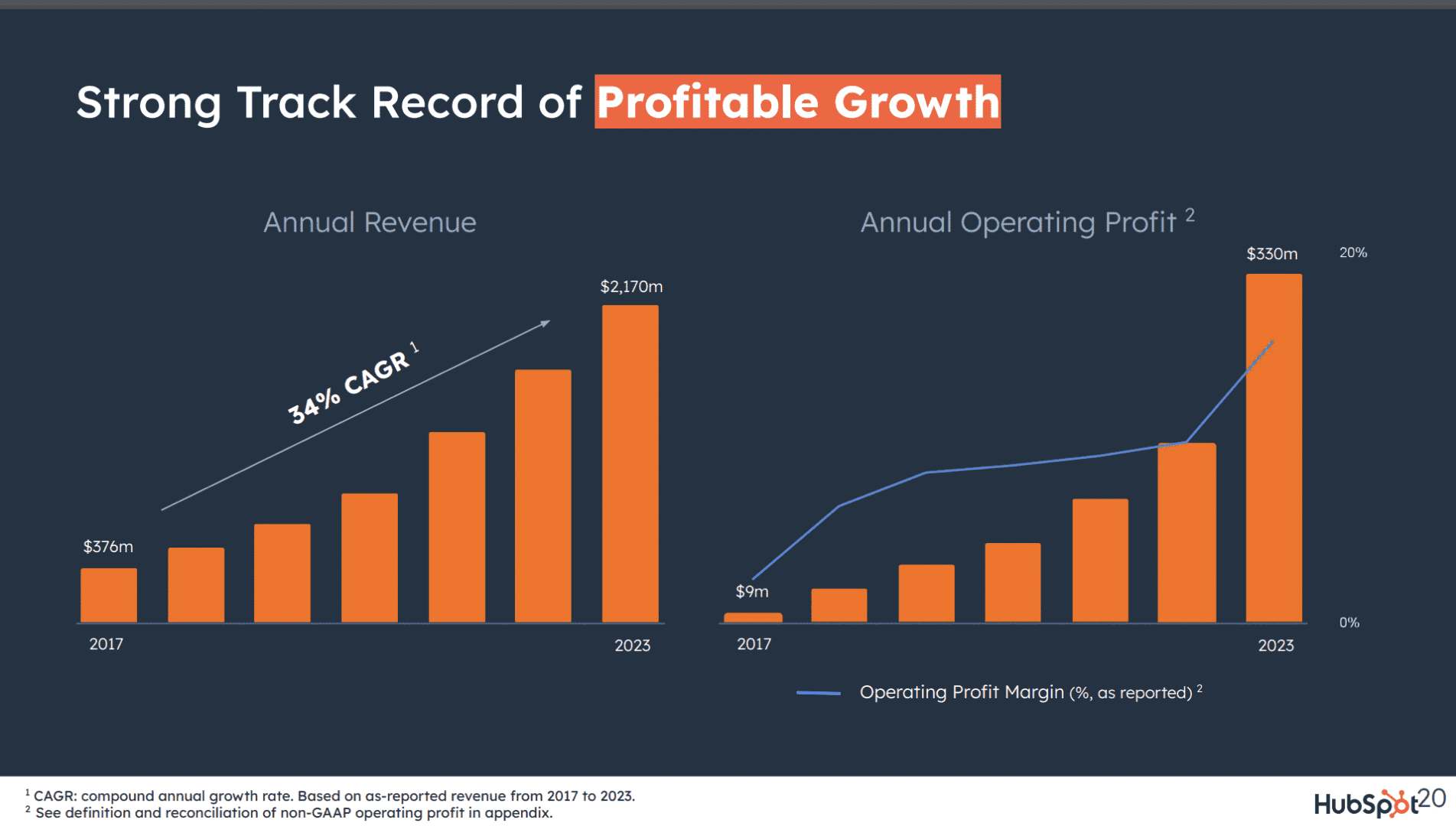

#4. Rocketed to Almost 20% Non-GAAP Operating Profit

Like almost every public SaaS and Cloud leader. HubSpot has gotten a lot, lot more efficient the past 18 months. It’s doubled its operating margins from ~10% to 17% in just 1 year.

#5. 7,770 Employees. So About $310,000 in Revenue Per Employee

As part of this efficiency drive, this is also where most SaaS and Cloud leaders are today, at $300,000+ in revenue per employee, and driving toward $400,000.

And a few other interesting learnings:

#6. 60% of Its Pro and Enterprise Customers Use 2 or More HubSpot Products

HubSpot has stopped breaking down its revenue per product, but going multi-product is the key to their growth at scale, with their Sales / CRM product the #1 driver of growth. Now 60% of their Pro and Enterprise customers use 2 or more products.

#7. Gross Retention in “The High 80s”

So while NRR is down to about 100%, customers aren’t leaving. GRR is more consistent. They just aren’t buying as much more in today’s macro.

#8. Expecting Clearbit to Add 1% to Revenue Growth

Every “bit” helps, but the Clearbit acquisition itself isn’t designed to dramatically increase revenue growth.

#9. Partners Still Contribute 40% of NRR

This is key to HubSpot (and Shopify)’s growth. 40% of their revenue comes from agencies, partners, and others deploying HubSpot for small businesses. How about you?

Pretty epic.

Right now, HubSpot has the full package: strong, efficient growth at scale, along with impressive growth in new customers.

But it hasn’t been easy. Macro impacts have hit NRR and put a lid on ACV expansion. HubSpot has just had to work even harder to overcome these headwinds.

And one of our many great deep dives with the HubSpot co-founders here: