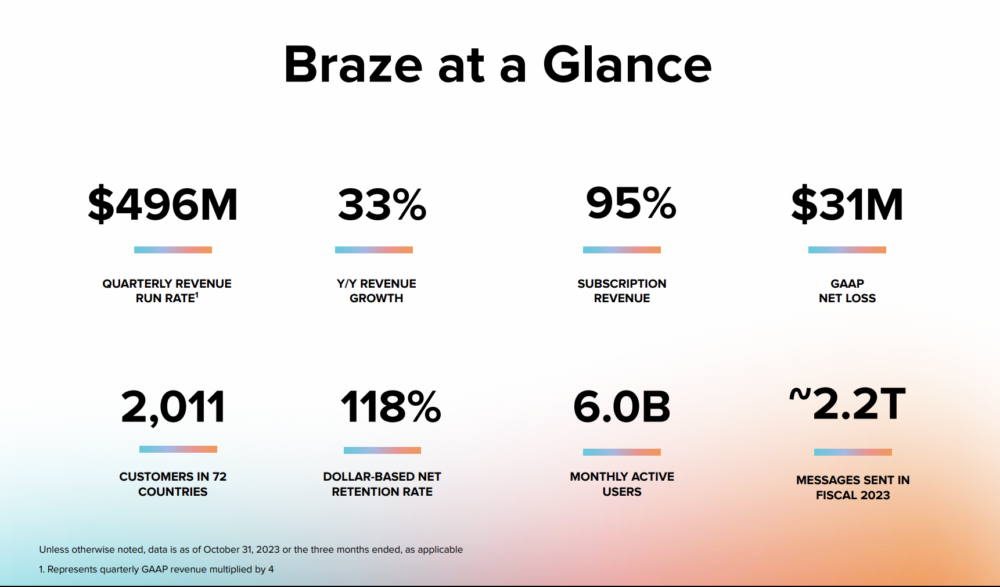

So Braze is one of the quiet winners in today’s SaaS and Cloud world. At $500m in ARR, they’re growing a strong 33% and trading at about $6 Billion, so they’re in the 10x ARR Club.

When the average public SaaS company is still stuck at 6x.

Braze is a top leader in enterprise mobile marketing and communications. The logos are strong, and the NRR is good. They sent a stunning 37 Billion messages between Black Friday and Cyber Monday!

Let’s dig in.

5 Interesting Learnings:

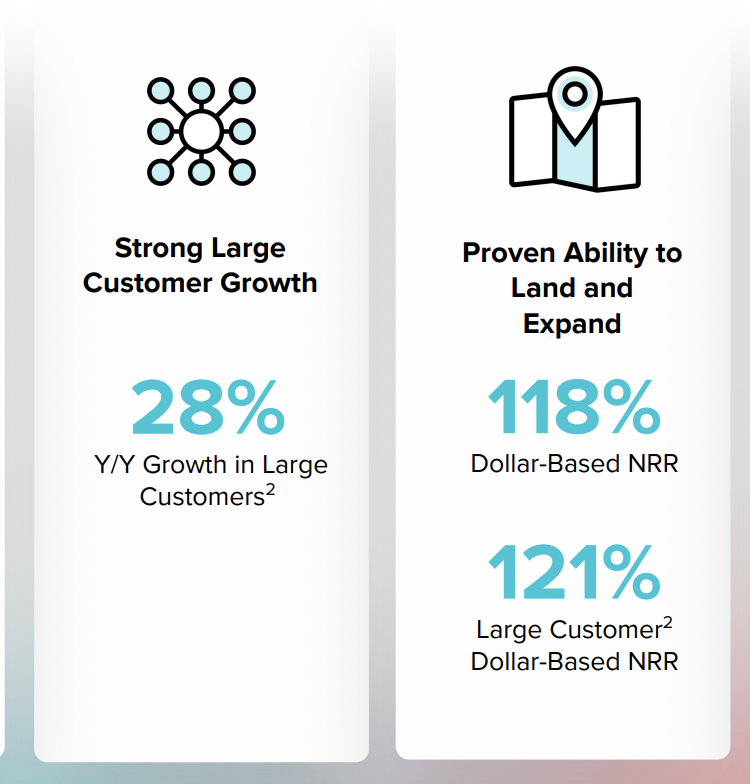

#1. $500k+ Customers Fuel Growth, Up 28% — And NRR is 121% There

A story of many SaaS and Cloud leaders today. The big enterprise customers are fueling growth at Cloudflare, at Blackline, at Smartsheet, and more. The $500k+ deals are now 56% of revenue for Braze.

#2. NRR Remains Strong at 118%, Albeit Down From 126% at $250m in ARR.

So roughly, half of Blaze’s path is from new customers, and half from account growth. A solid and healthy ratio.

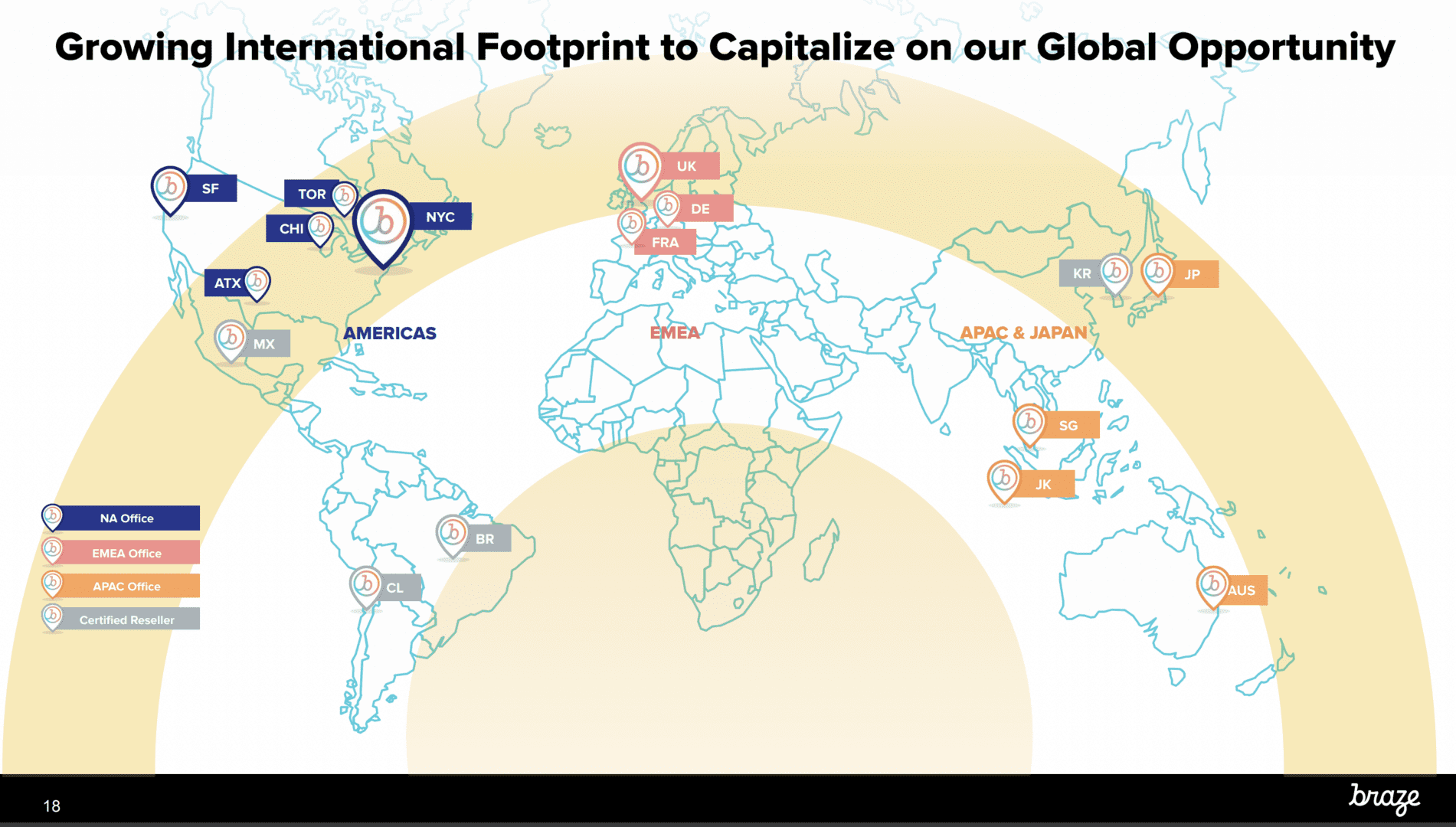

#3. Close to the Customer to Close Big Deals. Blaze Now Has Offices Across the Globe. And 44% of Revenue Outside U.S.

At SaaStr Europa 2023, CEO Bill Magnuson shared a great story. They were able to break into France and other countries in Europe by selling over Zoom — so long as they sold to tech customers and earlier adopters. But they couldn’t break into top French brands until they opened a local office with an in-person sales and success team. That’s the enterprise.

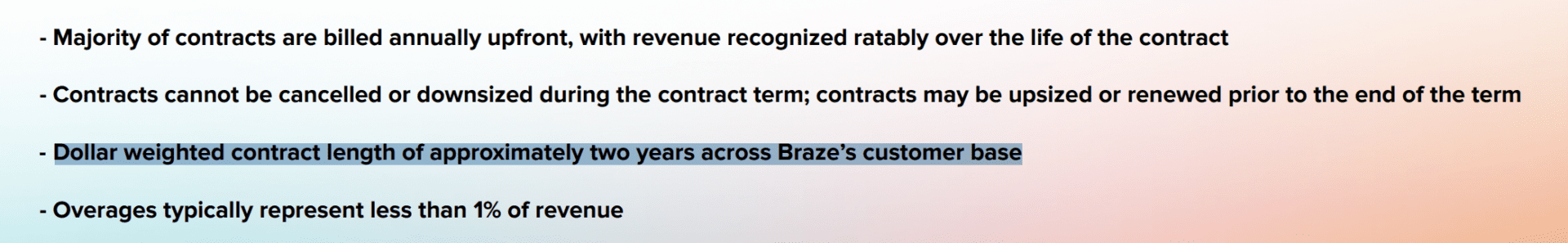

#4. Customers Sign 2-Year Deals on Average.

Not a surprise given the focus on $500k+ deals, but helpful to know

#5. 2,011 Total Customers, Up 17% Year Over Year.

That’s strong new logo growth for an enterprise product at $500m in ARR. Combined with 121% NRR from its bigger customers, Braze should have years of strong growth ahead of them.

And a few other interesting learnings:

#6. 4,000 Customers and Attendees at their annual customer conference

This stuff works, folks. Especially in the enterprise.

#7. More Efficient, But Not Hyper Efficient Yet

This is a theme of others growing at 30%+ at scale. They are getting much more efficient, but not everyone is marching toward +20% operating margins if they’re still growing like a weed. Braze is still hiring and expanding. Still, they are just about free-cash flow positive now. Operating margins have improved, but are still around -6%, but they are on pace to go positive in FY’25. So Braze is getting more efficient, but not swinging too far, too quickly. They’re managing expenses, and growing them more slowly than revenue. But still hiring and spending.

Braze. The quiet but mighty leader in enterprise messaging. It’s what the markets, and $500k+ customers, want.