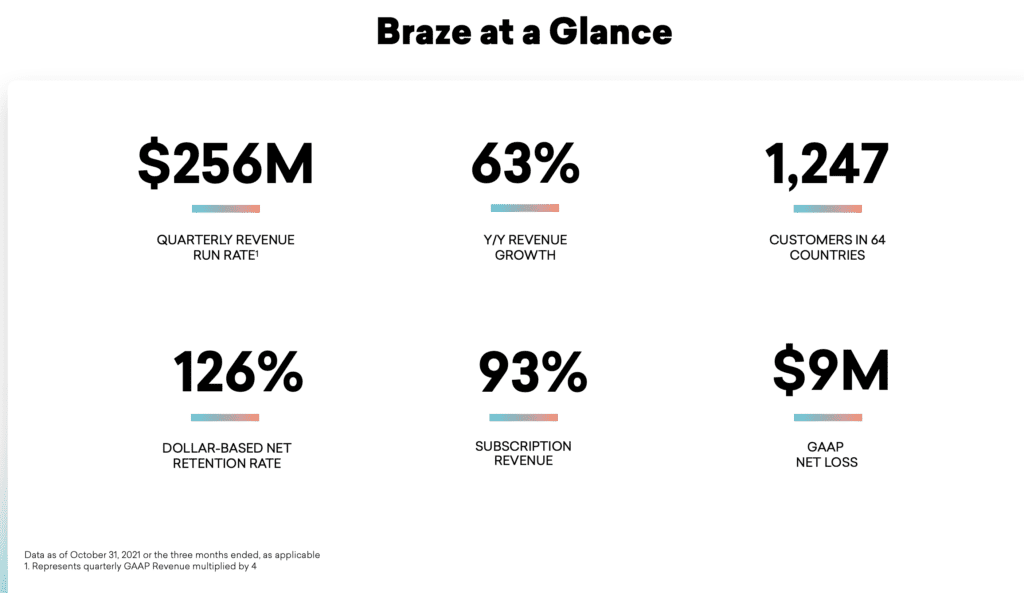

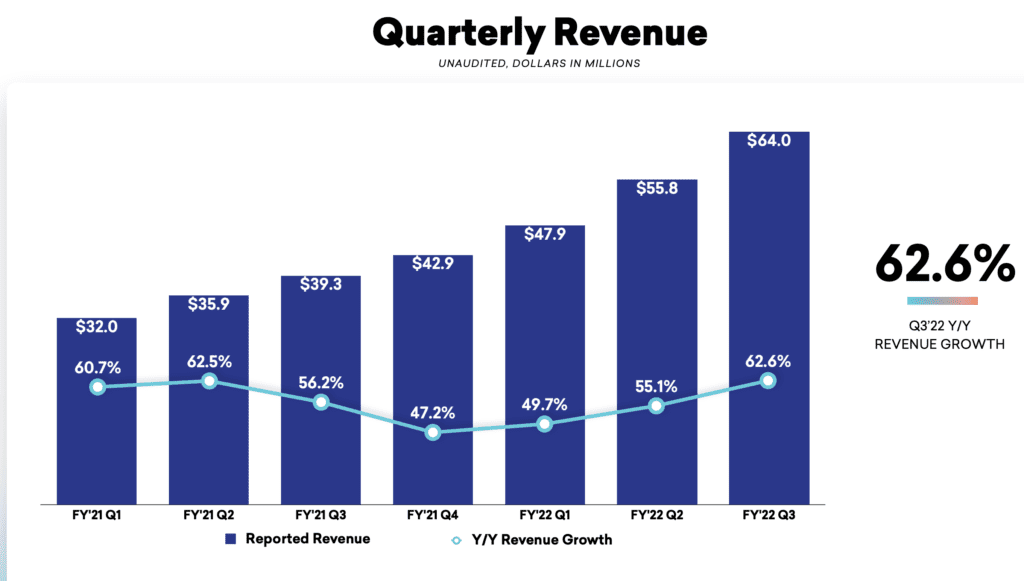

So an interesting IPO you may have missed is Braze. Braze a decade ago took a next-generation approach to marketing automation software, focused on being mobile and messaging first. In 7 years from launch it hit $100m in ARR in 2019, and then $200m in 2021, just two years later. Today, they are at $260m in ARR growing a stunning 63% with a $7 Billion market cap.

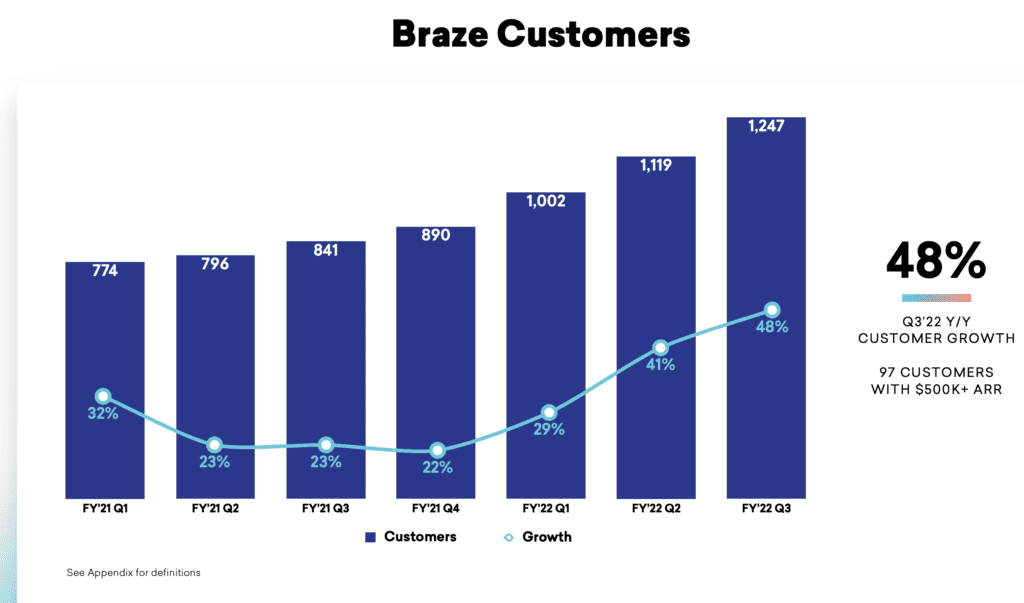

Braze has focused on the enterprise, with about 1,250 customers paying on average $200,000 each. Braze has a lot of competition, but especially older enterprise marketing platforms from Adobe / Marketo and Salesforce Marketing Cloud.

So a great case study if you are in that ARR range, or hope to be.

5 Interesting Learnings:

1. $500k+ deals make up half their revenue, and $1m deals 37%. $500k+ deals made up 50% and 41% of Braze’s revenue in 2021 and 2020, and $1m+ deals grew to 37% of their revenue, up from 25%. So big deals fuel the growth at Braze. Still, Braze isn’t overly concentrated, with no customer being over 5% of their revenue. A classic “going more and more upmarket” enterprise playbook.

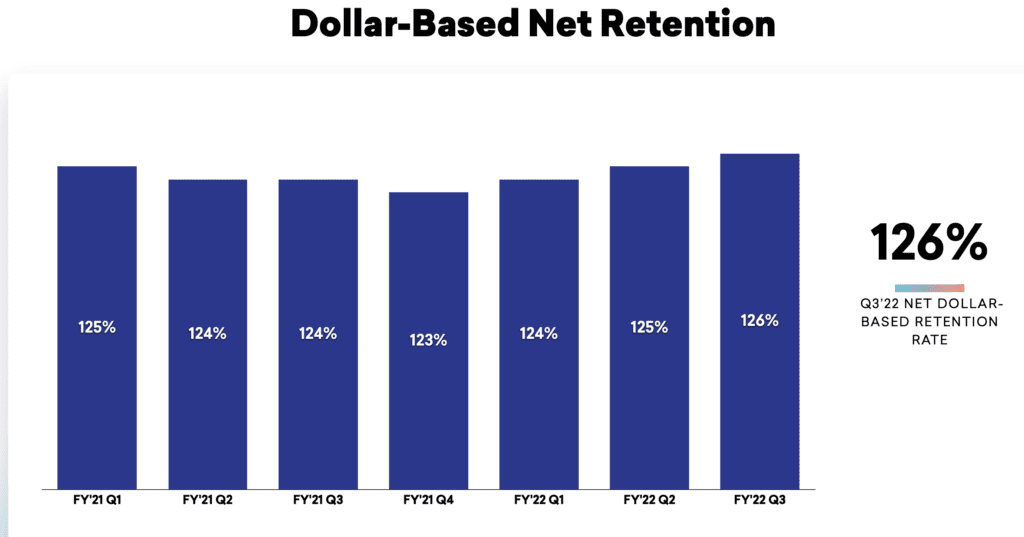

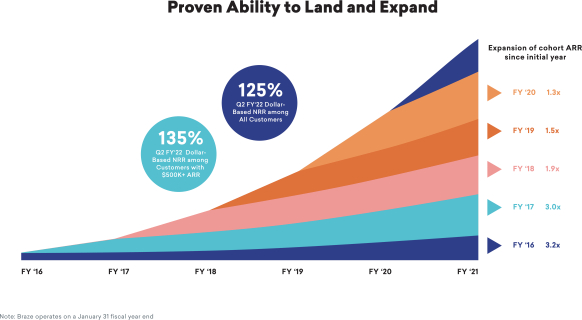

2. 126% NRR Overall, and 135% in their $500k+ customers. What you’d expect, and it’s helpful to see this segmented. The Really Big Customers have 135% NRR. You should aim for the same with similar-sized B2B customers.

3. Accelerating after $200m ARR. Braze is yet another SaaS leader growing even faster past $200m ARR. After a dip to a still very impressive 50%-55% growth at IPO, Braze is now growing even faster, at 62.5% a year at $250M+ ARR. Woah.

4. Dramatically accelerating its new customer count at scale. This is super impressive, and something we see less often. With 135%+ NRR in its biggest accounts, you might expect much of Braze’s growth to be from its base. And it has been. But the past several quarters Braze has doubled its new customer growth, from 22%-29% to 48% today. That’s a challenge to everyone that says customer growth has to slow at scale. At IPO, “Approximately 70% of the increase in revenue was attributable to the growth from existing customers, and the remaining 30% was attributable to new customers.” It could be closer to 60/40 going forward.

5. 2016 customer cohort spends 3.2x more today. This is a great way to see high NRR presented. Blaze’s 2016 customers spend 3.2x more today than they did in 2016. Invest in customers for life.

And a few bonus learnings:

6. 40% of Revenue from Outside U.S. This is what I tend to expect from B2B apps that work equally well everywhere, and are localized. Aim for that too if your are B2B enterprise and can work well anywhere. As part of this, Braze has and continues to maintain field offices in New York City, San Francisco, Chicago, London, Berlin, Austin, Tokyo and Singapore.

7. 60% Gross Margins at IPO, 66% Today. A bit lower than many B2B SaaS players due to their messaging costs, in part. Bull Wall Street seems fine with it. 60%+ still “counts” as software.

8. 1,000 employees at $250m in ARR. A good yardstick for more enterprise-focused SaaS.

9. CEO and co-founder Bill Magnuson was CTO until 2017, then took over as CEO from a co-founder, and owns 4.5%. I love to see a CTO become CEO, and founders pass the baton to each other when it works. Dilution added up over the years, with Magnuson owning 4.5% at IPO. That’s still $300m in net worth, but a good reminder that going big can involve material dilution.