Amplitude is a quiet Cloud leader that you might not have heard of — unless you are building software. There, Amplitude has become part of the core product stack for many SaaS and software leaders for product analytics.

They were founded in 2011 and IPO’d ten years later in 2021 at $150,000,000 in ARR, growing 57%, and have rocketed to a $7B+ valuation.

5 Interesting Learnings:

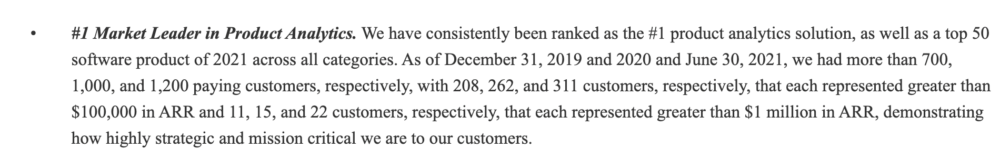

#1. 1,200 total paying customers, with 300 of them at $100k ARR and 22 at $1m ARR. Amplitude has consistently gone upmarket, but not as radically as some. This is the sort of organic upmarket path you see with a lot of leaders who don’t go 100% “all in” on enterprise but aggressively support it:

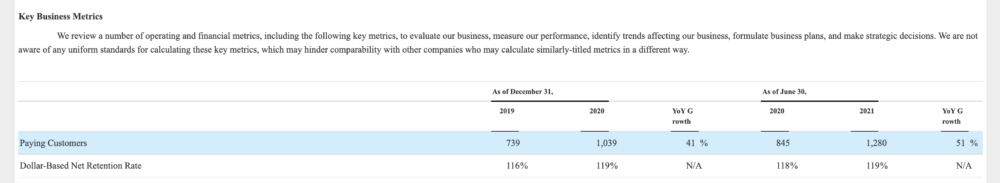

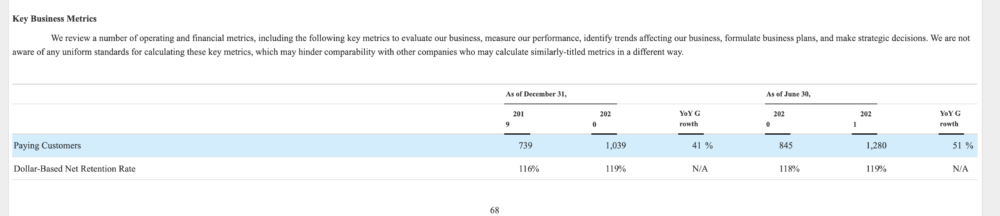

#2. Customer count growing as fast as revenue — a good sign for the future. From 41% in 2020 to 51% in 2021! We don’t see this that often. This is rare. Some leaders like Slack have seen the same, but most Cloud leaders at scale with high NRR end up getting more and more of their revenue from their existing base, not new customers. But Amplitude has 51% growth in paying customers on top of 57% overall growth. Having that high a ratio is a strong sign of future growth, and something important to track.

#3. Use overages to renegotiate contracts, not charge per event. Folks come out differently here, but while Amplitude charges per volume, in part, it doesn’t make a material amount from overages. Rather, it uses overage events to trigger a call from sales to buy more.

#4. 119% NRR. Strong, but not at crazy levels of some developer apps. 119% is strong NRR, but on its own, not the crazy high we’ve seen with some adjacent Cloud players. But plenty strong to fuel growth for a decade. A good comp if you are like Amplitude.

#5. Amplitude is accelerating — from 50% growth to 57% at $150m ARR. This is super impressive and what we’re seeing from so many Cloud leaders. The best of the best are not just maintaining growth rates we haven’t seen before. More on that here. They’re growing even faster at scale. Amazing.

And a few bonus notes:

#6. 245 employees in Sales & Marketing — vs. 101 in Engineering / R&D. It does take an army to support an analytics platform, even with a free edition driving leads. The engineering team is also surprisingly lean.

#7. Founders own about 16% together, 8% each, at IPO. CEO Spencer Skates owns 8.5%, CTO Curtis Liu 8.0%.

And an incredible deep dive on how they got here with CEO Spencer Skates:

And a few others in this series: