Thank you @jasonlk for giving me the @saastr stage +4 yrs ago to share both my story & build @pagerduty's brand … the Sunny Delight, solution to problem fit talk. We were <$50m ARR, & the audience was full of potential, now much larger @Saas customers! #startups https://t.co/ePfGkFd8DX

— Jennifer Tejada (@jenntejada) January 8, 2021

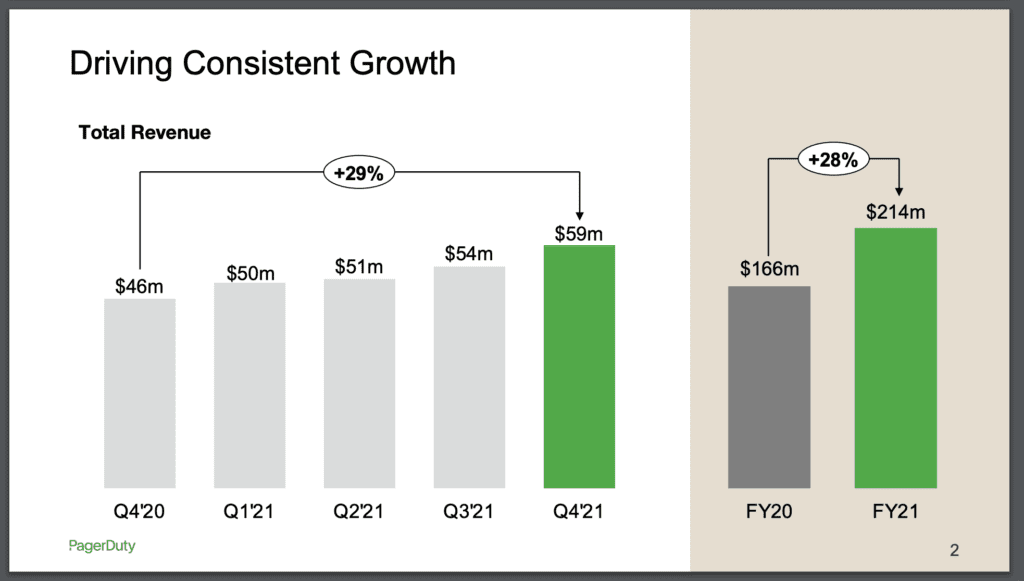

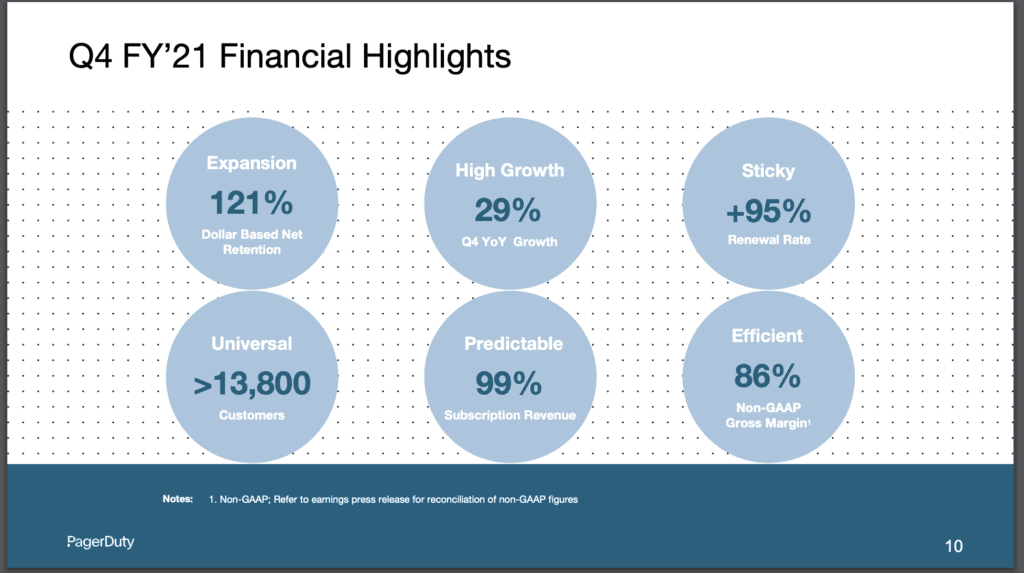

When we last checked in with PagerDuty, they were IPO’ing at $125m in ARR. Fast forward to today, and like every SaaS company, they’re just that much further along. Like clockwork. Indeed, today PagerDuty is now at $250m in ARR, growing almost 30% year-over-year!

5 Interesting Learning:

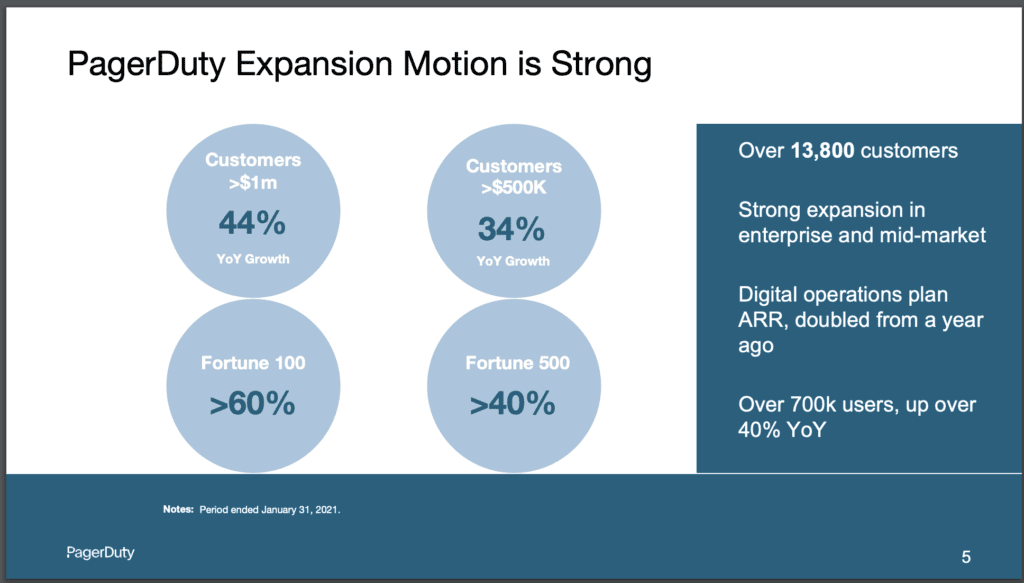

#1. PagerDuty’s biggest change has been in going upmarket and more enterprise. That segment is growing 44%! At IPO, PagerDuty’s ACV and core customer had been a pretty consistent mix of small accounts, SMBs, and some larger customers. At $125m ARR, PagerDuty still only had ~200 customers paying more than $100k.

Since then, a lot has changed. Growth since IPO though has been fueled by $500k+ ACV customers … a big change that mostly came after $100m+ ARR.

Fast forward to today, and its biggest growth is from $1M+ customers, up 44% — versus 29% growth overall. Its “digital operations” segment is a rough proxy for its enterprise customers and now is over 20% of its ARR.

It’s also an interesting contrast to Zoom, Zendesk, and Slack, which recently have seen enterprise and SMB growth be about equal post-Covid.

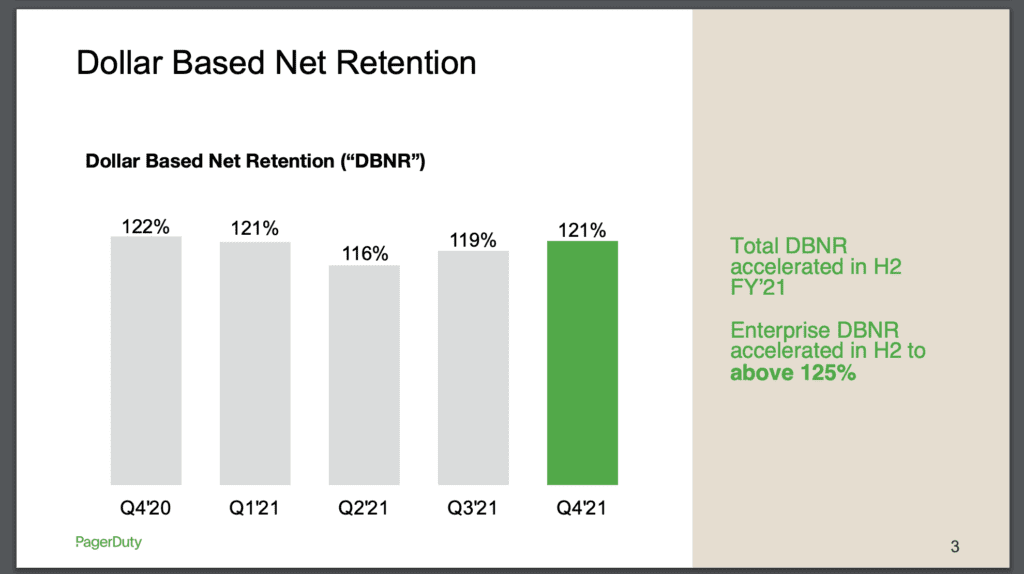

#2. NRR is up after going more enterprise, but not as much as you might think. PagerDuty’s NRR of 121% remains very impressive but is basically the same as 4-5 quarters ago. Covid brought a bit of a dip, but then NRR returned to 120%. This is top-tier NRR for a product with many SMB customers. But it’s interesting that it didn’t go up, despite the largest growth being in $500k and $1m+ customers. NRR at IPO was actually 139% mainly from SMBs.

#3. 95% renewal rate, even with 10,000+ SMBs. Even with 10,000+ SMB customers out of 13,800 total, PagerDuty sees an incredible 95% renewal rate. This is far higher than many products that sell to small businesses. It’s a testament to the ROI in PagerDuty. And also a challenge to those selling to SMBs to do as well, and not accept low renewal rates. Or at least, to drive them up over time.

#4. 8th straight quarter where at least 33% of its enterprise customer accounts expanded. This is an interesting way to see NRR presented and maybe a good KPI to track, i.e. what % of your customers each quarter have grown? At PagerDuty, it’s been 33%+ for 8+ quarters.

#5. Expanding beyond its core product is key to growth. We’ve seen this time and time again after $100m ARR, and we’re seeing it again here. PagerDuty’s core product is incident response. But customers who also use it for security grew 56%, and customers who also used it for customer service grew 40%. You probably don’t need a second or third product in the early days. But as we’ve seen in this series, you almost certainly will need one after $100m+ ARR to really scale quickly.

An incredible run for PagerDuty! We’ll check in again — at least by $1B in ARR!! With 30% growth at $250m ARR, it’s just a matter of time.