Asana is one of those companies all of us know in one form or another. Either we use it now, or we’ve used it in the past. And we all know the interesting CEO that cofounded Facebook and then decided … to do SaaS!

It’s also interesting in that it’s in a very, very competitive space. It’s hard to think of more spaces with $100m+ players than Asana, from Atlassian to Monday.com to Smartsheet to Wrike to Adobe and more. So we can learn a lot about how you can break out in a competitive space by taking a look.

Ok, so what are 5 Interesting Things We Can Learn from Asana at ~$250,000,000 in ARR?

- NRR of 115% Overall, but 125% for $5k customers and 140% for $50k customers. This is a super-interesting, crisp segmentation. We can see that NRR for tiny customers is probably about 100%, as it is for other SMB leaders. But it grows to 125% even just for $5k customers — i.e., folks really using Asana for real on a significantly sized, sticky team. And then 140% as the deals get more enterprise. This is world-class, and what you should shoot for, too. 100% very-small business /125% mid-sized / 140% large.

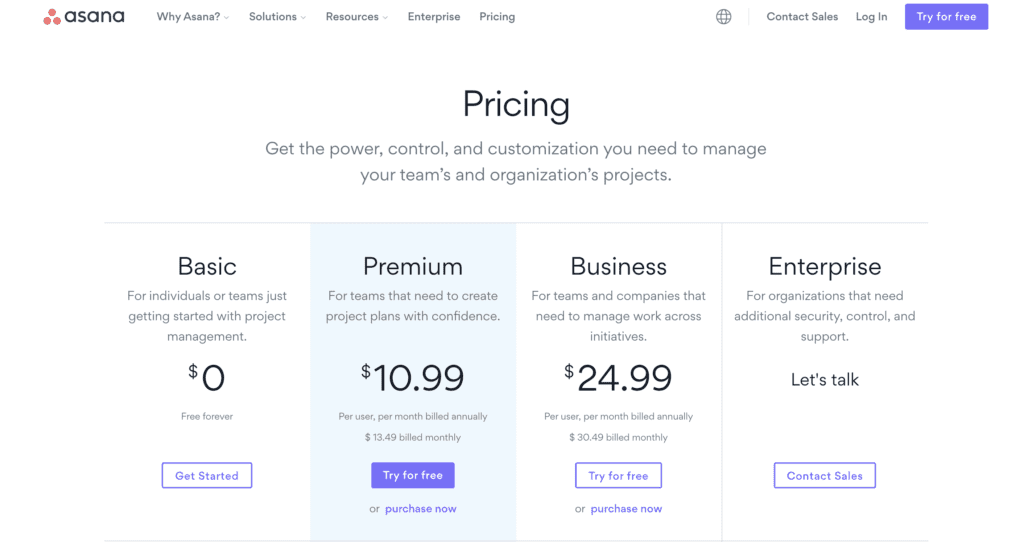

- 55% growth at $250m ARR, with 100%+ growth in $50k accounts. While Asana isn’t going super-enterprise, its larger accounts are fueling the most growth, growing twice as fast as average. Overall growth though is so strong at 55% that every segment deserves applause. Again, the latest crop of Cloud IPOs shows SMBs seem to have no limit in terms of TAM, with SMB growth at Shopify and Zendesk keeping up with enterprise, and even at Asana, SMB growth is still impressive at $250m ARR. Asana has a hybrid self-serve / direct sales model.

- 89,000 customers, so about $2,800/yr on average per customer. And 40% of its customers still pay less than $5,000 a year. Asana is able to service customers of all sizes while still going more upmarket. Many folks say it’s tough, but again, here’s another example of success. Yes, bigger customers are becoming a larger chunk of Asana’s revenue. But 40% of its customers at $250m in ARR are still tiny.

- Revenue growth far outpaced new customer growth. We’ve seen this with almost all cloud leaders except Slack. Yes, Asana added 7,000 new customers last quarter. But that’s just 10% or so year-over-year customer growth — while they saw 55% year-over-year revenue growth. Let that sink in, on how important again it is to keep your customers happy and buying more. Customer growth is strong but perhaps not on fire at Asana. But revenue growth is, because customers are very happy to buy more, and pay more, from a vendor they trust and rely on.

A few other smaller notes:

- Churn has returned to pre-Covid levels. For most of us in tech, it’s time to stop blaming Covid for elevated churn.

- Agile is important in competitive spaces. Asana added 130 new features this year. You have to keep up when the competition is fierce.

- Asana is finally adding a lot of key enterprise functionality. Almost everyone has to do this eventually. The earlier you do it, the more big deals you close. Asana is adding enhanced admin controls and enterprise security features. Every enterprise customer demands sophisticated admin tools, and most SaaS vendors don’t launch with them. Add them if you go even a little bit upmarket.

- Doubling the sales team, with real quota-carrying reps. If your enterprise sales are doubling, you need to double the sales team, too.

- 60% of customers self-serve, 40% go through sales — with sales going up over time This ties to the numbers above, but helpful to see it broken down this way.

And a few other great ones in this series:

- 5 Interesting Learnings from Zendesk. As It Crosses $1B in ARR

- 5 Interesting Learnings from HubSpot as It Approaches $1 Billion in ARR

- 5 Interesting Learnings from RingCentral. As it Approaches $1B in ARR.

- 5 Interesting Learnings from Palantir at $1 Billion in ARR.

- 5 Interesting Learnings from Slack at $1B in ARR

- 5 Interesting Learnings from PagerDuty, as It IPOs

- 5 Interesting Learnings from Zoom at IPO

- 5 Interesting Learnings from Bill.com at IPO

- 5 Interesting Learnings from Asana at $250,000,000 in ARR

- 5 Interesting Learnings from Qualtrics at $800m+ in ARR

- 5 Interesting Learnings from Xero. As It Approaches $1B in ARR

- 5 Interesting Learnings From Snowflake at $600,000,000 in ARR

- 5 Interesting Learnings from New Relic at $650,000,000 in ARR

- 5 Interesting Learnings from Box At $800,000,000 in ARR

Thank you to our customers in 190 countries & 200+ partners, and our team @Asana who gets even better & faster at delivering value for customers as we grow. pic.twitter.com/9lzHQtH4nX

— Dustin Moskovitz (@moskov) June 3, 2021