Snowflake was one of the hottest IPOs in Cloud ever in 2020, rocketing to an $85B+ market cap today!

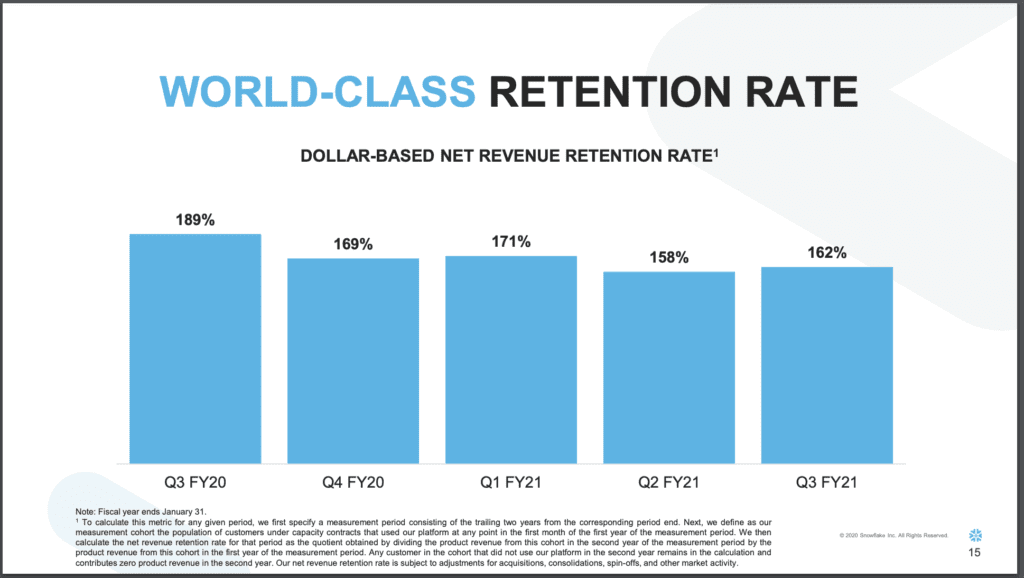

It’s earned it. While ARR is still “only” $850m, the growth numbers seem to justify the incredible revenue multiple: 110% YoY growth at $850m ARR (wow!) and 162% NRR (wow!):

Ok, so we can’t all be Snowflake. But what are 5 interesting things we can learn, and take away:

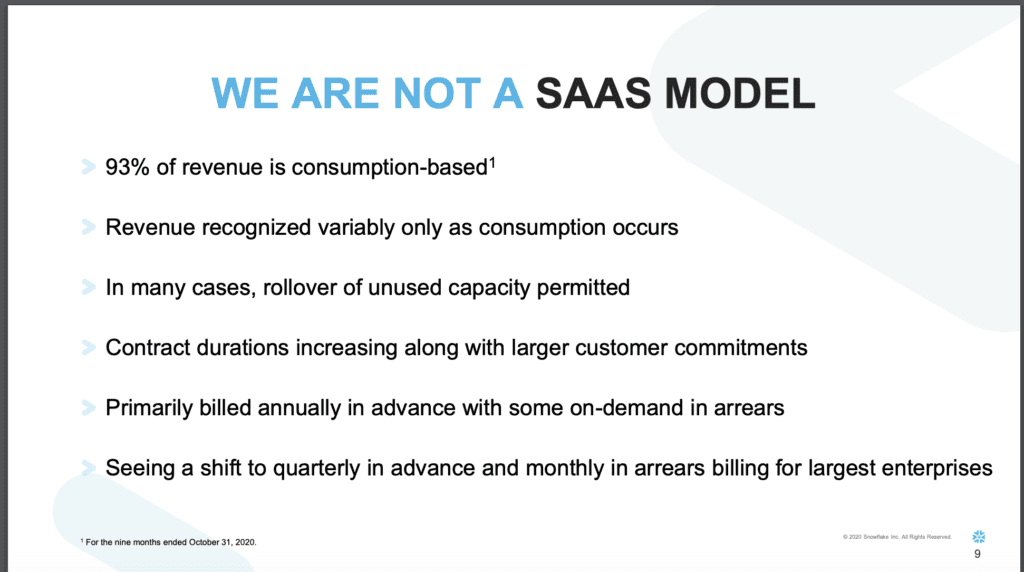

#1. 93% of Snowflake’s revenue is consumption-based … yet it still has a SaaS multiple. This is super-important and interesting. We’ve seen the other day New Relic move back toward consumption pricing, we’ve seen it with Datadog, we’ve seen some it with Fastly, and a lot with Shopify. Net net, if your customers want to buy in a consumptive vs. recurring fashion … let them. As long as the NRR is just as high as a subscription model, Wall Street says That’s A-OK today. Again, the key is the 162% NRR. Investors and Wall Street are saying they don’t really care how you get there. Subscription or consumption.

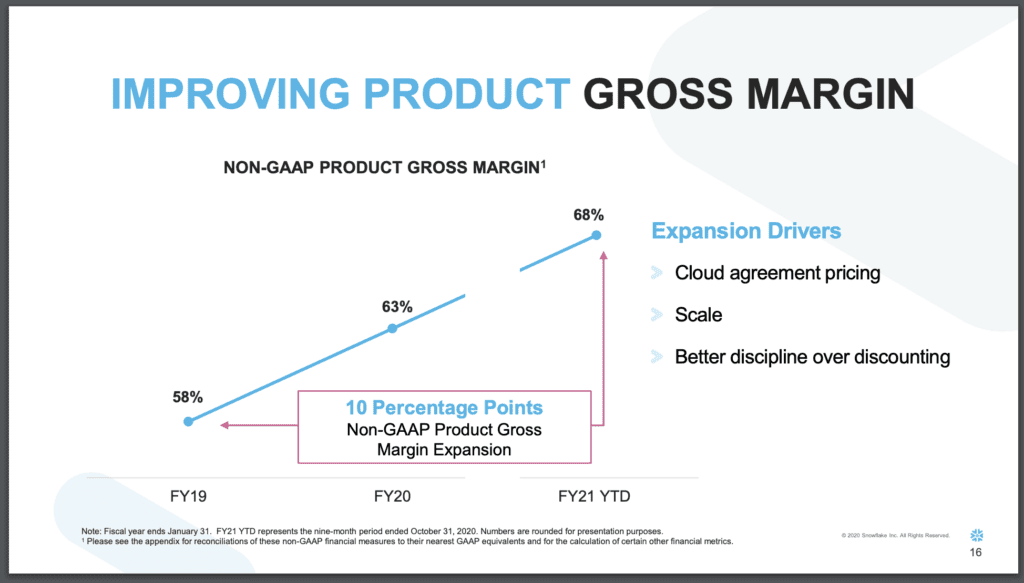

#2. Snowflake now has software-type margins (60%+), but it took its time getting there. Snowflake, as a data lake, has significant costs associated with it. We also saw Palantir take its time to get to 60% gross-margins, not even getting close until the IPO. Snowflake also took its time to get to 60%+ gross margins. The lesson is it’s OK if you have fixed costs like Twilio, Snowflake, etc. to not hit software-like margins until just before your IPO. But you may need to hit 60%+ gross margins as you IPO.

#3. NRR has come down a bit, but still world-class. This is a trend we’ve seen with so many Cloud leaders. NRR sometimes does dip a bit as you approach $1B ARR. We saw Slack’s decline a bit at $1B ARR. But it doesn’t mean NRR doesn’t still stay high. So no excuses for your NRR dipping.

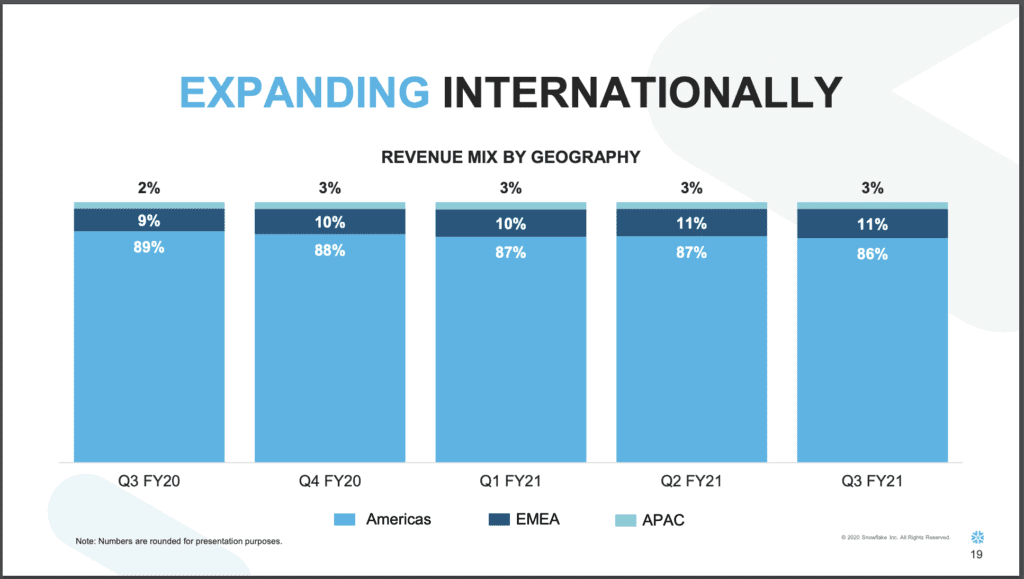

#4. Slow to go global, but becoming material now. We’ve seen many SaaS leaders go quite global in their footprint early. Snowflake waited until it was ready.

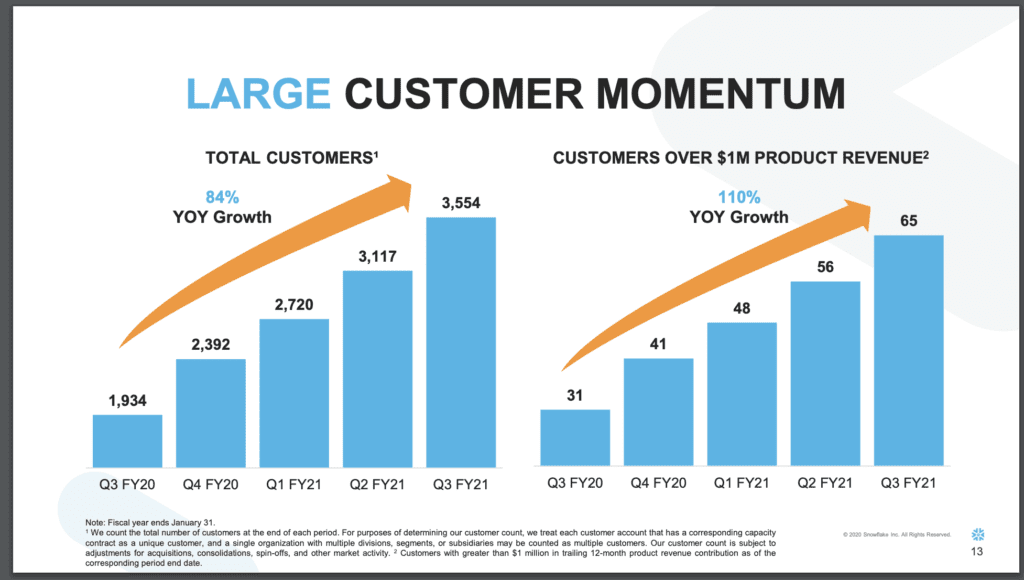

#5. 3,500+ Customers, But 100 $1M+/year Customers. Snowflake shows a similar interesting “Enterprise Cloud” distribution to Fastly and Twilio. Its top 100 customers pay $1M+, and are growing the fastest. But it has a pool of 3,500 customers trying, using, and loving the platform. Both segments are growing quickly. But while overall customer growth is 84% YoY, the “whales” are growing 110%:

Pretty impressive. Maybe you can do it all. Go very enterprise, but keep 3,500 customers happy. Start small, but still have 160%+ NRR. Growing 100%+ at $600m in ARR. Well, we can’t all do this. But it can inspire us to dream bigger. And to accept fewer excuses.

And a few other great ones in this series:

- 5 Interesting Learnings from Zendesk. As It Crosses $1B in ARR

- 5 Interesting Learnings from HubSpot as It Approaches $1 Billion in ARR

- 5 Interesting Learnings from RingCentral. As it Approaches $1B in ARR.

- 5 Interesting Learnings from Palantir at $1 Billion in ARR.

- 5 Interesting Learnings from Slack at $1B in ARR

- 5 Interesting Learnings from PagerDuty, as It IPOs

- 5 Interesting Learnings from Zoom at IPO

- 5 Interesting Learnings from Bill.com at IPO

- 5 Interesting Learnings from Asana at $250,000,000 in ARR

- 5 Interesting Learnings from Qualtrics at $800m+ in ARR

- 5 Interesting Learnings from Xero. As It Approaches $1B in ARR

- 5 Interesting Learnings from Snowflake at $600,000,000 in ARR

- 5 Interesting Learnings from New Relic at $650,000,000 in ARR

- 5 Interesting Learnings from Box At $800,000,000 in ARR

- 5 Interesting Learnings from Atlassian at $2B in ARR