We’ve done so much great content with Atlassian over the years, from CEO Michael-Cannon Brooks to Trello Founder and CEO Michael Pryor to ex-President Jay Simons, and the learnings are always amazing.

Atlassian is a fascinating case study because it showed so many of us that developer-focused SaaS products can be huge, and not just huge, but huge even in competitive markets. Atlassian dominates several markets where it still has intense competition (e.g., everyone from Asana on), and is fine ceding areas to partners where it’s less strong (e.g, Slack).

And Atlassian has always done things a bit differently. With, for the most part, a relatively small sales team (although a large channel since the early days, providing a lot of those functions externally). And a huge investment in R&D since inception. And … proof that you can build a decacorn from anywhere.

So what are 5 Interesting Learnings we call all take away from Atlassian at $2B in ARR?

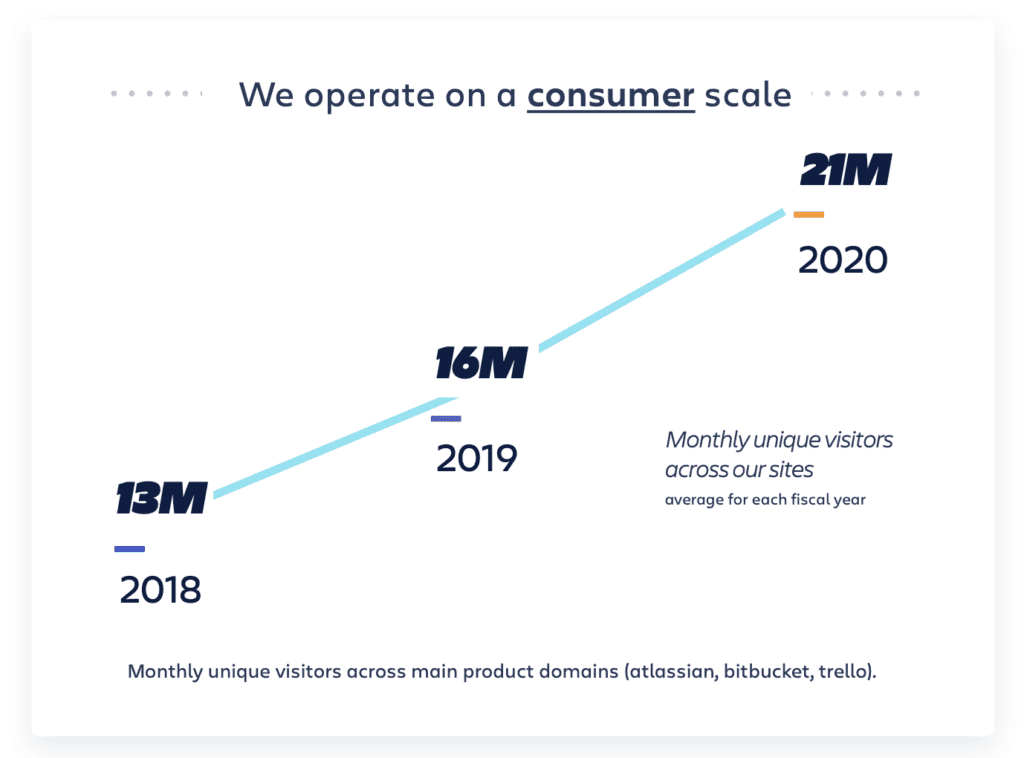

- SEO and brand continue to work at scale. Atlassian had 21m unique viewers to its website last year, up 30% year-over-year. A vivid reminder that investment in content and brand pay dividends … forever.

2. It’s never too late to add a great Free edition. Atlassian was relatively late to adding free editions for some of its products, but it’s working now. In fact, Atlassian sees Free as its key engine of growth for the next decade. While the Free editions of Jira and Confluence were somewhat inspired by Covid, the experiment worked. Sign-ups have tripled.

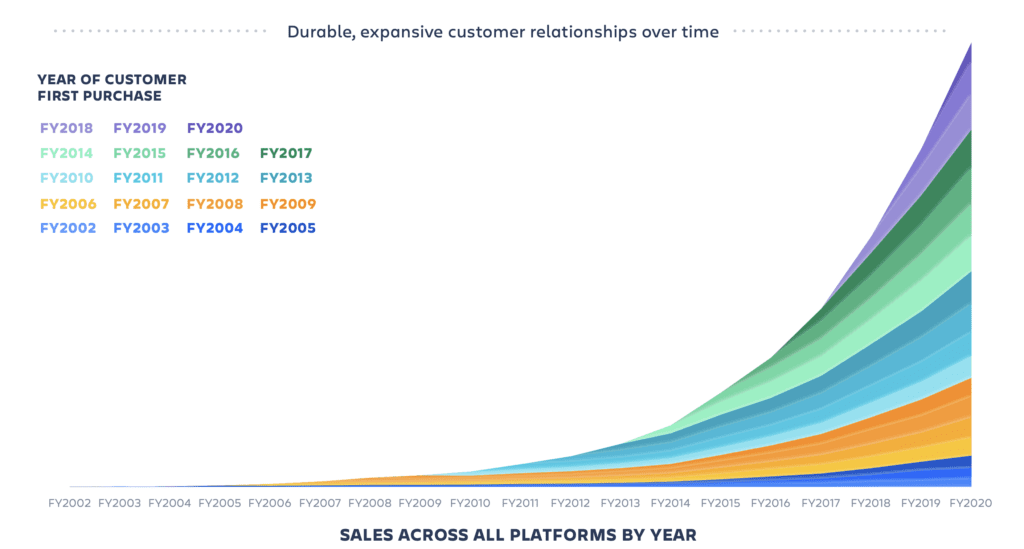

3. 121% NRR overall, 130% in enterprise. These numbers aren’t a surprise, but they are still top-tier and what you should aim for as well if you sell similar tools.

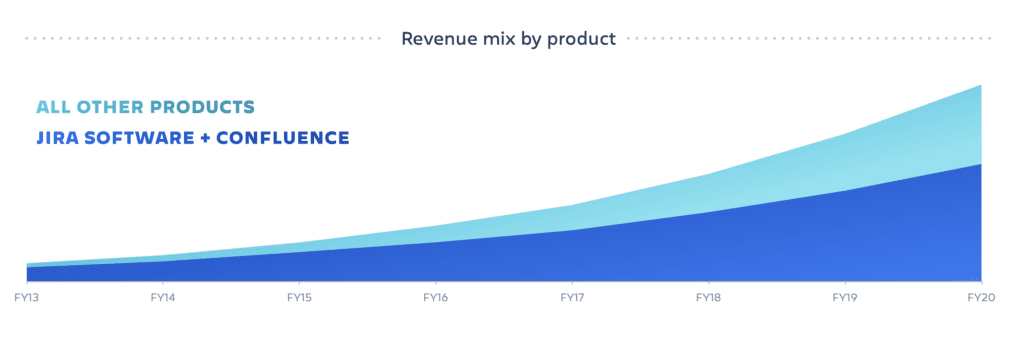

4. A long path to multi-product revenue streams, but today, 40% of revenue not from Jira+Confluence — and that’s growing. A top learning from this series is that to continue strong growth past $1B in ARR, you probably need more than one core product. We’ve seen this with Twilio, Veeva, Salesforce, and many others that find a second, and often third, anchor product to continue to fuel growth higher than 20% at $1B+ ARR. In just a few years, a minority of Atlassian’s revenue will be from its traditional 2 core products.

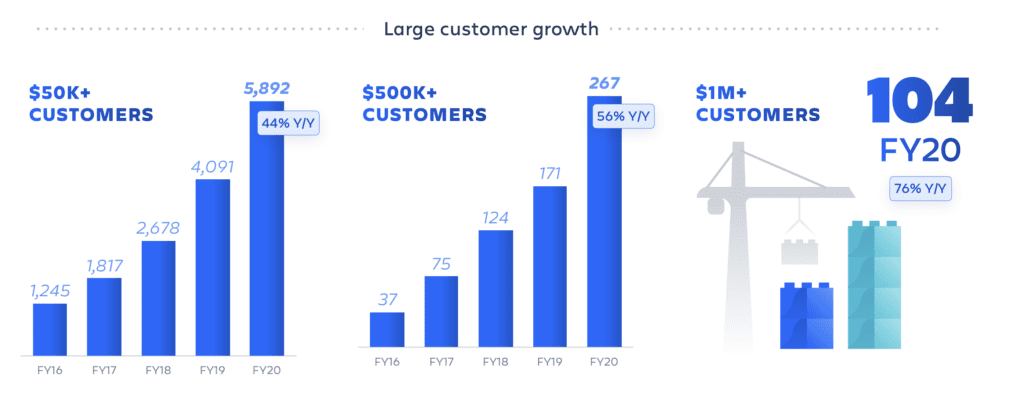

5. Atlassian, too, is going more enterprise now. One of the biggest changes from IPO to $2B ARR is just how enterprise Atlassian has gone. It’s $50k+ customers are growing 44% and it’s $500k+ customers are growing 56% … and it’s $1m+ customers are growing 76%. They now have over 100 $1M+ ACV customers. We’ve seen Slack, Asana, PagerDuty, and Zoom all go more enterprise post-IPO:

And a few other interesting notes:

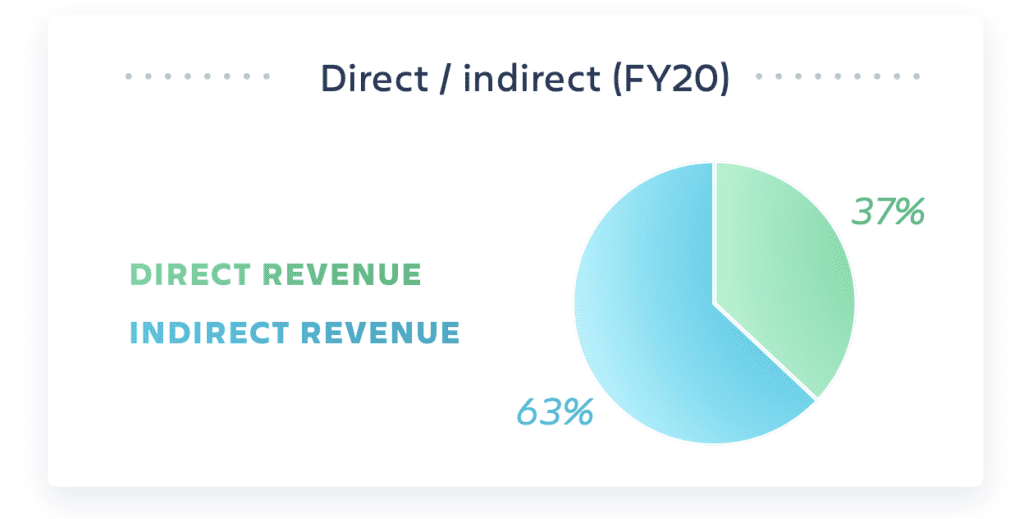

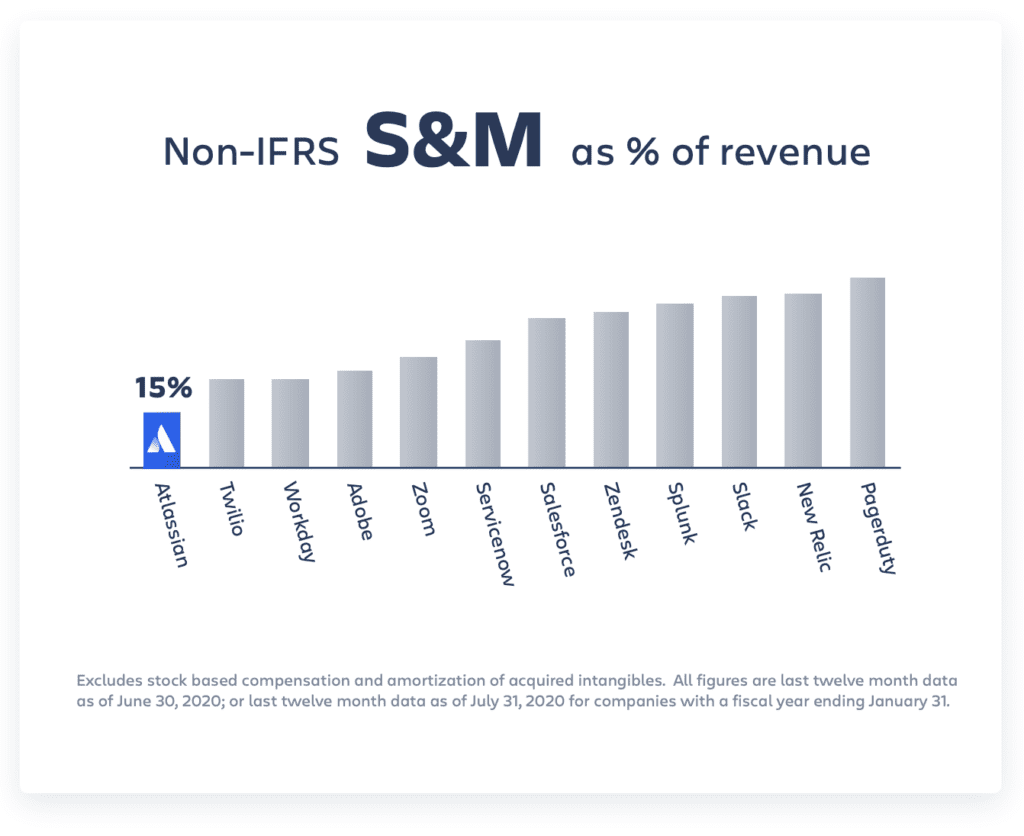

6. Channel partners drive 37% of revenue (!). A lot of Atlassian’s sales efficiency is driven by its channel partners doing the heavy lifting on sales — and it’s still working well at $2B in ARR. Atlassian only spends 15% of its revenue on sales and marketing, which is the lowest or close to it of any Cloud leader. But that doesn’t mean it doesn’t do sales and marketing. Its partners just do a lot of the sales, and its brand and web traffic do a lot of the marketing.

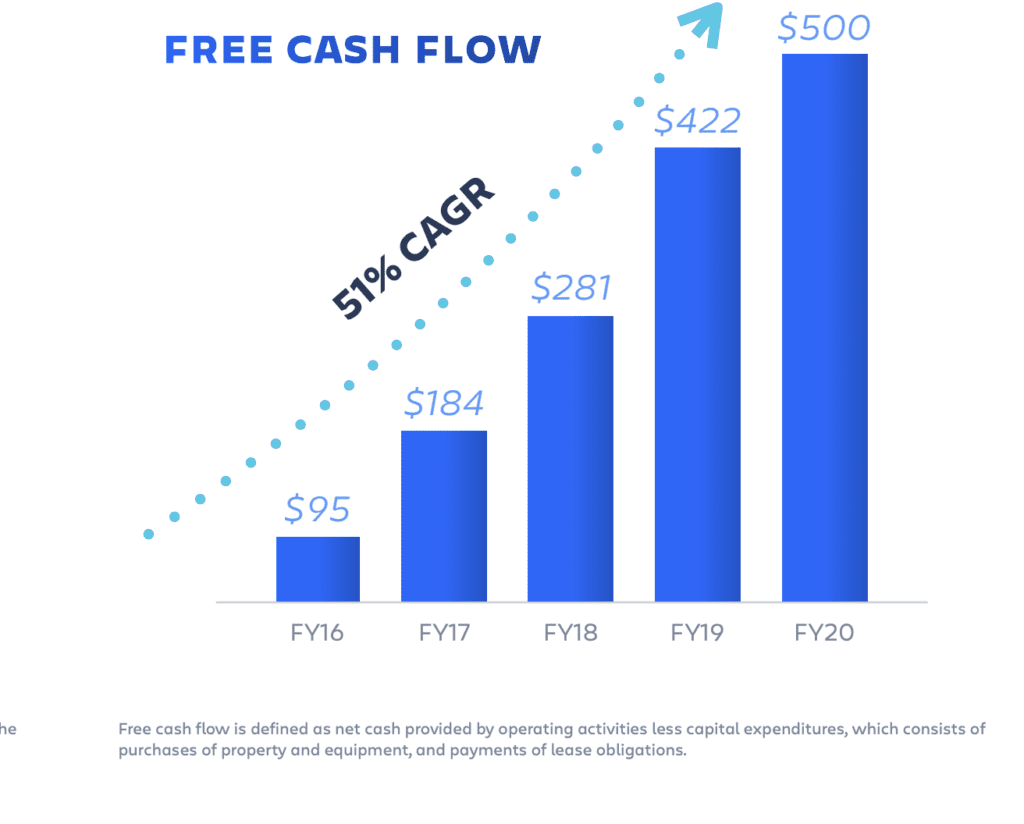

7. Atlassian is a cash-generating machine. Yes, it can be done in SaaS, especially companies that are very efficient in sales and marketing like Atlassian and Zoom. Atlassian is generating $500m+ a year in free cash flow:

And a few other great ones in this series:

- 5 Interesting Learnings from Zendesk. As It Crosses $1B in ARR

- 5 Interesting Learnings from HubSpot as It Approaches $1 Billion in ARR

- 5 Interesting Learnings from RingCentral. As it Approaches $1B in ARR.

- 5 Interesting Learnings from Palantir at $1 Billion in ARR.

- 5 Interesting Learnings from Slack at $1B in ARR

- 5 Interesting Learnings from PagerDuty, as It IPOs

- 5 Interesting Learnings from Zoom at IPO

- 5 Interesting Learnings from Bill.com at IPO

- 5 Interesting Learnings from Asana at $250,000,000 in ARR

- 5 Interesting Learnings from Qualtrics at $800m+ in ARR

- 5 Interesting Learnings from Xero. As It Approaches $1B in ARR

- 5 Interesting Learnings from Snowflake at $600,000,000 in ARR

- 5 Interesting Learnings from New Relic at $650,000,000 in ARR

- 5 Interesting Learnings from Box At $800,000,000 in ARR

- 5 Interesting Learnings from Atlassian at $2B in ARR