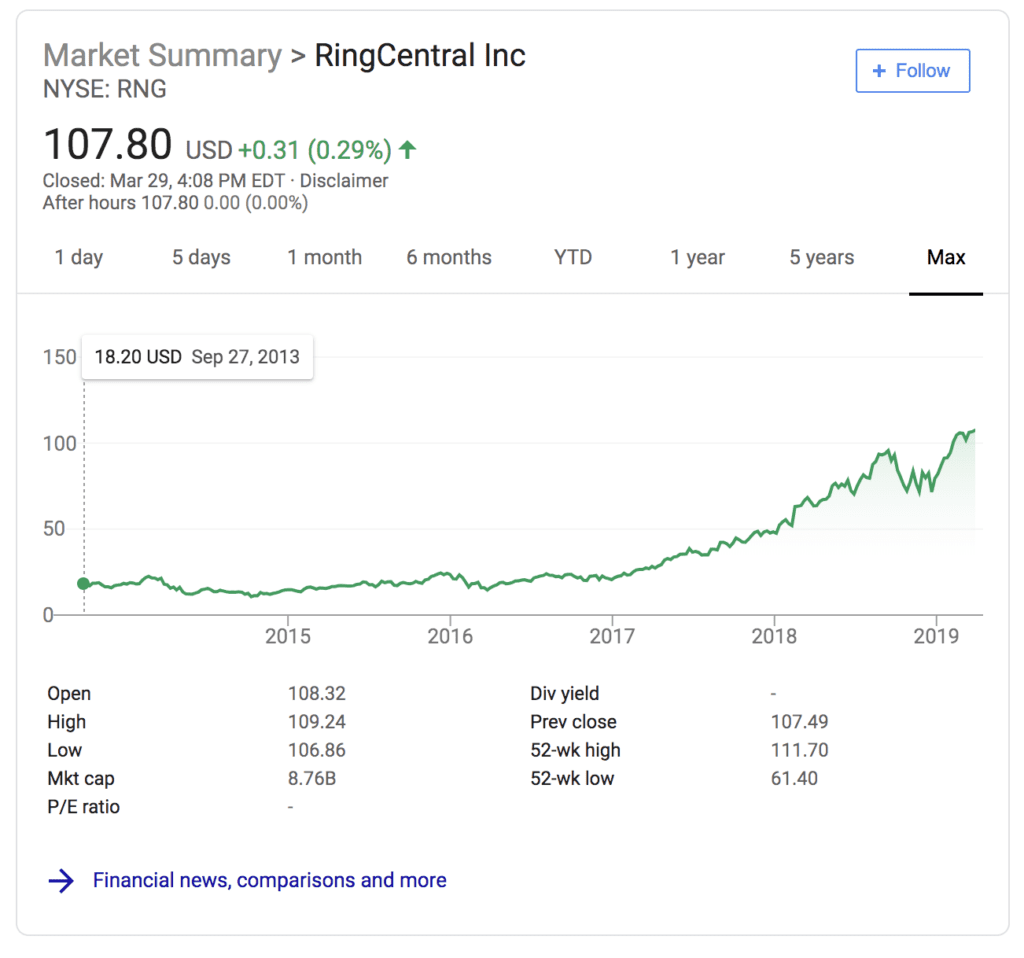

While companies that are about to go public get a lot of metrics analysis, we can perhaps learn even more interesting things from the quarterly reports and check-ins from various public SaaS companies after they’ve IPO’d. We’ll check in with a bunch. First up is RingCentral, which IPO’d relatively early and quietly in 2013. Since then, revenue has grown 5x and market cap 10x to an impressive $8.8 billion at $1b ARR and $35B today.

Some of the interesting learnings from RingCentral at $1B in ARR:

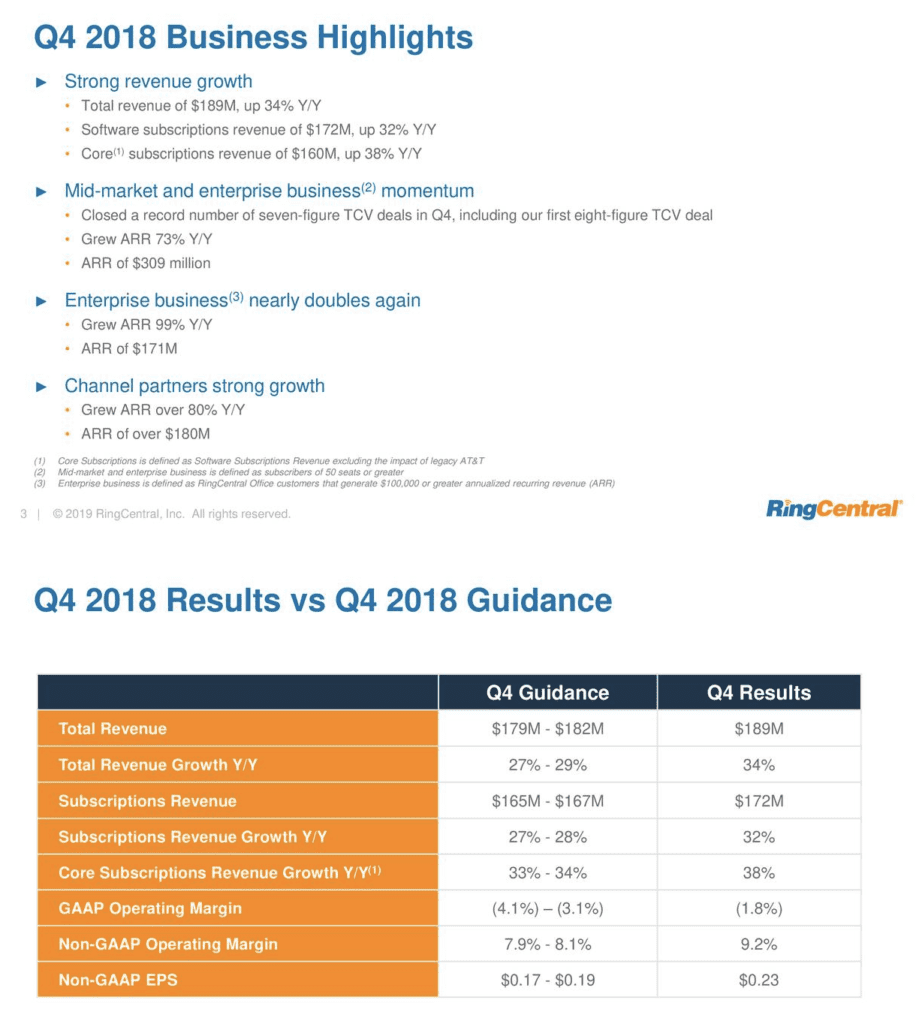

- RingCentral at $1b in ARR (on track for 2020), was still growing 34%. This is pretty darn impressive, and probably more importantly, shows the continued jaw-dropping growth of Cloud. This is despite the fact that Ring Central has many strong, fast-growing direct and adjacent competitors, from Five9 to Talkdesk to Dialpad to Genesys to Zoom to many others. No vendor here has anything close to a majority market share, and yet RingCentral remains on fire at almost $1b in ARR.

- Channel Partners can work — they drive $180m in ARR, and are growing fastest at 80%. Their churn is lower in the channel, as are total sales and marketing costs.

- RingCentral was slow to international sales, still < 10% of revenue. This is most likely due to the fact that communications platforms are quite different in different countries. Still, most SaaS companies start to go international to some extent by $10m in ARR or so.

- They just closed their first eight-figure TCV deal. RingCentral has gone impressively upmarket from its earlier days as simply an inexpensive voice tree system for small businesses. Its mid-market and enterprise segment is a third of total revenue ($309 ARR), but the fastest-growing segment at 73% YoY. RingCentral somewhat later in life is growing into a true enterprise-play at $1b+ in ARR vs. the SMB play it was in its earlier and middle days. Some of us go upmarket early, some later, but most of us go there eventually. At least to some extent.

- 40% of new bookings are from existing customers. Go long in SaaS, as we’ve discussed many times. Even as RingCentral approaches $1b in ARR, still 40% of its growth is from its base. Take a pause and think about that. And now go do whatever it takes to make your top customers happy. Whatever it takes. Treat them right, and they are an annuity.