Ok times are tough in the public markets for SaaS and Cloud

But not for Zscaler

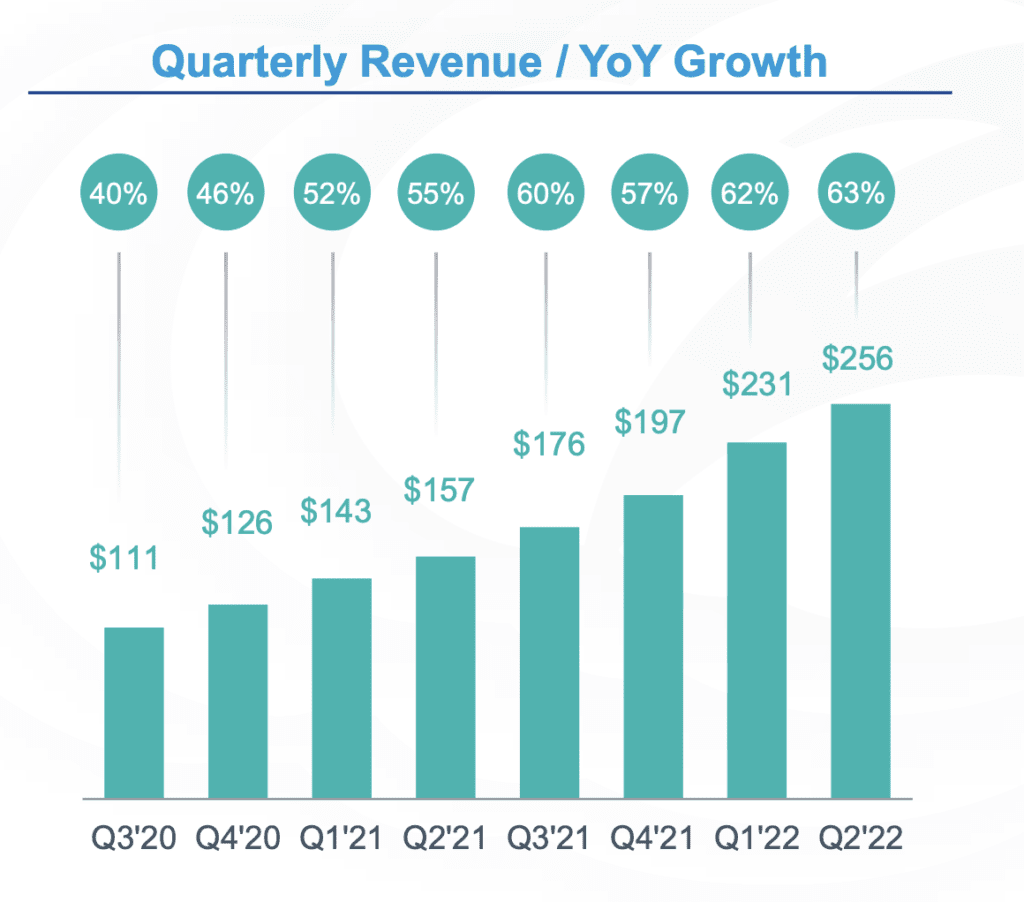

It's worth $30B at $1B in ARR, and it's growing an incredible 63%.

The key?

It's doing that, AND generating $200m of free-cash flow a year.

That's the bar today.

And it's a high one.

— Jason ✨BeKind✨ Lemkin #ДобісаПутіна (@jasonlk) April 26, 2022

So Zscaler is the quiet SaaS and Cloud leader that just … delivers. Even in a challenging time for public stocks.

Zscaler is worth a breathtaking $30B at $1B in ARR, growing a stunning 63%.

With a seasoned solo founder that knew security cold, Zscaler has been a quiet winner in Zero Trust and more. Zscaler leaned early into security in a cloud-first model, and it worked. With CEO Jay Chandhry still owning 25% of a $30B market cap, it’s also an epic model in managing dilution.

5 Interesting Learnings:

#1. Accelerating at scale. We’ve seen this with many leaders now, from Confluent to Monday and more, but it’s still breathtaking to see. Zscaler is growing faster at $1B in ARR (63%) than it did at $500m in ARR! Or any quarter prior. Whoa.

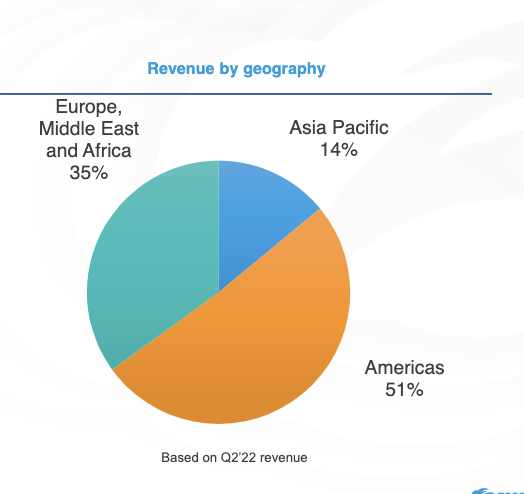

#2. U.S. only half its revenue. That’s interesting to see. Zscaler is based in San Jose, CA, but it had early wins in Europe and it kept scaling there. A reminder to lean in early when you get early traction outside your home geo. Zscaler’s sales team is also similarly constituted, with an equal amount of the team outside the U.S.

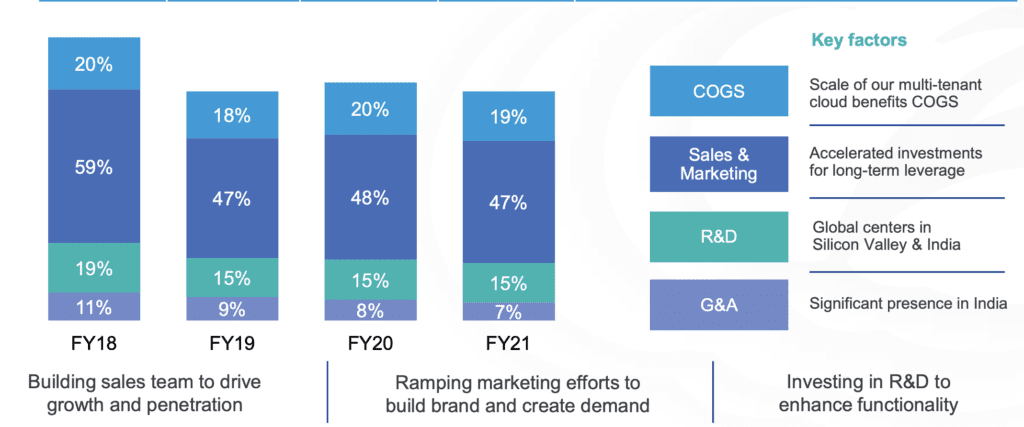

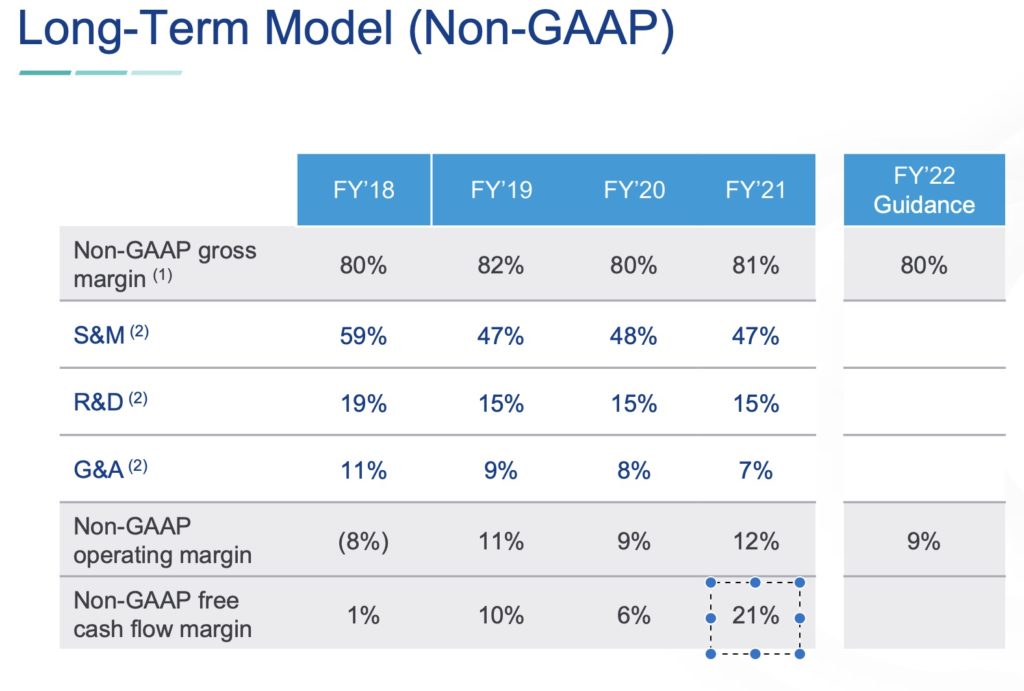

#3. Sales + Marketing declined from 59% of revenue to 47%. Zscaler is still a sales-driven model, and those struggle to get sales and marketing expenses below 50% of revenue, unless there is a PLG or freemium element. Zscale isn’t an exception, but they’ve been thoughtful as they scaled and IPO’d and got sales & marketing under 50%. Their long-term goal is to get Sales & Marketing to 33%-37% of revenue.

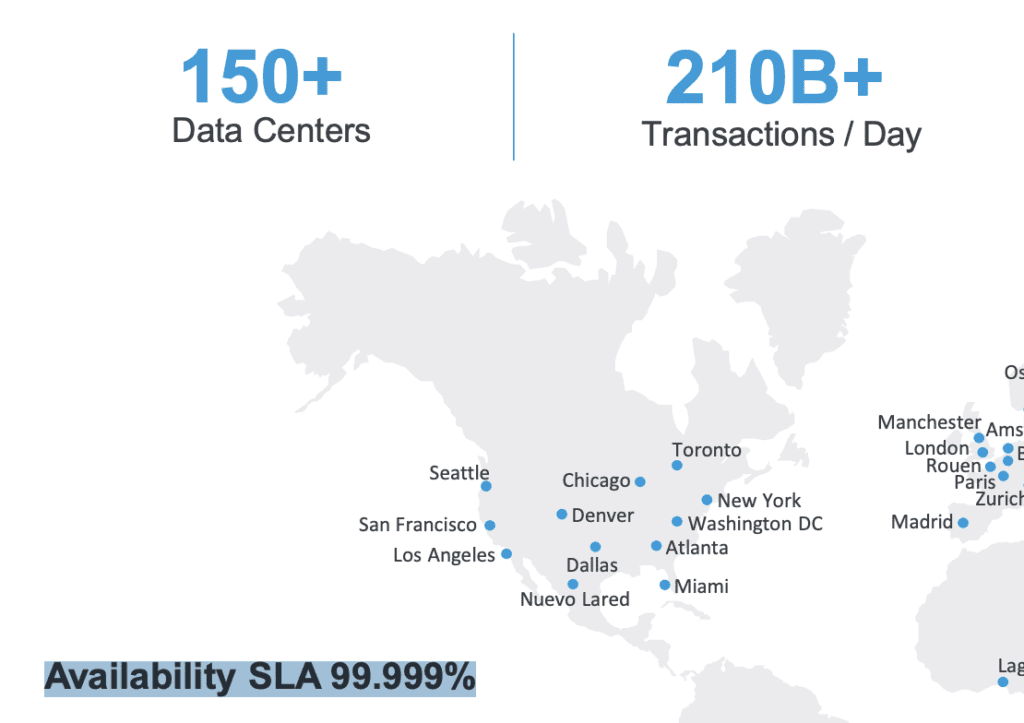

#4. SLA 99.999% across 150+ Data Centers. Yes, this is hard. Yes, it’s part of being very enterprise. And pulling away from the rest.

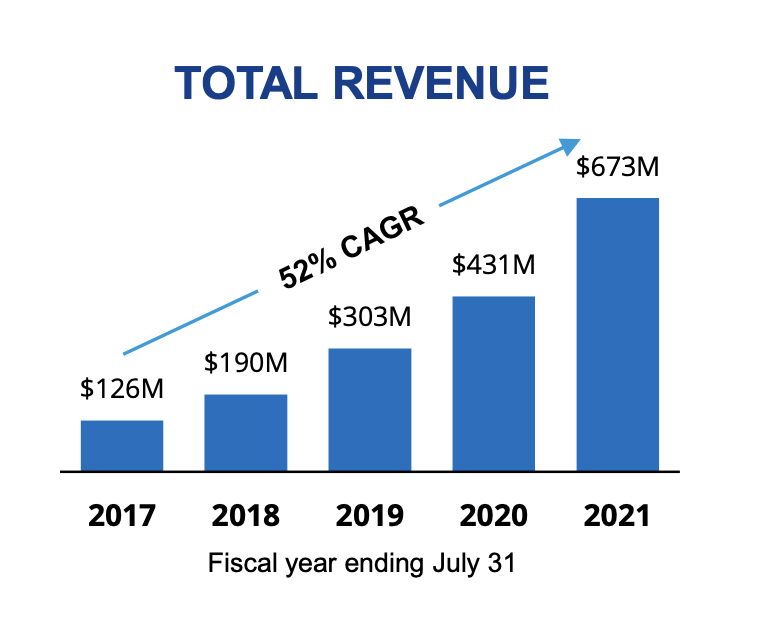

#5. 10 Years to $100m in Revenues. Then Just 5 More To $1B in ARR. Ok, this is an epic example of the compounding nature of SaaS. Zscaler was founded in 2007, and took a decade to cross $100m in revenues — as it does for most of us, even the best of us. But then boom! That acceleration kicked in. And they hit $1B in ARR just 5 years later:

And a few other interesting learnings:

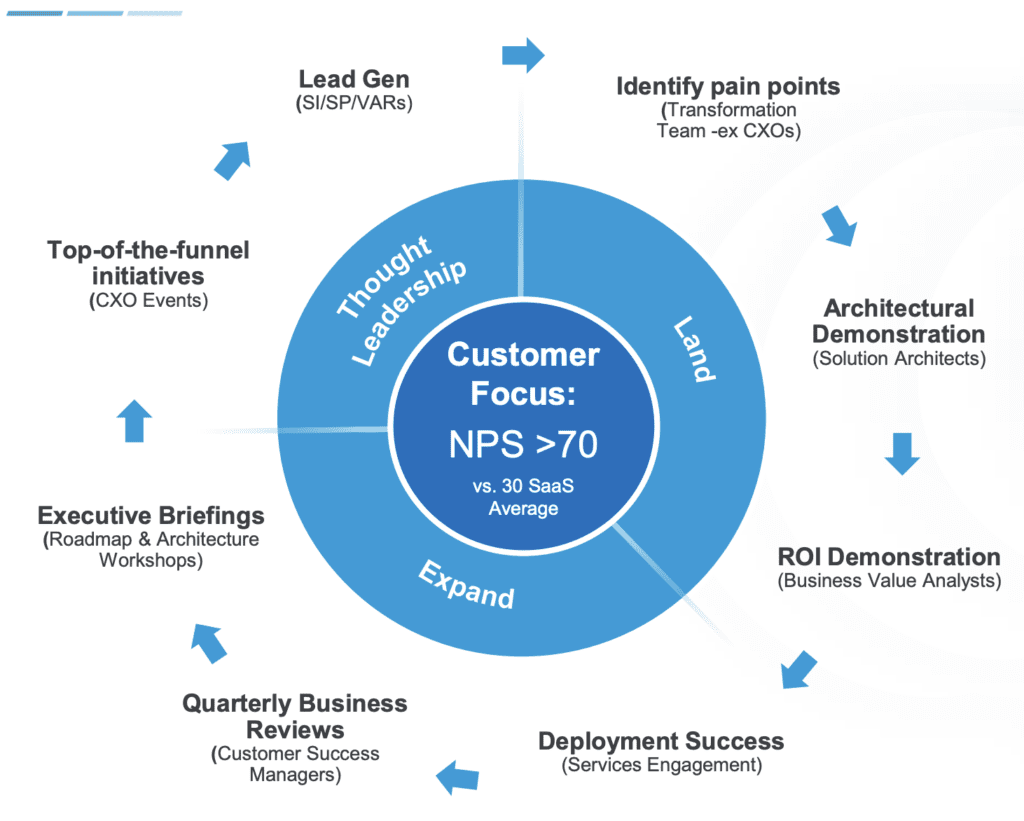

#6. 125% NRR, and NPS of 70. Everyone asks NPS questions in a slightly different way, but still useful to see.

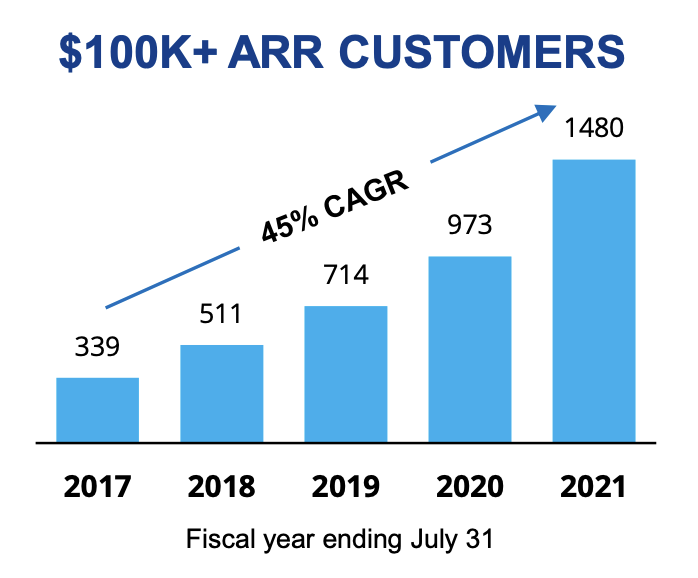

#7. $100k+ ARR customers fuel growth. They are growing almost as quickly as revenue. The “Golden Ratio” in SaaS, when your customer count grows almost as fast as revenue.

#8. Generating $200m of Free Cash Flow a Year, or 19% of Revenues. OK, now here’s why Wall Street really, really loves Zscaler. Why even now, it’s worth $30B in market cap. It’s not just the ARR, and the growth. It’s the efficiency now at scale. Zscaler beats the “rule of 40” and is growing at an epic rate while still generating epic free cash flow. A tall order. And what investors are looking for today. And they are guiding to even better net margins, with a target of 20%+ operating margins and 22%+ free cash flow:

Wow. Just Wow.

Zscaler.

It’s what the public markets want now in SaaS and Cloud. They want — it all.