So GitLab is one of those ones that sort of … always was doing well. It was exciting at YC 2015 Demo Day. It was exciting as it scaled to be a more “enterprise” Github at first. And the engine really never stopped running, evolving into a dominant DevOps Platform for software development.

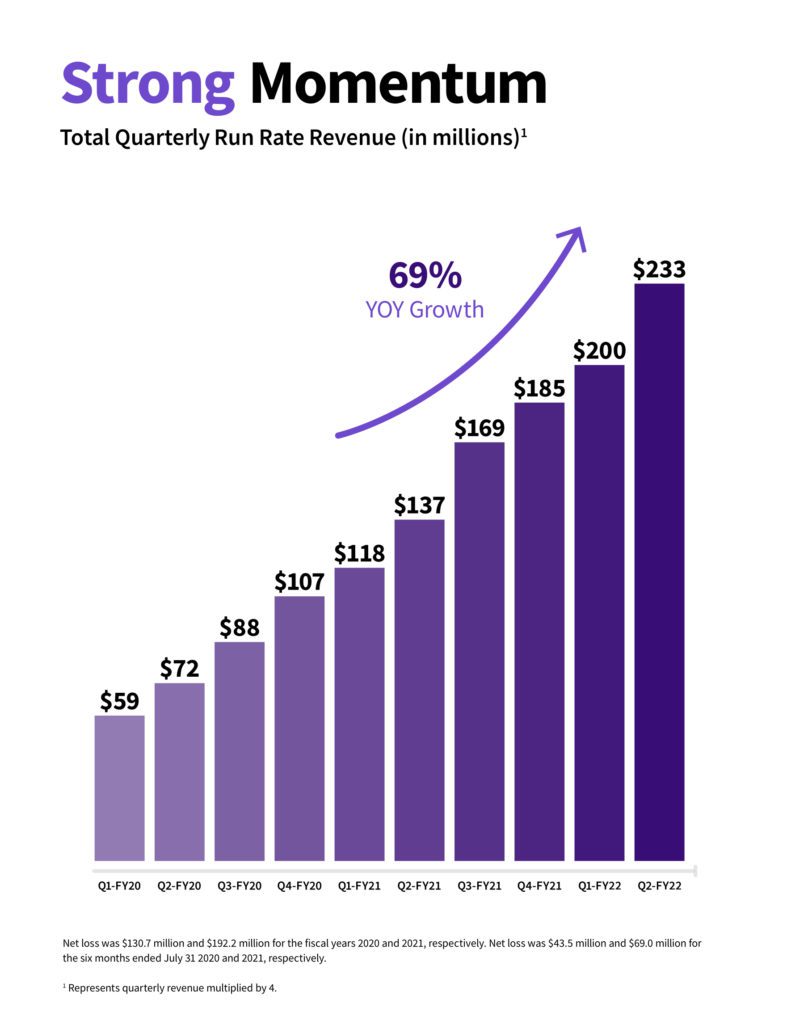

Today, it’s IPO’ing at $250m in ARR, growing a stunning 69% year-over-year, with 3,600+ customers at $5k or more in ACV.

🔔 “If you want to go fast, go alone; if you want to go far, go together.”⁰

Look at how far we have been able to go together at GitLab, where we believe #EveryoneCanContribute.$GTLB at @Nasdaq pic.twitter.com/Tix2iaEqAr

— 🦊 GitLab (@gitlab) October 14, 2021

5 Interesting Learnings:

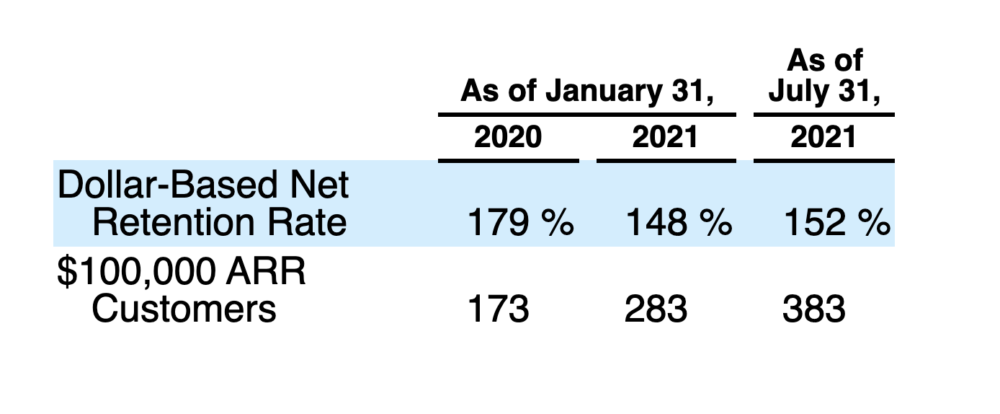

#1. 152% NRR from $100k+ customers. We’re getting used to seeing these super-high NRR numbers from the top developer-focused leaders, in many cases because utility pricing often encourages it (see also Datadog, Twilio, etc). Still, these are truly top-tier numbers:

#2. GRR (Gross Retention Rate) of 97%. It’s great and helpful to see this broken out as well to compare yourself to. GitLab’s customers … stay. Almost all of them.

#3. GitLab China is a new independent company formed in 2021, both SaaS and self-managed, available only in China, Hong Kong and Macau. We may see this more often.

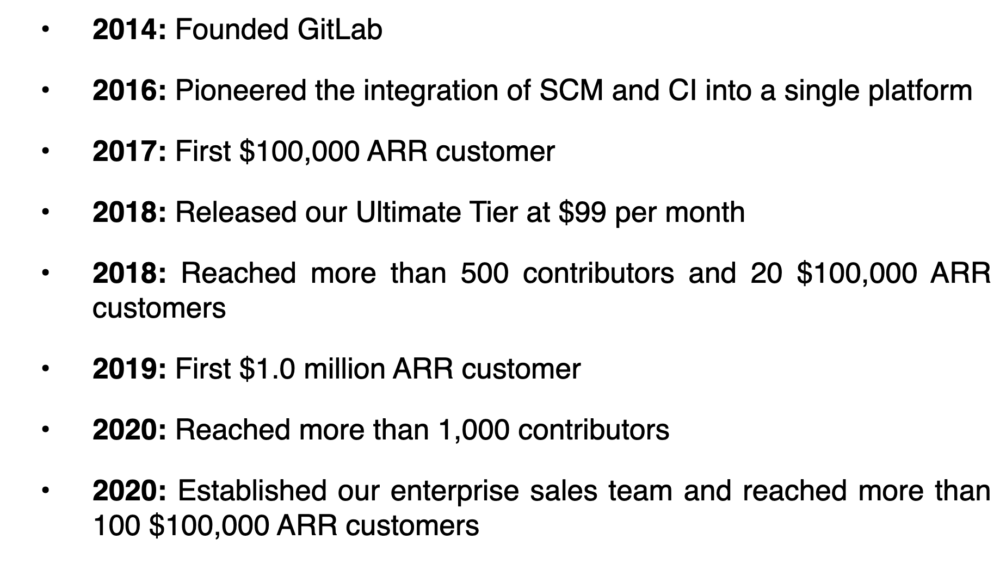

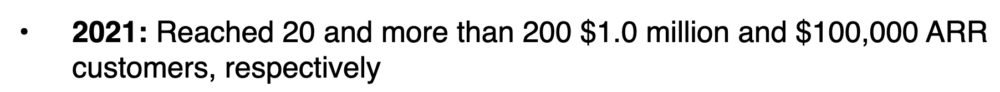

#4. First $100k customer in 2017. Then 20 by 2018. And 100 by 2020 and 200 by 2021. GitLab lays out a terrific chronology that is similar to how many of us learn to go upmarket. First, we close one big deal, and you learn so much from the first one. It seems almost impossible at first. But then you close another. Then 20. And then, a few years later … 100. And GitLab closed their first $1m customer in 2019. Fast forward 2 years, and they have 20 $1m+ customers.

#5. Most customers still deploy GitLab to their own private or hybrid Cloud. 90% of GitLab’s customers pay by subscription — but most still self-manage the deployment. GitLab’s SaaS revenues are still just 20% of their revenues, although that’s up from 9% in 2020.

And a few bonus learnings:

#6. Most customers under contract pay annually or multi-year. Perhaps not a surprise, given the larger deals GitLab has closed.

#7. GitLab has done a new release on the 22nd of every month … for 118 months straight. A clear commitment to consistent innovation!

#8. Define their “Base Customer” as ones at $5k ACV or above. This is an interesting segmentation of core metrics. While GitLab has 15,356 customers as of July 2021, it focuses its metrics on its 3,600+ ones with an ACV of $5k or more. While this makes sense as their core persona and area of growth, it also flatters a lot of the metrics like NRR, etc. And perhaps it’s a little cute given that they are a freemium product based on land-and-expand.

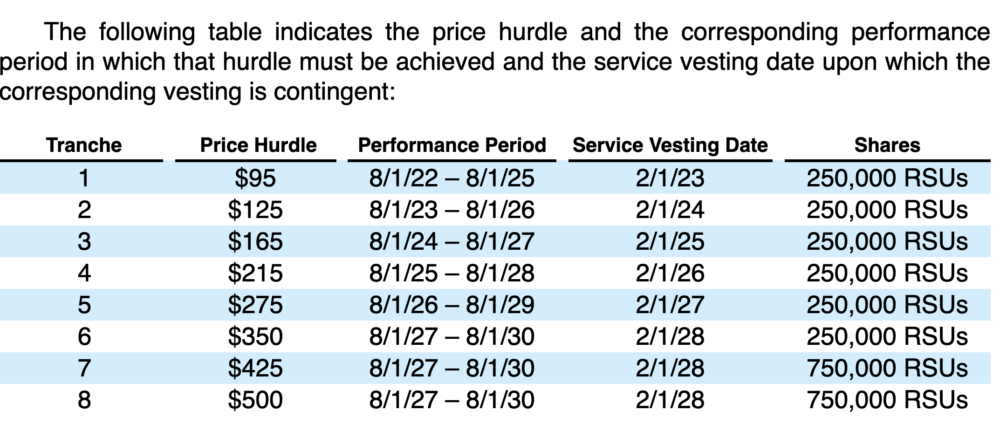

#9. CEO Sid Sijbrandij has been granted massive additional stock grants — but they are only worth massive amounts if the company’s stock price skyrockets. Elon Musk made a similar deal years back, and it made him currently the richest person on the planet — but only because Tesla hit a market cap that seemed almost impossible at the time. This is more and more common with founders who already own a lot (Sid owns 18%) that the board wishes to incent to build something really, really big.

Here, Sid has to build a $40B-$50B+ company to get the biggest grants:

Wow, what a success story!!