Elastic $ESTC Q4FY21:

– Revenue: $177.6M. +44% YoY

– SaaS rev: $51.3M, +77% YoY

– Net dollar retention: slightly below 130%

– 60 net new customers w/ 100k+ ACV

– Billings: $240.9M, +38% YoY (33% cons. currency)

– Gross margins: 74.2%

– FCF: -$3.1M (-1.7% margin)Shares +7% AH!

— Public Comps (@publiccomps) June 2, 2021

So Elastic is one of the quiet Cloud monster success stories. If you’ve built any sort of web service in the past decade, you’ve likely used Elastic search in one part of your app or another. We last checked in with Elastic a ways back when it IPO’d here, at about $230m in ARR.

Elastic is also a fascinating story of how open source develops over time to a $10B cloud leader at $700m+ in ARR, growing 44%+ a year. And that’s up from 39% just a quarter earlier.

5 Interesting Leanings:

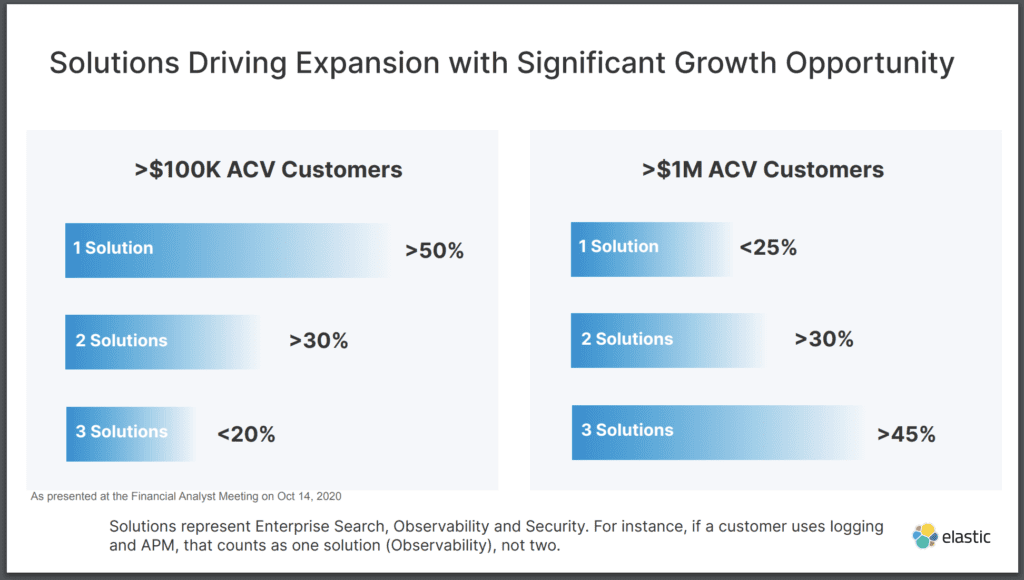

#1. 3+ Products is Key to $1m+ accounts.

Elastic has gone very upmarket over time, growing to 50%+ $1M ACV accounts today. Key to that has been to add more solutions. Search its core plus more solutions.

This chart is particularly illuminating. $1M+ ACV customers buying 3+ solutions more and more — search AND observability AND security. But for $100k customers, most still buy just 1 solution (usually ‘just’ Search, the original heart of Elastic).

We’ve seen this again and again that multiple core products is, at least at the later growth stage, the key to higher NRR and expansion.

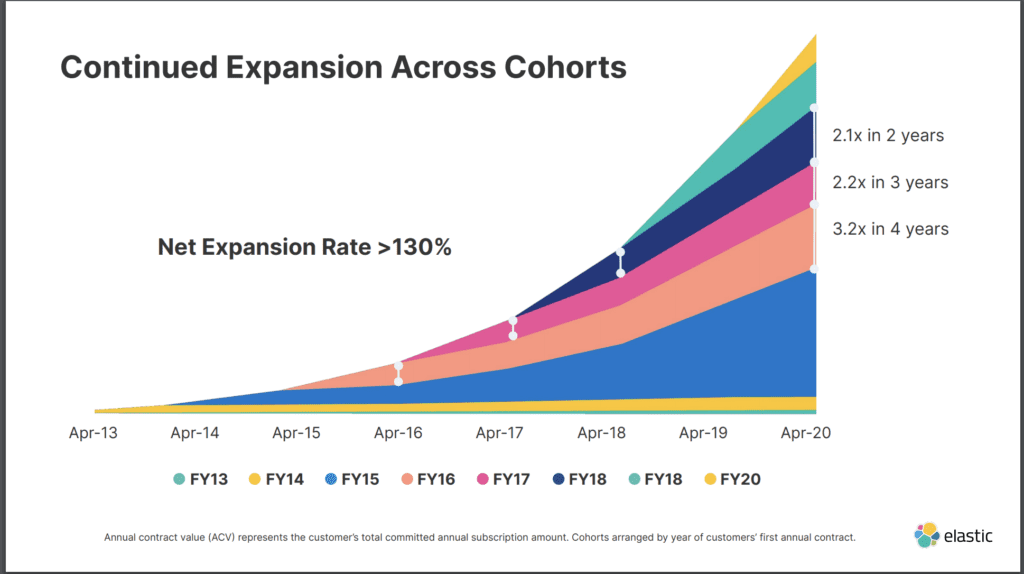

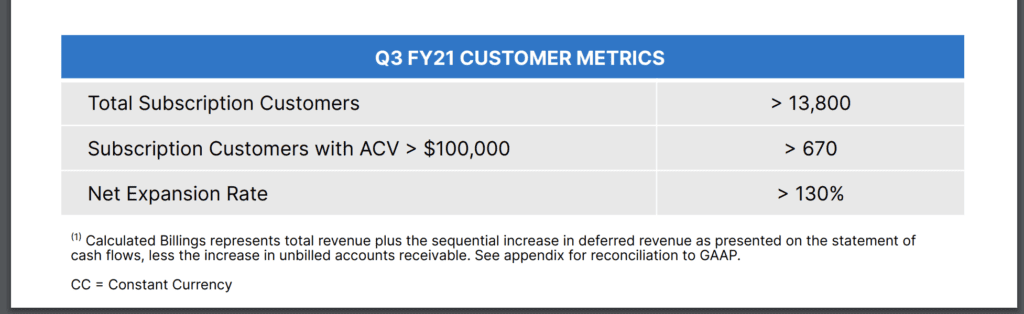

#2. 130% NRR yields 3.2x growth in customer accounts over 4 years.

While it’s easy to make a spreadsheet of how NRR compounds, a lot of companies fudge the numbers a bit. It’s super interesting to see Elastic directly tie its stated NRR — 130% — to the precise account growth it yields.

The answer? A stunning 3.2x growth in existing customer account sizes over 4 years

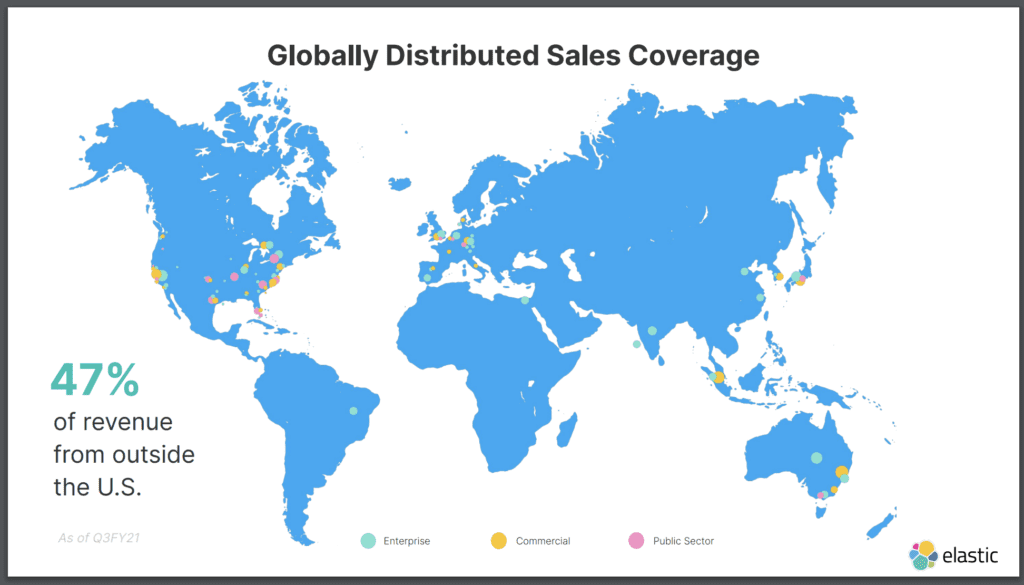

#3. 47% of revenue from outside the U.S.

This was a bit surprising to me, and it’s gone up. At IPO, it was 40% international.

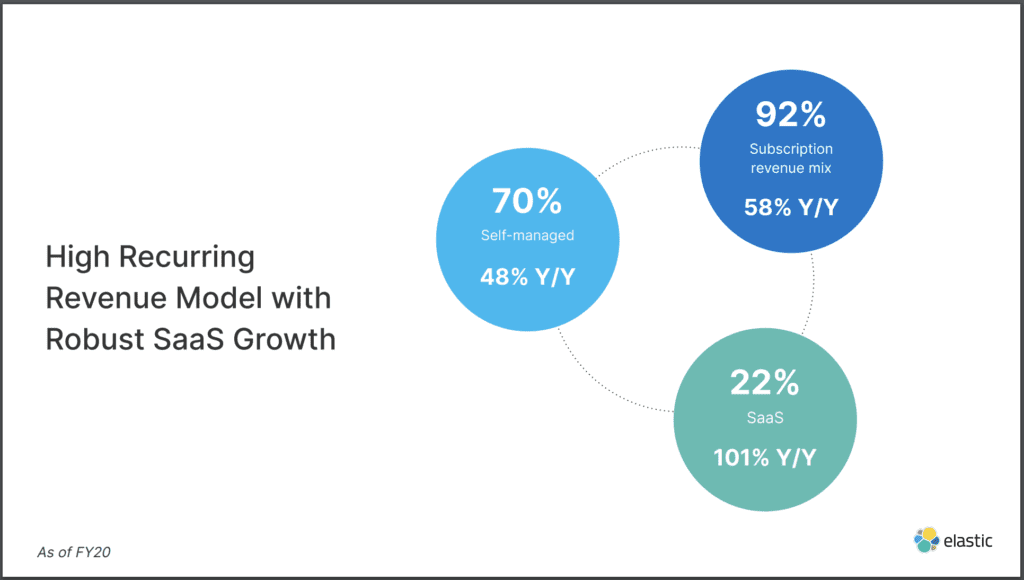

#4. Elastic getting more SaaS.

Elastic can be deployed in a variety of formats — licensed, self-managed, and “SaaS”. Hosted SaaS and the ‘Elastic Cloud’ is now growing the fastest now, at 79% quarter-over-quarter and 101% year-over-year. We’ve seen a somewhat similar migration with Atlassian for example.

#5. 14,000 customers at $600m in ARR — 5% of which pay $100k or more.

It does seem as if 10,000-20,000 is sort of a magic number for many SaaS companies getting to $1B ARR, from Hubspot to Okta and more. Of the ~14,000 customers, 670 pay $100k or more.