Blackline has quietly been one of our favorite SaaS companies because they just never gave up. A solo founder and even a solo parent, founder Therese Tucker wrote the initial code herself and had to tilt the company into an entirely new product 2 years in. The company was also bootstrapped and waited until the pre-IPO phase to raise external capital. Solo, solo, and bootstrapped to $400m ARR. Wow.

But they never quit. After 20+ years Therese moved to Chairperson and you look back at our deep dive here:

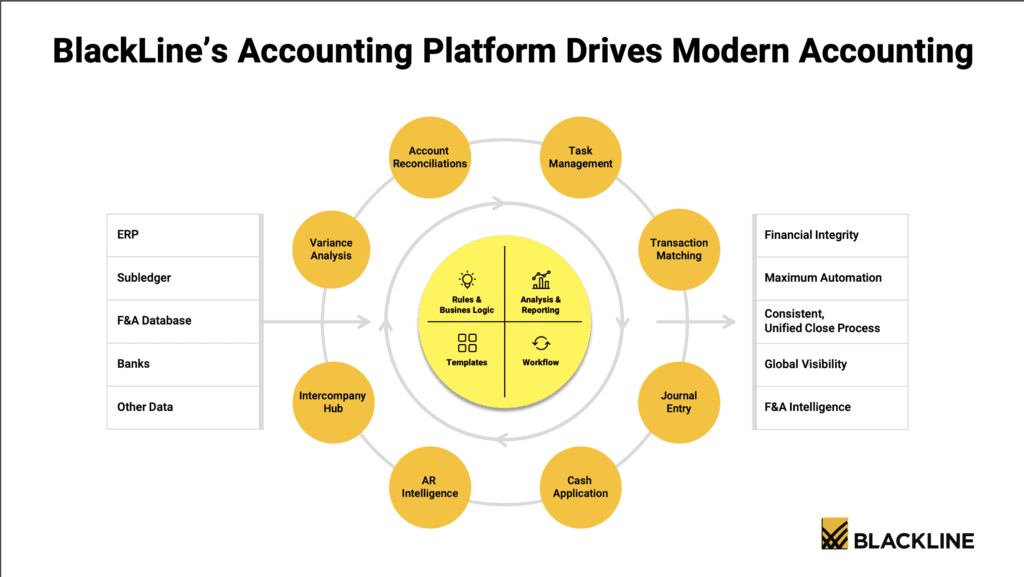

But it was never a true rocketship. That’s 20+ years to $400,000,000 in ARR, now growing 23% year-over-year. Selling mid-market and enterprise software to manage strategic accounting and financial close and account reconciliation in particular is a sizeable market, but one with real work and sales cycles to sell and close, and with more competition than you might think.

5 Interesting Learnings:

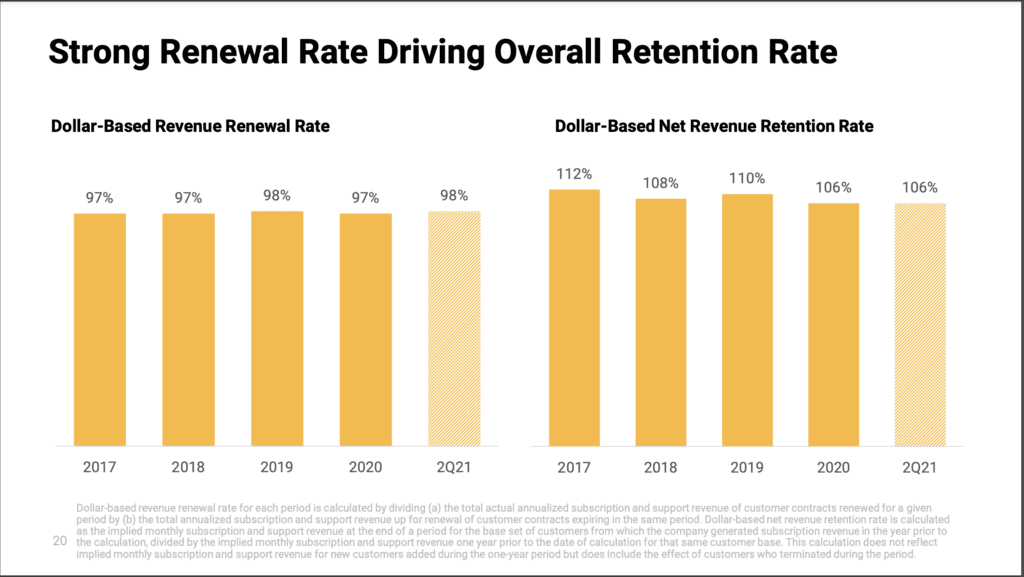

#1. 98% Renewal Rate, 106% NRR. I love seeing how they present both side-by-side. Not just NRR, but the core dollar-base renewal rate. Blackline does an incredible job at renewals (and who would want to rip out an accounting close system, if it’s working?). But they don’t have that much more to sell to their customer base, leading to a relatively low NRR/Dollar Renewal Rate ratio.

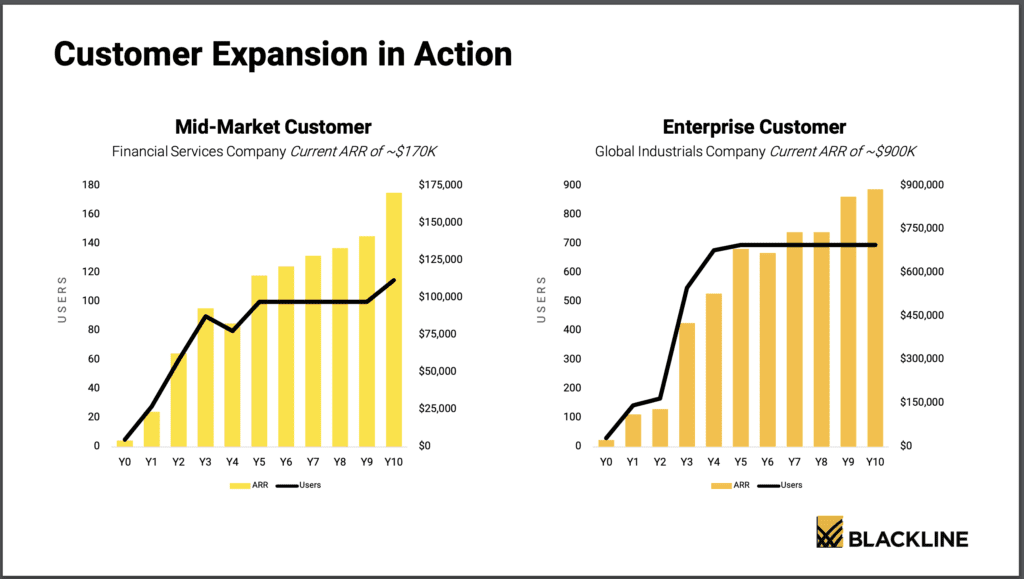

#2. Years 3-5 are the good ones for account expansion. I also love how this chart is presented, and it’s what so many of us really see with NRR of 110%+. NRR numbers are an average, but the reality is, it’s often years 3-5 when account expansion really kicks in. Year 1 is a deployment year. Year 2 is scaling up. Then Years 3-5 are where you expand it all across the company. This is what I saw with most of our largest customers, and many other SaaS vendors do too. It’s great to see it presented this way:

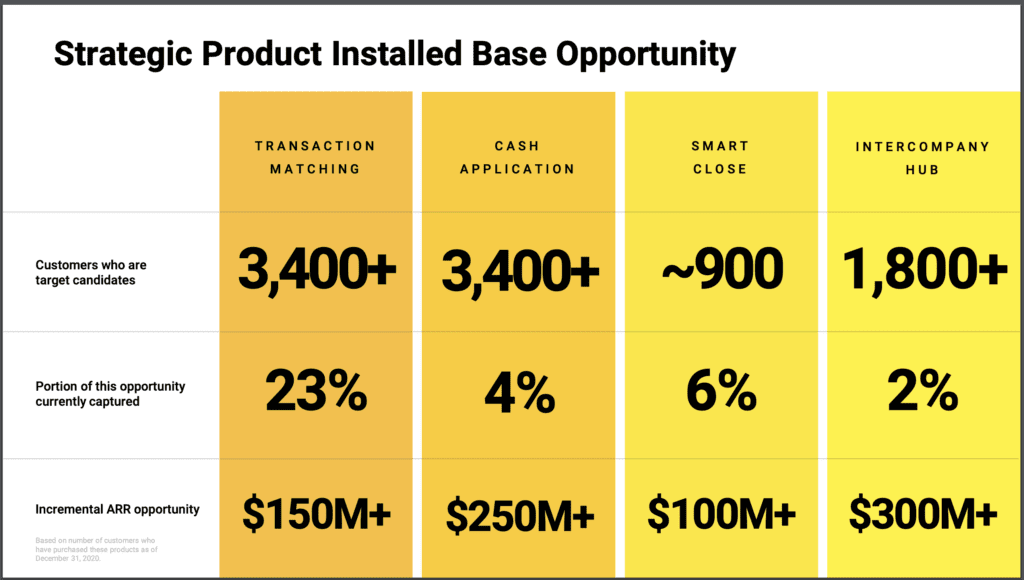

#3. Multi-Product Expansion is the key to unlocking more growth at scale. Blackline’s growth from additional products has been fairly slow, but as we’ve seen with almost every other Cloud leader, multi-product is the key to growth at $300m+ ARR. Blackline’s contributions from additional products are real, but still fairly early especially in attach rates:

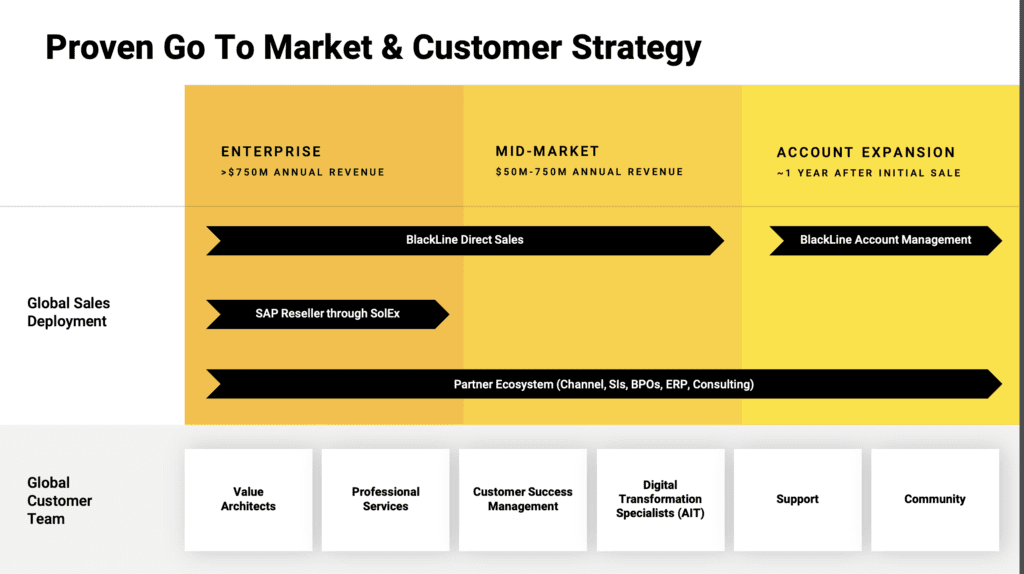

#4. Majority of customer deployments through partners. This shouldn’t surprise anyone who has been deep in the space, but while Blackline has a sizeable direct sales force, a lot of it is in partnership with implementation and deployment partners. And it’s the partners that often make the vendor recommendation. If you are selling to mid-market or enterprise like Coupa, or even to SMBs like Shopify and HubSpot, you’ve really got to understand the partner landscape. They are often the ones really making the effective buying decisions.

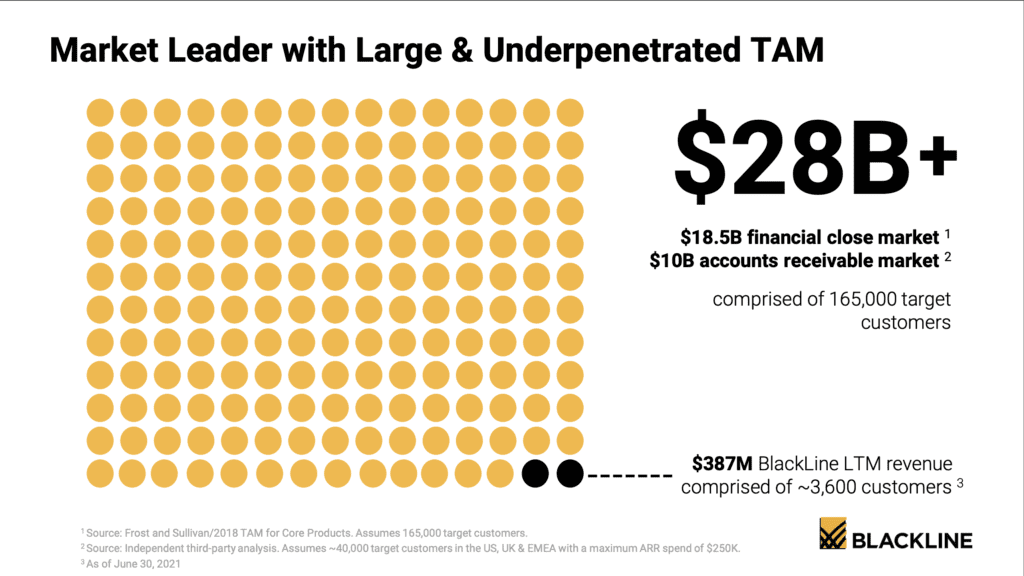

#5. 3,600 customers — out of 165,000 target customers. The SaaS-ification of many industries is still in early innings, folks.

And bonus, a great and top-rated talk from Therese Tucker on the early days and her advice to next-generation founders here: