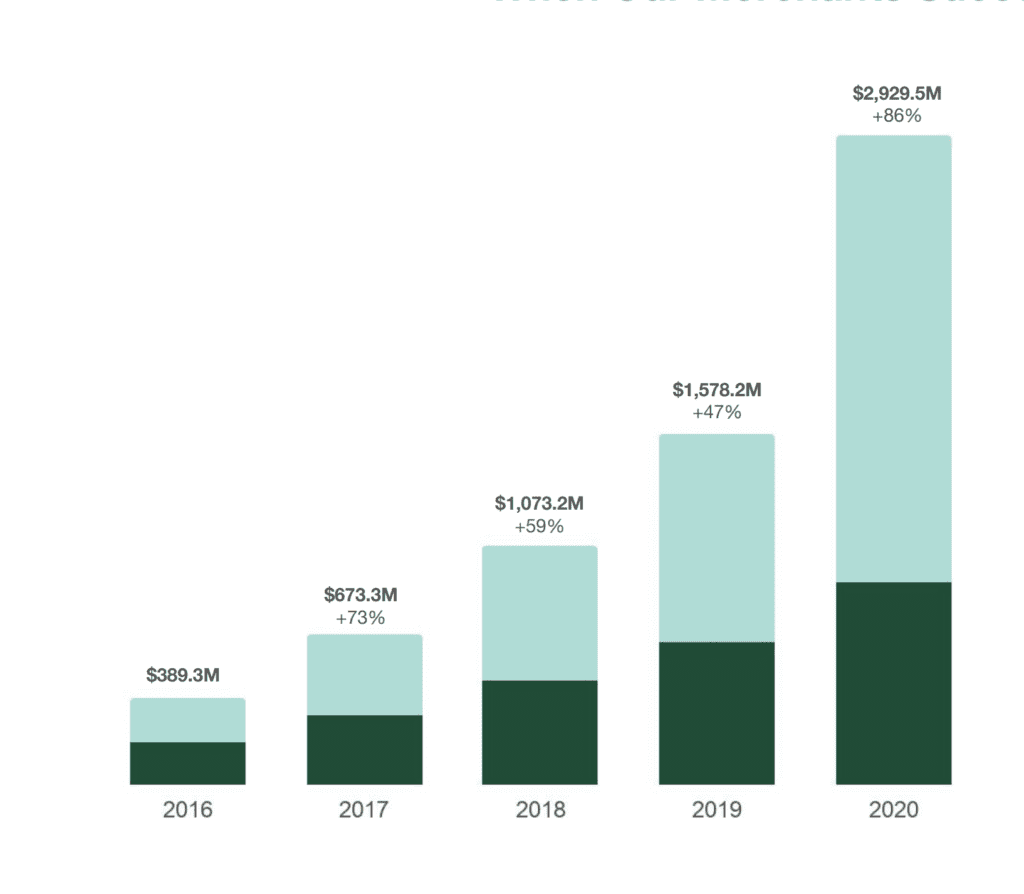

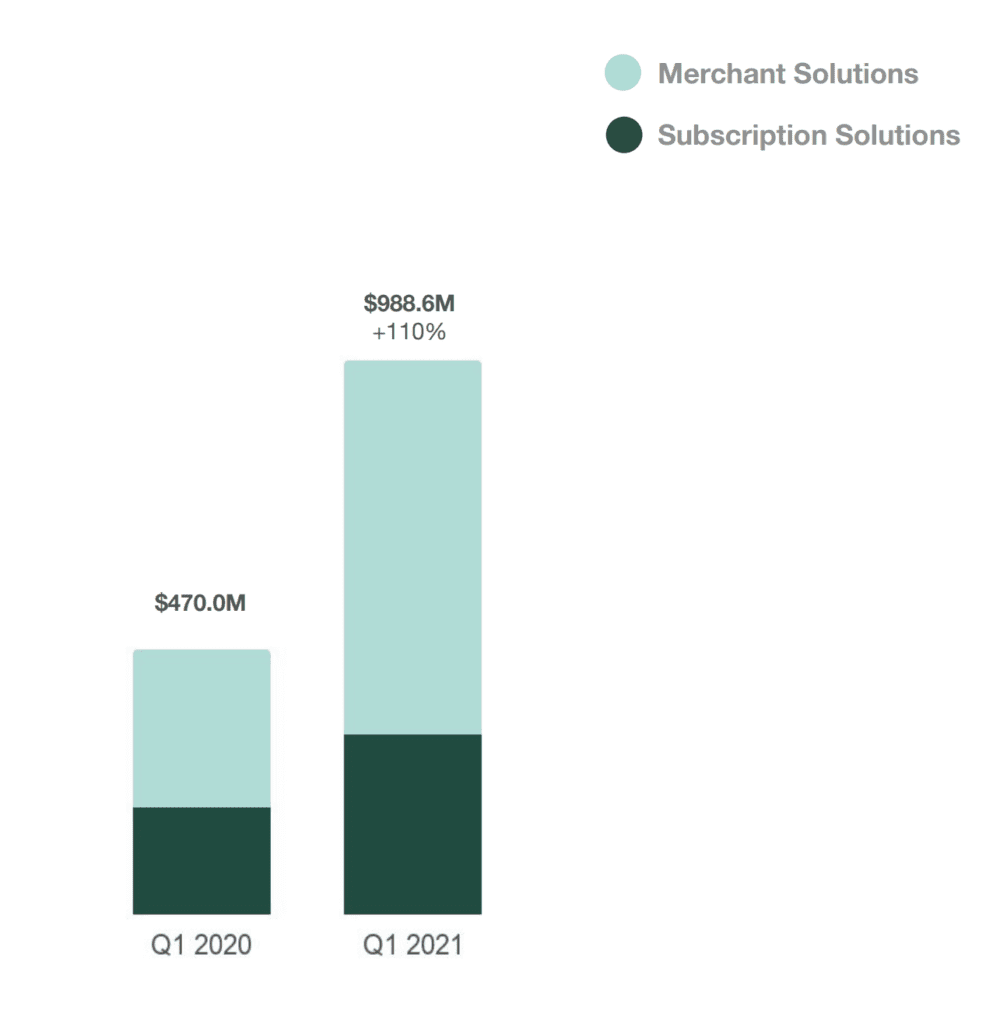

Shopify’s first quarter revenue:

Q1 2021: $989 million

Q1 2020: $470 million

Q1 2019: $321 million

Q1 2018: $214 million

Q1 2017: $127 million

Q1 2016: $73 million

Q1 2015: $37 million

Q1 2014: $19 million

Q1 2013: $9 million— Jon Erlichman (@JonErlichman) April 28, 2021

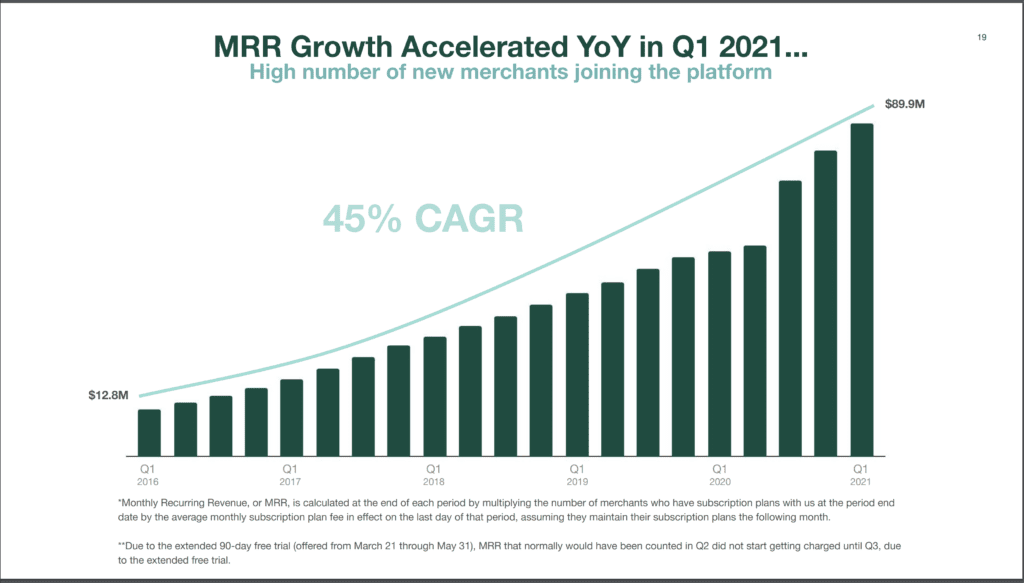

It wasn’t that long ago we checked in at Shopify at $3B in ARR. But Shopify is growing so fast — 110% a year (!) — that we’re already at $4B in ARR. Whoa.

Enough has changed that it’s worth doing another deeper dive.

5 Interesting Learnings:

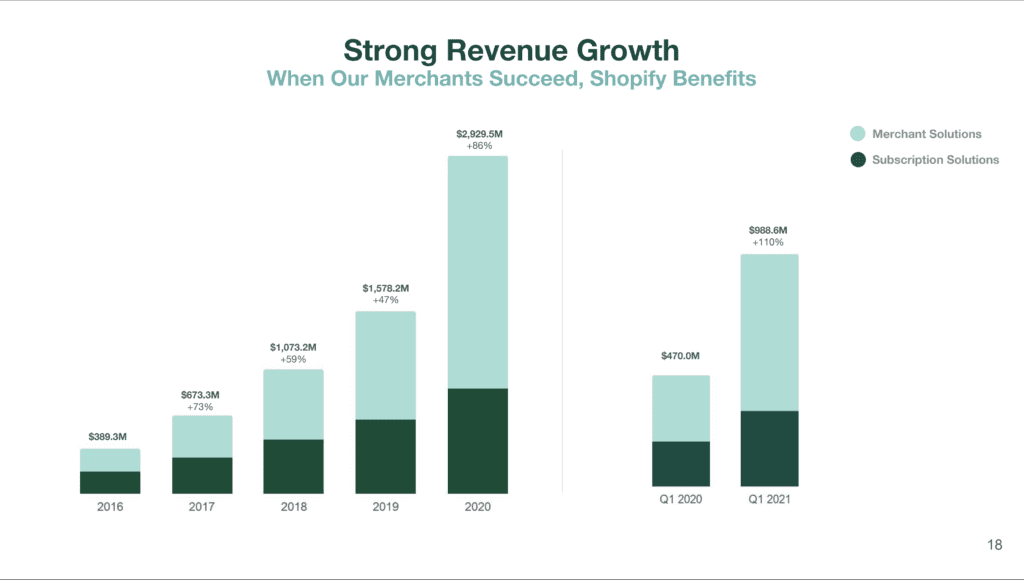

#1. The Covid Boost for SaaS. Cloud and ecommerce may end soon, but it hasn’t ended yet. While Shopify projects slowing growth in 2022 post-Covid, it sure hasn’t shown up yet. Q1’21 was its fastest growth — ever.

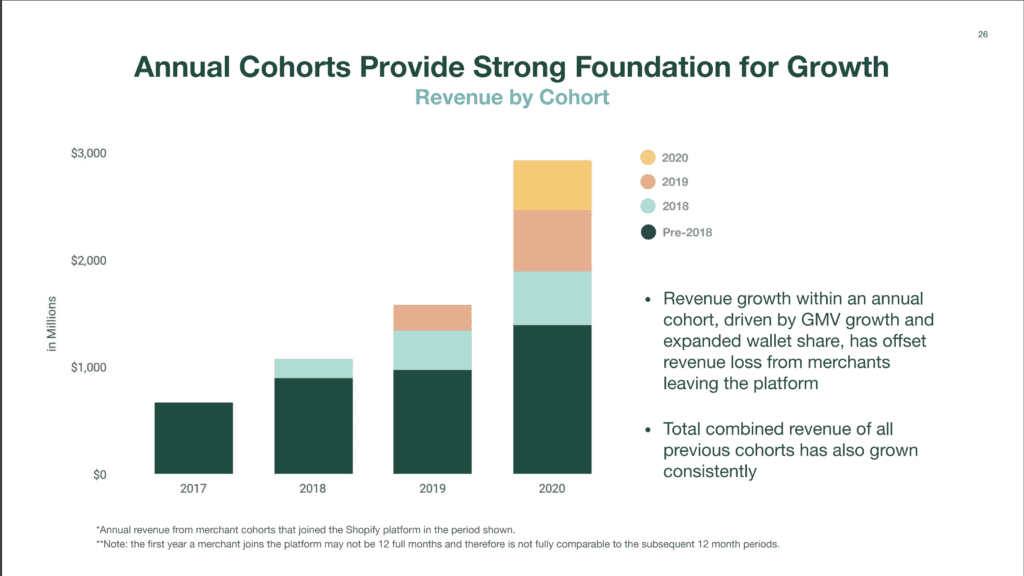

#2. NRR of 110%+ since 2018 — sort of. What is Shopify’s NRR? It would be so helpful to know, as the #1 leader in SMB eCommerce, and also one of the very top leaders in SaaS SMB overall. Well, it’s murky. When you add in payments, i.e. merchant services, NRR for 2018+ is about 110%, based on the below new chart. But likely it’s below 100% excluding payments. After all, many of its customers are single-person companies and tiny vendors. If nothing else, it’s a reminder the more value you provide SMBs, the more they pay. By processing payments and more, Shopify has grown its effective NRR from 100% to 110%, and perhaps even more.

#3. Shopify doesn’t call its non-software revenue “MRR”. A small but interesting note. Most of Shopify’s revenue isn’t SaaS per se anymore, and it only includes actually software revenue in its MRR calculations.

#4. Now clearly a fintech with a layer of software underneath. In 2021 Shopify’s payments and merchant services have pulled even further ahead of its software revenue. We’ve also seen this with Bill.com, where since its IPO, its payments revenue have skyrocketed to 50% of its overall revenues. If you can add a fintech layer to your SaaS product, magic can happen. While SaaS revenue alone grew a stunning 71%, payments / merchant services grew a breathtaking 137% (!).

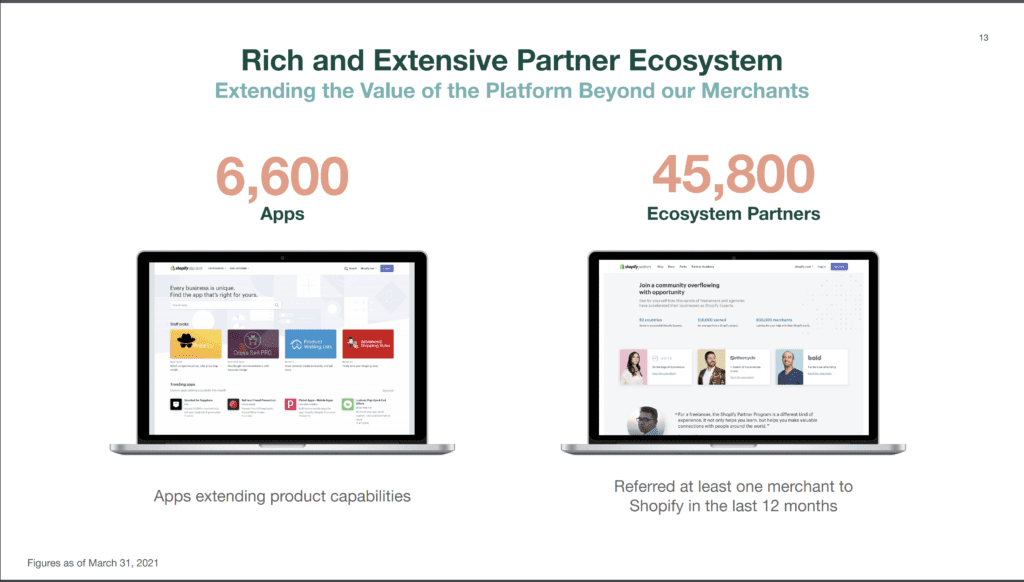

#5. 45,800 partners referred a customer to Shopify in the past 12 months, up 73%. A vivid reminder of how key it is to nurture a partner program, especially if you are a market leader of any sort.

And a few bonus notes:

#6. Shopify isn’t getting more enterprise. Its SMBs are growing even faster. We did a deep dive on this here the other day, and it’s super interesting. While Shopify’s enterprise offering, Plus, is doing extremely well, SMBs grew even faster. As a result, Plus (i.e., enterprise and bigger customers) declined from 28% to 26% of Shopify’s revenue. Still a lot. But enterprise isn’t growing faster than SMB as it often does as you scale.

#7. Shopify does expect things to slow down post-Covid. Shopify is still projecting extremely strong growth, but post-Covid, not the record number of merchants joining its platform as they did during Covid.

Wow. 110% growth at $4B in revenues.

Not that it’s easy. But don’t let anyone tell you it’s impossible.

Really, it wasn’t that long ago Shopify was a $36m ARR start-up. In fact, that’s what it was just back in 2013.