So ChartMogul pulled together some nice data and statistics across its 2,100 SaaS customers and users for its 2023 Benchmarks report here.

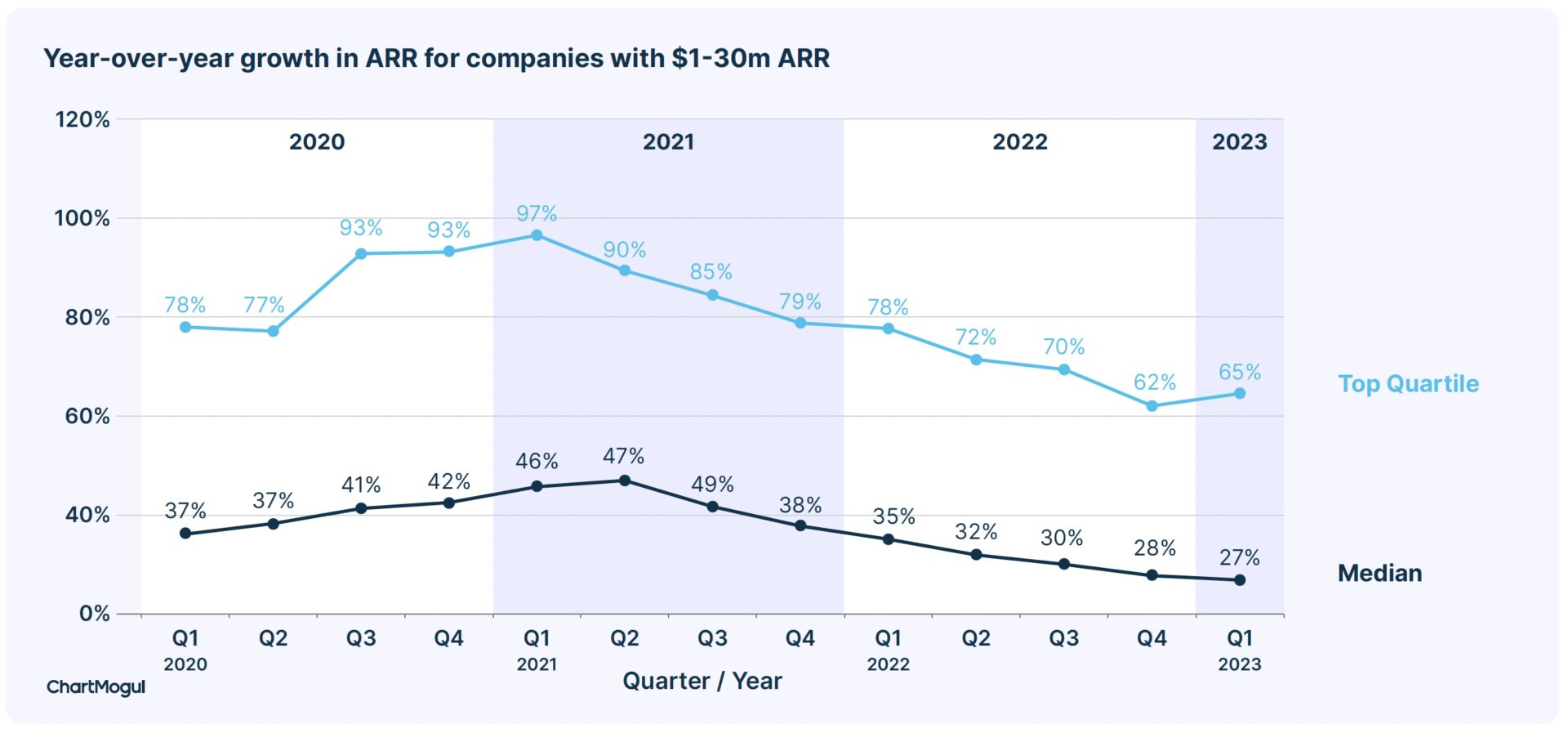

My favorite chart is this one that tracks how Top Quartile SaaS companies have grown the past few years:

What it shows it what we all sort of know, but puts specifics on. The crazy growth of the 2020-2021 period peaked in Q1’21, and then just started falling right after that. Like a rock.

Today, top quartile SaaS companies are still growing 65% annually on the way to $30m ARR, but that’s far from the 97% at the peak in Q1’21. And realistically, that also means most of them may no longer be venture-fundable. 100% growth from $1m-$30m or so ARR is sort of the bar for venture funding. If you are doing OK, but have fallen to 65% growth like above, you may still be a top quartile SaaS company … but are fundable no longer. At least, not for now.

ChartMogul also saw a bit of a bottom in Q4’22, but noted it wasn’t sure that was statistically significant. And that’s the question of the day. Have we reached a bottom in SaaS growth? Some data suggests yes. On the other hand, most Growth Stage SaaS VCs have told me the majority of their portfolio missed their Q1’23 plans. The majority. And that’s after just setting the plans in Q4’22. Inconiq Growth touched on this in a recent SaaStr Workshop Wednesday:

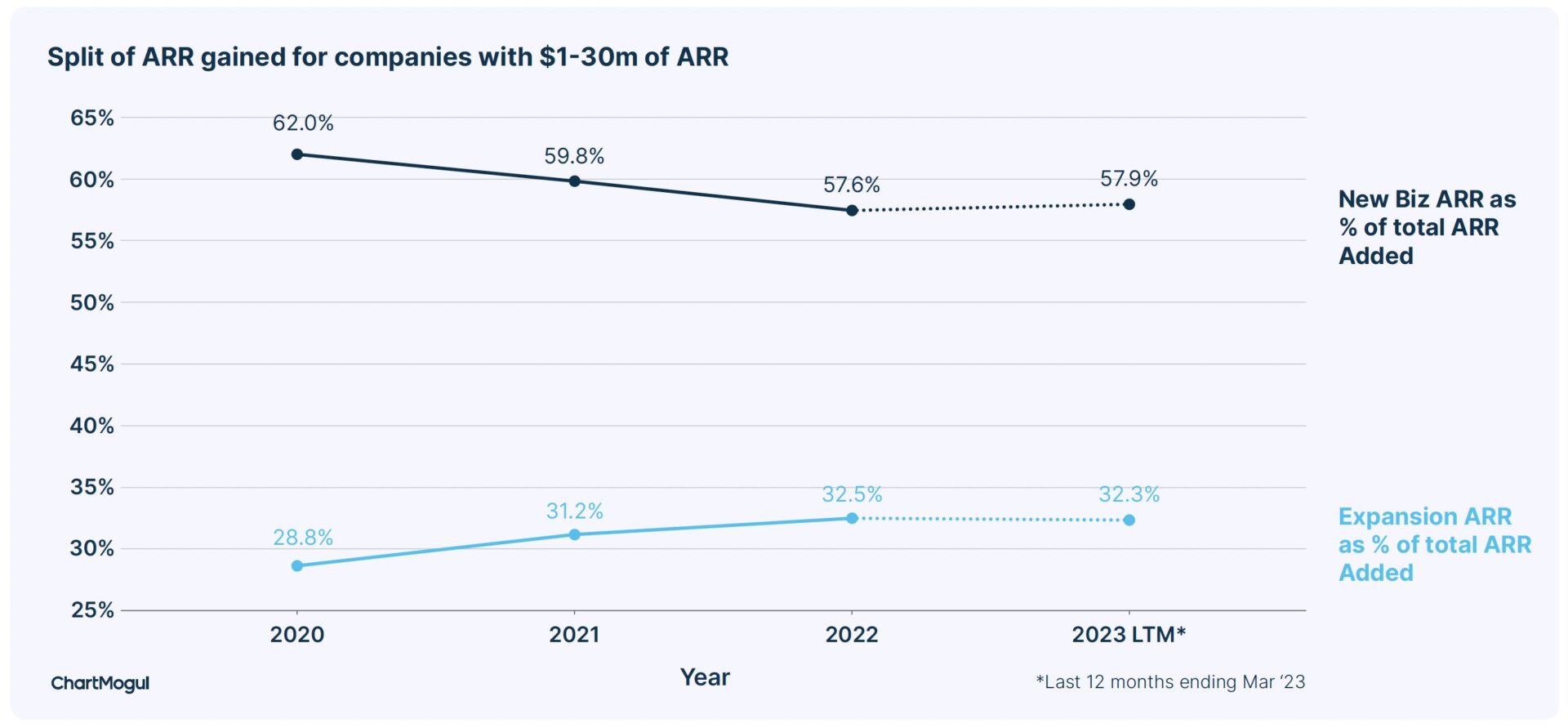

I also liked this chart a lot, on the average amount of bookings from New vs. Expansion revenue, a bit less than 2:1 across 2,000+ SaaS startups. You can also see how much SaaS startups are relying on the existing base to carry them through lower growth times, as Expansion ARR is a materially higher percent of new revenue than a year ago:

Guess those price increases are working. 🙂

You can grab more of the report here: