So at $3.1 Billion in ARR, Snowflake finally feels a bit … human. Like a truly epic, incredible, generational tech leader. But perhaps, no longer like it’s from another planet altogether 🙂

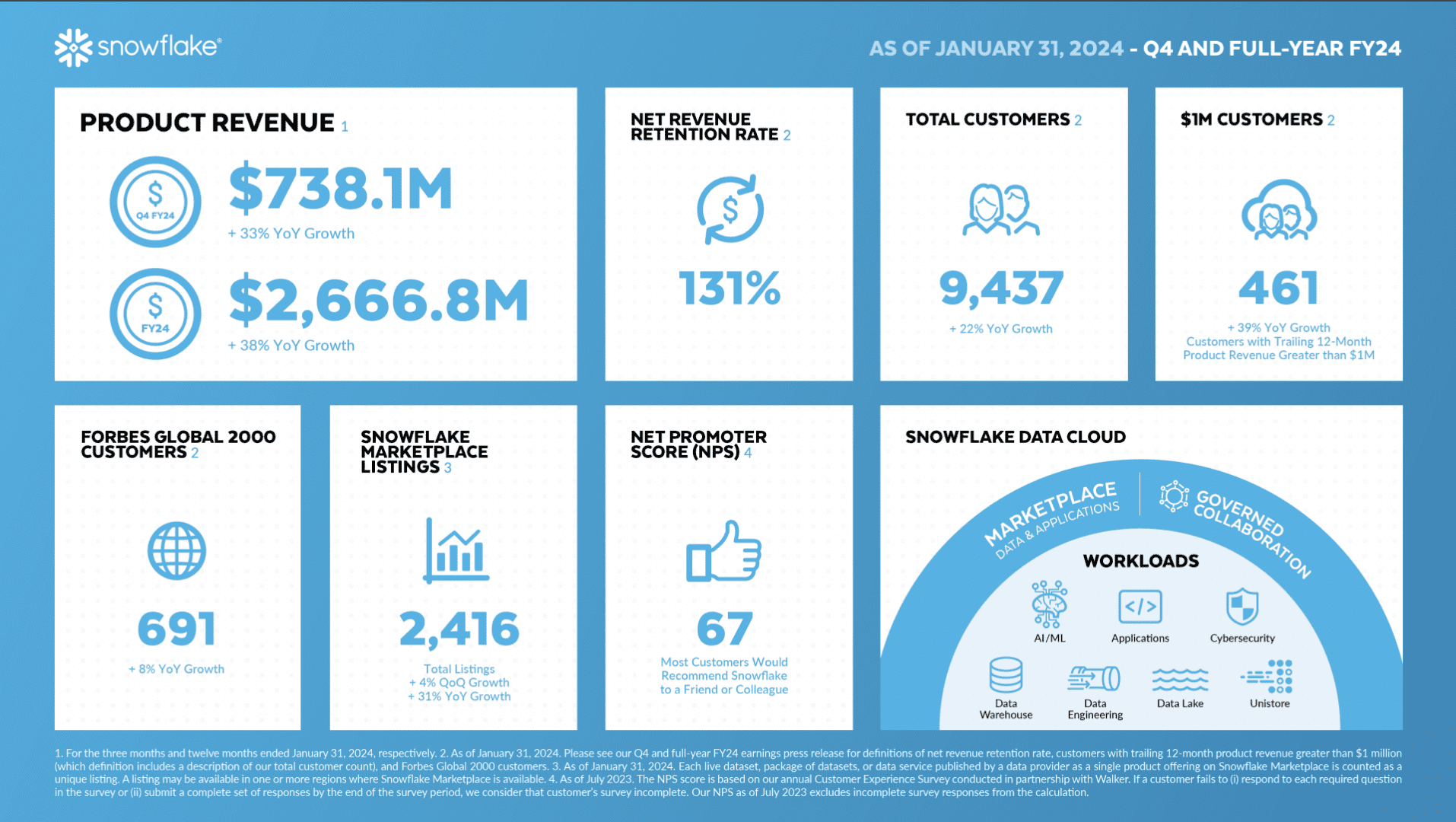

After years of metrics (170%+ NRR) and growth (110% at ~$1B ARR) like we’ve never seen before, it hasn’t been immune from macro slowdowns, and now is growing 32% at $3.1 Billion in ARR. And generational transition comes for all of us, eventually. Legendary CEO Frank Slootman has stepped down, and up, to Chairman.

All that is still incredible. Growing 32% at $3.1 Billion in ARR still means adding +$1B in new ARR a year! But growth and NRR are starting to normalize at scale. For the first time ever.

5 Interesting Learnings:

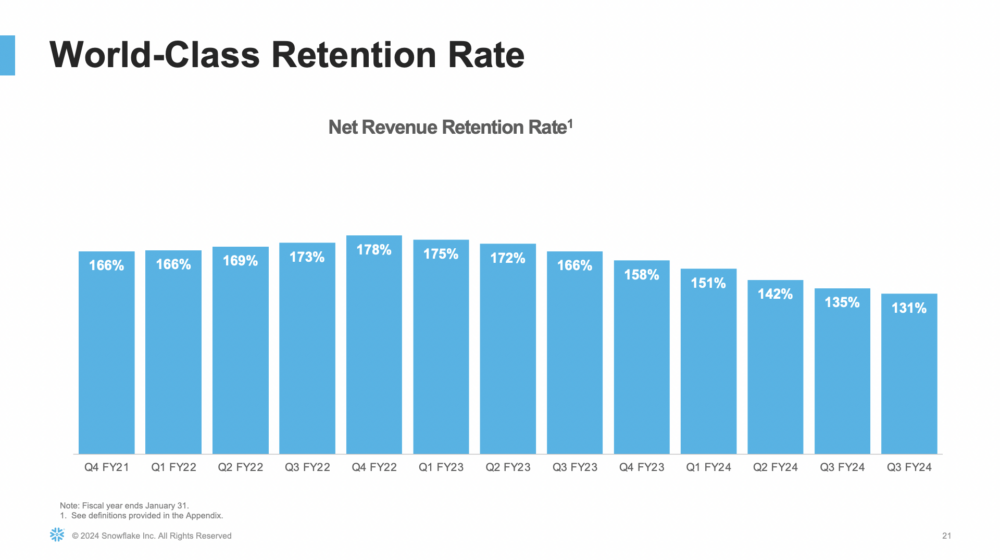

#1. NRR Remains World Class at 131%, But Down From the Jaw-Dropping 170% at Its Peak

High NRR really can last forever. 131% NRR is still incredible. But it’s way down from the physics-defying 160%-170% it saw for years. In fact, the decline in NRR itself is responsible for the decline in revenue growth from jaw-dropping to merely very, very good.

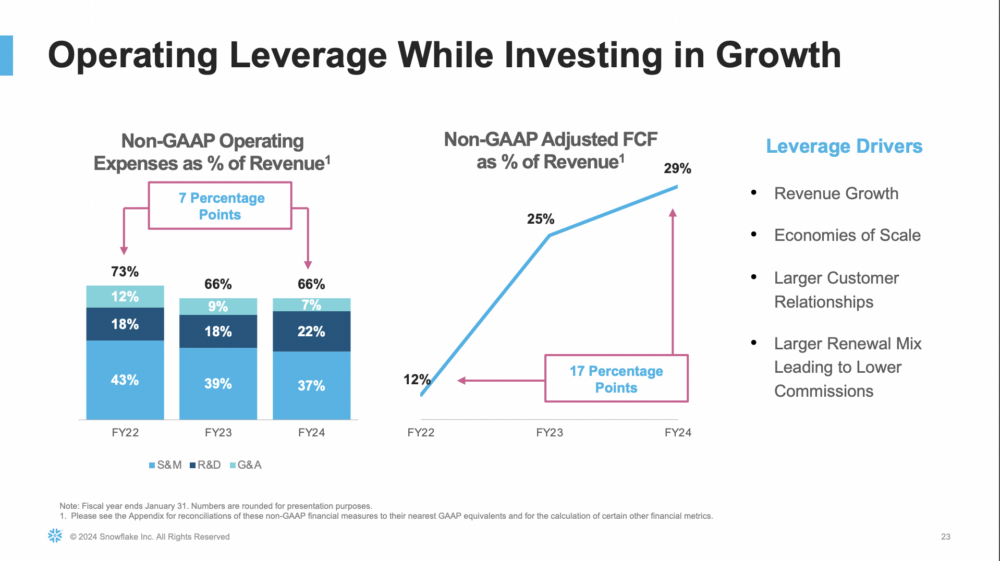

#2. Insanely Efficient Now. 29% Free Cash Flow Margins.

Snowflake was efficient before, but it’s gotten even more so. Free cash flow has grown from 12% of revenue in 2022 to 29% (!) today. Key to this is holding the line on Sales & Marketing, which has declined substantially as a percentage of revenue. Commissions in particular are down.

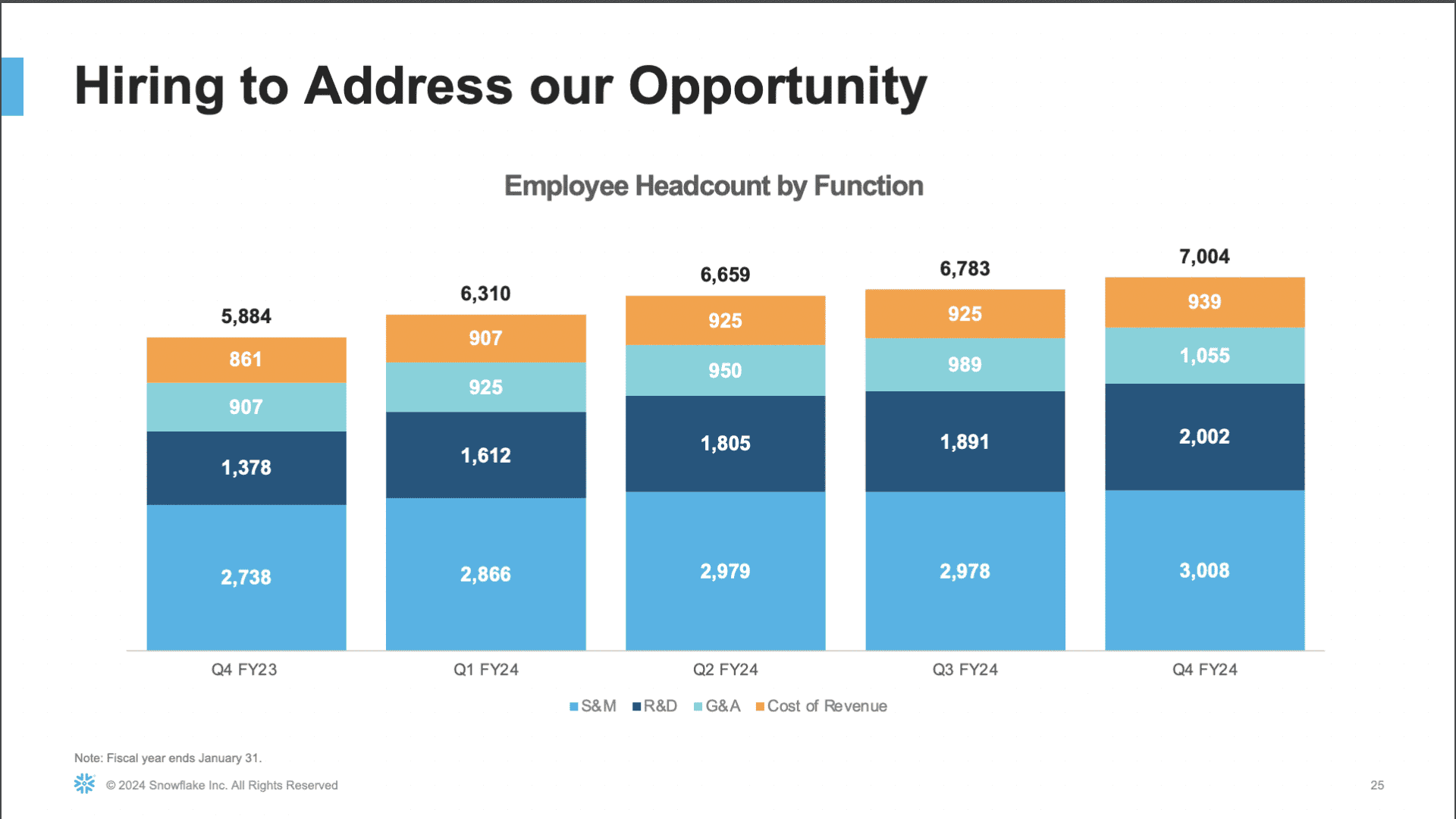

#3. Adding Headcount, Just More Slowly Than Revenue Growth

This is the story at many Cloud and SaaS leaders today and key to getting more effiicient. Snowflake grew headcount +19% the last year, from 5,884 to 7,004. But it grew revenue +32% at the same time. Put differently, it’s growing headcount and thus headcount expense 60% as fast as revenue. A healthy ratio at scale.

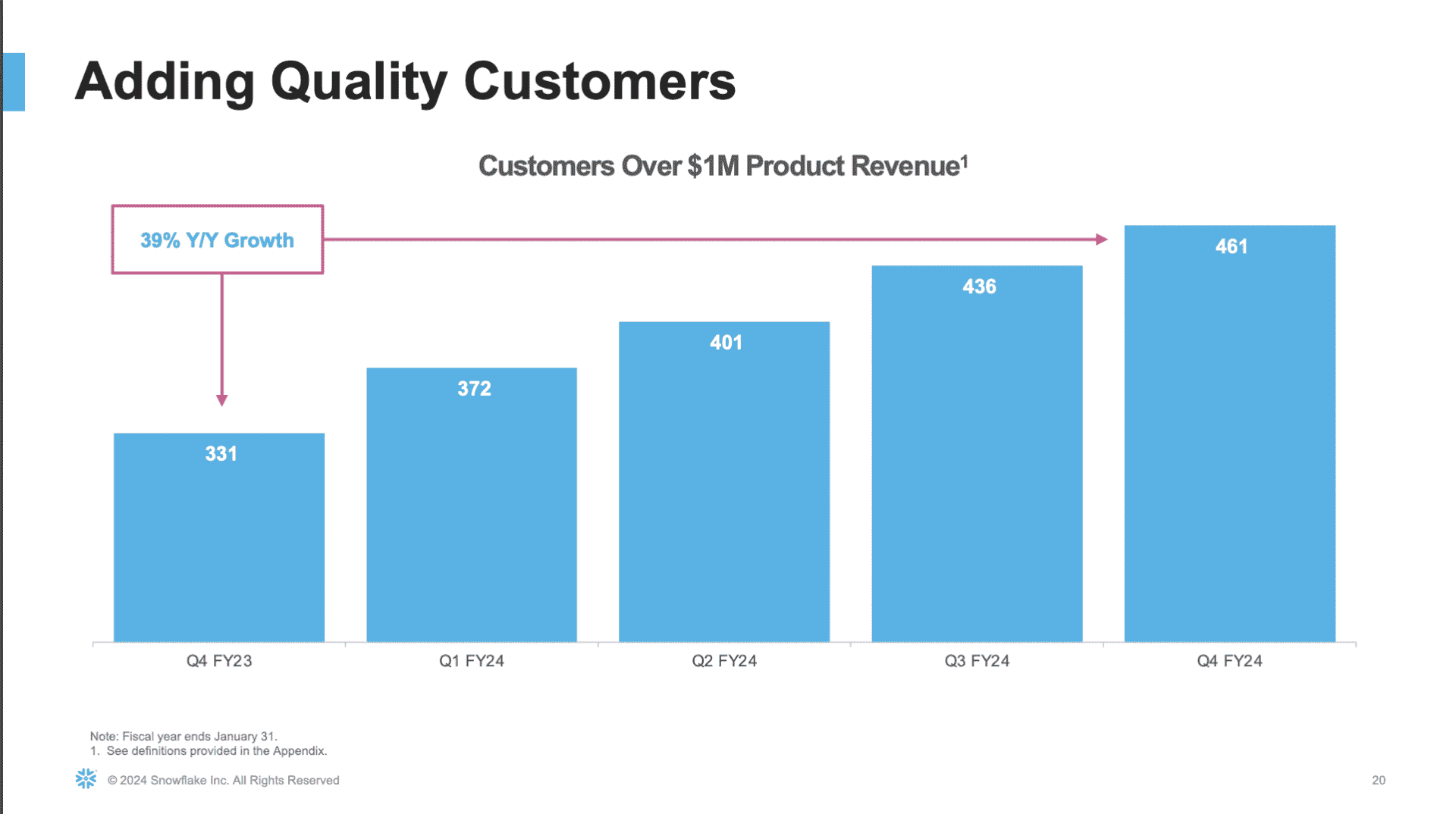

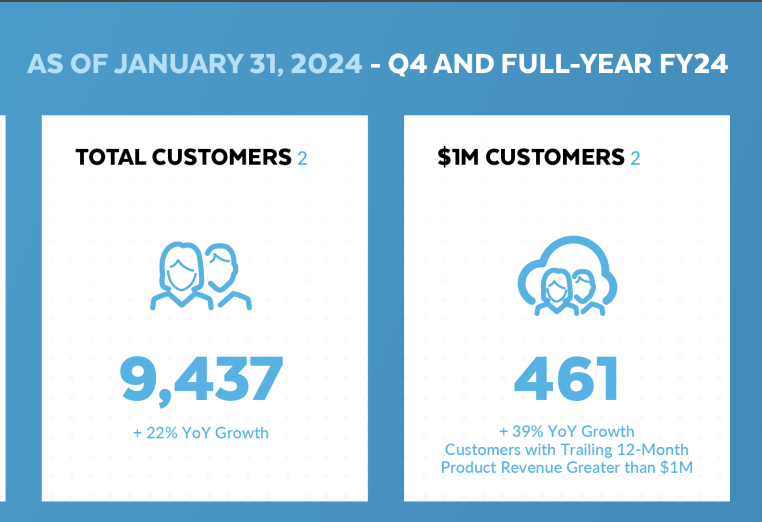

#4. $1M+ Customers Growing the Fastest, at +39% a Year

The story again at so many Cloud and SaaS leaders today. The biggest customers are growing the fastest, and the most immune to some of the higher churn and other issues with smaller tech customers. They now have 461 $1M+ customers and 691 Global 2000 customers. That’s very enterprise.

#5. NPS of 67. Pretty solid!

Can NPS be gamed? Sure. Is it a formal, GAAP metric? Of course not. But 67 is still a high bar. Well done, Snowflake.

And a bonus learning:

#6. New Customer Count Still Growing +22% Overall at $3B+ ARR

It’s a bit hard to tie this to 131% NRR, i.e. if new customers are up 22%, and NRR is 131%, one would think overall revenue growth would be higher. than +32%. It’s nice when this math ties :). But NRR isn’t a true GAAP metric. Anyhow, no matter what, the fact that at $3B+ ARR, Snowflake is still growing new customers +22% is incredibly impressive. It bodes well for the next 5+ years, as those customers pay more and more 🙂

Snowflake is still growing like a weed, with NRR and NPS metrics we’d all die for. It’s an epic story and an epic platform.

It’s just in 2024, it’s finally just a little bit … human. It finally got a bit harder at Snowflake (or so it seemed from the outside. From the insider, it’s always hard). Snowflake became a “normal” Top .01%, Very Very Incredibly Great, Tech Company. One for the ages.