So everything changed in SaaS in Feb-March 2022. The public markets were under stress before then, as we emerged into this new post-Covid restrictions, higher interest rate world. But it didn’t fully hit startups and even many public companies until February 2022. And then everything crashed in venture.

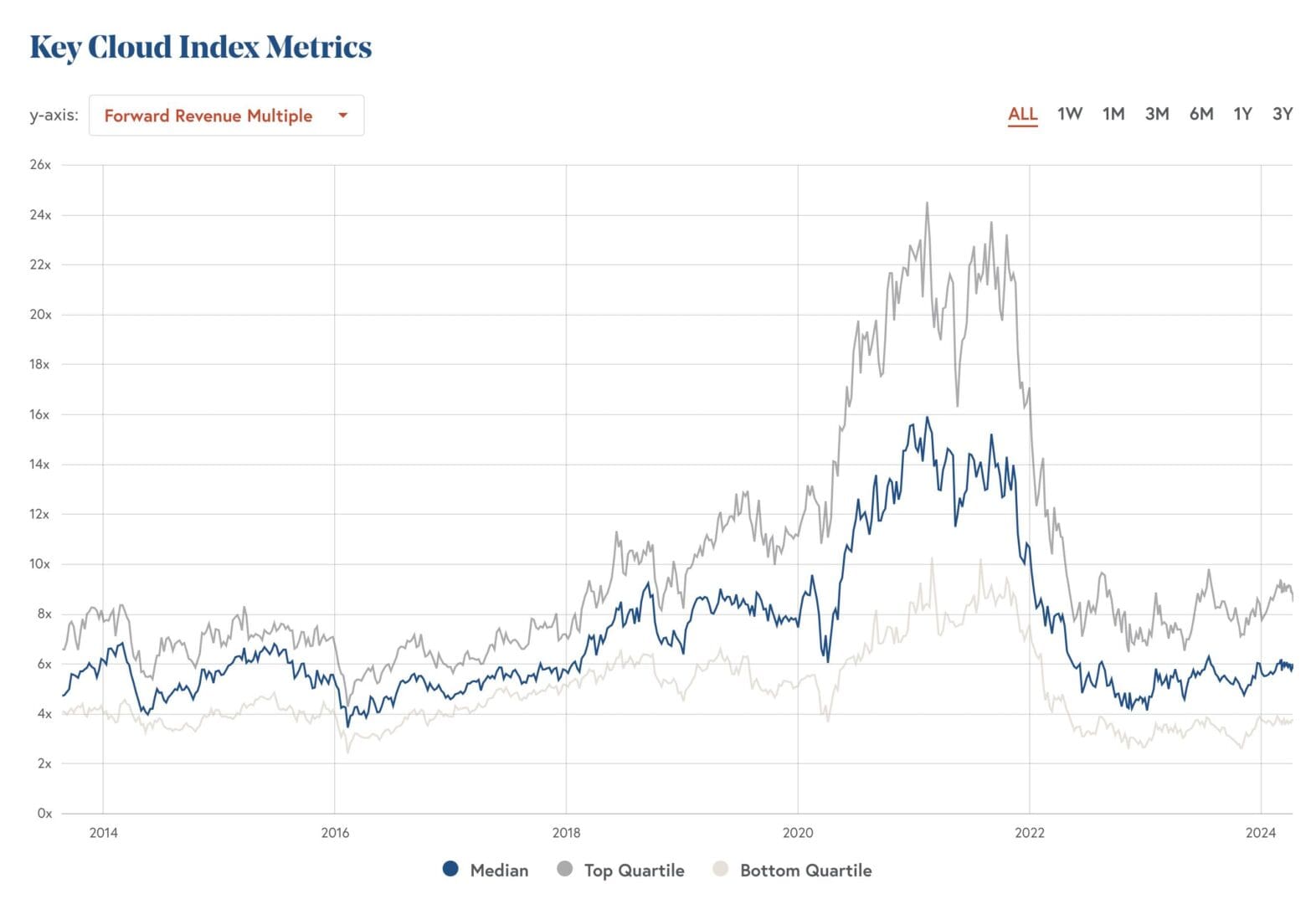

Even the leaders in SaaS are often just back to where they were in 2021, even with years of growth. Why? Revenue multiples. They were nuts in 2021, but have since crashed back to earth. That means getting to $100m, $500, $1B+ valuation is far harder than before.

And with that, a lot has changed in the venture capital markets, even early stage. The change is still being figured out. YC demo day is still as hot as ever. Seed funding seems to be all over the place, with many seed investors investing the same as before. But later stage investing has clearly changed. Yes, AI is hot at the Series A and later stage in B2B. The rest? Not as much. The expectations, the metrics, the pool of VCs. Every Series A and later round has now changed.

And what I find is that most founders just don’t know. They don’t see the change directly, and they don’t really know for sure if they are fundable or not. Especially when so many of the big rounds on TechCrunch were actually signed and even closed before the Big Change.

So here’s my simple suggestion, in good times and bad:

Once a quarter at least, at your board meetings, if nothing else, if you have them — ask each of your 4-5 largest investors:

Are we fundable today? What are the odds we can close a round? And at what terms?

You’ll often be surprised. And the one thing VCs usually know better than founders is how fundable you are. That’s what they do all day, every day, after all.

Especially the founders doing pretty well, but not knocking it out of the park, are often surprised. Especially the founders who had such an easy time raising the last round, are often surprised.

I’d say at least half are surprised.

A related post here:

Close image from here