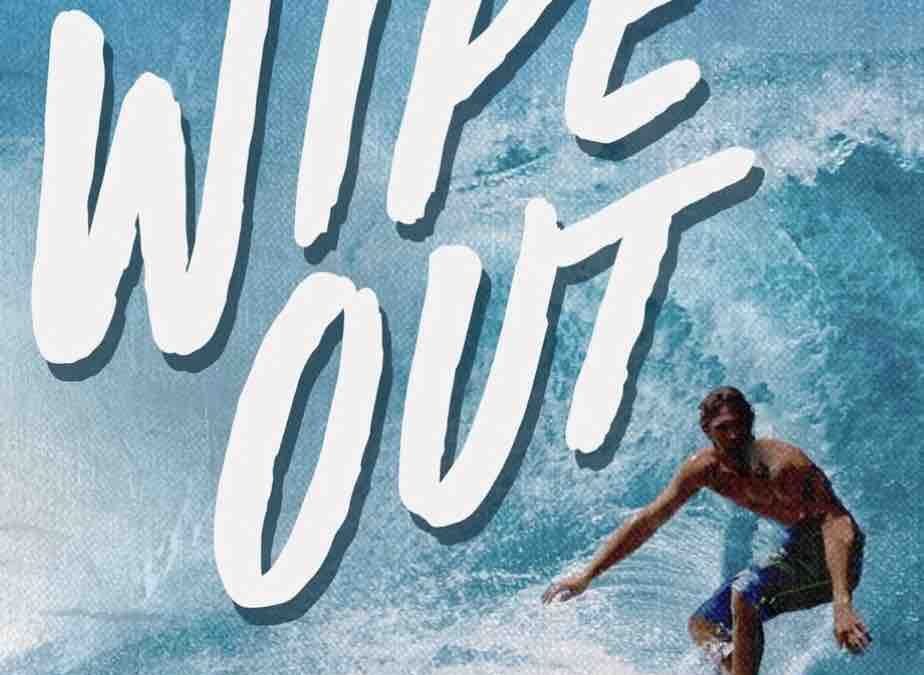

12 Things You’ll Look Back On in SaaS … And Regret (Updated)

A little while back on LinkedIn and Twitter we put together a list of things that later, once you are successful, even very successful, you’ll regret. It got a lot of engagement from the SaaS veterans out there, so I thought it would be worth digging in more on...

Dear SaaStr: How Do I Craft a Winning Investor Deck for an Early-Stage Startup?

Dear SaaStr: How Do I Craft a Winning Investor Deck for an Early-Stage Startup? Here’s my #1 piece of advice: Get it all down to One Slide. "How to Create a Compelling Investor Deck: The Power of the First Slide" pic.twitter.com/AyyS7lHATz —...

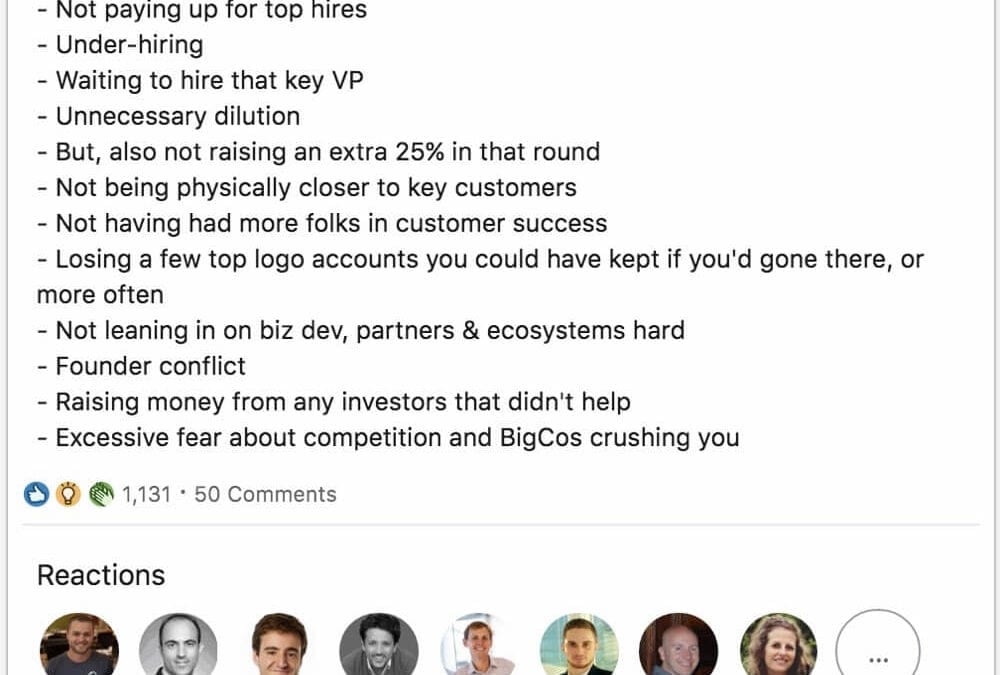

Raising Money After a Rough Patch? At Least Put Up 3 Good Months in a Row

So it may surprise some of you to learn that it’s not >that< hard to raise venture capital after a rough patch — if things reaccelerate. In fact, it’s pretty common. VCs know the vast majority of startups have a tougher time or two. But...

Dear SaaStr: Why Do VC Backed Startups Seem To Almost Always Be Running Out of Money?

Dear SaaStr: Why Do VC Backed Startups Seem To Almost Always Be Running Out of Money? The #1 issue I see is not understanding what investments really are accretive — and which aren’t. And so the money goes far, far faster than anticipated. Venture capital, if you...

Dear SaaStr: What Will Venture Capitalists Do if Our Startup is a Loss?

Dear SaaStr: What Will Venture Capitalists Do if Our Startup is a Loss? Move on. Especially, if you’ve only raise one VC round or so. This is telling article re: Bill Gurley, one of the best VC investors of all time: “I give Bill a lot of credit because Bill...

Dear SaaStr: How Hard Is It To Get to $1m ARR Without Investors?

Dear SaaStr: How Hard Is It To Get to $1m ARR Without Investors? My learnings are three-fold. First, it depends on the team. Most of the SaaS unicorns have been built on at least some venture capital … but a number haven’t. Atlassian ($30b market cap), Qualtrics...

The Investments Where I’m Going to Lose All My Money

So when I started writing venture checks in 2013, I didn’t know what I was doing, but I had a strong start: First was Pipedrive co-leading seed, then acquired for $1.5B cash Second was Algolia leading U.S. seed, now at $200m+ ARR and an IPO candidate Third was...

Dear SaaStr: How Would You Invest a 5 Million Dollar Payout From an Acquisition?

Dear SaaStr: How Would You Invest a 5 Million Dollar Payout From an Acquisition? Bear in mind I’m not a CFA, CPA, or professional financial advisor. But I have been through it. And so I know this is a more difficult question to answer than you might think. The...

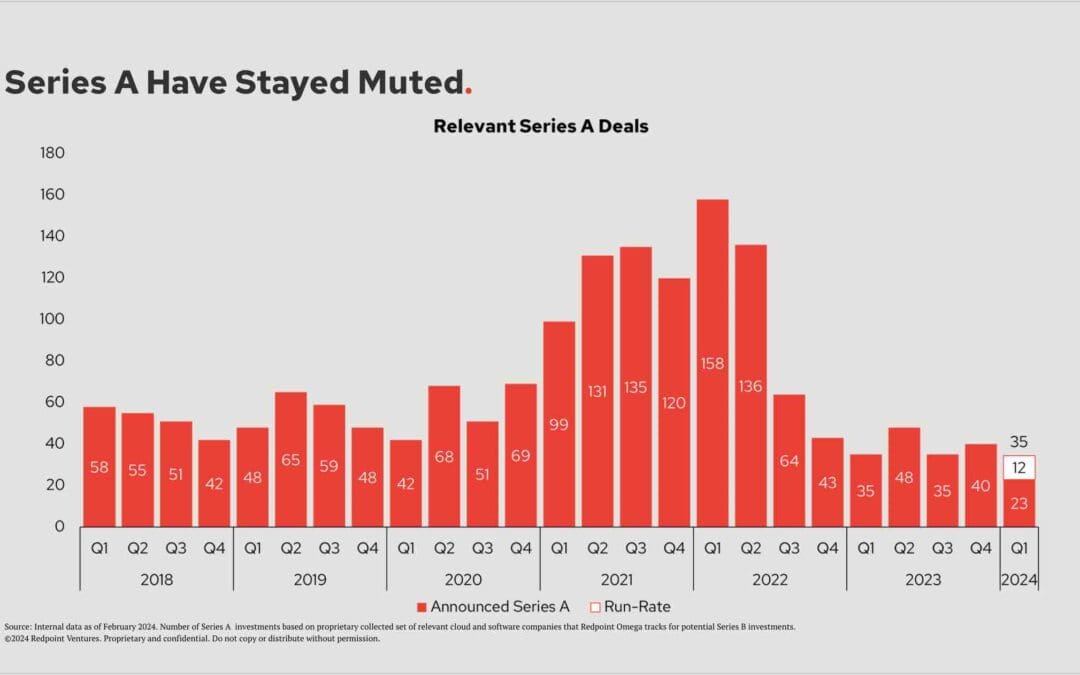

Redpoint: Seed May Still Be Strong, But There’s No Bounce Back at Series A. And the AI Premium is 3x.

So Redpoint Ventures published some of the slides they recently presented to their Limited Partners (their own investors) here. There’s a ton of good data there, but this one slide stood out to me, because it was put together in a really clear fashion, better...

If Things Aren’t Going Well … Should You Offer To Give Your VCs Their Money Back?

Dear SaaStr: Should you offer to give the money back to your VCs if your startup just isn’t going to make it? It’s an interesting question. Many of us have been there — or at least close. I’ve been there. When in the earlier days at Adobe Sign / EchoSign, my...

Dear SaaStr: Does the Fund Make The VC or VC Make The Fund?

Dear SaaStr: Does the fund make the VC or VC make the fund? The VC makes the fund — but it’s a little more nuanced than that. Only 2 things matters for VC until it’s late stage, and maybe even then: Getting the best founders to pick you; and Picking...

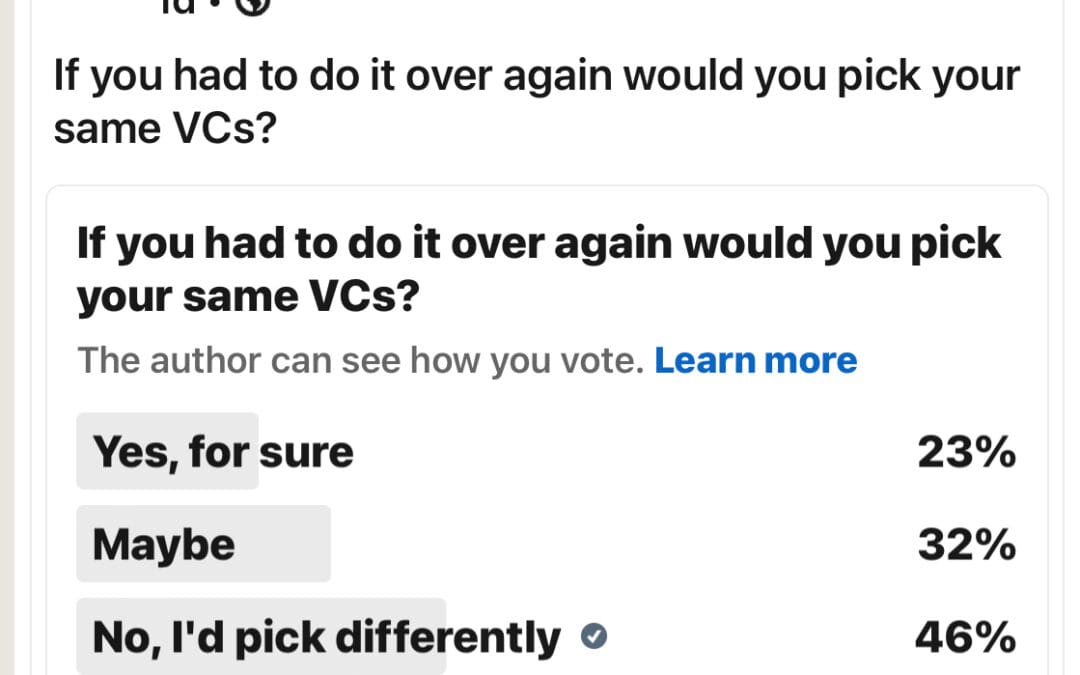

Only 23% of You Would Pick The Same VCs Again

So we recently did a SaaStr survey on if folks would pick the same VCs if they have to do it all over again. The learnings aren’t surprising, but they are interesting: only 23% would pick the same VCs for sure. Now there is a lot of nuance beyond this poll. The...

9 Things Founders Should Know About Getting Acquired with Brett Goldstein, Former M&A at Google

Former member of the M&A team at Google, Brett Goldstein, now Founder at Micro and Co-Founder & CEO of Launch House Ventures, shares the nine things founders should know about getting acquired. It’s a common dream for founders to hope their startup be acquired one day, but what is a company, like Google, really looking for in their acquisitions? And what should all founders know about the process if the time comes?