Can You Still Get Acquired for a Decent Price if Growth Has Slowed or Even Stopped? Yeah, Sometimes

So the other day a CEO reached out to me about advice on an acquisition. They wanted to do three things: Enter a space they had no product or customers in today; and Add on at least $10m of extra revenue for the year; and Not add too much to their burn rate. So this...

9 Things Founders Should Know About Getting Acquired with Brett Goldstein, Former M&A at Google

Former member of the M&A team at Google, Brett Goldstein, now Founder at Micro and Co-Founder & CEO of Launch House Ventures, shares the nine things founders should know about getting acquired. It’s a common dream for founders to hope their startup be acquired one day, but what is a company, like Google, really looking for in their acquisitions? And what should all founders know about the process if the time comes?

Dear SaaStr: How Do Investors Feel About “Acquihires”?

Dear SaaStr: How Do Investors Feel About “Acquihires”? Back when I started investing, in 2013, VCs worked on getting acquihires for their struggling startups. A lot of energy was put in to find a “soft landing” for struggling investments...

Tech and Startups Have Changed. Do Founders Still Come Last?

So the other day I did a 20VC with Harry Stebbings, and one of the topics that came up was the Hopin founder’s $100m+ secondary that the CEO took out of the company. While the company is still around, the Hopin product was subsequently sold for pennies on the...

Dear SaaStr: Is It Normal for a Founder CEO to End Up With Just 10% Equity?

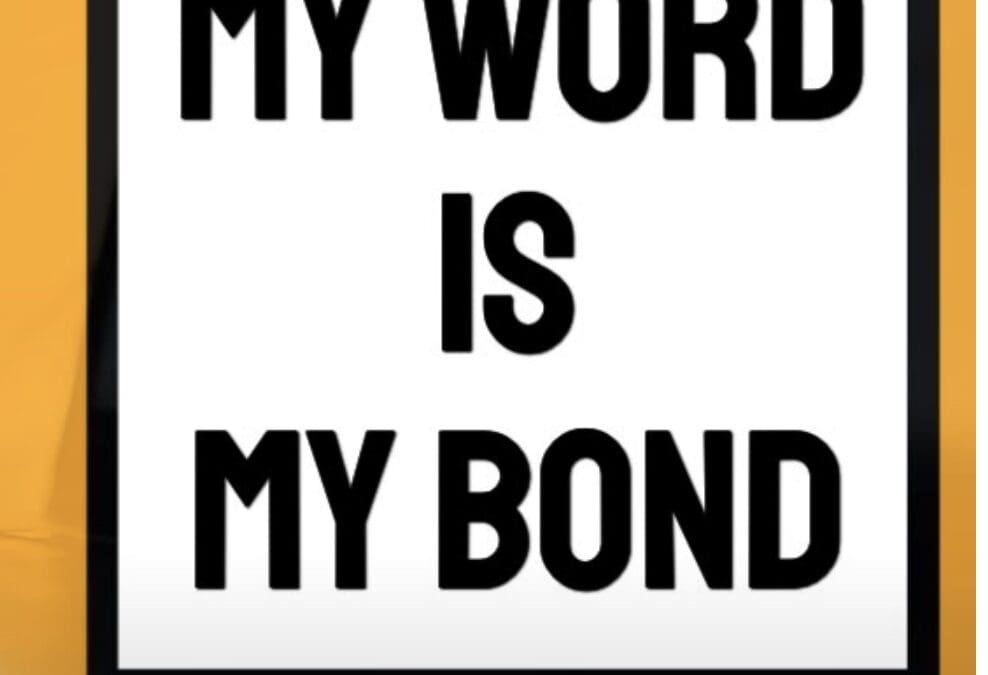

Dear SaaStr: Is It Normal for a Founder CEO to End Up With Just 10% Equity? Yes — if you are venture-backed. Roughly speaking, this is what generally will happen after 3 rounds of traditional venture capital. Expect it and plan for it. If the company sells...

Dear SaaStr: What Happens to Employees After Your Startup Gets Acquired?

Dear SaaStr: What happens to employees after your startup gets acquired? It varies — a lot. But as a rule: Top engineers will all be given retention packages, extra money / RSUs / options designed to keep them for 2-4 years. All engineers and product people...

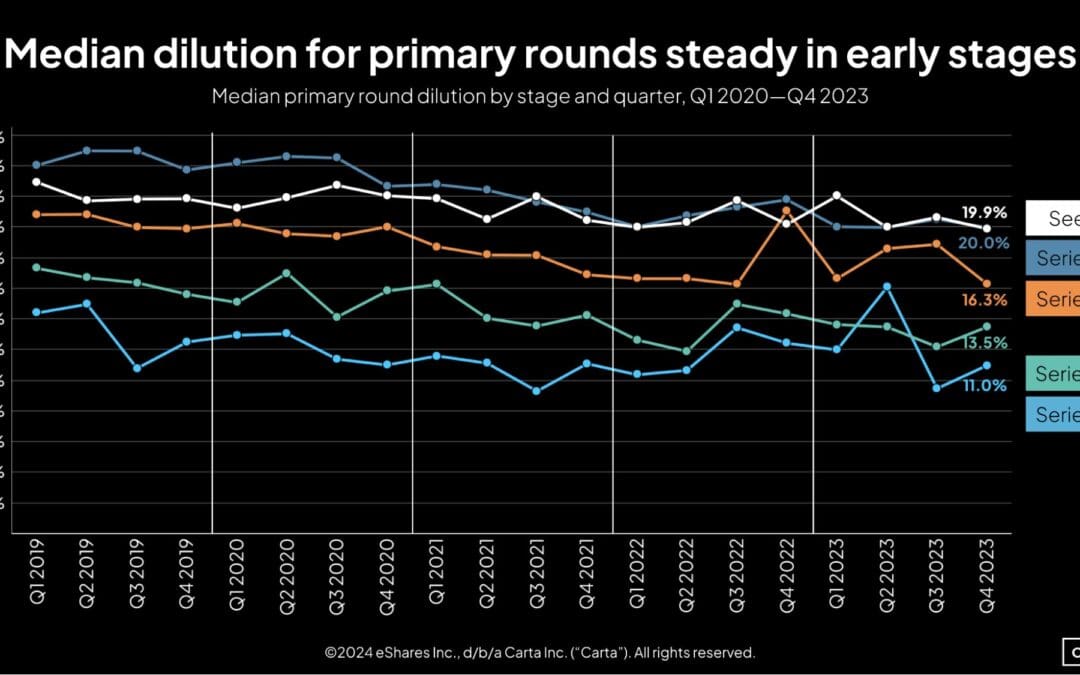

Most SaaS Metrics Really Only Work if You Have 75%+ Gross Margins and 100%+ NRR

So over the past decade-and-a-half we’ve come up with a lot of yardsticks, metrics and rules for SaaS companies. E.g.,: CAC of < 12-14 months is Good-to-Great Paying sales reps 25%-30% of what they close is Good A burn multiple of 1 or less is Good These metrics do...

Dear SaaStr: Why Do Many Startup CEOs Quit After Their Companies Are Acquired?

Dear SaaStr: Why Do Many Startup CEOs Quit After Their Companies Are Acquired? Five reasons: First, it’s very difficult for most founder-CEOs to work for someone else. They generally don’t mind working with others. They don’t even need to be “the boss”. But being told...

Dear SaaStr: What Are the Exit Options for VCs That Fail to Make It in The VC Industry?

Dear SaaStr: What Are the Exit Options for VCs That Fail to Make It in The VC Industry? There is probably no better business to fail at than to be a failing General Partner at a sizeable VC firm. If you fail as an associate, principal, etc. … that’s just like any...

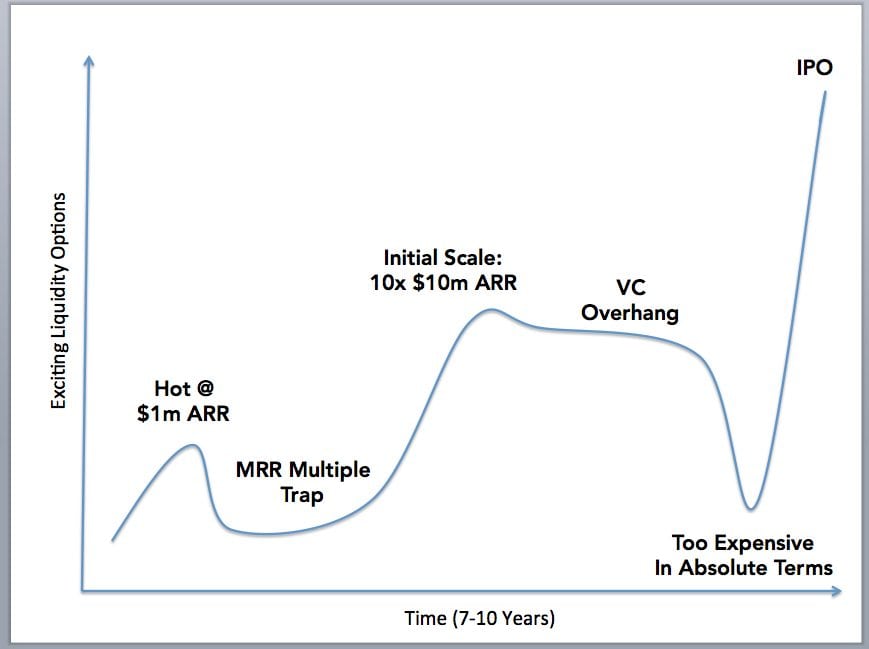

Dear SaaStr: Do Late Stage Startups Prefer to Get Acquired or Go Public?

Dear SaaStr: Do Late Stage Startups Prefer to Get Acquired or Go Public? It really varies. Especially these days, when the IPO markets are closed. When it was literally an IPO a Day in 2021, it seemed almost easy. And today — it seems so far from easy. It Was...

Dear SaaStr: Do Companies Prefer Stock Over Cash When They Acquire Startups?

Dear SaaStr: Do Companies Prefer Stock Over Cash When They Acquire Startups? It depends on how profitable the acquirer is. All things being equal, most tech companies that are very profitable (Adobe, Microsoft, Intuit, SAP, Oracle, Google, Facebook etc) would prefer...

Should I Sell for $50m … Or Push On And Try to Build a Unicorn? Especially … Today?

A life poorly lived is a trap Go for it at least once — Jason ✨Be Kind✨ Lemkin (@jasonlk) May 5, 2023 BusinessInsider had a great story a ways back on Datto’s $1b exit to Vista Private Equity (more on the role of PE in SaaS here). So much of it...

Acquisitions — If You Do Sell, Try to Make Sure It’s At a Local Maximum

Have a strong M&A offer? Not sure what to do? Look at this pic or a similar one Do you want it? If so, say No If not? Probably just say Yes pic.twitter.com/K483lKnyzd — Jason ✨Be Kind✨ Lemkin (@jasonlk) April 21, 2021 So I wrote a version of this post...