Dear SaaStr: Is It Normal for a Founder CEO to End Up With Just 10% Equity?

Yes — if you are venture-backed.

Roughly speaking, this is what generally will happen after 3 rounds of traditional venture capital. Expect it and plan for it. If the company sells 15–20% in each round, and 15–20% is reserved for employees, that typically will leave 15–25% for the founders in total.

Q4 2023 Median primary round dilution:

⚪️ Seed: 19.9%

🟣 Series A: 20.0%

🟠 Series B: 16.3%

🟢 Series C: 13.5%

🔵 Series D: 11.0%(via @PeterJ_Walker @cartainc) pic.twitter.com/TJqnhPETpv

— Ron Pragides (@mrp) February 8, 2024

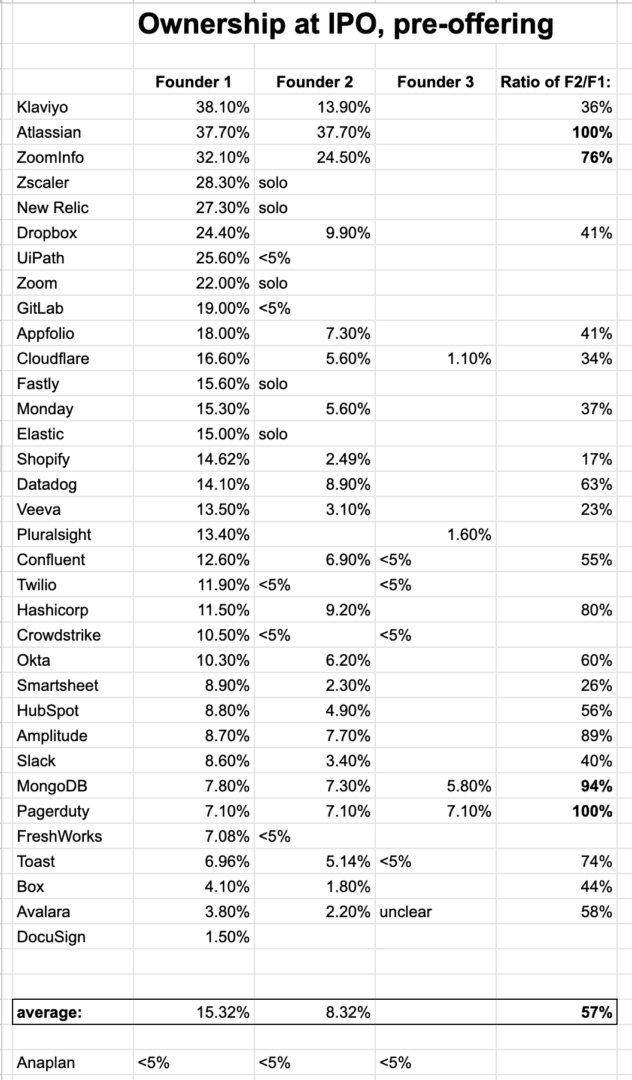

At IPO, the average SaaS Founder-CEO owns 15%. The average co-founder? About half that. More here.

It’s not the end of the world. This is after 3 full rounds of venture capital, and if you are then on the path to IPO or Big Acquisition (which hopefully you are if you take 3 rounds), that 10% (or whatever amount) will still be worth a lot.

But if you can — skip a round. Or at least, half a round — by stretching a little longer until the next round.

Be a little bit more frugal. Maybe even, don’t take that extra round if you don’t need it and can’t put it to good work.