Dear SaaStr: Do Late Stage Startups Prefer to Get Acquired or Go Public?

It really varies. Especially these days, when the IPO markets are closed. When it was literally an IPO a Day in 2021, it seemed almost easy. And today — it seems so far from easy.

Today, an acquisition can seem so much easier. And being CEO is a very, very hard job. It’s constant 24×7 and you never get a break. A chance to sell late stage and make tens or even hundreds of millions is not just a once-in-a-lifetime opportunity … but also a chance to get a mental break.

And yet … if you do sell … that’s it.

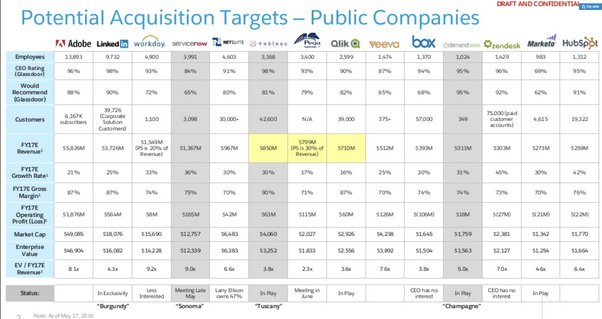

Look at this leaked Salesforce M&A target list from a little while back and go to the bottom — you can see Box and Zendesk are “CEO has no interest”, Workday is “less interested”. Yes, Zendesk was eventually acquired for $10 Billion, but it was basically over the CEOs and board’s objection. They had no choice — it was a borderline hostile deal.

If all that matters is money, selling for a high price, especially late stage or just post-IPO is the way to go. Especially in SaaS, the odds you can say 3x-10x your valuation again to justify the risk of saying No is … tough.

But life is short, especially where timelines are long. It takes 7–10 years to build anything big in SaaS. And another 10 to really go big.

You may not have another chance to go even further.

And a ways back we had an amazing deep dive on this, right after SAP bought Qualtrics for $8 Billion just before the IPO:

(note: an updated SaaStr Classic answer)