Dear SaaStr: Is Late-Stage Venture Capital More Stressful than Early-Stage Venture Capital?

It’s more lamentful, I think.

If you do late stage investing … well, every company you invest in is pretty darn good and growing nicely. And probably even most of the companies you meet with are, too. Well, outside of the late ’20-late ’21 bubble,. that is.

In SaaS, growth investments generally will all be at at least $20m ARR, or $40m ARR, or more. And growing nicely.

Full of risks, yes. Sometimes burning epic cash, yes. But all good ones.

What’s hard is that pricing and predicting is even more important than early-stage investing.

Doing 3x in a late-stage fund is hard. You can get the meeting. You can almost always out-bid everyone. You can almost always get into the Pretty Good ones. You don’t ever have any “Never Heard of Zenefits Where Did That Come From” moments.

But:

1-/ You can’t lose as often. One write-off can destroy your fund.

2-/ A lot of your investments can IPO and do great and still barely do 1x your investment price. A lot of late stage investors are underwater or sitting on low returns in the current markets from their IPOs.

3-/ Finding 3x-10x opportunities is HARD. You’re often betting on a $10B+ IPO, and that’s just pretty darn rare these days in SaaS and Cloud.

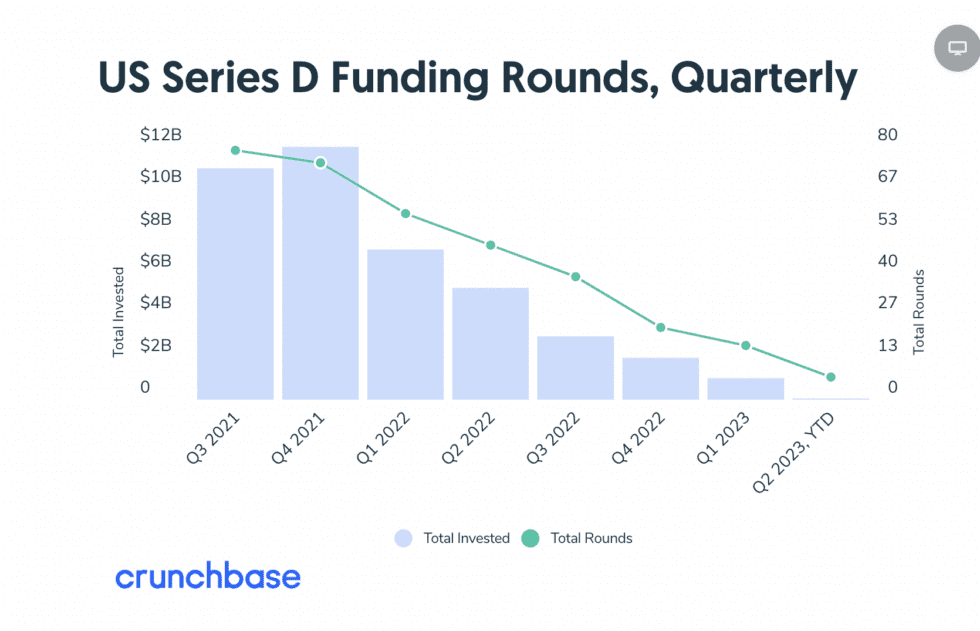

And it’s even harder today when public multiples are at multi-year lows. As a result, late-stage investment has slowed to a crawl:

So I think you end up saying no to Great ones that are too expensive, and yes to merely Very Good ones that fit the model, more than you’d like many times.

But if you can absolutely, totally nail it — it’s the best segment of all. See, e.g., IVP. ‘Cuz the cash comes back out much, much faster … and you can deploy much more of it.

Super early stage is for suckers, in many ways. The checks are too small and the companies too unproven 🙂

A deep dive on why late stage is harder than you might think here: