The Wall Street Journal had a great summary of IPOs in 2021 and before.

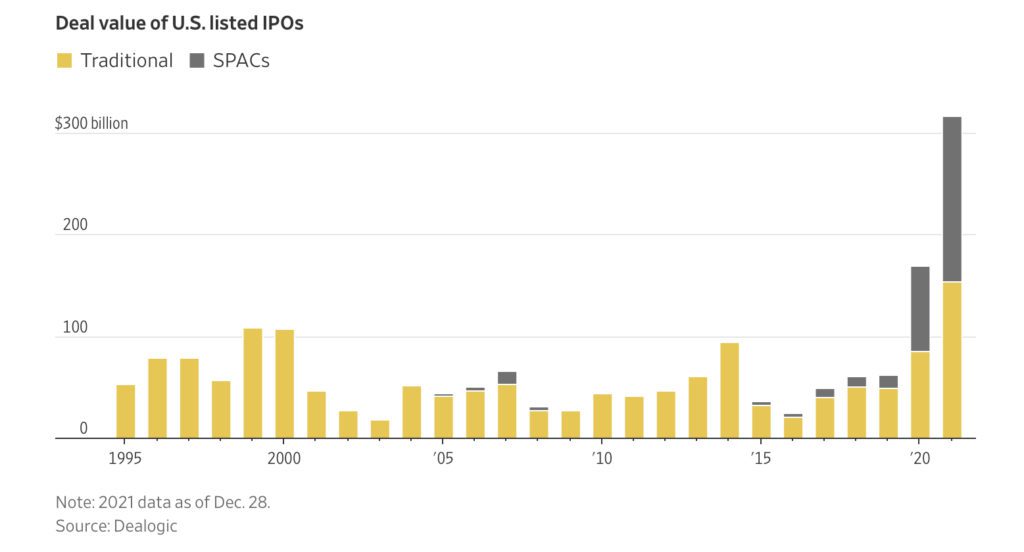

One of the top takeaways is the sheet rate of IPO creation. Much as Unicorn creation more than doubled in 2021, so did IPOs:

There’s a lot you can read into this:

* First, it’s good IPOs grew as quickly as Unicorns were minted, more or less. A top liquidity worry we should all have is if there won’t be enough IPO demand for the ~1000 Unicorns we already have (with far more to follow). Yes, some will get acquired and some will be bought out by private equity. But you need there to be a large enough IPO market to support at least say half the Unicorns. Traditionally, IPO demand has been fairly narrow and niche. So it’s good to see this growth in IPOs in 2021.

* Second, the “private markets” for SaaS aren’t that irrational. With the S&P up 25% this year, Cloud stocks still trading at higher multiples than pre-Covid, record growth in Cloud and SaaS spend, and a record IPO window … these are the best of times in SaaS. And you need an open IPO window for it all to really work.

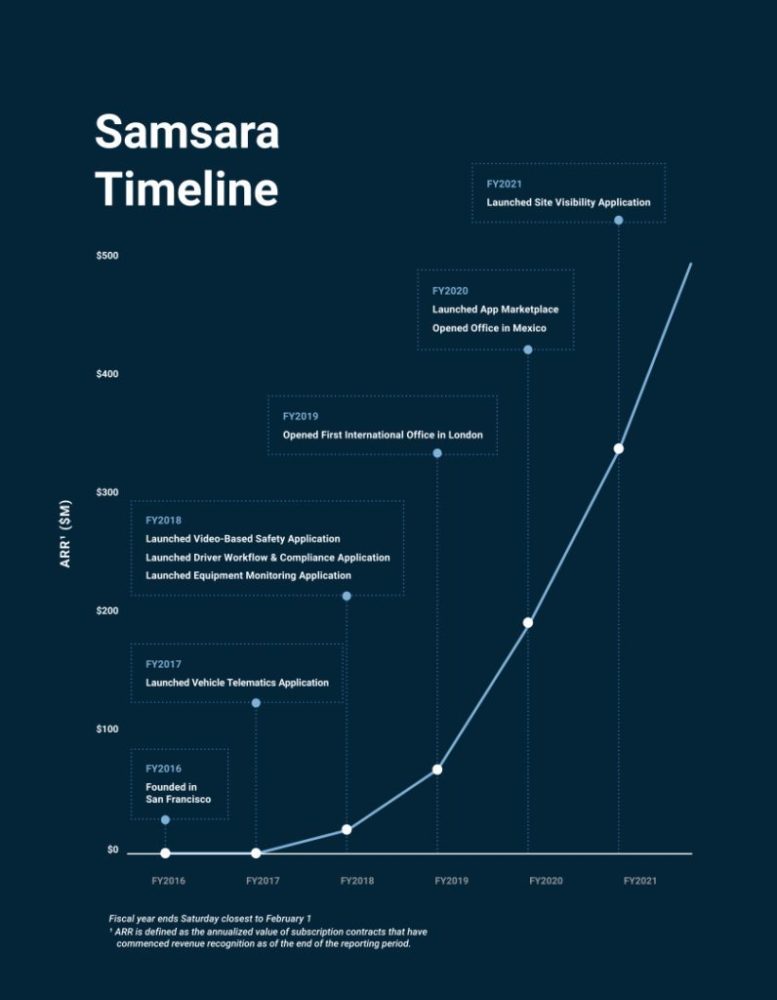

* Third, the SaaS IPOs are mostly really, really high quality. Top SaaS IPOs are growing faster than ever. Samsara was growing 75% at $500m at IPO. Ditto Snowflake at $850m ARR, growing even faster. This should keep at least some of the engine running for a while.

* Fourth, SPACs are something to worry a bit about. The quality of SPACs is simply lower than traditional IPOs. As you can see above, they were half the IPOs in 2021. However, few Cloud companies IPO’d with SPACs. Still, they drag the overall IPO quality down.

* Fifth, this is a record that may be hard to continue to sustain and beat. SaaS revenues will continue to grow at unprecedented rates, but will IPOs? Hopefully, they’ll stay correlated. But the “IPO Window” tends to slam shut in anything but the best of times. And for IPOs, 2021 really was the best of times. The best of our lifetimes.

And 2021 was a lesson that even in the Best of Times, it’s not all so easy. Toast and Robinhood still trade flat or down from their IPO prices, for example, and they are iconic properties.

So keep a quiet eye on the rate of IPO Creation. When it slows down, Unicorn and Decacorn creation probably should, too. It won’t stop your startup’s success. But it may be a sign to be a touch more conservative if the window becomes a bit little open.