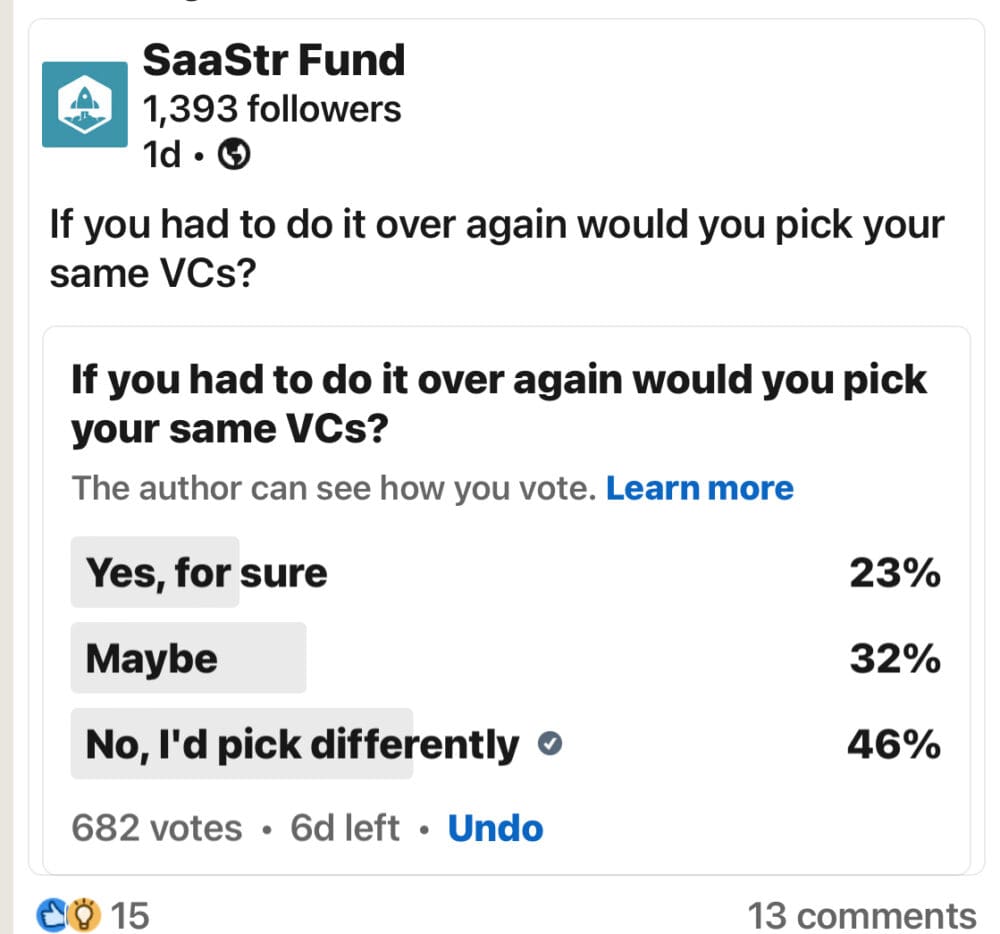

So we recently did a SaaStr survey on if folks would pick the same VCs if they have to do it all over again.

The learnings aren’t surprising, but they are interesting: only 23% would pick the same VCs for sure.

Now there is a lot of nuance beyond this poll. The relationship between investor and founders should be supportive. Interests truly are aligned, at least 90% of the time. But there are frictions.

Many are natural, e.g.:

- Some founders are way too wasteful and spend too much, too quickly. Sadly, this became commonplace in 2020-2022. The “go down with the ship and spend it all” mentality can lead to a lot of friction.

- Some founders expect their VCs to bail them out. It doesn’t work that way. A second (and third) check has to be earned.

- Some VCs just are way too patronizing. Many. This rubs almost everyone the wrong way.

- Some VCs are manipulate around outcomes. Pushing founders to sell, or not sell, or raise more, or not raise more.

- Many VCs now are grinfrackers. They tell you everything is great, or fine. No VC wants to be labeled un-founder friendly now. This leads to tough conversations happening far later than they need to.

- Etc. Etc.

There are some natural tensions points, and while founders bear the brunt (they have to run the place, after all), they are often at fault as well. Rarely is one side 100% to blame. VCs and founders both just want every startup to be a big success.

But net net, it does lead to a sense of regret in many founders that have raised.

So what’s actionable here? Just a few thoughts:

#1. If You Can, Slow the VC Process Down a Bit If It Looks Like You Will Get More Than 1 Offer. Just a Bit.

This doesn’t mean halt it. It just means, it’s OK to take a few extra days. It’s ok to do another meeting, to have another conversation, before you decide who, in essence, to get married to on the cap table for 10-20 years.

#2. Trust Matters. Be a Bit Wary of “Nice” VCs and Too Many Sales and High Pressure Tactics from VCs.

Once a VC decides they want to do a deal, the vibe changes. They move into sales mode instead of the founders. And some are very, very good at this. “Nice” doesn’t mean trustworthy, “Nice” doesn’t mean alignment. At least, be wary of Mr. Nice. In the end, Ms. Honest and Trustworthy is better than Mr. Nice in a Puffer.

#3. Don’t Hide Stuff.

VCs are wired to take bad news along with good. They expect hypergrowth, but they don’t expect perfection. Too many founders hide things from their VCs, both during fundraising and after. This almost always breaks the relationship. Don’t do this. And if you hide things during the fundraising process that are important and come up later — expect the relationship to never recover.

#4. Read.

A lot of VCs publish today. Blog posts. Tweets. Podcasts. Etc. Read, watch, and listen. Do this enough, you will get a sense of what they are truly like. Folks really do express themselves on social media. Not their 100% true self, but still, a lot of themselves.

#5. Do Reference Checks — Thoughtfully

VC reference checks are a bit nuanced. What will failed founders say? What about folks that never hit the plan? They may give negative feedback on VCs. So you have to make sure you talk to the successful porfolio companies, too. Reach out to 2 portfolio CEOs that seem a bit like you, but are further along. And just ask. Expect some mixed feedback. But at least you’ll learn.

And finally:

#6. Understand that Some VCs Have Feelings, Too

Some VCs really don’t have feelings, maybe most. I don’t mean that literally, but what I mean is, it’s a job, and as founders, you’re a product. In fact, that’s how VCs are treated by their own investors (LPs). This doesn’t mean VCs won’t be on your side and helping a ton. But some go further. Some deeply care about you, the mission, and the journey. I’m not convinced this is all good. I’m guilty of this myself, and if you go too far here, sometimes as an investor, it doesn’t help. But understand as a founder, you can inadvertently step on toes. Of your team, your customers, and yes, your investors. But your investors you’re sort of stuck with. It’s OK to walk a few things back, or apologize, if you make a mistake or two with your investors.

A related post here: