So Redpoint Ventures published some of the slides they recently presented to their Limited Partners (their own investors) here.

There’s a ton of good data there, but this one slide stood out to me, because it was put together in a really clear fashion, better than other data sources I’ve seen.

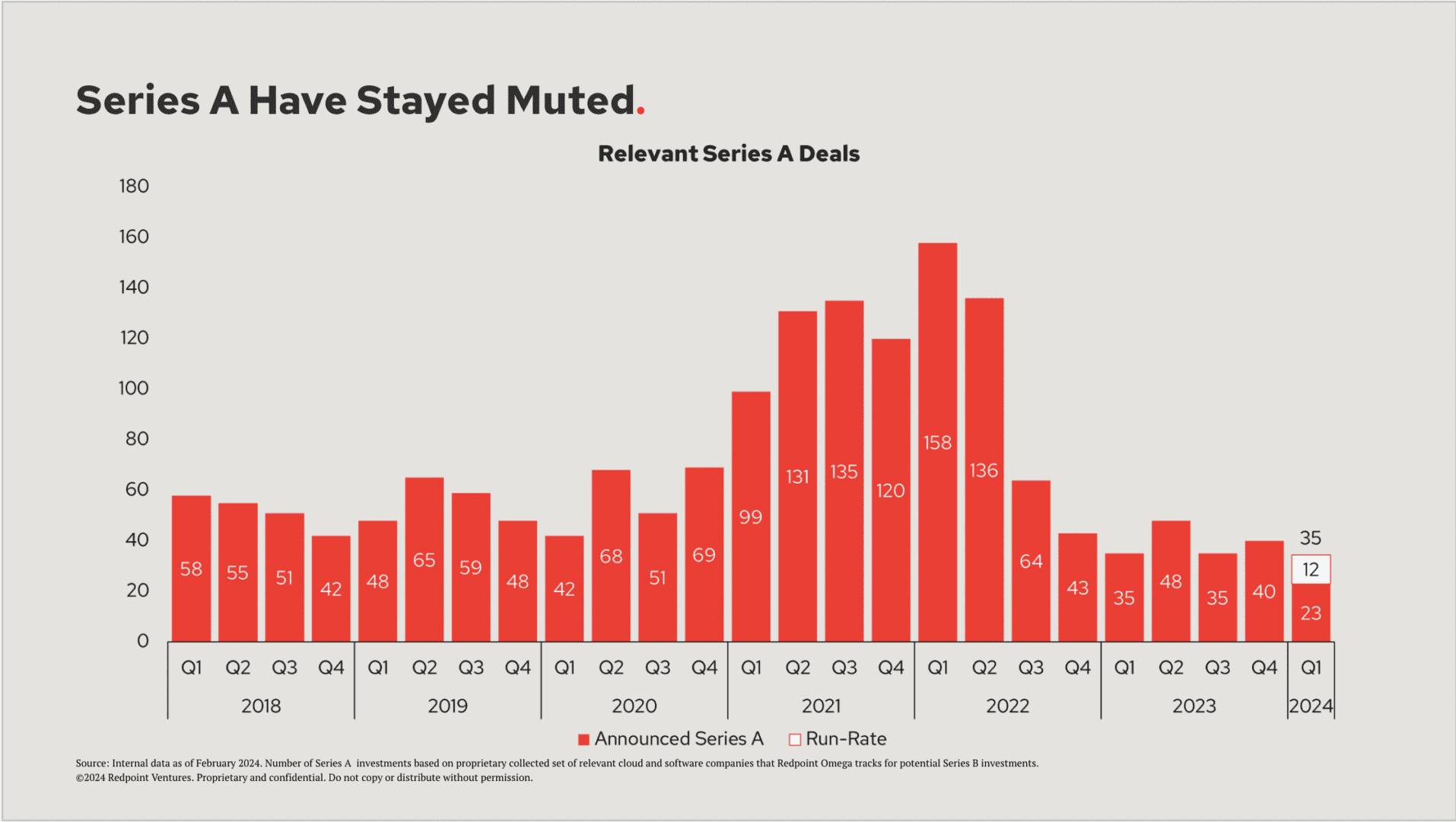

And what it says is that even though Seed stage investing remains arguably as strong as ever … Series A hasn’t bounced back. Not at all:

Per their data, there is some modest pick-up at Series B and C, but that’s less relevant to most founders. What’s most important after a seed round is … how hard is it to raise another round?

Raising a Series A is as hard as it’s been since 2018 is the answer. And it hasn’t gotten any easier since last year.

This just makes sense. The public markets are up overall, but multiples aren’t, and overall growth in public SaaS companies has slowed.

It shouldn’t be any easier to raise a Series A, outside of AI Hype deals. And per Redpoint’s data — it isn’t. Although Redpoint suggests that historical data suggests we may be bouncing off lows in terms of funding rates.

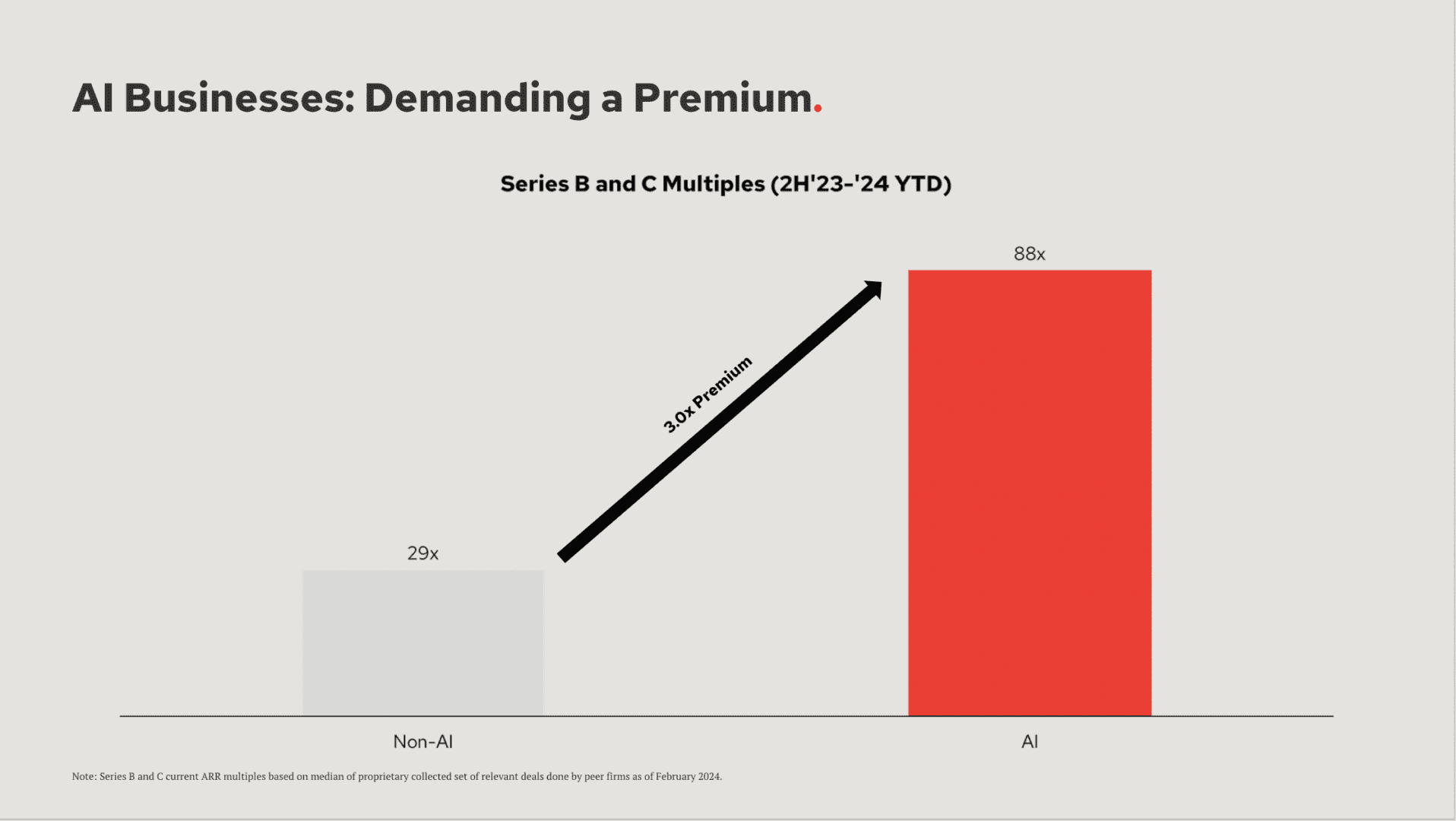

And on a related note, Redpoint data shows that the hottest late-stage “AI” deals are getting done at 3x the price of non-AI deals. We knew that, too, but helpful to see it clearly here:

But, while AI deals are priced at 3x “normal” growth rounds — investors are looking for 2.5x the growth. There’s no free lunch.

I did a deep dive on my learnings from the data and much more here: