Dear SaaStr: How Would You Invest a 5 Million Dollar Payout From an Acquisition?

Bear in mind I’m not a CFA, CPA, or professional financial advisor. But I have been through it. And so I know this is a more difficult question to answer than you might think.

The other day at our most recent SaaStr Miami Super Meetup, I was with a founder that had made $50m over 18 months ago. He still hadn’t figured out how to invest it!

Here’s my best advice:

First, resist the urge to invest in anything specific at first. It’s OK to take a pause and reset.

Don’t invest in restaurants or real estate ventures you don’t understand. No kooky ideas. A few start-up investments are fine, but don’t do much. You have to learn.

Second, understand how you think about inflation. This is a lot of money. One option is to Do Nothing — For a Little While.

This is >not< a terrible idea, as long as it’s just for 12 months or less. Look at all the professional athletes that end up broke. So many. The only terrible part of doing nothing is inflation. If you do nothing, every year, that $5m shrinks on a real basis. But — there is no inflation in the short term. You don’t have to invest it instantly.

Third, be honest about your risk tolerance.

In ‘08-’09, I was 99% in the stock market. 99%. No cash (not even enough for expenses), no bonds. My net worth plunged > 50%. I was devastated. It took me years to recover. It made me too conservative, and it made the founder above sitting on $50m too conservative, too. He literally lost everything in his prior startup. Everything.

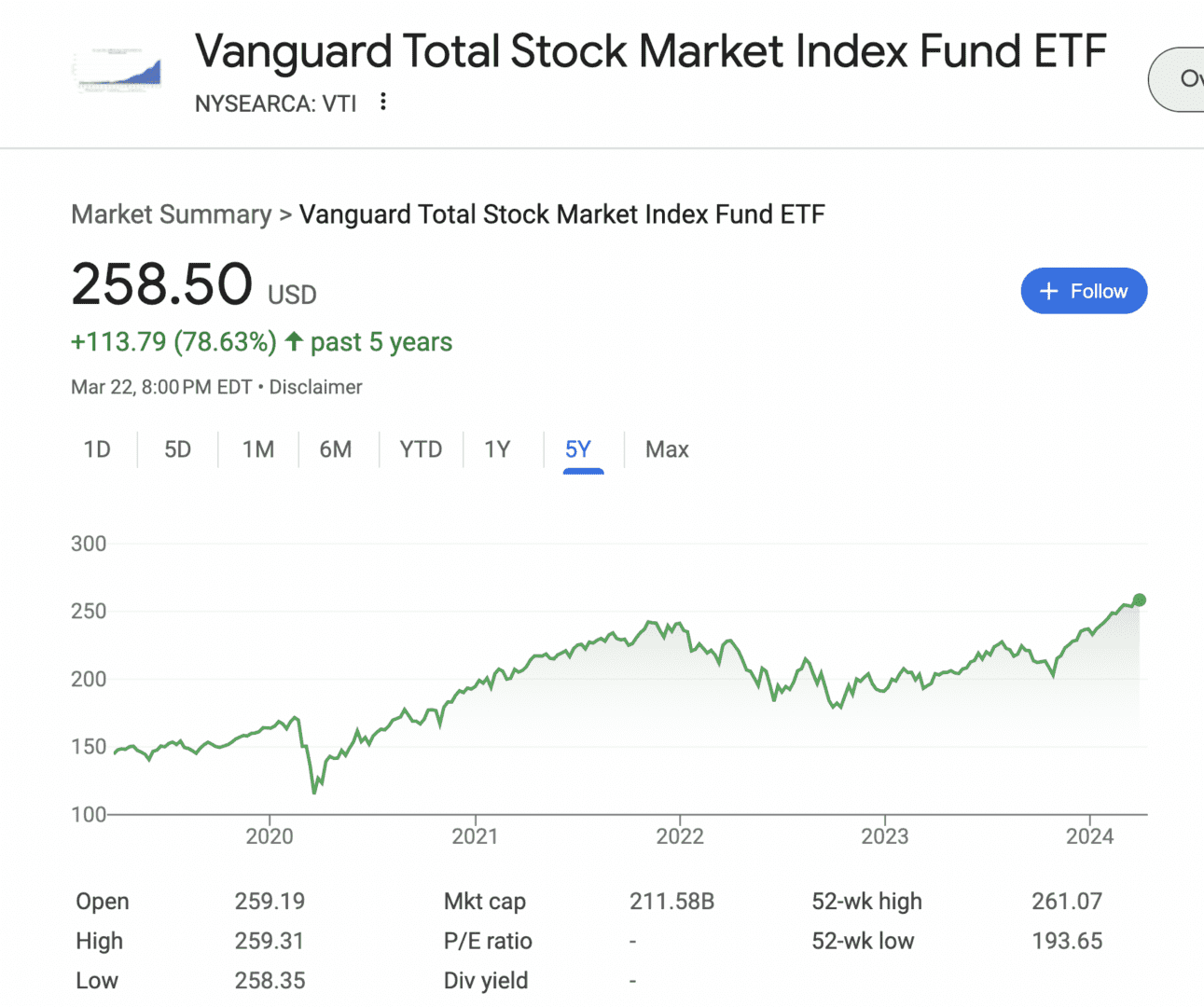

Fourth, just put 80% of it in VTI.

This is my #1 bit of advice. Put 80% of it in a broad, U.S-weighted stock market index like VTI. It is almost impossible for 95% of us to do better. You may do better here and there, but not with all of it. With VTI, you are done in about 60 seconds. And be wary of financial advisors that claim they can do better, with less risk. If so, make sure they really explain it to you. They likely cannot. The biggest advantage to putting 80% of it into VTI is it’s easy and actionable. You can do it this week in a few clicks. And mostly ignore it.

Fifth, yes, buy a home. That you can afford.

It’s not a great investment but it’s not a terrible investment and it has good leverage and you’ll enjoy it. Just stay within your means. It’s also a super easy way to slightly diversify your portfolio. Most of us are just happier buying a home. Maybe renting is better financially, maybe not. But you gotta live a little.

Sixth, take some nice trips.

A lot of folks say it’s trips with family and friends that you really remember and cherish, not cars and watches. They are right. Doing fun things with family and friends is special.

Finally, don’t put more than 10% in start-ups and high-risk investments. Just don’t.

You will likely lose it all. Or even if you don’t, these investments will be highly illiquid. Lose 10%, it’s OK. Lose 50%, you may be devastated.

It’s hard enough to make $5,000,000. Almost no one does.

Turns out it’s even harder to make it twice.