Crunchbase has a new post on lots of data on how VC investing is changing, and how so much of it comes from growth funds and firms. Read it here.

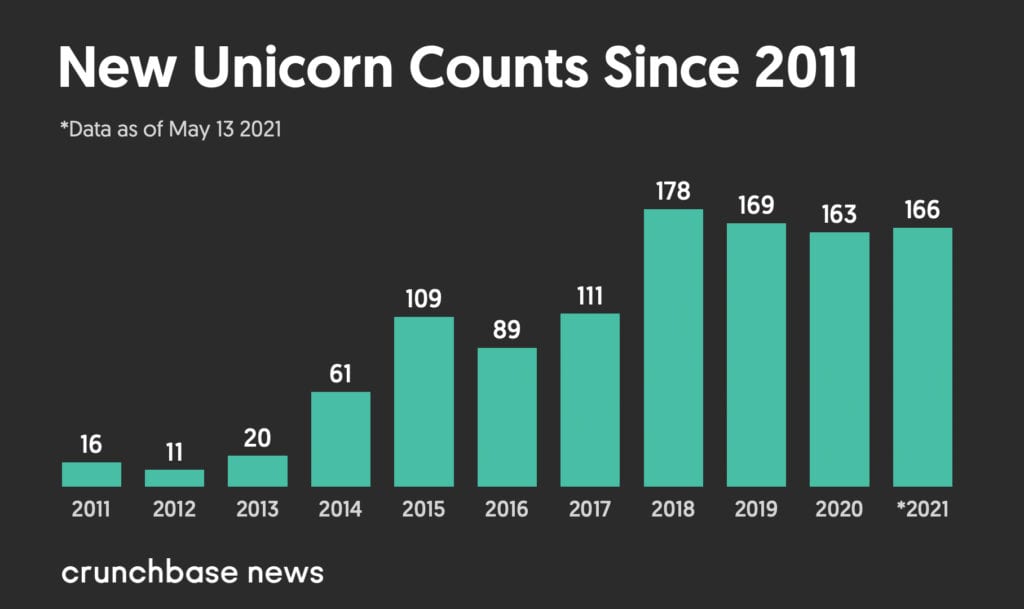

Perhaps the most interesting tidbit to me was quantifying just how many unicorns we are creating. It seems like the pace has picked up dramatically, but what does the data say?

It says the pace of Unicorn Minting is insane. 🙂

We’ve already minted more unicorns 5 months into 2021 than we minted in all of 2020!:

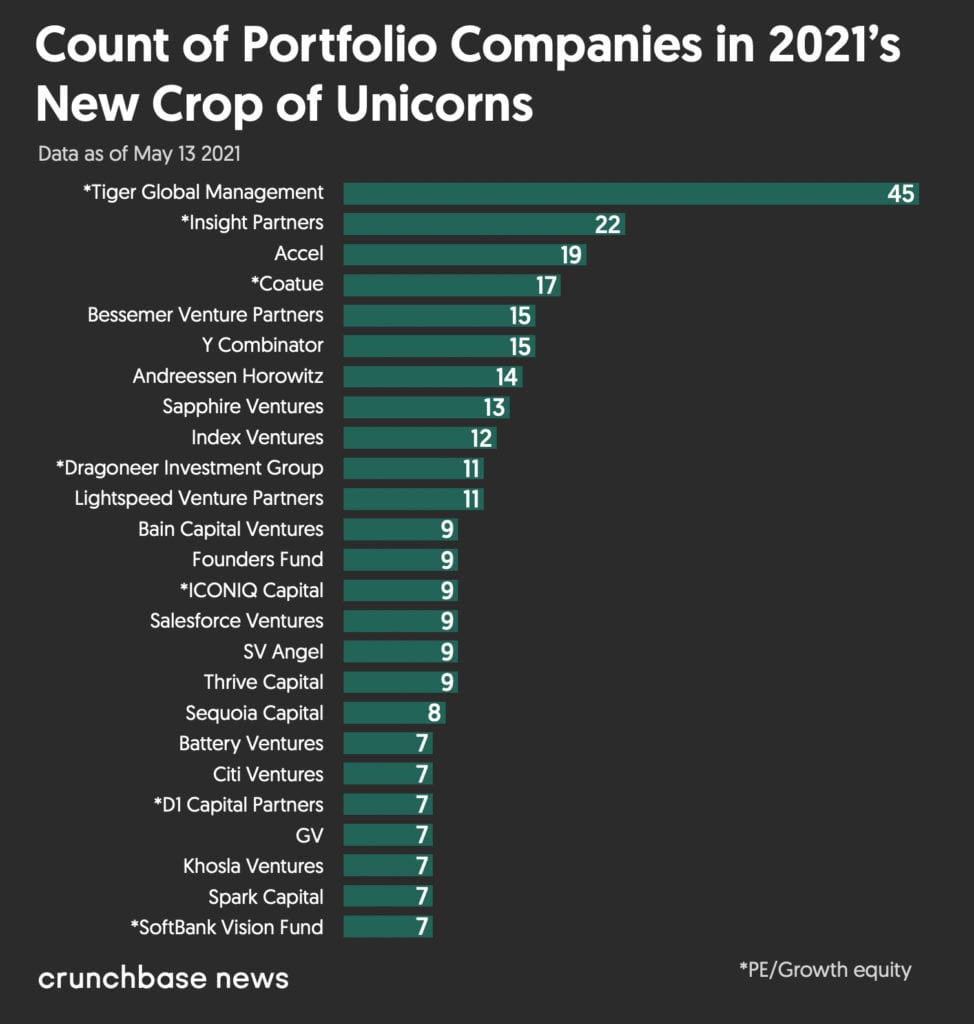

Also, it can seem like it’s always Tiger and Insight leading these rounds on TechCrunch. But is that accurate? It seems like it is 😉 according to Crunchbase:

Now, these aren’t all SaaS and Cloud companies. Perhaps half are, broadly defined.

Still, these are the best of times in Cloud and SaaS indeed.