Every year, you should double your TTAM

Your True TAM

(Not the TAM in the deck you made for the VCs)

Otherwise, growth stalls

— Jason ✨Be Kind✨ Lemkin (@jasonlk) July 10, 2022

So generally, as an investor, you don’t want to worry too much about TAM — Total Addressable Market. At least, not after a certain point. If a SaaS company can double or even triple at $1m ARR, it’s on to something good. Something big. Even if the initial market sweet spot is small.

But what I’ve learned over the past years is some founders get more ahead of a small-ish TAM than others. And most of us start with small TAMs, even if in theory they can be large.

Let me take a few example of the unicorns and decacorns I’ve been lucky enough to invest in. and how they expanded their True TAM over time:

- Salesloft, bought out by Vista for $2.2B, started off as a pretty basic prospecting and then email cadence tool at $8m valuation when I was first involved. Today, it’s a full featured revenue management suite, growing 55% at nine-figures in ARR.

- Talkdesk, last valued at $10B, started off as an SMB Zendesk and Salesforce plug in at a $25m valuation when I first invested. Today, it’s arguably the most advanced and full-featured enterprise contact management application, routinely closing seven-figure deals. That’s a big change from a grab-and-go SMB solution in the early days.

- Algolia, last valued at $2.2B, started off an search API for ecommerce and B2B companies when I first invested at a $12m valuation — and it still is. But it embraced bigger and bigger deals, including its first seven figure deals, while maintaining its long tail of developers. It had a slowdown around $50m ARR when it didn’t go as upmarket as it could have — and then accelerated after $100m ARR once it did. Algolia arguably changed the least of the 3 on the way to $100m ARR, but it did still need to evolve its core ICP to keep growing as top-tier rates.

Now all 3 are just examples, we can come up with others. What I won’t share is a few that did OK, but didn’t quite get to that level. Those ones didn’t really expand their True TAM.

Because almost always, you’ll exhaust your initial wedge. That initial 10x reason folks will buy you. And if your market itself is growing rapidly, sometimes you can just ride that wave without truly growing your TAM. But almost all of have to do something to expand it.

So I’ve come up with a basic rule, but I think it works well in practice: as founders, you need to find a way to double your true TAM, the real TAM you are selling into, right now — each year.

A few ways to do that, none of which are revolutionary, and only some of which will work for you –but all of which can work in general:

- Expanding into a new, key second (or third) vertical. This was key to Front’s evolution from a simple email sharing tool to a $1.7B contact center leader. Focusing and winning several key verticals.

- Going more upmarket when the customers and prospects support it. I see too many startups resist going upmarket because it’s more work. Because they want custom features, compliance, security etc. That’s your call. But more often than note, going upmarket can 2x-10x your True TAM right there.

- Adding a team / enterprise / collaboration edition. Going from a single-user product to a collaborative, multi-user one can often dramatically expand your customer base.

- Doubling Your ACV. There are many ways to do it, but if you set it as a goal, you almost always back into doubling your TAM.

- Asking your customers. Ask your customers what they’d pay you more for. That’s often the quickest path to seeing how your can double your true TAM.

- Being / becoming the most enterprise vendor. The most enterprise vendor in a space can often charge twice what other do, and tap into customer segments (regulated, government, etc) that others can’t. This isn’t the same as going upmarket. Often, several competitors do this. No, this is about being the #1 most enterprise vendor in a space.

- Adding a second product that can be bigger than your first. $30B Veeva’s second produt (Vault) is bigger than the one that got them to $1B (their CRM). You usually don’t want to do this too early, but sometimes it can make sense as early as $20m ARR, and almost always makes sense before $100m ARR. Veeva’s CEO Peter Gassner and I did a deep dive on that here:

And a few things that are great and worth doing, but that usually don’t double your TAM:

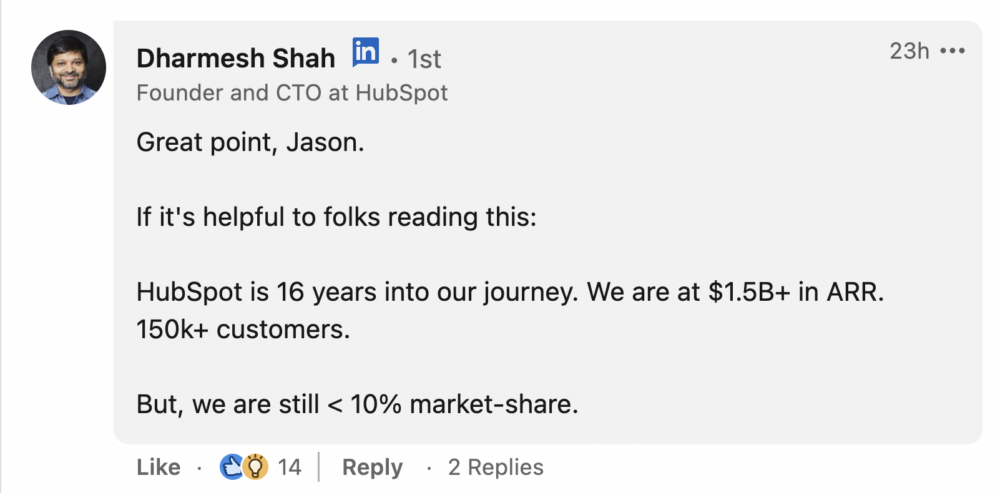

- Expanding into smaller platforms. Many startups that are strong on the Salesforce platform expand into Microsoft, HubSpot, etc. Similarly. startups strong on the Shopify platform often expand into BigCommerce, Magento, WooCommerce, etc. You should generally do this. Just bear in mind, expanding into smaller platforms rarely can double your TAM. They aren’t big enough.

- Tweaking pricing. Doubling your ACV can double your true TAM. But pricing tweaks don’t really do that. They may give you a revenue boost this year. But they don’t materially impact TTAM.

- Most new features. You have to continue to provide innovation to your customers. But most features don’t double your TAM on their own. Make sure you’re honest about the few that can.

- Getting better at sales and marketing. This again is critical and helps a ton. But ultimately, even the best sales and marketing team can only mask a flat TAM for 12-15 months or so. You need to help them, by expanding your TTAM as they close more and more.

As a side note, SMB SaaS companies often hit TTAM issues earlier. Enterprise deals are bigger, and slower, and often give you more time to do this TTAM work. But in SMB SaaS, you can often get to 1,000-10,000 customers in your initial core niche, and often begin to exhaust it.

So double your True TAM each year. Then nothing really can stand in your way.

And choose not to build what it takes to do so? That’s up to you. But that’s trading off some short-term pain for longer-term doldrums.