Fenwick, one of the bigger Silicon Valley / tech law firms put out its quarterly report on the venture market, sourced from 194 deals that actually closed in Q2’22, and I found the way the data was presented super helpful given all the drama in the venture markets, on Twitter, etc.

A few learnings:

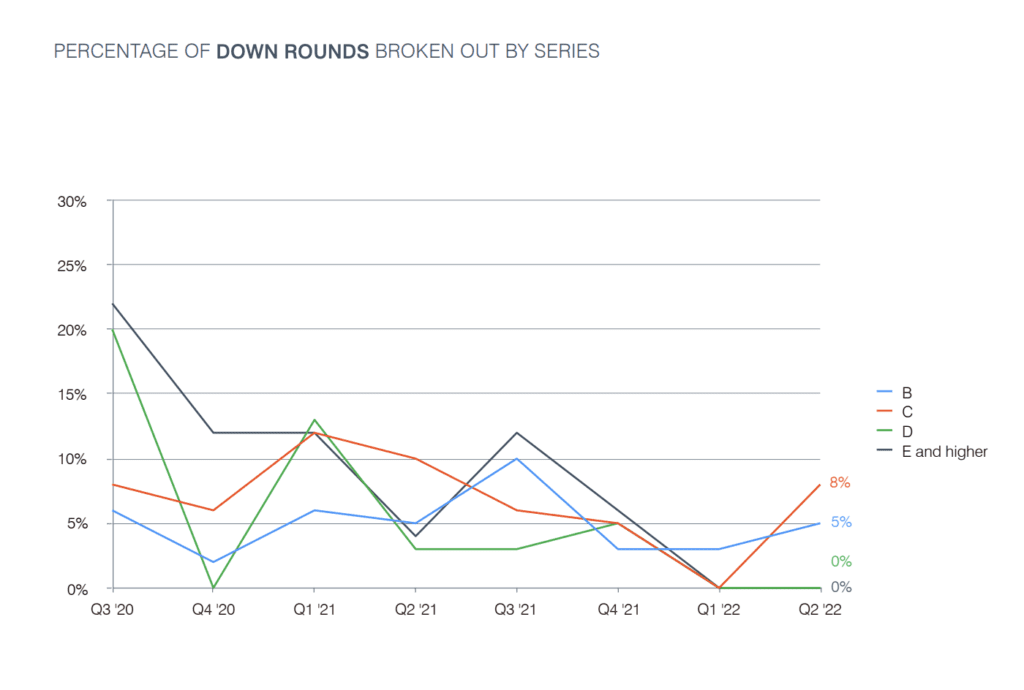

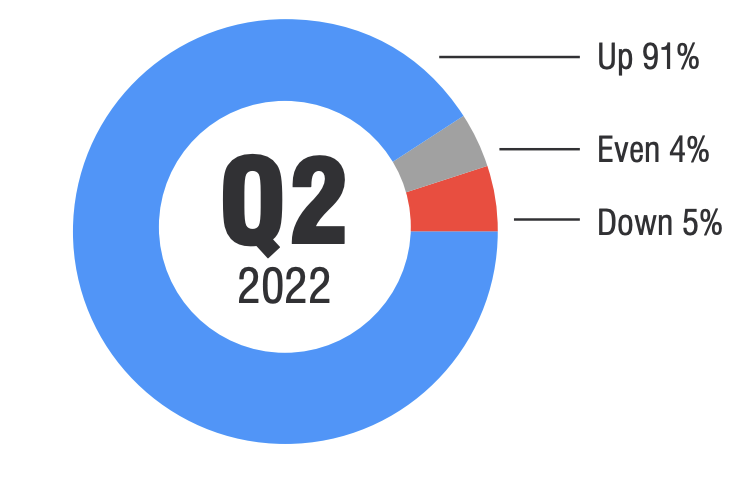

#1. Yes, while downrounds have increased, there still aren’t very many of them. Just 5% of the deals Fenwick closed were down rounds. While Twitter talks a lot about downrounds, in reality, VCs don’t really want to do them. They’d rather pass. So they remain uncommon, even as some startups are under runway stress, etc.

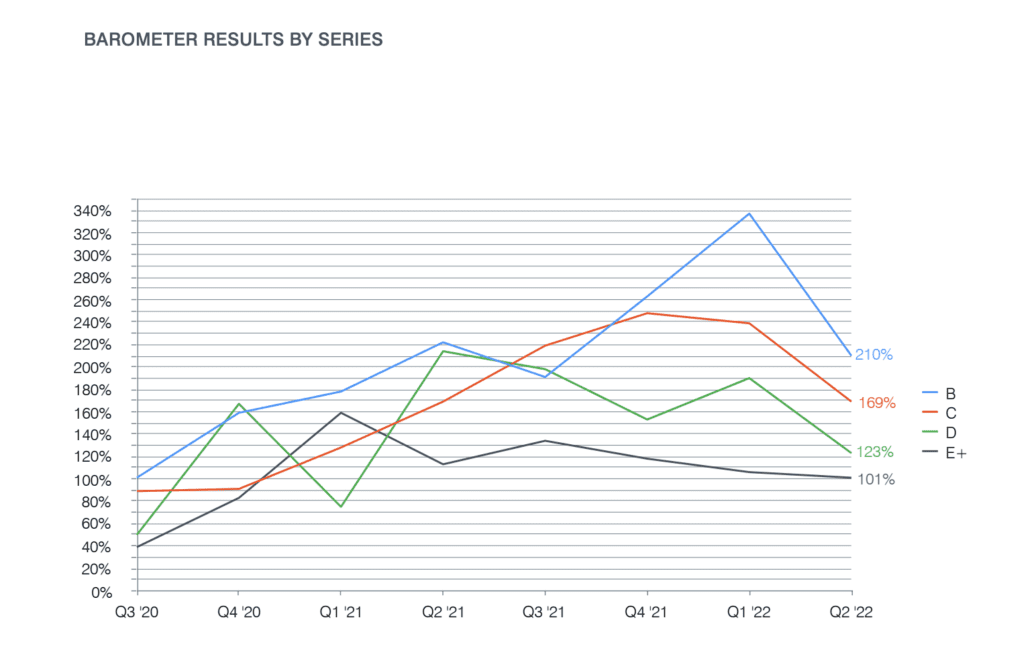

#2. Series B and later prices are down across the board from their peaks in 2021 and Q1’22, down 30% or more. This is also what I’m seeing, and where Twitter has it right. Crazy Series B+ rounds and 100x rounds have mostly paused. Fenwick’s blended numbers see overall Series B and later round pricing down about 30%.

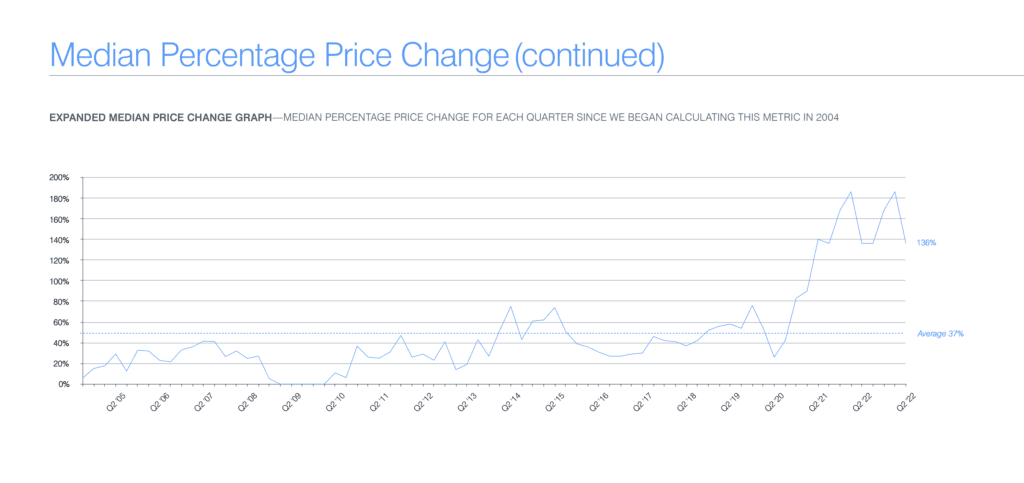

#3. But overall, valuations and prices post-Series A still remain way ahead of where they were up until 2018. Even though things are down, SaaS overall and valuations are still much, much stronger than any time before 2019. Fenwick’s data on valuation increases going all the way back to 2005 illustrates that:

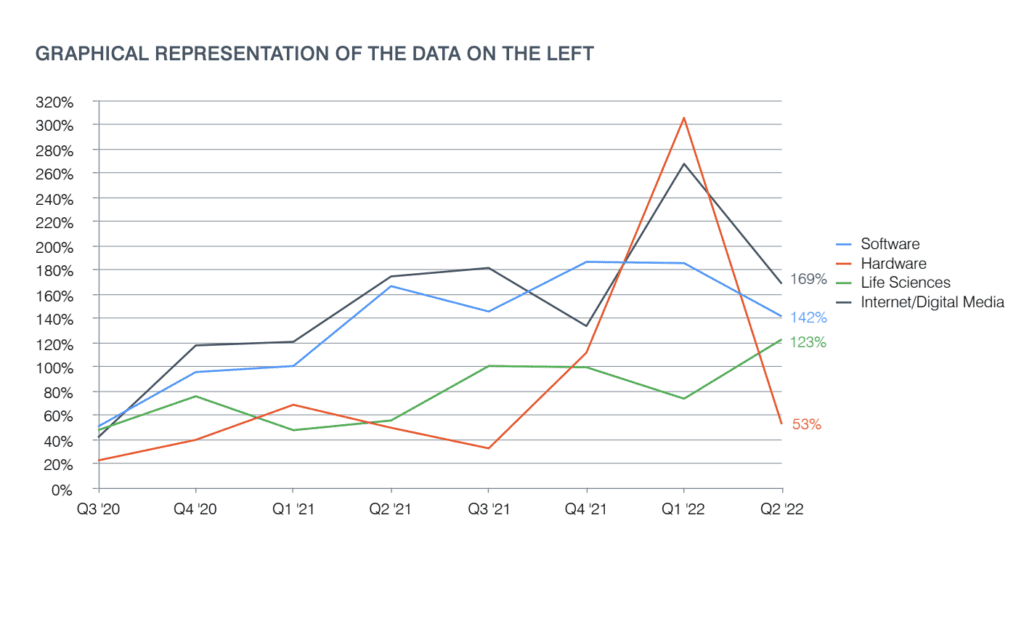

#4. Software hasn’t been hit as hard as other tech segments. A lot of press and PR around downrounds and layoffs is about B2C and less SaaS-y companies. The data here confirms that:

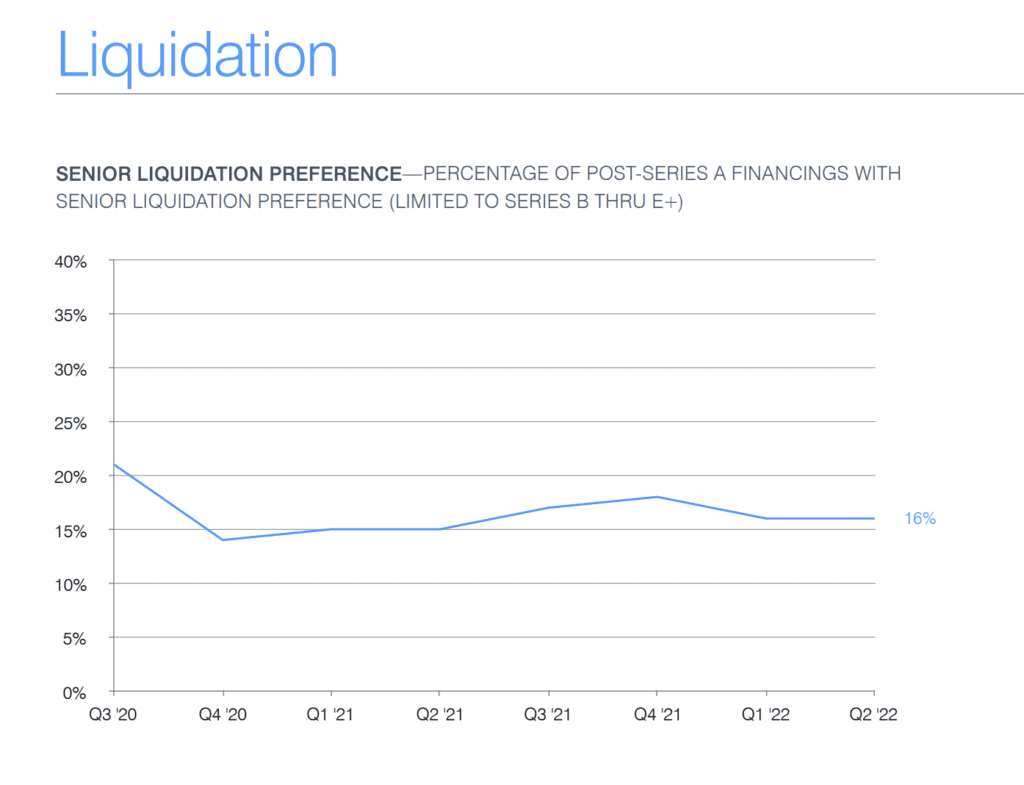

#5. For the most part, terms aren’t really getting that much worse. Fenwick has seen, as you would expect, some increase in investor-favorable terms in the liquidation preferences, pay-to-play, and more. But not that much. Terms may be a bit tougher today, but in normal uprounds they don’t seem to be changing all that much, despite, again, what you might see on Twitter.

Summary:

Don’t get me wrong, it’s a lot tougher out there in venture land than it was in 2021. Post-seed and Series A rounds are a lot harder to get, crazy valuations, to some extent, have gone on pause, and everything has slowed way down.

But it’s not quite as bad in my experience as it may look on social media. And the data from Fenwick above confirms that.

Grow your business, do great things, don’t run out of cash, get it done. The rest mostly works itself out.