So everyone is now paying the price for lowering the bar in the Boom Times of mid ‘20 to early ‘22.

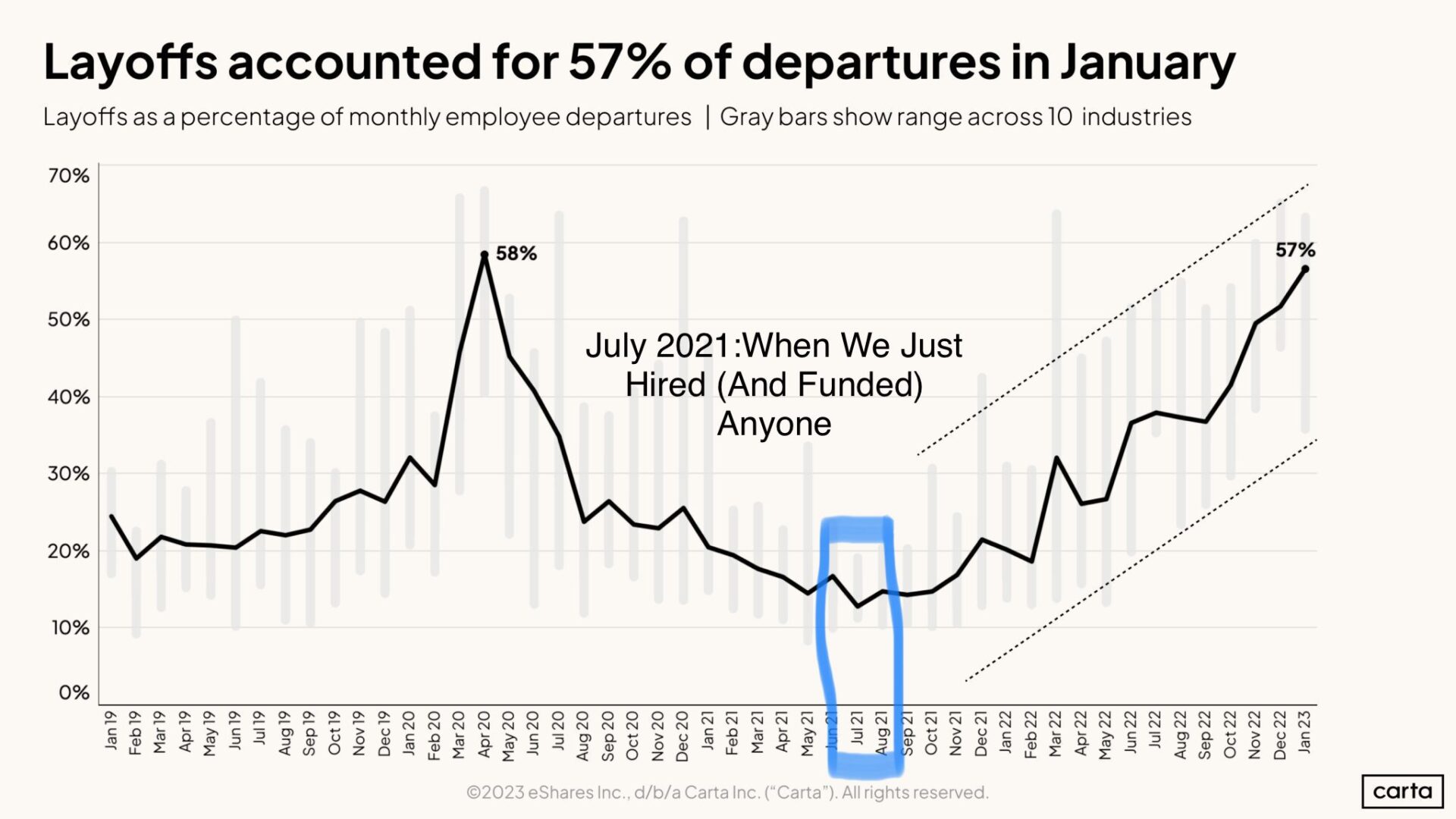

On the hiring side, it often seemed like you just couldn’t hire anyone. While layoffs are all across the news today, looking back, July 2021 was the nadir for layoffs. Everyone was hiring everyone, anyone, back in mid-2021. This data from Carta helps illustrate it:

So we cut corners. We stopped doing reference checks. No time, didn’t want to know. We hired job hoppers that never stayed anywhere for more than 18 months for leadership roles. We hired folks that really never understood the product in sales, or that never really finished any projects in marketing. We all did, just to get it done.

And now we’re paying the price. Those folks aren’t productive, or quit, or are gone. We learned. We learned it’s almost never worth it to lower the bar.

The same things happened in VC and investing. And startups got funded that never should have:

- VCs ignored low gross margins and funded startups with low gross margins with the same multiples as those with high margins

- VCs funded pseudo-SaaS companies as if they were SaaS companies

- VCs stopped caring if a potential startup really could be #1 or even #2, so long as the metrics looked good

- VCs flooded certain markets with secondary liquidity to get into hot deals

- And most importantly, VCs stopped worrying about the next round. They just assumed it would come.

I did some of this myself, both on people and investments.

In the end, it’s all a reminder. Better to do with fewer people, fewer investments, fewer initiatives. And no matter how hard it is, find someone you truly, honestly believe can do it.