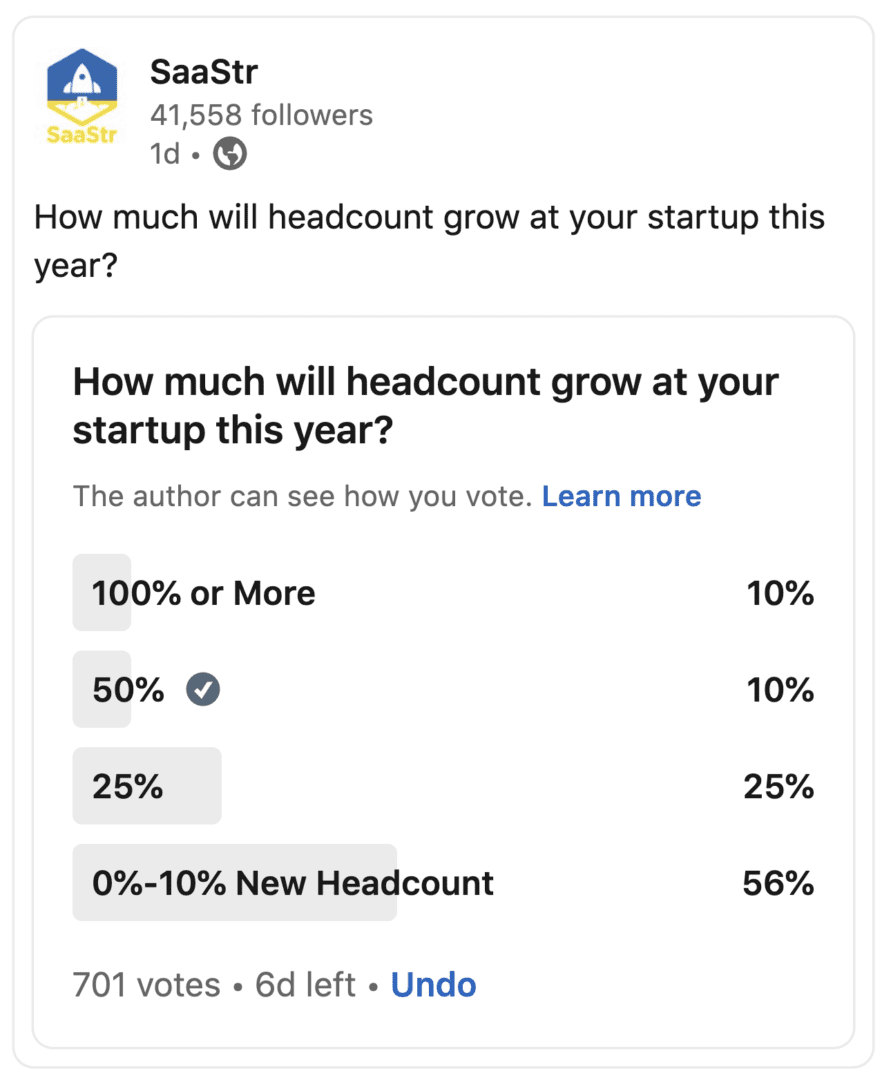

So it’s hard to miss the layoffs on Twitter and in the media. Even tiny ones seem to get big press. And tons of startups, worried about their cash reach now, are doing hiring freezes. It’s a natural, quick reaction.

But there’s a third path that’s much more common, actually. It’s merely slowing hiring.

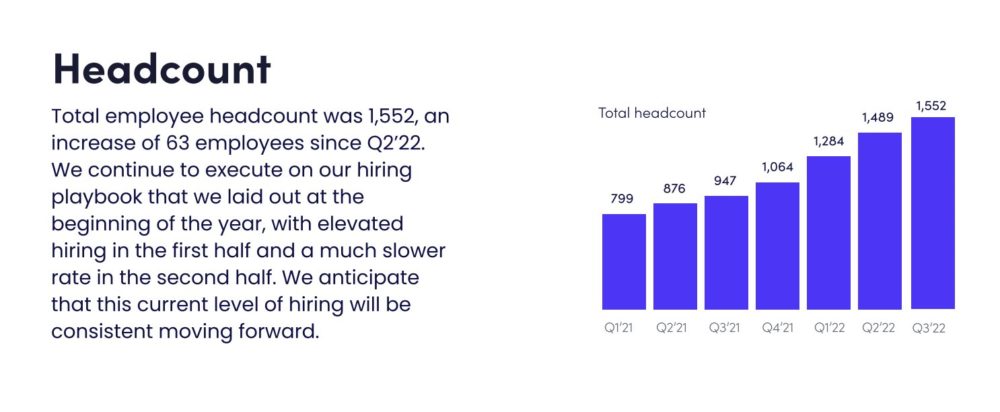

One example is Monday.com. They are growing a smidge slower than last year, but really, still at just epic rates. At 65% (!) at $550,00,000,00 in ARR. That’s incredible. And yet … they are slowing hiring:

They went on a hiring tear like most of us did in 2021, adding 500 employees in a year. Now, they are hiring at about half that rate.

Still hiring, to support torrid growth. Just at half the rate of before.

This is pretty common, for a variety of reasons. For Monday, it’s a reaction to the public markets wanting everyone to get more profitable, sooner. Monday’s operating margins have dramatically improved as hiring as slowed, to 10% free cash flow last quarter. And it will continue to get better and better.

For startups, many of even the most capital efficient are slowing hiring to calmly make cash last. In a time when the IPO window is closed and growth funding is … close to closed.

In fact, I have a rule for most startups that have a decent amount of funding, and really, for most bootstrapped companies at scale. Keep hiring. Always keep hiring. But — hire more slowly than you are adding ARR. Ideally, hire half as fast as you are growing ARR. If you add $10m this year, maybe increase headcount $5m (worth of com)p. $20m, $10m. And so on. Keep growing and building that amazing team. Just fund it with half of your ARR growth. And you’ll likely grow just as quickly. Without too much stress about money. And you’ll probably hire even better people this way.