SVB failing was a stunning moment in the history of startups. Stunning, and I think, actually still under-discussed. As SVB’s situation appeared to be deteriorating, I thought, based on ‘08-‘09, they might get acquired, or backstopped, or bailed out in some fashion.

I never thought on a Friday morning I’d see a tweet the bank had been shut. A bank. The bank. The bank startups had used for decades. Shut down, like the Great Depression. Locked the doors, everyone sent home.

A week ago this morning, our bank balances still read as follows: pic.twitter.com/h4kTDaDFeb

— Jason ✨Be Kind✨ Lemkin (@jasonlk) March 19, 2023

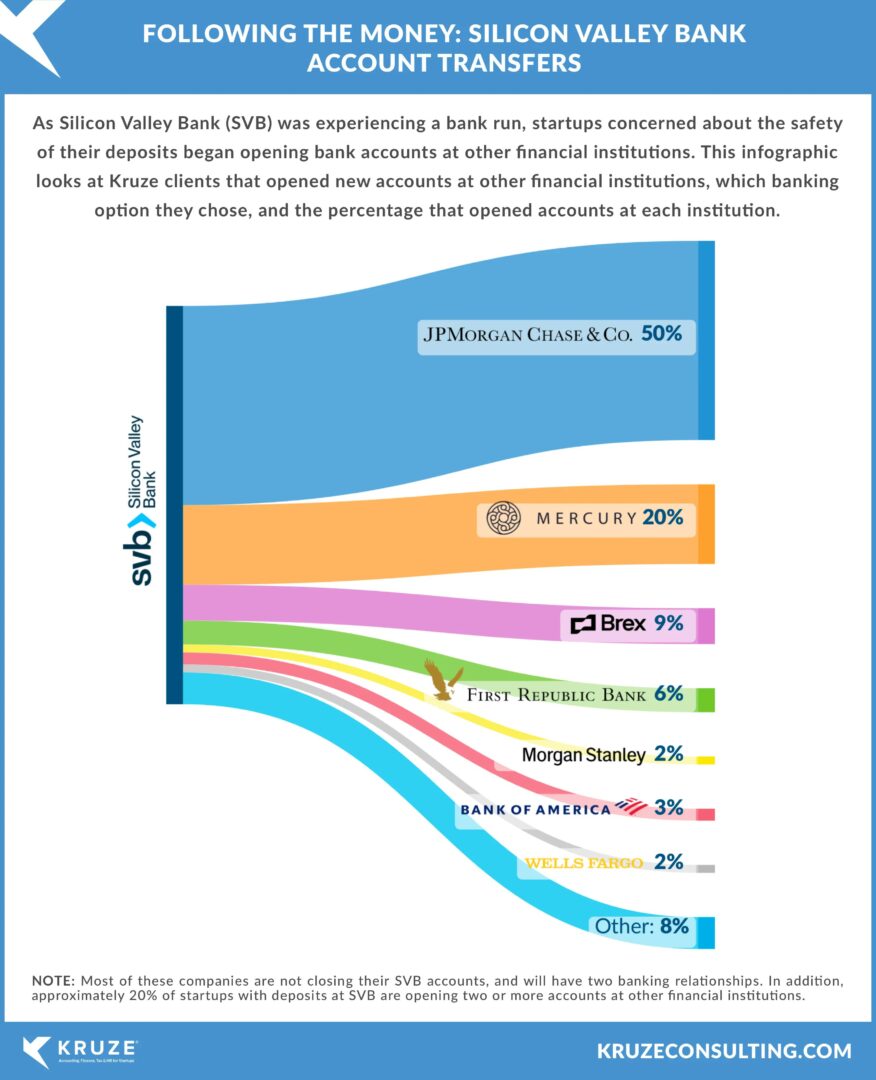

So … where did startups that took out their cash put it?

Kruze Consulting has some great data. They act as trusted outsourced finance teams for 100s of startups, including some of my investments.

The winner, by a large margin, appears to be JP Morgan Chase.

I’m not personally really sure what everyone should do with their working capital right now. This story is still unfolding. At SaaStr, we had the majority of our capital at SVB — and for now, still do. But if the SVB guarantee is removed for any reason, we’ll move it. Likely, we’ll move a bunch in the future if SVB isn’t part of larger bank.

I don’t think anyone exactly knows what to do right now. Even diversifying only partly helps most startups. Losing half your cash isn’t great for a startup, although it’s better than losing all of it.

It’s probably time for all of us to just, in general, be a bit more conservative. Everyone’s burn rate has come down, our efficiency is up. And our banking probably should be more conservative for a little while, too. Even if it was something we hardly used to think about.

History doesn’t repeat, but it does rhyme.

November 23, 2008

I’m at a conference in Half Moon Bay

I get a phone call from my banker at Citibank

“Jason, pull all your money out. We probably will go under tomorrow”

Citibank? Impossible pic.twitter.com/AU7POM7LTY

— Jason ✨Be Kind✨ Lemkin (@jasonlk) March 14, 2023