So Sprinklr is one big Social Media and More management tool you might not have heard of — because it’s pretty darn enterprise. And yes today, it does a lot more than social media management, but that’s its original core. And managing content and the overall customer experience at scale in big companies is a big endeavor.

Sprinklr is good at it. At $700m in ARR, it’s still growing 20%, and it’s getting better and better at closing big, $1m+ deals. And it’s worth an impressive $3.7 Billion. Although a 5x ARR multiple is still pretty modest compared to the Go-Go Days of 2019-2021.

5 Interesting Learnings:

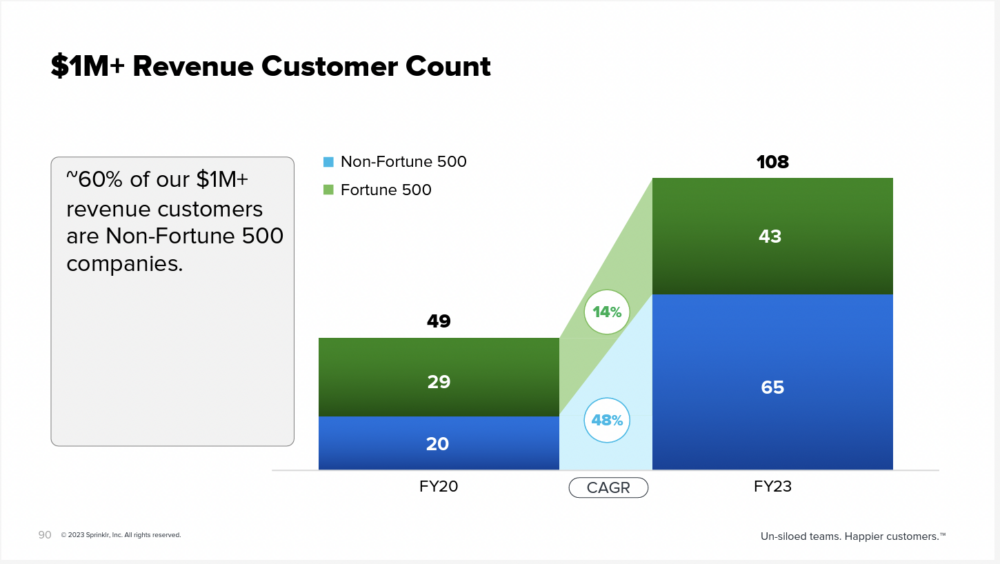

#1. 115+ $1m Customers.

Enterprise workflows are valuable. Basic social media tools? Less so. Sprinklr has gone more and more upmarket with a big focus on $1m+ deals.

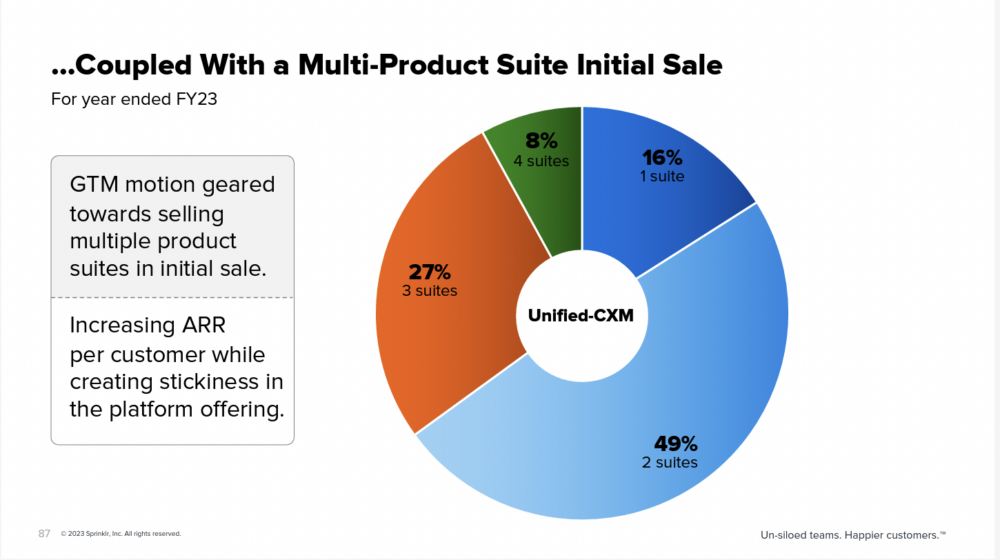

#2. Going Multi-Product / Multi-Suite is Key At Scale. Only 16% of Customers Buy Just One Product.

Sprinklr has focused on finding ways to add a ton of value in the enterprise to some functionality that at a basic level is commodified.

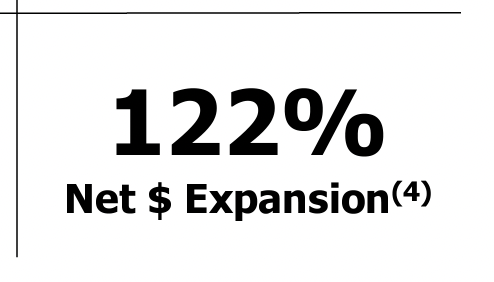

#3. 122% NRR

While you’d expect this with an enterprise SaaS product, the fact they’re also able to achieve in a space that sometimes has to prove its value in the enterprise is impressive.

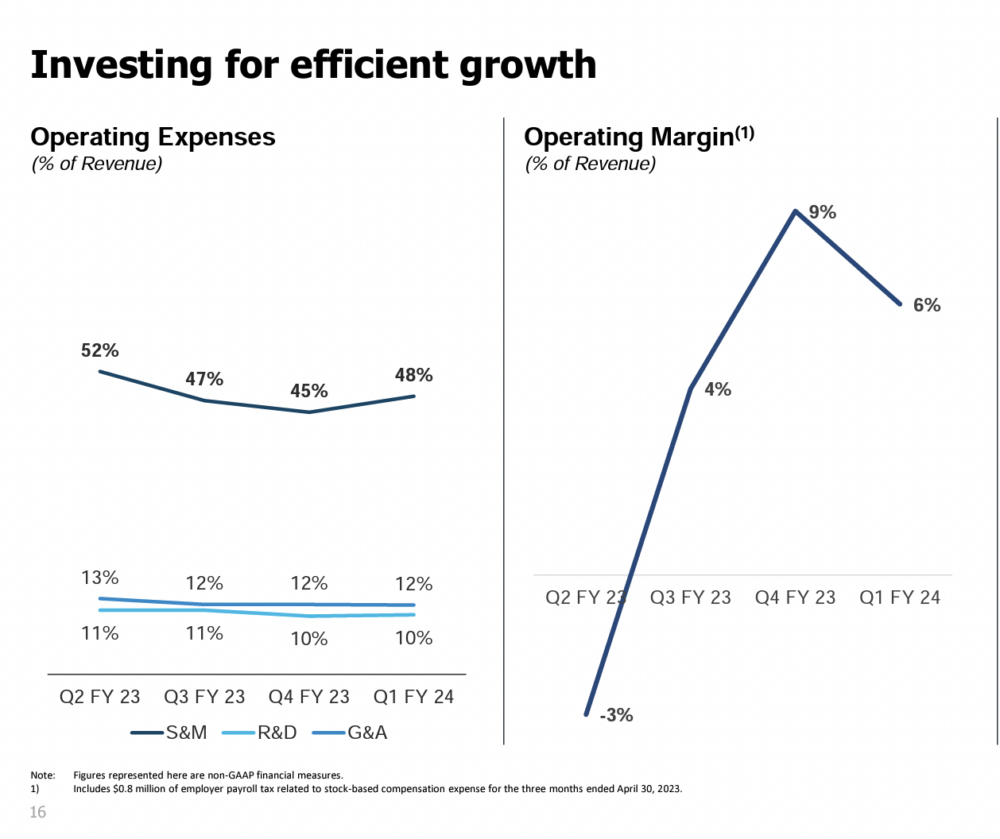

#4. Much More Efficient Than a Year Ago, But More Work To Do

It seems like everyone in SaaS and Cloud at scale has gotten more profitable and efficient, from Monday to Salesforce to HubSpot to MongoDB. Spriklr has as well, in just a year swinging from negative operating margins to +6% to +9%. That’s a huge gain in one year. But to get to Wall Street’s target of 20% operating margins will take more work.

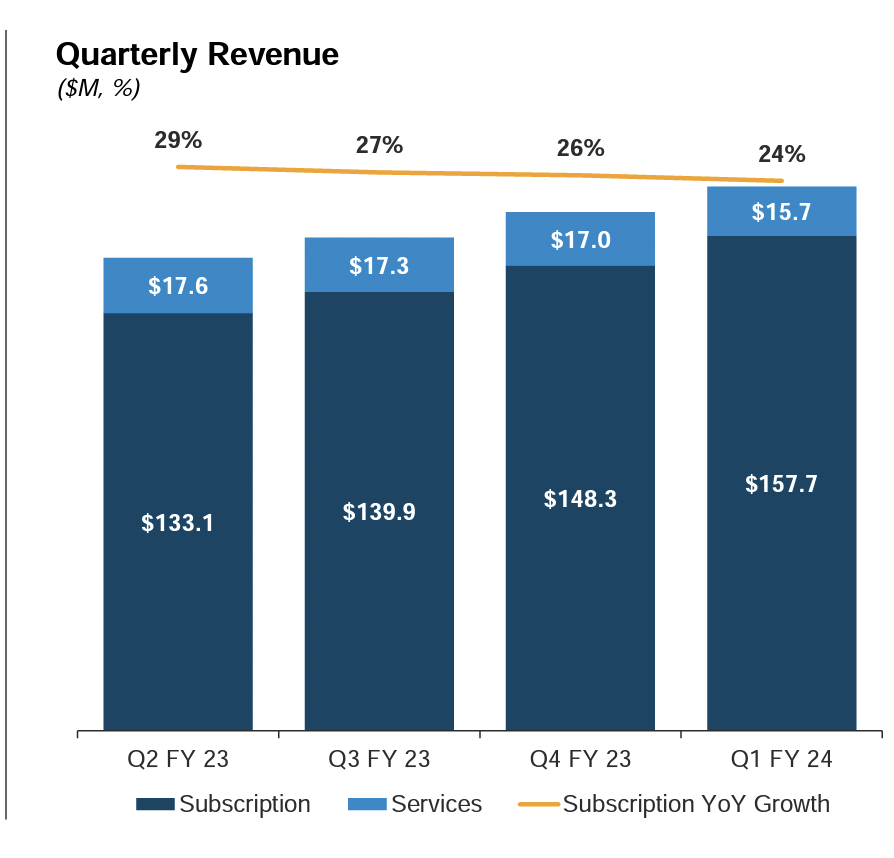

#5. Revenue Growth Has Seen Macro Pressure, But Growth Remains Real

Sprinklr is a marketing product for the most part, and marketing budgets have been under pressure the past 18 months. Sprinklr hasn’t been immune, with growth slowing from 29% to 20% over the past 5 quarters. And with growth (20%) approaching NRR (122%), a lot of that growth does come from the existing base. Sprinklr has grown its $1m+ customers 28% over the past year.

And a few other interesting leanings:

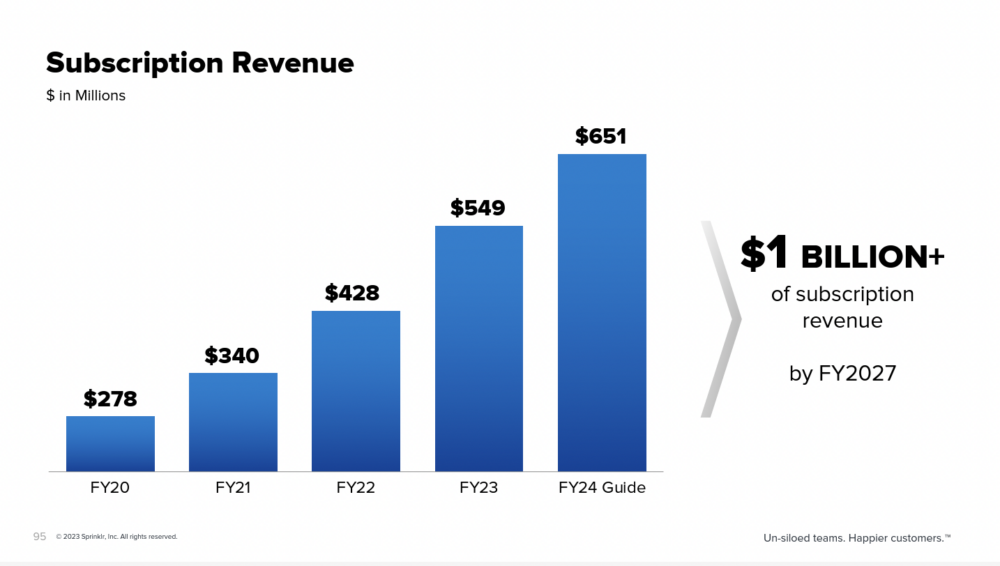

#6. Predicting $1B in ARR By 2027

The power of 120%+ NRR in a truly recurring revenue model means you have a lot of visibility. Spriklr sees $1B in ARR by 2027. And it should get there — it’s just math.

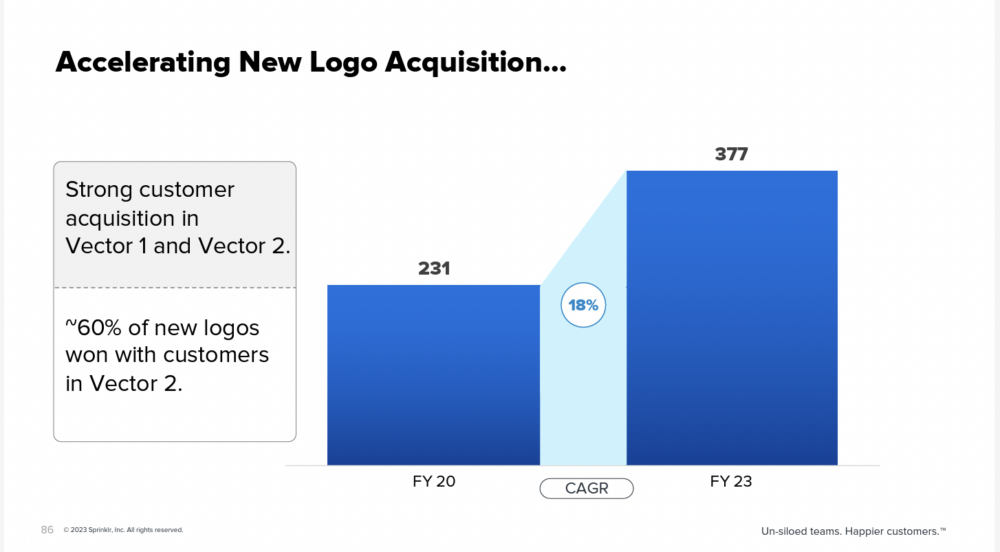

#7. New Logo Growth is Slow and Steady

This is a reality of big enteprise deals, and Sprinklr is a great example. It can be stressful to rely on $1m+ customers to fuel growth. Sprinklr doesn’t close 300+ new customers a day. It closes that many a year. Still, new logo growth has remained up and to the right. A good sign for the future.

Sprinklr is a great case study of going enterprise in a space that starts off simpler and becomes a rich workflow and AI-enhanced engine. Really automate a complex problem for big companies, and you can charge $1m+ a year, either up-front or over time with upgrades. Sprinklr does. And it’s got a clear path to $1B ARR and well beyond doing so.