So what if I told you there is a SaaS company you likely have never really heard of unless you are in adtech / advertising, doing $2 Billion in ARR, with a $28 Billion market cap even today, that’s insanely profitable and yet still growing 32%?

Yes, this company exists.

It’s called The Trade Desk.

It’s self-service SaaS for AdTech, so it’s often seen more as an Adtech player than a SaaS company, but the reality is it’s software for ad spend. It’s SaaS.

Let’s dig in. Because they’re doing just about everything right. And even in today’s low multiple, tougher world — being rewarded for it.

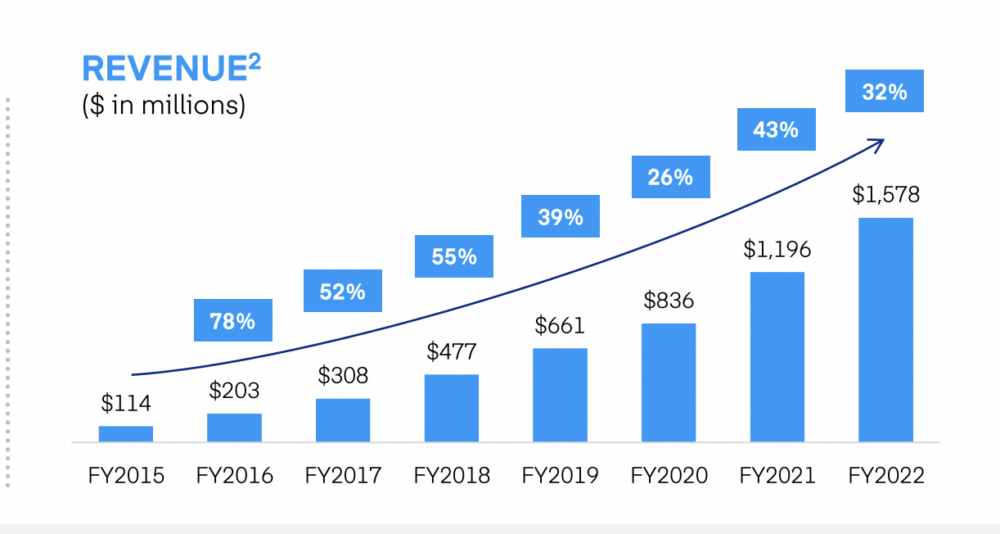

#1. Impressive but Not Insane Growth After $100m ARR. We’ve seen many SaaS leaders grow at a jaw-dropping 100%+ at $100M ARR. The Trade Desk has executed to perfection, but never quite grown to that level. And growth has slowed as it has scaled past $1B in ARR. But you know what? It’s also done it wildly profitably (see point #2). And that’s mattered even more than utterly insane growth. Top-tier growth + top tier profits beats Insane Growth in today’s world. As perhaps it always should have.

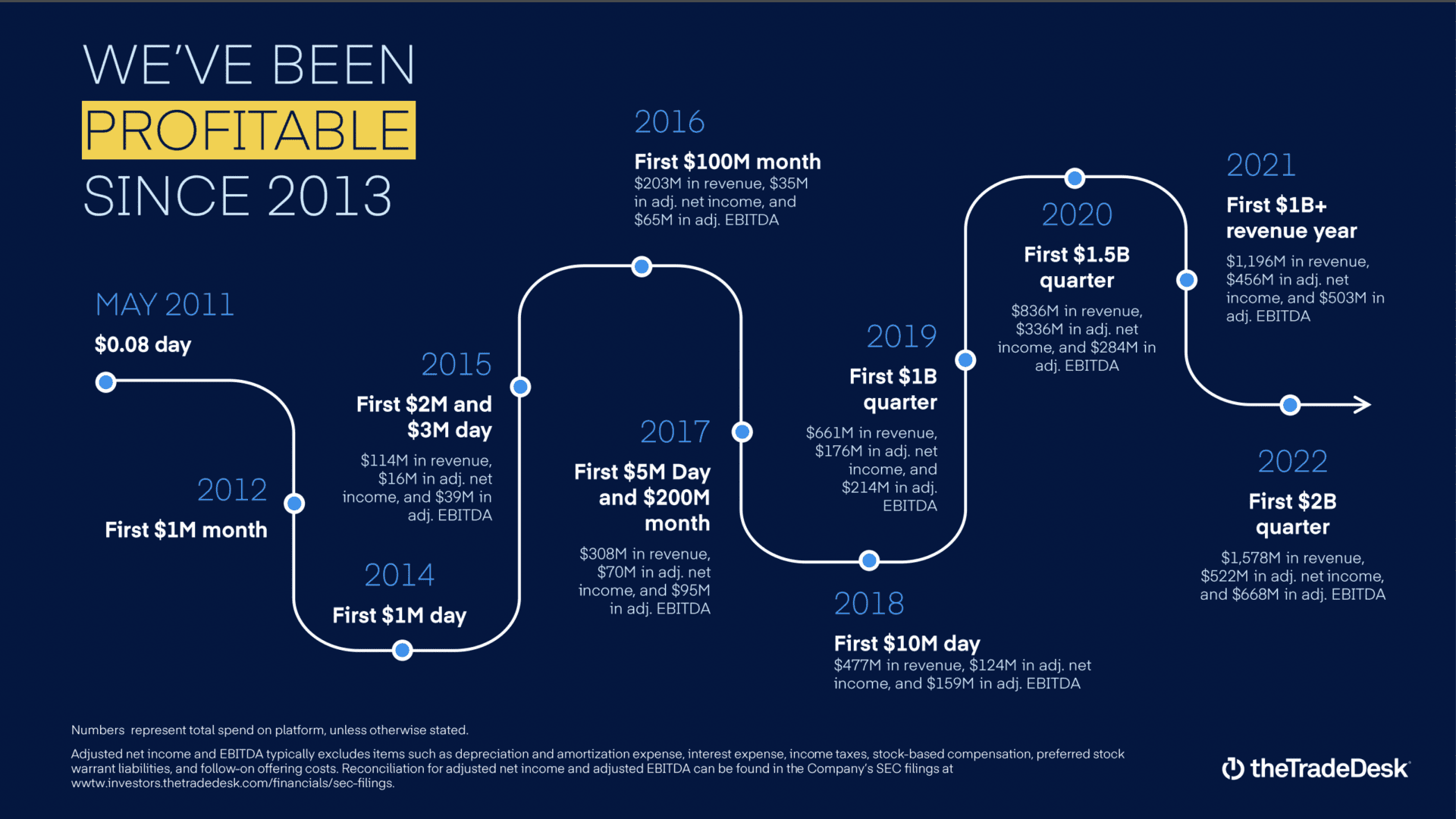

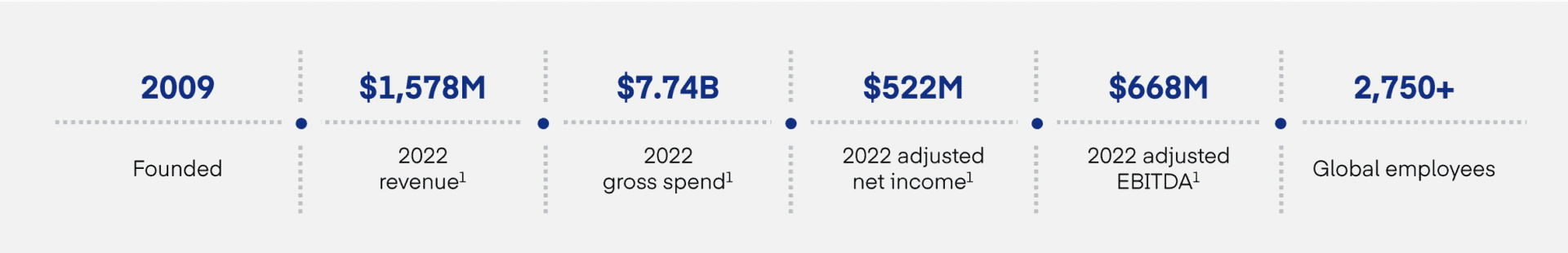

#2. Wildly Profitable — And Profitable Since 2013. The Trade Desk was founded in 2009 and began to take off in 2012. By 2013, it was profitable and never looked back. Today, it’s insanely profitable. Just last quarter, it produced $522m in adjusted net income and $668m in adjusted EBITDA on $1.6B in revenue. Yes, I’m using “adjusted” numbers so some will come to different amounts here, and this doesn’t include stock-based expenses which are substantial — but still it’s insane. That’s a 42% adjusted EBITDA margin! 42%!

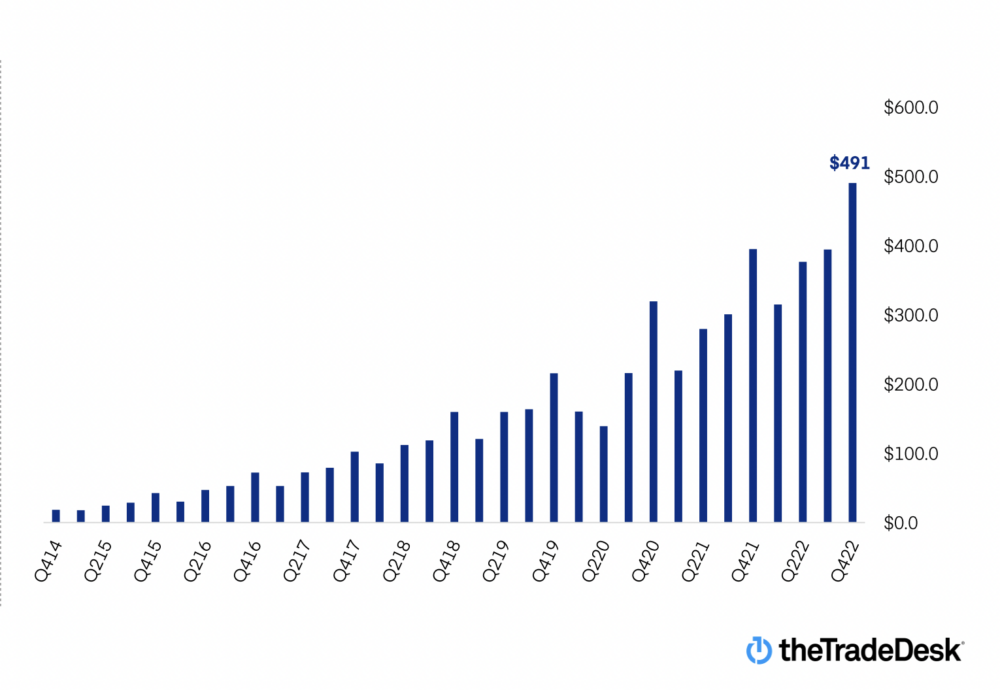

#3. True Seasonality in their Revenue. Many SaaS companies talk about “seasonality” to their revenue, but it’s often really just an excuse for slower growth. Not The Trade Desk. A huge amount of ad spend happens at the end of year, and that’s reflected in The Trade Desk’s big Q4 each year:

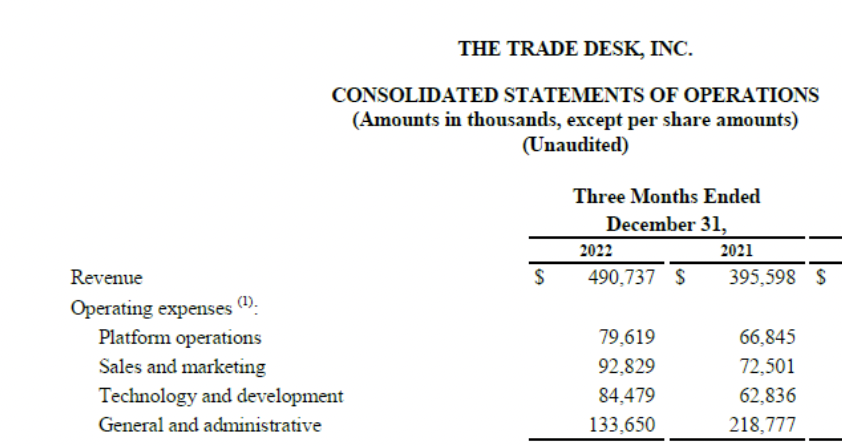

#4. Self-Serve Means Relatively Low Sales & Marketing Expense — But Not Zero. The Trade Desk spends about 19% of its revenues on Sales & Marketing, which is one way it’s been profitable for so long. That’s about half of what many fast-growing public SaaS companies spend. But even with a self-serve motion, it’s not 0%. It’s still almost 20% of each dollar into acquiring and keeping customers.

#5. 2,750 employees, so about $720,000 in revenue per employee. This is the secret sauce to all those profits. Most public SaaS companies struggle to hit $250,000 in revenue per employee.

And a bonus learning:

#6. Founder CEO Owned 25% at IPO. Staying profitable doesn’t eliminate dilution, but it does reduce it. 25% of $28 Billion isn’t too shabby!