So we’ve taken a look at Monday several times in this series, but with so much change in the world of SaaS and Cloud the past few months, it seemed like a great one to dig in on.

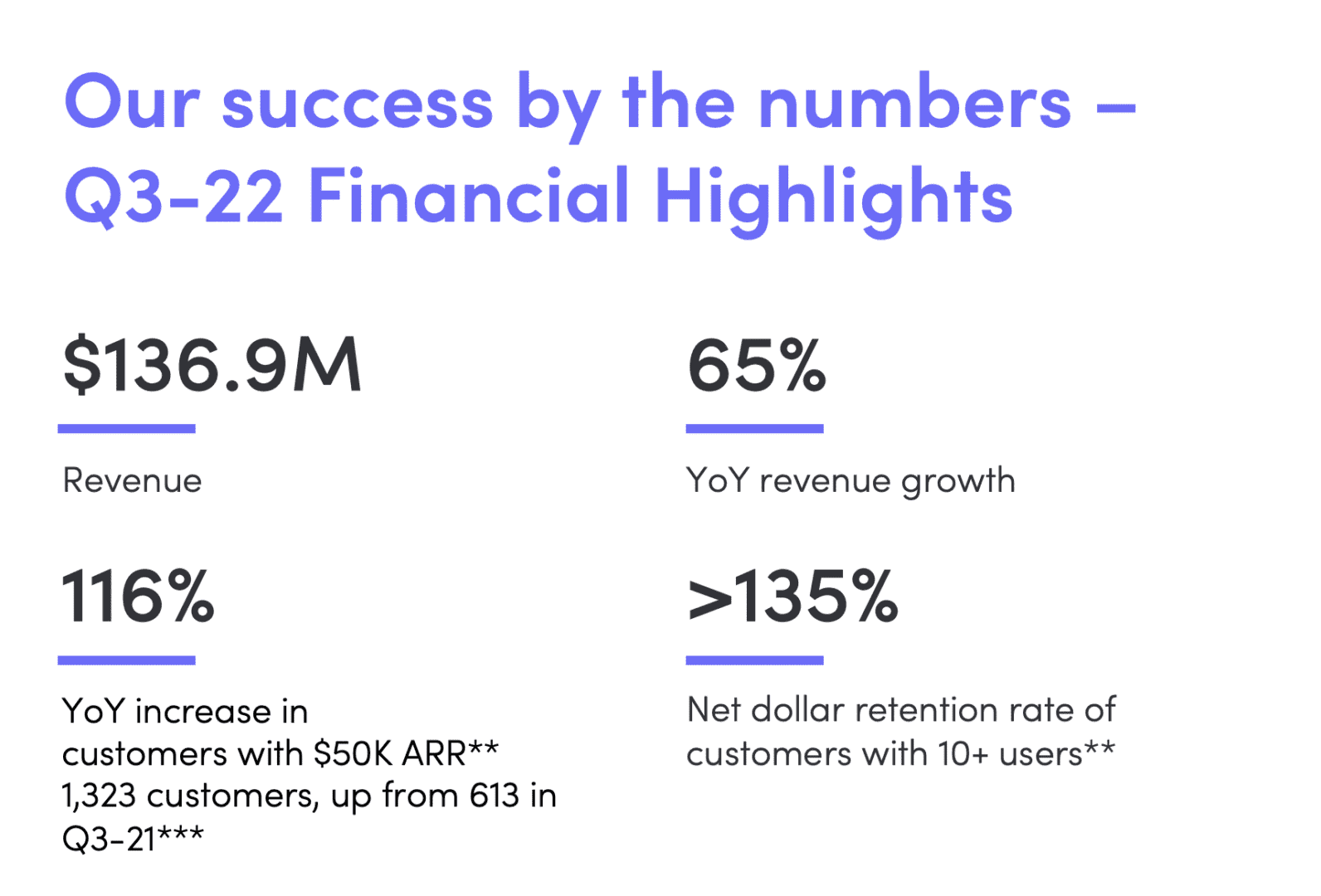

Because Monday remains on fire — growing a truly stunning 65% (!) at $550,000,000 ARR. Jaw-dropping rates.

But it is down a bit from earlier in the year. A reminder of the conflict in perspectives we’re seeing today in SaaS. Growth levels for all the best are still at incredible rates. But in many cases, down from even more incredible rates a few quarters earlier. E.g., at $400m in ARR, Monday was growing 91%.

5 Interesting Learnings:

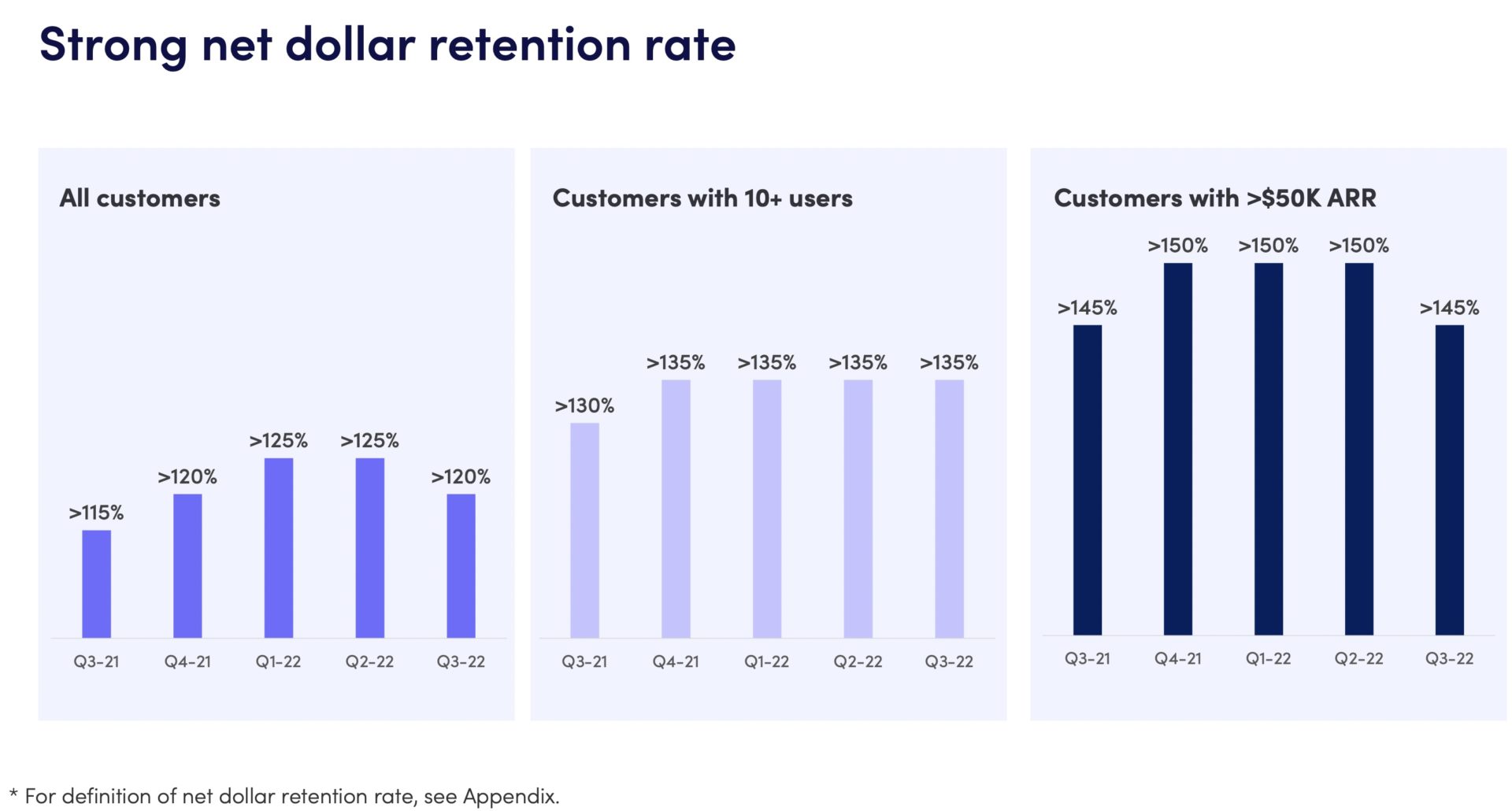

#1. NRR for 10+ seat deals remains strong at 135% — with no overall decline (at least not yet). While some SaaS leaders are seeing some decline in NRR in today’s macro environment, Monday isn’t, at least not yet. It still has very strong NRR for a still muchly SMB and mid-market product at 135%, with no decline since the same 135% at $400m in ARR.

#2. But, high NRR in bigger customers is masking a modest NRR decline overall. While minor for Monday’s business, this is interesting for us all to see. Strong growth in 10+ user customers with consistent 135% NRR is masking some decline in NRR from smaller customers (and possibly a tiny bit at the largest ones). NRR of 10+ seat customers hasn’t declined at 135%, but overall NRR is down from 125% to 120%.

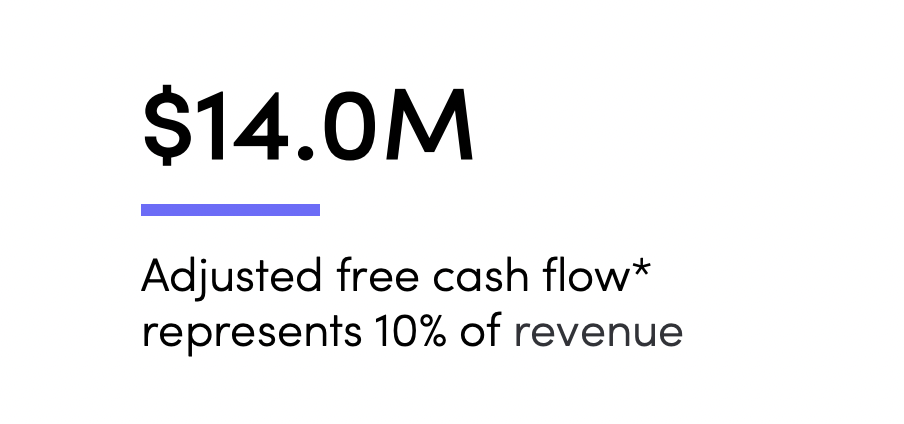

#3. Free Cash Flow up from 3% of revenue at $400m in ARR to 10% at $550m in ARR. This is impressive, and Monday is well on its way to 20%+ free cash flow and ultimately operating margins. They’ve clearly pushed hard on efficiency and it’s working.

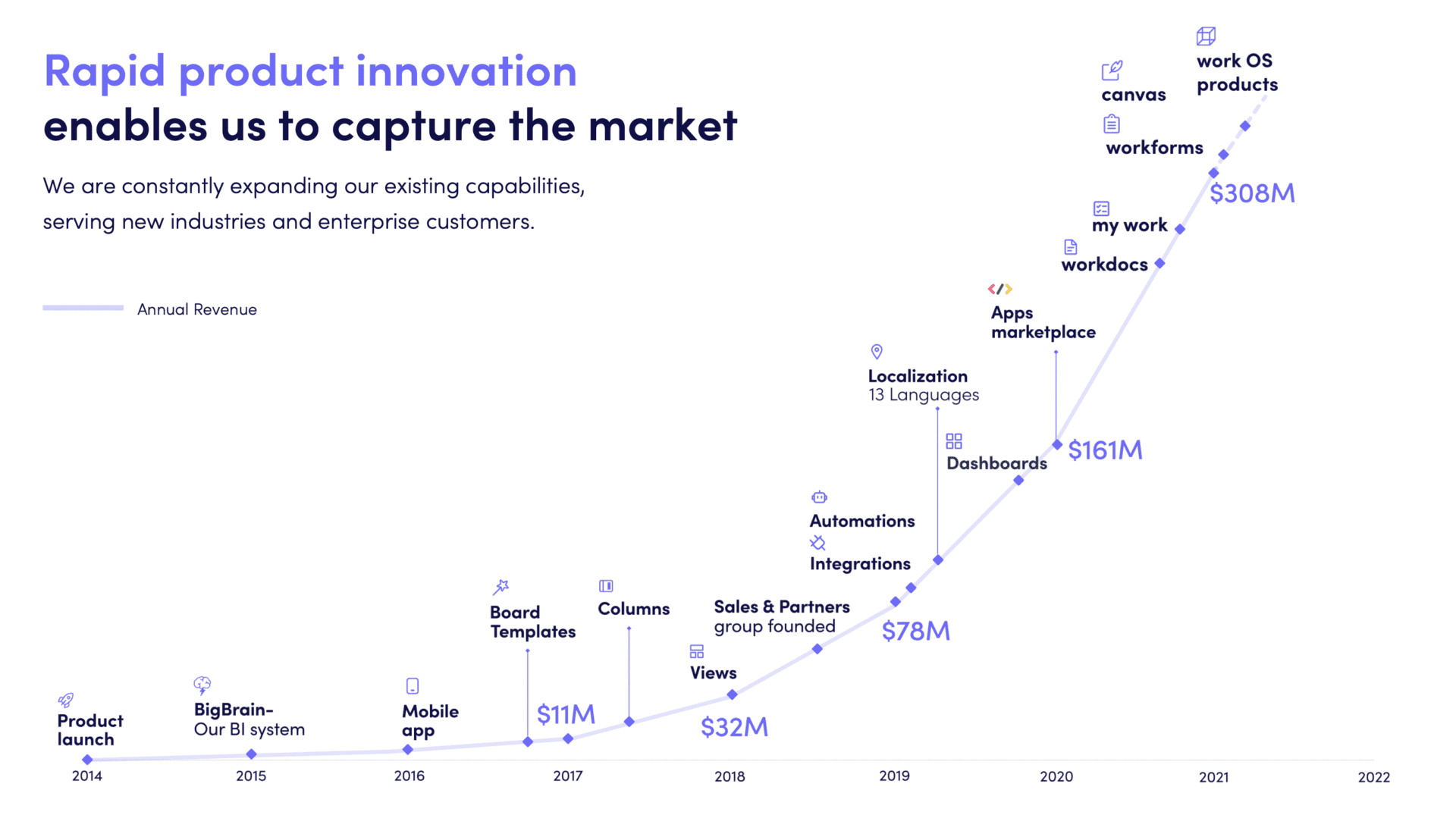

#4. From $11m in annual revenue in 2017 to $500m+ in 2022. Just seeing the power of compounding growth in SaaS in this chart makes my jaw drop:

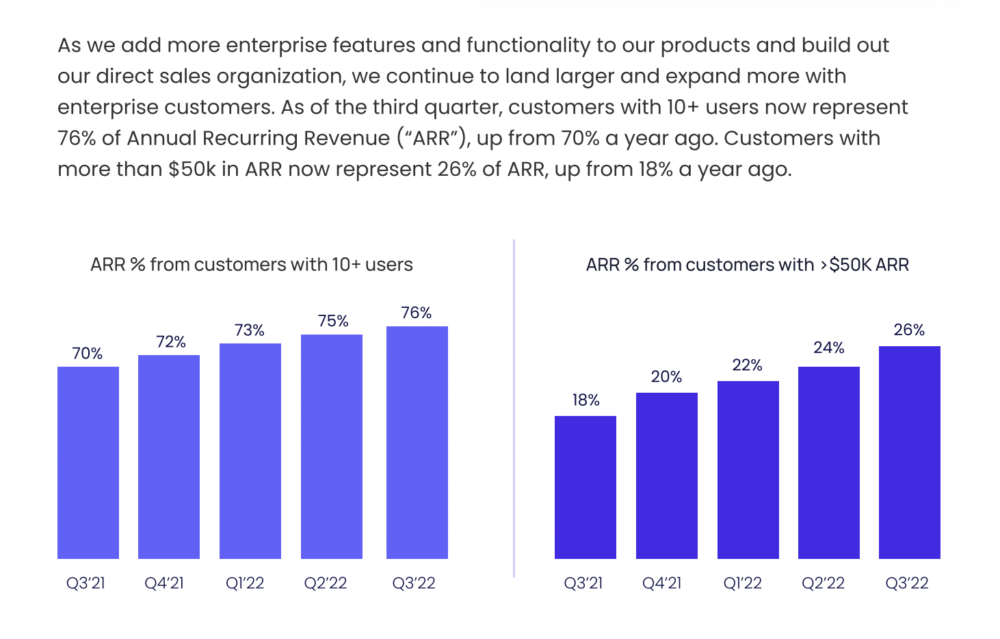

#5. $50k+ customers are biggest engine of growth. While Monday still serves tiny customers, its focus isn’t really the smaller SMBs anymore. $50k+ deals (which they define as enterprise) are the biggest engine of growth today, and growing 116% year-over-year. $50k+ customers are 26% of revenue today, and 10+ seat deals are 76%. Still, a quarter of their revenue is still from smaller customers.

And a few other interesting learnings:

#6. Customer base remains 70% non-tech. This has always been a non-obvious part of Monday’s success. Despite all the YoutTube ads we all see, Monday is decidedly targeting the non-tech industries, and doing it very, very well. Even past $500m in ARR, 70% of its customers are non-tech.

#7. Marketing engine getting more efficient at scale. This slide below I found interesting. Their cost per sign-up is declining for 10+ straight quarters. SaaS leaders at scale often find their cost per acquisition goes up at scale, as they saturate the market, but Monday has gotten better and better here:

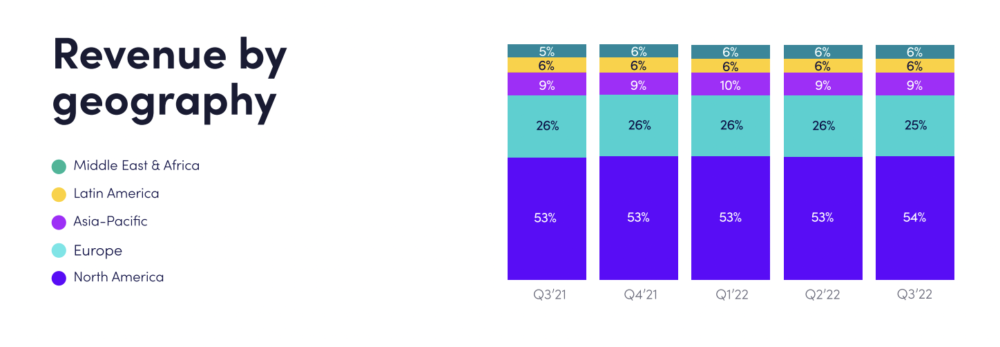

#8. More stress in Europe than North America. Monday is seeing more customer stress in Europe than North America, which is compounded by currency effects.

#9. Consistently 55% or so revenue from North America, 45% from Rest of World. Another reminder to go global in SaaS as early as you can!

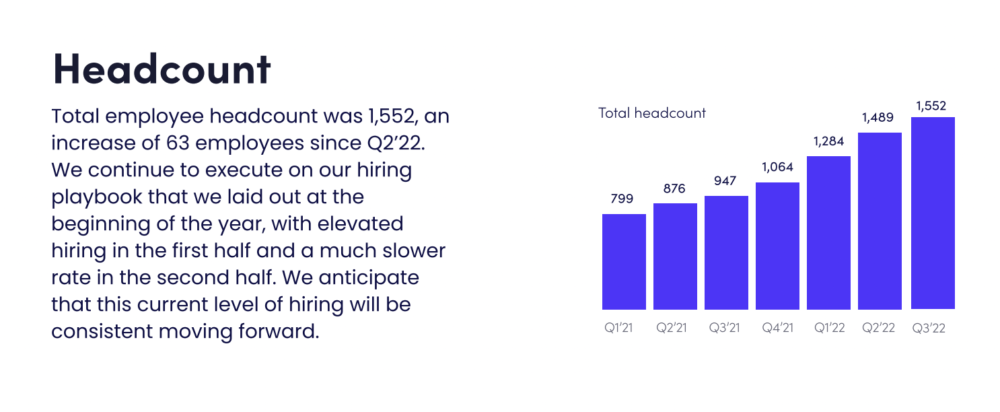

#10. Slowing hiring has been key to driving up free cash flow. Like many tech companies, Monday added a ton of headcount in 2021. It then added only 63 employees last quarter, and plans to continue with very slow headcount for a while. A lot of SaaS companies aren’t so much doing layoffs as slowing the pace of hiring or even doing quiet semi-freezes. Monday is doing the former. Still hiring, but at a much slower pace than revenue is growing. That’s calmly getting them to the cash flow and operating margins they need to hit.

And an A+ SaaStr deep dive with the co-founders on Monday and how they got there … here: