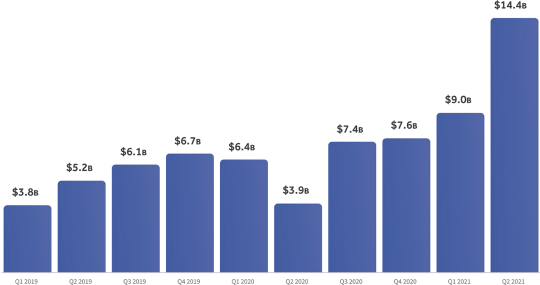

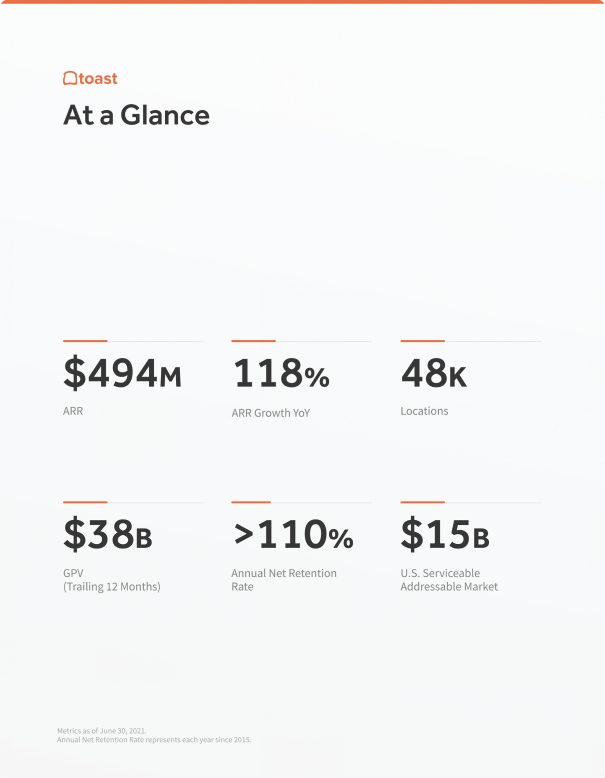

Toast … we’ve all used it in a restaurant or 10 by now. Now with a $30B (!) IPO behind them, we can take a look behind its metrics. And they are both incredibly impressive — 118% growth at $3B run-rate and $500m in ARR in software alone may be an all-time record — but also, perhaps not SaaS?

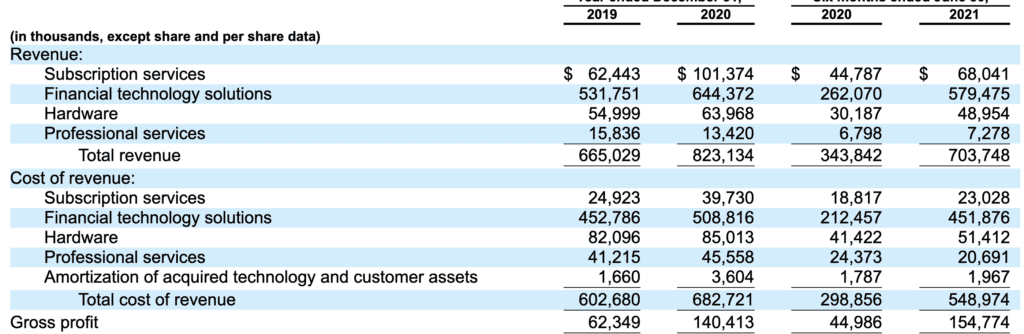

#1. With gross margins of only 21%, is Toast really a software company? Not yet. Not today. While its software has decent margins of 66%, software is only 10% of Toast’s total GAAP revenue. It loses money on the hardware (gross margin negative) and the payments solutions have barely a 20%+ margin and constitute the vast majority of revenue today. It would take a lot of work for Toast to hit the 60% gross margin standard to be a true software company. Wix has a similar challenge at $1B+ in ARR, where its website SaaS has high margins but its payments products for eCommerce have a 29% margin. Wix just has more software revenue to blend the total margins higher.

Still, Toast has an incredible ARR multiple for a low-margin business, even a very fast growing one. This will be interesting to track over time.

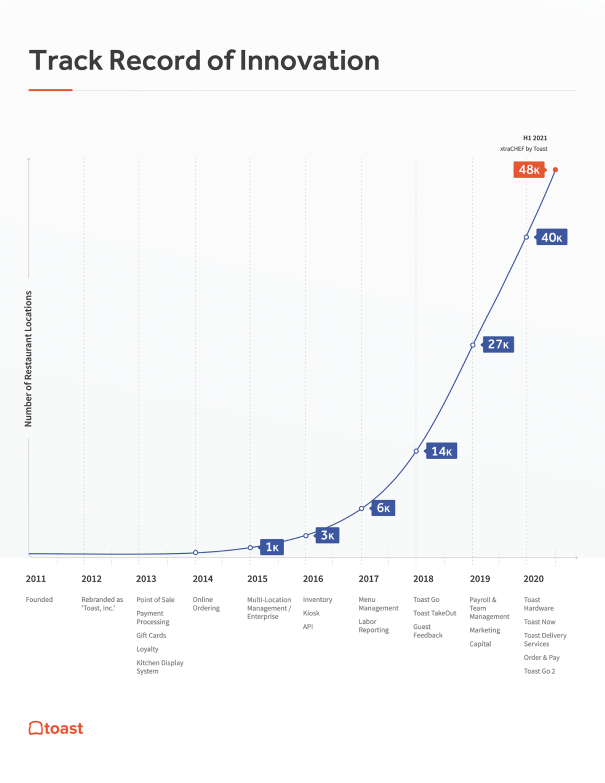

#2. Incredible acceleration around Year 6. Toast exploded around Year 6-7, and you can see an incredible power-law curve taking off. But it took 6+ years to get there. The company exploded from 3,000 restaurant locations in 2016 to 40,000 in 2020. Wow.

#3. Mediocre margins in payments. Fintech is hot, and adding payments to a SaaS solution has turbocharged Shopify, Bill, Wix … and Toast. But Toast sure doesn’t make that much money on payments yet. The margins here too are only 22%.

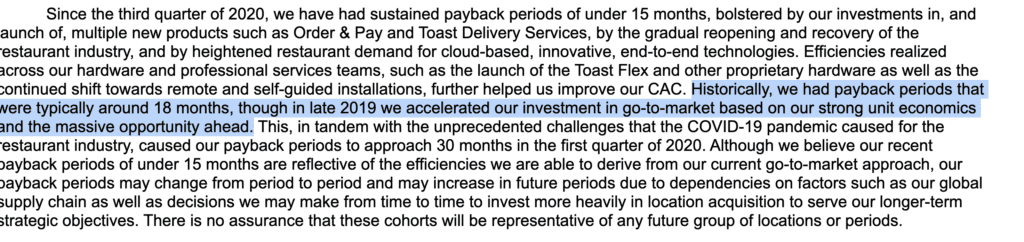

#4. Historical CAC of 18 months, driving down to 15 months by IPO. Not uncommon in fast-growing Cloud companies, but a CAC that does consume a significant amount of capital, especially in a business with lower margins and a large hardware component.

#5. NRR of 114% — but took 4 years to get to 100%. 114% in not bad, and consistent with restaurants signing 1-3 contracts. But like many of us, it took them a while to cross 100% NRR. It’s a reminder many Cloud leaders started off with lower NRR than they ended up hitting at IPO (see, also, Shopify, HubSpot, etc.). So take the public NRR comps as targets to reach for, not necessarily ones you’ll always meet in the earliest days.

And a few bonus notes:

#6. 29,000 Customers and 48,000 Locations. That’s a little more than a $65k revenue per customer on average. But again, payments is the vast majority of this revenue. True software subscriptions are just $6k a year or so, on average.

#7. 734 employees in sales and marketing (out of 2,200 total), and 669 in customer success. It’s a hands-on sales and hands-on support for Toast. 30% of the company does support alone.

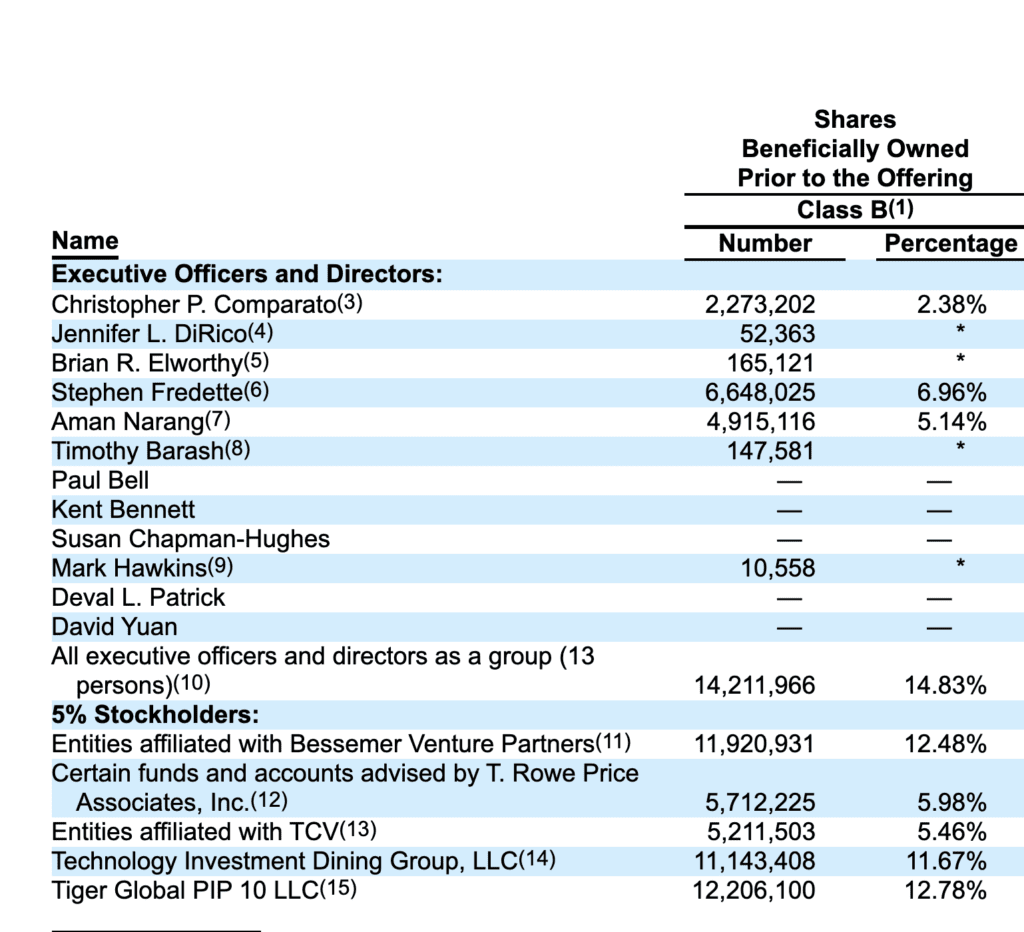

#8. A relatively dilutive journey. Toast will create many millionaries and more, but it’s been a capital-intensive business with those lower margins and hardware. The co-founders now own 7% and 5% each (Fredette and Narang), and the outside CEO 2.4% (Comparato) plus more grants. They’ll all be rich, it’s all good. It’s just a reminder of the toll a heavily capital-intensive business takes on the cap table. All the rounds on TechCrunch? They sound great. But they aren’t free.

And Toast was a small part of our deeper dive with Bessemer’s Byron Deeter here: